Italy Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Italy Steel Market Overview:

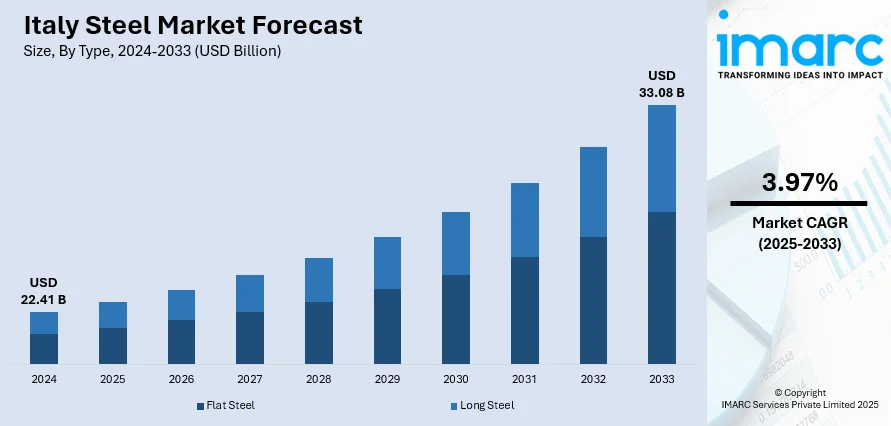

The Italy steel market size reached USD 22.41 Billion in 2024. Looking forward, the market is expected to reach USD 33.08 Billion by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The market is driven by recovering industrial and automotive sectors, escalating infrastructure investment, and sustainability regulations boosting green steel adoption. Technological modernization and energy efficiency initiatives further enable competitiveness. Foreign investment in revitalizing steelworks underpins market resilience. These dynamics enhance Italy steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.41 Billion |

| Market Forecast in 2033 | USD 33.08 Billion |

| Market Growth Rate 2025-2033 | 3.97% |

Italy Steel Market Trends:

Infrastructure Rebound and Construction Demand

The revival of infrastructure and construction projects across Italy has reinforced the foundational demand for steel. For instance, as per industry reports, in May 2025, Italy increased steel production by 8.9% month-on-month to 1.96 million tons and by 3.7% year-on-year. From January to May, production rose 4.1% year-on-year to 9.32 million tons. Flat products reached 824,000 tons in May, up 9% year-on-year, while long products hit 1.2 million tons, growing 1.8% year-on-year. Renovation of transport networks, expansion of renewable energy facilities, and modernization of public utilities are all dependent on robust steel inputs. Demand for structural steel is notably strong in residential and commercial development, particularly in urban centers undergoing renewal. Moreover, the drive for earthquake-resistant construction and energy-efficient buildings has accelerated the use of specialized steel products. This sustained activity in public and private construction is complemented by regulatory incentives aimed at improving building resilience and sustainability. As a result, infrastructure remains a key sector underpinning Italy steel market growth, supporting domestic consumption and encouraging further investment in production capabilities.

To get more information on this market, Request Sample

Green Steel Transition and Decarbonization

Italy’s steel industry is undergoing a strategic shift toward greener production methods in response to evolving environmental regulations and market expectations. Traditional manufacturing processes are gradually being replaced by cleaner technologies that focus on reducing carbon emissions and promoting circular production models. Key producers are adopting renewable energy sources and increasing reliance on recycled materials to minimize their environmental footprint. This transition is supported by both domestic policy frameworks and broader European Union climate goals, which collectively incentivize sustainable industrial practices. The growing preference among buyers for low-emission steel is reshaping supply chain expectations and production priorities. This commitment to sustainability plays a central role in Italy steel market growth, positioning the country as a progressive player in the global steel industry. For instance, in May 2025, Italy reached a strategic agreement to relaunch green steel production in Piombino, Tuscany. This framework involves collaboration between the Italian government, local authorities, Metinvest, Danieli, and JSW Italy. The joint venture aims to build a low-emission steel plant and modernize rail production, making Piombino a key European hub for sustainable steel manufacturing, supporting Italy’s national plan for green steel development.

Italy Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

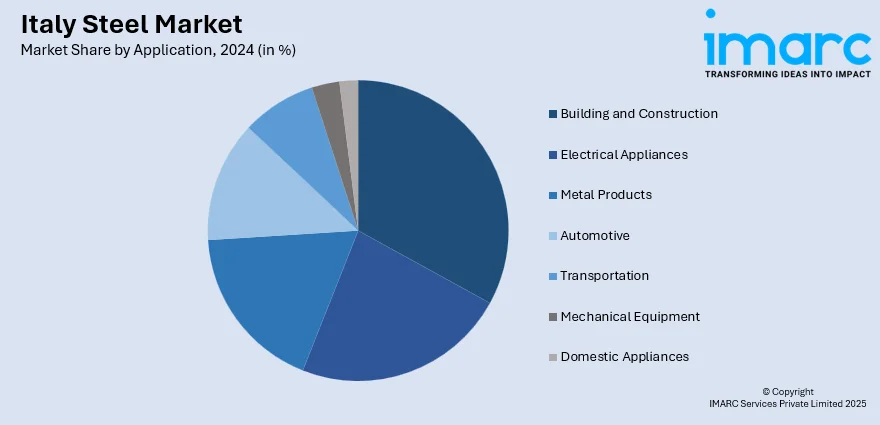

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Steel Market News:

- In February 2025, Jindal Steel & Power Ltd. increased its bid for Italy's troubled steelmaker, Acciaierie d'Italia, to approximately €4 Billion ($4.2 Billion). The proposal includes a €1 Billion payment for assets and around €3 Billion in investments to revamp the main steel plant in Taranto. The Italian government is expected to select a winning bidder soon among Jindal, Bedrock Industries, and Baku Steel Co.

- In October 2024, Italy’s Ilva in Extraordinary Administration, Acciaierie d'Italia, and DRI D’Italia signed an MoU to build a 2.5 million tons/year direct reduction plant in Taranto. The project aims to support steel sector decarbonization and will use DRI technology, backed by €1 Billion in public funding from cohesion resources.

Italy Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy steel market on the basis of type?

- What is the breakup of the Italy steel market on the basis of product?

- What is the breakup of the Italy steel market on the basis of application?

- What is the breakup of the Italy steel market on the basis of region?

- What are the various stages in the value chain of the Italy steel market?

- What are the key driving factors and challenges in the Italy steel market?

- What is the structure of the Italy steel market and who are the key players?

- What is the degree of competition in the Italy steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)