Italy Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2026-2034

Italy Toys Market Summary:

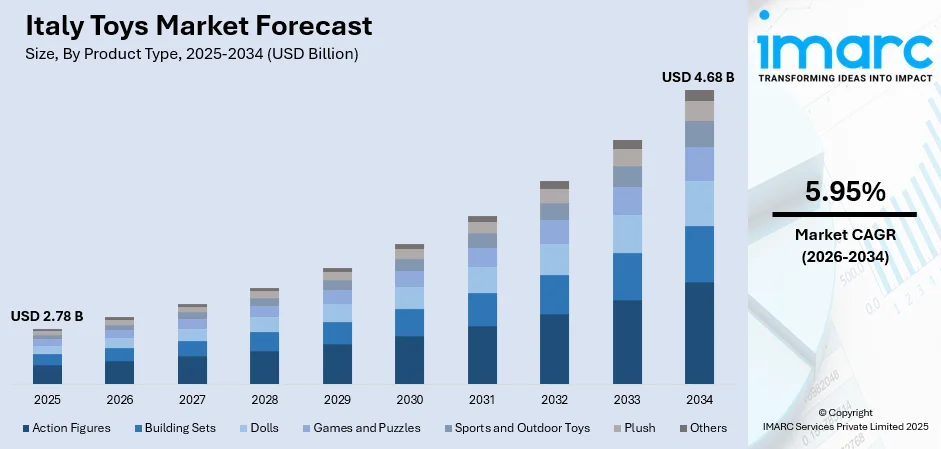

The Italy toys market size was valued at USD 2.78 Billion in 2025 and is projected to reach USD 4.68 Billion by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

The Italy toys market is experiencing steady growth driven by the rising emphasis on educational and STEAM-based toys among Italian families. The market benefits from a strong tradition of high-quality craftsmanship, growing demand for eco-friendly products, and increasing adoption of digital retail channels that complement established specialty store networks across the country.

Key Takeaways and Insights:

-

By Product Type: Sports and outdoor toys dominates the market with a share of 20.08% in 2025, driven by the Italian cultural emphasis on active outdoor play and the growing awareness of physical fitness among children and parents alike.

-

By Age Group: The 5 to 10 years segment leads the market with a share of 42.12% in 2025, reflecting the peak spending period for toys as children develop more complex play preferences and educational needs during primary school years.

-

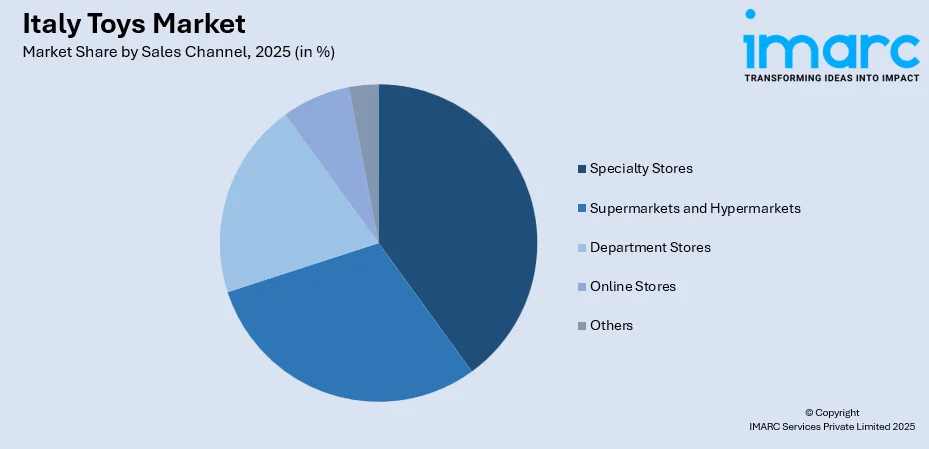

By Sales Channel: Specialty stores represents the largest segment with a market share of 38.05% in 2025, owing to Italian consumers' preference for expert guidance, hands-on product experience, and the personalized shopping atmosphere these retail outlets provide.

