Italy Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Italy Online Travel Market Overview:

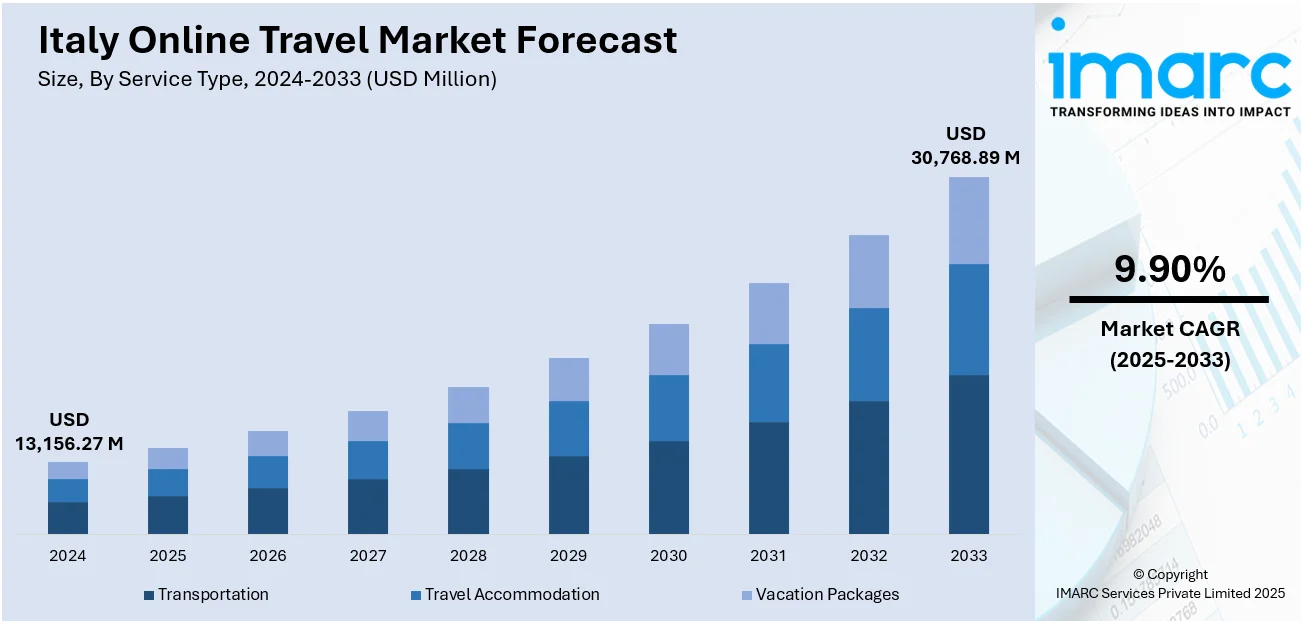

The Italy online travel market size reached USD 13,156.27 Million in 2024. The market is projected to reach USD 30,768.89 Million by 2033, exhibiting a growth rate (CAGR) of 9.90% during 2025-2033. The market is expanding rapidly, driven by increasing internet penetration, widespread smartphone adoption, and the growing use of digital payments. Demand for personalized and flexible travel experiences is rising, supported by post-pandemic tourism recovery and government initiatives promoting digital transformation. Enhanced infrastructure and innovative offerings like AI-driven planning and virtual tours are attracting more users. As a result, Italy Online Travel market share is witnessing steady and sustained growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,156.27 Million |

| Market Forecast in 2033 | USD 30,768.89 Million |

| Market Growth Rate 2025-2033 | 9.90% |

Italy Online Travel Market Trends:

Digital Booking Surge with Focus on User Experience

The Italy online travel market has experienced remarkable momentum as digital adoption continues to accelerate. According to sources released in January 2025, the total nights spent in tourist accommodation in 2024 reached millions, surpassing the previous record. This achievement reflects the underlying shift toward online booking platforms, as modern travellers increasingly prefer the convenience of digital channels for both accommodation and travel arrangements. Mobile optimisation and secure payment gateways are being prioritised to meet consumer expectations, while sophisticated search and recommendation algorithms enhance user experience. Destination marketing is now highly targeted, online platforms leverage geolocation, customer preferences, and real-time inventory data to showcase personalised travel suggestions. Investment in immersive technologies, like AR previews and virtual tours, further supports high conversion rates by enabling users to virtually explore hotels, regional attractions, and transport options before committing. Meanwhile, improvements in UX design and multilingual support are broadening market reach, catering to both domestic and inbound tourists. As Italy refines its digital infrastructure and user engagement strategies, the stage is set for ongoing expansion in Italy online travel market growth.

To get more information on this market, Request Sample

Growth in Sustainable Travel with Cultural Emphasis

Digital platforms in Italy are now strategically integrating sustainable offerings and cultural immersion to enhance the value of travel. Data from May 2024 highlights that non‑residents accounted in millions of nights spent, making up over half of all tourist accommodation usage in 2024. This shift has influenced the Italy online travel market curated for an experience‑driven audience, with many travelers actively seeking eco‑certified lodgings and heritage‑rich stays in lesser‑visited locales. Online booking channels are not only showcasing agritourism and boutique rural properties but are also facilitating access to curated experiences such as wine tasting, artisan workshops, and conservation‑oriented excursions, seamlessly packaged and promoted via digital interfaces. Coupled with smart campaigns that disperse tourist flows beyond hotspots, this trend enhances regional economic resilience and underscores responsible travel practices. Data analytics are being employed to forecast demand for off‑peak periods and highlight emerging cultural destinations. In doing so, platforms are converting consumer interest in authenticity and sustainability into tangible booking behaviour. This strategic alignment underscores the growing importance of Italy online travel market trends.

