Japan Agrochemicals Market Report by Fertilizer Type (Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, and Others), Pesticide Type (Fungicides, Herbicides, Insecticides, and Others), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others), and Region 2026-2034

Market Overview:

Japan agrochemicals market size reached USD 20.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 31.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.66% during 2026-2034. The growth of extensive commercial farming, changes in dietary choices with a rise in fruit and vegetable consumption, and the increasing demand for flowers and decorative plants are among the key drivers of market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.7 Billion |

| Market Forecast in 2034 | USD 31.1 Billion |

| Market Growth Rate (2026-2034) | 4.66% |

Agrochemicals refer to chemical compounds utilized to improve crop yield and safeguard plants from pests, diseases, and unwanted vegetation. They are crucial components of contemporary agricultural techniques, fostering increased productivity and maintaining crop standards. These substances include a range of products like fertilizers, pesticides, herbicides, and fungicides. Their evolution aims to maximize agricultural productivity while tackling the complexities posed by pests and environmental elements. They assist in regulating plant growth and development, enabling farmers to plan harvests more efficiently and ensure timely delivery of produce to the market.

Japan Agrochemicals Market Trends:

The Japanese agrochemicals market is experiencing significant growth owing to the expansion of large-scale commercial farming operations, necessitating effective pest and disease management practices. This trend is mirrored globally, with governmental initiatives, subsidies, and incentives encouraging farmers to invest in agrochemicals to enhance crop yields, thereby fostering market growth. The escalating consumption of fruits and vegetables further drives this expansion. Similarly, the increasing preference for flowers and ornamental plants is fueling the demand for agrochemicals tailored to the specific needs of these crops. In light of the growing population, ensuring food security has emerged as a pressing concern. Agrochemicals, encompassing fertilizers and pesticides, play a crucial role in bolstering crop yields and safeguarding plants against pests and diseases, thereby ensuring a consistent and plentiful food supply. They enable farmers to maximize food production on limited arable land, meeting the escalating demand for agricultural products. As indispensable tools in contemporary agriculture, agrochemicals support sustainable and efficient farming practices that are crucial for providing sustenance to an ever-expanding population. Agrochemicals, including insecticides, fungicides, and herbicides, have a vital function in safeguarding these productive crops from potential risks, ensuring their continued productivity and sustainability. With farmers aiming for heightened yields and profitability, the need for agrochemicals is expected to increase in parallel with the adoption of high-yield crop types, which is expected to fuel the regional market over the forecasted period.

Japan Agrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on fertilizer type, pesticide type, and crop type.

Fertilizer Type Insights:

- Nitrogen Fertilizer

- Phosphatic Fertilizer

- Potassic Fertilizer

- Others

The report has provided a detailed breakup and analysis of the market based on the fertilizer type. This includes nitrogen fertilizer, phosphatic fertilizer, potassic fertilizer, and others.

Pesticide Type Insights:

- Fungicides

- Herbicides

- Insecticides

- Others

A detailed breakup and analysis of the market based on the pesticide type have also been provided in the report. This includes fungicides, herbicides, insecticides, and others.

Crop Type Insights:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals and grains, oilseeds and pulses, fruits and vegetables, and others.

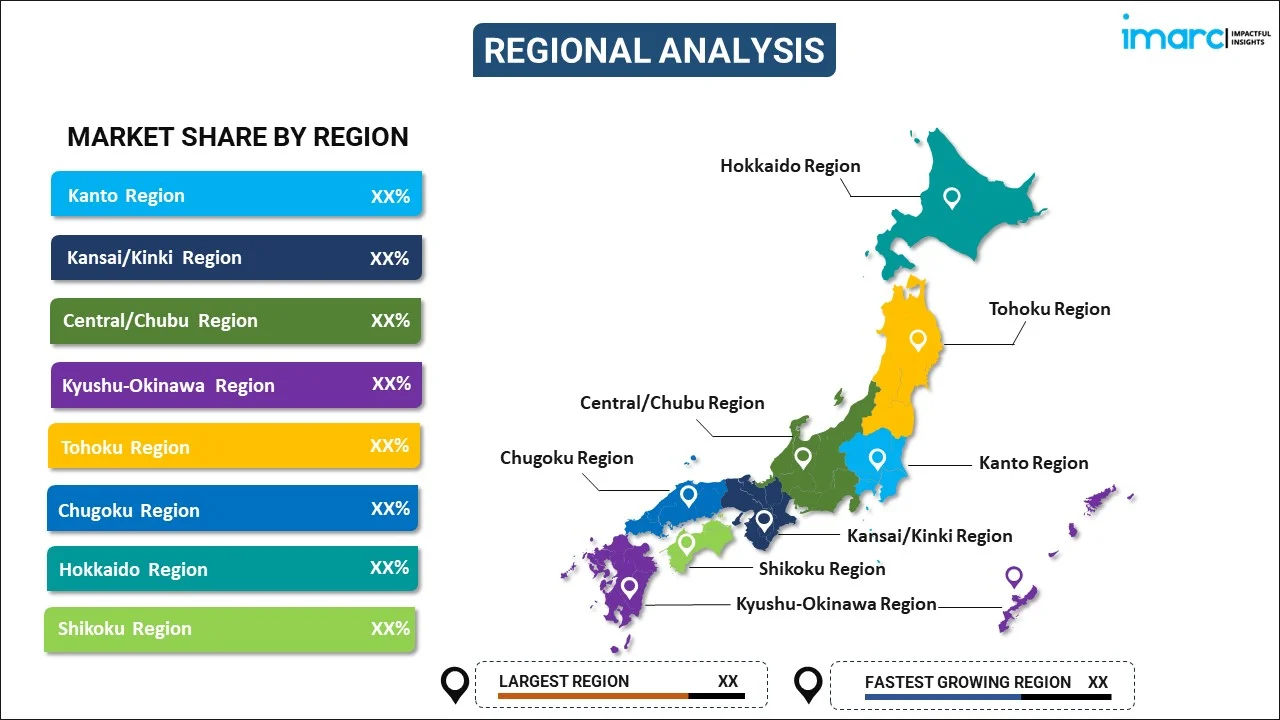

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- FMC Corporation

- Ishihara Sangyo Kaisha Ltd.

- Nippon Soda Co. Ltd.

- Sumitomo Chemical Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Agrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fertilizer Types Covered | Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, Others |

| Pesticide Types Covered | Fungicides, Herbicides, Insecticides, Others |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | FMC Corporation, Ishihara Sangyo Kaisha Ltd., Nippon Soda Co. Ltd., Sumitomo Chemical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan agrochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan agrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan agrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agrochemicals market in Japan was valued at USD 20.7 Billion in 2025.

The Japan agrochemicals market is projected to exhibit a CAGR of 4.66% during 2026-2034, reaching a value of USD 31.1 Billion by 2034.

The Japan agrochemicals market is driven by rising food demand, government support for modern agriculture, and innovations in crop protection chemicals. Emphasis on sustainable farming practices, pest-resistant crops, and precision agriculture solutions enhances productivity. Additionally, climate change mitigation strategies and growing export-oriented agriculture bolster the adoption of agrochemical solutions across Japan.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)