Italy Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Italy Vegetable Oil Market Overview:

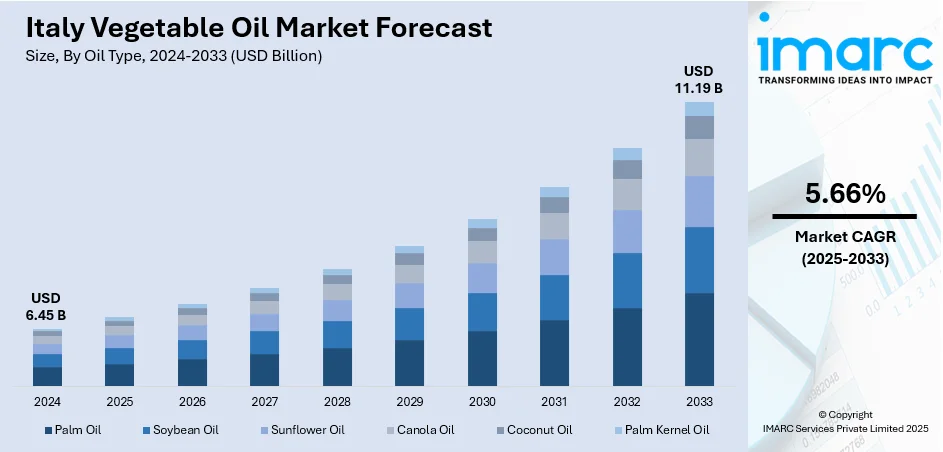

The Italy vegetable oil market size reached USD 6.45 Billion in 2024. Looking forward, the market is projected to reach USD 11.19 Billion by 2033, exhibiting a growth rate (CAGR) of 5.66% during 2025-2033. The market is driven by Italy’s culinary emphasis on olive oil, reinforced by origin certifications and premium consumption habits. Regulatory oversight and consumer health concerns are prompting reformulation and cleaner oil profiles across segments. International demand for Italian olive oil, backed by branding and geographical indications, is further augmenting the Italy vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.45 Billion |

| Market Forecast in 2033 | USD 11.19 Billion |

| Market Growth Rate 2025-2033 | 5.66% |

Italy Vegetable Oil Market Trends:

Culinary Tradition and Premium Consumer Preferences

Vegetable oils are central to Italian cuisine, with olive oil reigning as the cultural and nutritional staple across households, restaurants, and food processors. In 2024, it was reported that Italy's olive oil production reached 289,000 tons in the most recent crop year. The region of Apulia led national output with approximately 202,000 tons and operated the highest number of olive oil mills at 746 facilities. In trade, extra-virgin olive oil remained the most exported type, with Germany being the top EU importer at a value exceeding EUR 268 Million (USD 291.6 Million). While extra virgin olive oil dominates, there is also notable demand for sunflower, corn, and grapeseed oils, especially in applications requiring neutral flavor profiles. Consumers show a strong preference for quality indicators such as Protected Designation of Origin (PDO) and organic certification. Regional varieties like Tuscan or Apulian olive oils cater to a sophisticated market where taste, aroma, and origin heavily influence purchasing decisions. Italian families use vegetable oil not only for cooking but also in cold dishes, dressings, and marinades, often preferring cold-pressed and unrefined formats. This emphasis on purity and traceability drives demand for minimally processed, artisanal products. Food retail chains offer dedicated oil aisles segmented by origin, extraction method, and fat composition, reinforcing informed consumer choices. Domestic production, particularly of olive and sunflower oil, is complemented by imports to meet demand for blended or specialty formats. The premiumization trend and strong integration into everyday culinary habits remain key drivers of Italy vegetable oil market growth.

To get more information on this market, Request Sample

Regulatory Standards and Health-Focused Reformulations

Italy has implemented stringent food safety, labeling, and nutritional disclosure regulations, particularly under EU frameworks, influencing both producers and retailers. Vegetable oil manufacturers must adhere to specific compositional standards, including clear labeling of extraction method, origin, and fat content. In response to rising concerns over obesity and cardiovascular diseases, the market has shifted toward oils with healthier profiles—such as high-oleic sunflower, canola, and blends enriched with omega-3s. In 2025, Italy imported USD 415.41 Million worth of sunflower oil from Ukraine in 2024, ranking as the fifth-largest export destination for Ukrainian sunflower oil and accounting for 8.1% of Ukraine’s total sunflower oil exports. Italy, alongside India and Spain, emerged as a leading growth market for Ukrainian sunflower oil. Italian food manufacturers, especially in baked goods, sauces, and processed snacks, are reformulating products to reduce saturated fat and eliminate trans fats entirely. Public institutions and NGOs actively promote awareness of healthy fat consumption, amplifying consumer expectations for clean-label oils. These trends are reflected in retail as demand grows for fortified oils containing vitamins A, D, and E. Government-backed nutritional campaigns and EU-origin labeling schemes further support consumer trust and product transparency. As health consciousness increases, consumers are more selective about the oils they use for different purposes, from frying to cold preparations. This health-driven market segmentation is encouraging innovation, improving oil quality, and reinforcing regulatory compliance as a foundation for market competitiveness.

Italy Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

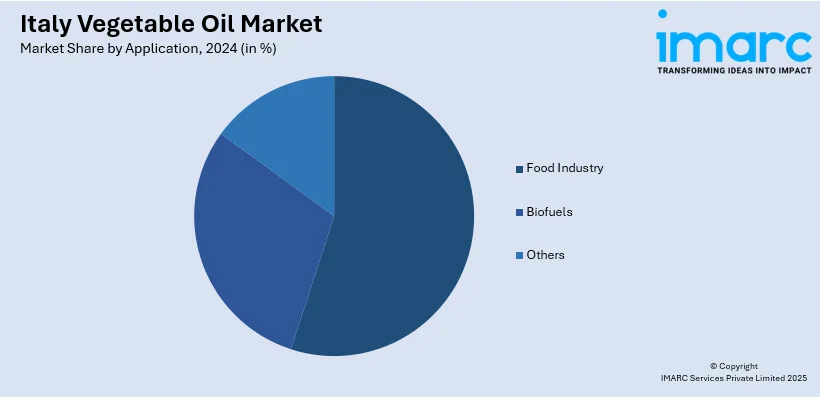

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy vegetable oil market on the basis of oil type?

- What is the breakup of the Italy vegetable oil market on the basis of application?

- What is the breakup of the Italy vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Italy vegetable oil market?

- What are the key driving factors and challenges in the Italy vegetable oil market?

- What is the structure of the Italy vegetable oil market and who are the key players?

- What is the degree of competition in the Italy vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)