Mobile-First Innovation through AI-Driven Personalisation

Italy’s digital tourism ecosystem is advanced mobile engagement powered by AI. Throughout 2024, travel planners in Italy increasingly relied on mobile apps that embed artificial intelligence for dynamic itinerary creation, predictive pricing alerts, and real‑time support. Integrating chatbots and machine intelligence, these apps guide users through a tailored journey, suggesting eco‑friendly stays, seasonal experiences, and lesser‑known attractions, while adapting to changing preferences. Mobile penetration rates and high‑speed connectivity have enabled seamless in‑app transactions, virtual concierge services, and automatic updates for travel disruptions. These features streamline the entire trip lifecycle, from research and booking to on‑site engagement. Augmented reality (AR) capabilities are also being incorporated to enrich local exploration through interactive maps and guided tours. National tourism authorities have supported this trend by launching digital initiatives optimized for AI, partnering with accommodation providers to embed smart tools within the customer journey. As travellers seek personalised, efficient, and immersive experiences, Italy’s mobile‑centric, AI‑enabled platforms are gaining prominence, solidifying their role in shaping Italy online travel market.

Italy Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

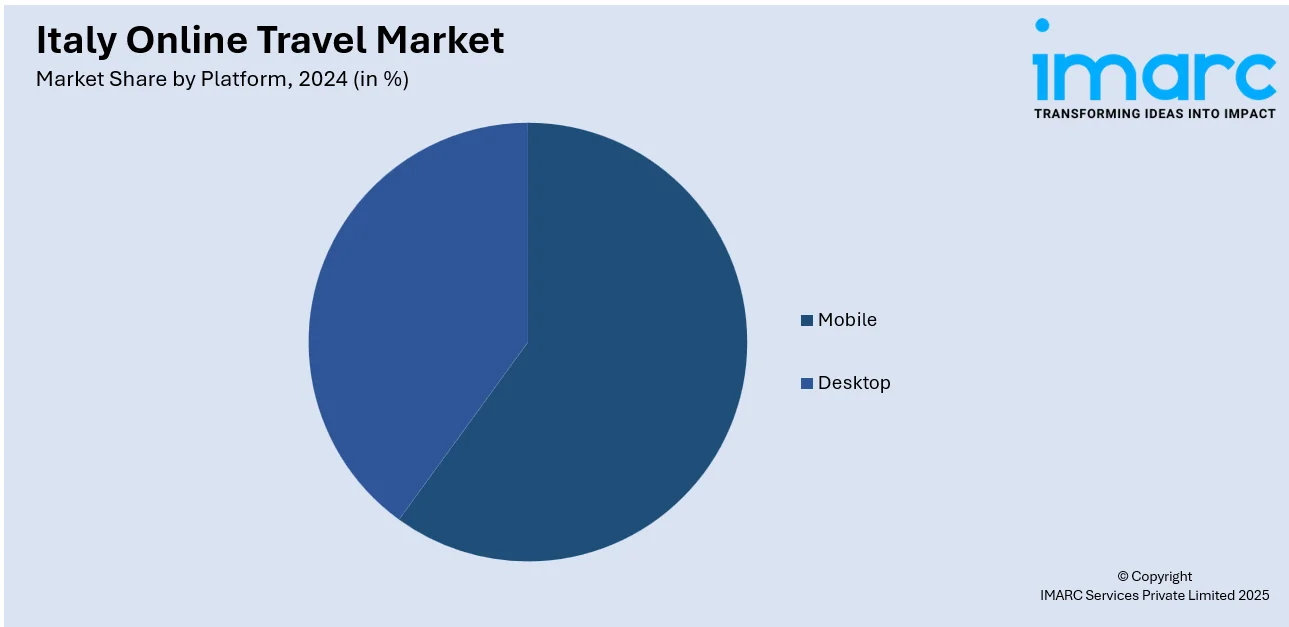

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Online Travel Market News:

- May 2025: Italian travel tech startup Hotiday has secured €5.5 million in funding to expand its decentralized hospitality model across Europe. The investment, led by P101 SGR with participation from 40Jemz and international business angels, will support Hotiday's growth in new European destinations and enhance its services for partner hotels. Founded in 2022, Hotiday has rapidly partnered with over 65 hotel operators across more than 90 locations, including Italy, France, Spain, Greece, and Portugal, transforming underutilized hotel inventory into a decentralized network of rooms under its "Hotiday Room Collections" concept.

- September 2024: Design Your Italy unveils its 2025 vision for travel in Italy, repositioning slow travel as the new benchmark for luxury. The boutique travel design firm highlights eco-luxury stays from sustainable Tuscan agriturismos to mountain retreats, and immersive train journeys that prioritize cultural depth over speed. Flexible itineraries enable travelers to linger longer, adjusting their pace and plans to fully engage with Italy's landscapes, history, and traditions. This strategic repositioning underscores Italy’s emerging status as a premier destination for intentional, sustainable luxury travel.

Italy Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy online travel market on the basis of service type?

- What is the breakup of the Italy online travel market on the basis of platform?

- What is the breakup of the Italy online travel market on the basis of the mode of booking?

- What is the breakup of the Italy online travel market on the basis of age group?

- What is the breakup of the Italy online travel market on the basis of the region?

- What are the various stages in the value chain of the Italy online travel market?

- What are the key driving factors and challenges in the Italy online travel market?

- What is the structure of the Italy online travel market and who are the key players?

- What is the degree of competition in the Italy online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)