-

Key Players: The Italy toys market exhibits a moderately concentrated competitive landscape, with multinational corporations competing alongside established Italian manufacturers known for their craftsmanship and innovation in educational and traditional toy categories.

To get more information on this market Request Sample

The Italy toys market continues to evolve with changing consumer preferences and demographic shifts. Italian parents increasingly prioritize toys that offer developmental benefits while maintaining entertainment value. The market has also seen a surge in the “kidult” phenomenon. For example, in the first half of 2025, Circana reported that Italy’s toy sector grew by +6.8%, with collectible toys (action-figures, plushes, and anime- or manga-linked items) surging by +45%, underscoring growing demand from teens and adults. The market has witnessed a notable rise in the kidult phenomenon, with specialty stores expanding their offerings to target adult consumers seeking nostalgic and collectible items. Traditional Italian toy manufacturers continue to thrive by emphasizing quality craftsmanship and innovative designs that distinguish their products from mass-market alternatives. The integration of sustainable materials and eco-friendly manufacturing practices has become a significant differentiator as environmentally conscious consumers influence purchasing decisions across all age segments.

Italy Toys Market Trends:

Rising Demand for Educational and STEAM-Focused Toys

Italian parents are increasingly investing in toys that combine entertainment with educational value, particularly those promoting science, technology, engineering, arts, and mathematics learning. This trend reflects growing awareness of early childhood development and the desire to provide children with tools that enhance cognitive skills while keeping them engaged in meaningful play activities. A sign of this shift: Spin Master, through its 2024 acquisition of Melissa & Doug, has expanded its Italianmarket offering for 2025 to include a broad range of educational and creative toys (from arts & crafts kits to buildingblock sets), signalling demand among Italian parents for playthings that are both fun and developmentally beneficial.

Growing Adoption of Sustainable and Eco-Friendly Products

Environmental consciousness is reshaping the Italian toys market as consumers seek products made from recycled materials, bamboo, and other sustainable resources. Manufacturers are responding by developing eco-friendly product lines that maintain durability and play value while reducing environmental impact, attracting families who prioritize responsible consumption in their purchasing decisions. According to sources, in November 2024, PRG Retail Group recently launched the “Grow Green” initiative (2024), which introduces a “Green Score” labelling system in its Toys Center stores to help shoppers identify toys made with sustainable materials, responsible packaging, and Europeansourced production.

Expansion of Kidult and Collectible Segments

The adult toy consumer segment is experiencing significant growth in Italy, driven by nostalgia and the appeal of premium collectibles. Specialty retailers are adapting their strategies to cater to this demographic by offering exclusive products, limited editions, and experiences that resonate with adult enthusiasts seeking cross-generational play opportunities and hobby engagement.

Market Outlook 2026-2034:

The Italy toys market is positioned for sustained growth through the forecast period, supported by evolving consumer preferences toward quality-driven and educational products. The market is expected to benefit from continued digital retail expansion, innovative product development, and the enduring strength of licensed merchandise tied to popular entertainment properties. The market generated a revenue of USD 2.78 Billion in 2025 and is projected to reach a revenue of USD 4.68 Billion by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

Italy Toys Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sports and Outdoor Toys |

20.08% |

|

Age Group |

5 to 10 Years |

42.12% |

|

Sales Channel |

Specialty Stores |

38.05% |

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The sports and outdoor toys dominate with a market share of 20.08% of the total Italy toys market in 2025.

The dominance of sports and outdoor toys in Italy reflects the country's strong cultural emphasis on physical activity and outdoor recreation. Italian families traditionally value active play as essential to child development, with parks, open spaces, and favorable Mediterranean climate encouraging year-round outdoor activities. This segment encompasses bicycles, sports equipment, water toys, and garden play sets that align with the Italian lifestyle of outdoor family gatherings and community-based recreational activities. For instance, riding toys remain extremely popular: bicycles were among the topselling toys for Christmas 2024 in Italy, according to a report from a major retail chain.

The segment's leadership position is further reinforced by growing parental awareness of the health benefits associated with physical play and screen-time reduction initiatives. Italian consumers increasingly seek quality outdoor toys that promote fitness, coordination, and social interaction among children. The rising popularity of organized youth sports and recreational programs across Italian communities continues to drive demand for sports and outdoor toys that support both structured activities and free play opportunities.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

The 5 to 10 years leads with a share of 42.12% of the total Italy toys market in 2025.

The dominance of the five to ten years age group reflects the peak period of toy consumption in Italian households, coinciding with primary school years when children develop more sophisticated play preferences and educational needs. This demographic commands substantial parental investment as families seek products that balance entertainment with developmental benefits including cognitive stimulation, creativity enhancement, and social skill development through collaborative play experiences.

Italian parents demonstrate strong purchasing commitment for this age group, investing in quality toys that support academic achievement and personal growth. The segment benefits from diverse product offerings spanning educational kits, construction sets, board games, and creative arts supplies that cater to the expanding interests and abilities of school-age children. Licensed merchandise tied to popular entertainment franchises also drives significant revenue within this demographic as children develop brand awareness and character affiliations.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

The specialty stores dominate with a market share of 38.05% of the total Italy toys market in 2025.

Specialty toy stores maintain their dominant position in the Italian market through personalized customer service, expert product knowledge, and curated assortments that differentiate them from mass-market retailers. Italian consumers value the hands-on shopping experience these outlets provide, allowing children to interact with products before purchase and parents to receive tailored recommendations based on age-appropriate developmental needs and individual preferences. For instance, in 2025, Toys Center, a major toy‑specialty retail chain, won the title “Retail Brand of the Year” in the Toys & Games category, reflecting strong consumer appreciation for its in‑store experience and toy‑focused retail approach.

The strength of specialty retail in Italy reflects broader cultural preferences for personalized shopping experiences and trusted local establishments. These stores have successfully adapted to changing market dynamics by expanding their kidult offerings, hosting in-store events, and developing loyalty programs that foster long-term customer relationships. The ability to provide exclusive products, gift-wrapping services, and seasonal promotions continues to attract Italian families seeking premium shopping experiences for special occasions.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Northwest region represents the leading market, supported by strong economic prosperity, higher disposable incomes, concentrated urban populations, and a well-developed retail ecosystem with numerous specialty stores and premium shopping destinations.

The Northeast area shows strong performance driven by affluent family demographics and thriving manufacturing activities. A prosperous industrial base and quality-focused consumer behavior fuel demand for premium educational and innovative toy products.

The Central region offers a diverse market shaped by varied consumer preferences across both urban and rural areas. A major metropolitan hub drives substantial retail activity, while rich cultural influences strengthen demand for artisanal and traditionally crafted toys.

The South area represents a growing market with expanding retail infrastructure and evolving buying patterns. Despite relatively lower income levels, strong family-centric culture and gifting traditions ensure steady demand throughout the year.

The others group includes island territories that present emerging opportunities, characterized by distinct consumer preferences, unique cultural traditions, and geographic isolation. Increasing adoption of e-commerce is helping overcome gaps in traditional retail accessibility.

Market Dynamics:

Growth Drivers:

Why is the Italy Toys Market Growing?

Increasing Focus on Child Development and Educational Play

Italian parents are demonstrating heightened awareness of the developmental benefits associated with quality play experiences, driving demand for toys that offer educational value alongside entertainment. This shift reflects broader societal emphasis on early childhood development and the recognition that appropriately designed toys can enhance cognitive abilities, motor skills, and social-emotional learning. At Spielwarenmesse 2025, exhibitors showcased interactive STEM and tech‑integrated educational toys, highlighting the growing “learning + play” trend. Manufacturers are responding by developing innovative products that integrate learning objectives with engaging play patterns, creating opportunities for sustained market growth as families invest in developmental tools for their children.

Expansion of Omnichannel Retail Strategies

The Italian toys market is benefiting from retailers' adoption of integrated omnichannel approaches that combine physical store experiences with digital convenience. This evolution enables consumers to research products online, compare options, and complete purchases through their preferred channels while maintaining access to in-store demonstrations and expert guidance. Under the 2025 Investimenti sostenibili 4.0 programme, SMEs, receive incentives to digitize operations, implement ecommerce, and improve supply chains, lowering barriers to building strong omnichannel online and offline presence. The seamless integration of online and offline retail touchpoints enhances customer satisfaction and expands market reach, particularly among younger parents who value digital engagement alongside traditional shopping experiences.

Growing Popularity of Licensed and Character-Based Merchandise

Entertainment licensing continues to drive significant growth in the Italian toys market as popular media franchises translate into compelling toy products. Italian children's exposure to international entertainment content through streaming platforms and traditional media creates strong demand for associated merchandise. The emotional connections children develop with beloved characters motivate purchasing decisions and support premium pricing for officially licensed products, benefiting both international brands and domestic manufacturers who secure licensing agreements with popular properties.

Market Restraints:

What Challenges the Italy Toys Market is Facing?

Declining Birth Rates and Demographic Shifts

Italy's persistently low birth rates present fundamental challenges for the toys market, resulting in a shrinking core consumer base of young children. Demographic aging reduces the natural demand pool while increasing competition among manufacturers and retailers for remaining consumers, potentially constraining long-term market expansion despite growth in per-child spending.

Competition from Digital Entertainment Alternatives

Traditional toys face intensifying competition from digital entertainment options including video games, mobile applications, and streaming content that capture children's attention and discretionary family spending. The prevalence of screen-based entertainment creates challenges for conventional toy categories that must demonstrate compelling value propositions to secure consumer preference.

Economic Pressures on Consumer Spending

Macroeconomic uncertainties and inflationary pressures influence Italian household budgets, potentially constraining discretionary spending on toys particularly in price-sensitive consumer segments. Rising living costs may shift purchasing patterns toward value-oriented options or reduce overall purchase frequency, affecting market revenue growth trajectories.

Competitive Landscape:

The Italy toys market features a moderately concentrated competitive structure with established multinational corporations competing alongside distinguished Italian manufacturers. Major global players leverage extensive distribution networks, brand recognition, and licensing portfolios to maintain market positions, while domestic companies differentiate through craftsmanship traditions, innovative educational products, and regional market understanding. The competitive environment encourages continuous product innovation and strategic retail partnerships as participants seek to capture consumer attention across diverse channels and demographic segments.

Recent Developments:

-

In December 2025, MINISO launched its first dedicated collectible-toy store in Milan, targeting rising demand for pop-culture figures and Gen Z consumers. The brand, already operating nearly 70 Italian locations, plans further expansion with new flagship stores.

Italy Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy toys market size was valued at USD 2.78 Billion in 2025.

The Italy toys market is expected to grow at a compound annual growth rate of 5.95% from 2026-2034 to reach USD 4.68 Billion by 2034.

Sports and outdoor toys dominated the Italy toys market with a share of 20.08%, driven by the Italian cultural emphasis on active outdoor play and growing awareness of physical fitness benefits among children and families.

Key factors driving the Italy toys market include increasing focus on educational and developmental play, expansion of omnichannel retail strategies, growing popularity of licensed merchandise, and rising demand for sustainable and eco-friendly toy products.

Major challenges include declining birth rates reducing the core consumer base, increasing competition from digital entertainment alternatives, economic pressures constraining discretionary consumer spending, and supply chain complexities affecting product availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)