Japan Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2026-2034

Japan Aircraft Line Maintenance Market Overview:

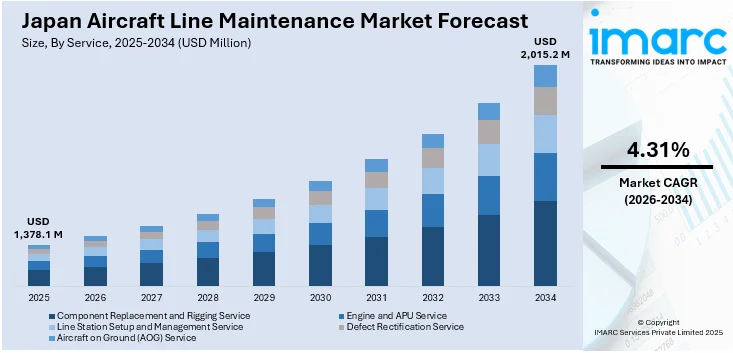

The Japan aircraft line maintenance market size reached USD 1,378.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,015.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.31% during 2026-2034 The market is driven by the ongoing increase and modernization of Japan's commercial aircraft fleet, rising focus on minimizing aircraft downtime and enhancing operational reliability, and implementation of favorable government policies and rigorous regulatory environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,378.1 Million |

| Market Forecast in 2034 | USD 2,015.2 Million |

| Market Growth Rate 2026-2034 | 4.31% |

Japan Aircraft Line Maintenance Market Trends:

Expansion of Commercial Aviation Fleet

An ongoing increase and modernization of Japan's commercial aircraft fleet are a prime motivator behind the line maintenance market. As domestic and foreign air travel is rising, Japanese airlines are expanding fleet numbers to meet increasing passenger demand. For instance, in 2025, Japan Airlines (JAL) took the decision of introducing 17 additional Boeing 737-8 aircrafts from The Boeing Company. Along with the Boeing 737-8 planes joining the local fleet, 11 Airbus A321neo planes will be introduced to replace the Boeing 767 planes, mostly on Haneda routes to and from. Large carriers are acquiring newer-generation aircraft, which, despite their advanced technology, still require regular and specialized line maintenance to ensure airworthiness and efficiency. Furthermore, the emergence of low-cost carriers (LCCs) is increasing the frequency of short-haul flights, thus the number of turnaround checks, transit checks, and daily inspections required. With heightened aircraft utilization rates, the need for quick, efficient, and highly dependable line maintenance services at major airports like Narita, Haneda, and Kansai also increases.

To get more information on this market Request Sample

Technological Advancements in Maintenance Practices

Japan's image as a world leader in technology greatly affects its aircraft maintenance industry. Incorporating digital solutions, predictive analysis, and cutting-edge diagnostics into line maintenance increases efficiency and safety. Real-time aircraft health monitoring systems (AHMS), automatic fault detection, and mobile apps for maintenance enable technicians to diagnose and correct issues quickly, sometimes before they become major issues. These developments minimize aircraft downtime and enhance operational reliability, which is particularly important to Japanese carriers that value punctuality and safety. Additionally, the utilization of augmented reality (AR) and wearable technology is becoming increasingly popular within Japan's maintenance environment, enabling remote support and hands-free instruction for inspections. These technologies are transforming maintenance procedures by reducing human error, streamlining workflows, and enabling on-the-spot training of less skilled staff, thus promoting long-term cost-effectiveness and adherence to global safety standards. The Japan wearable technology market size is expected to reach USD 15,881 Million by 2033.

Government Policies and Regulatory Compliance

Encouraging government policies and rigorous regulatory environments are contributing to the market growth in Japan. The Japan Civil Aviation Bureau (JCAB), a part of the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), are imposing strict maintenance standards. This regulatory environment compels line maintenance operators to provide high-quality services and embrace the best global practices. Moreover, the Japanese government's programs to upgrade airport facilities and aviation safety by means of grants and public-private partnerships indirectly contribute to the maintenance business. In 2024, the government announced its plans to upgrade 5 airports to make them efficient for defense forces’ usage during military emergencies. The growing focus on carbon neutrality and fuel efficiency of aircraft is leading to the adoption of regulations that demand more frequent checking and servicing of aircraft systems, especially engines and avionics. These translate into a long-term demand for line maintenance services, especially those that deal with environmental compliance and fuel system optimization, encouraging investments in personnel training, certification, and green technologies in the maintenance ecosystem.

Japan Aircraft Line Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on service, type, aircraft type, and technology.

Service Insights:

- Component Replacement and Rigging Service

- Engine and APU Service

- Line Station Setup and Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes component replacement and rigging service, engine and APU service, line station setup and management service, defect rectification service, and aircraft on ground (AOG) service.

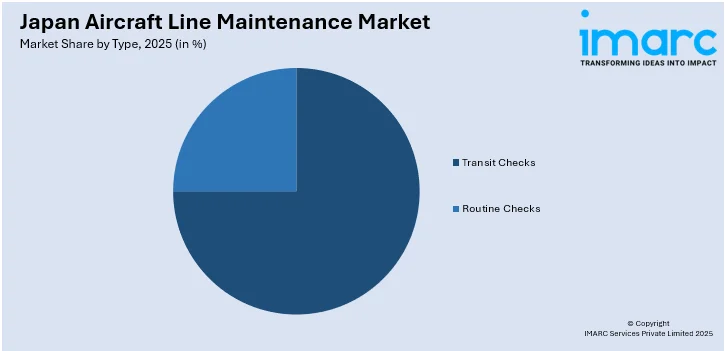

Type Insights:

Access the comprehensive market breakdown Request Sample

- Transit Checks

- Routine Checks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes transit checks and routine checks.

Aircraft Type Insights:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

- Others

A detailed breakup and analysis of the market based on the aircraft type have also been provided in the report. This includes narrow body aircraft, wide-body aircraft, very large body aircraft, and others.

Technology Insights:

- Traditional Line Maintenance

- Digital Line Maintenance

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes traditional line maintenance and digital line maintenance.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Aircraft Line Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement and Rigging Service, Engine and APU Service, Line Station Setup and Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan aircraft line maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan aircraft line maintenance market on the basis of service?

- What is the breakup of the Japan aircraft line maintenance market on the basis of type?

- What is the breakup of the Japan aircraft line maintenance market on the basis of aircraft type?

- What is the breakup of the Japan aircraft line maintenance market on the basis of technology?

- What is the breakup of the Japan aircraft line maintenance market on the basis of region?

- What are the various stages in the value chain of the Japan aircraft line maintenance market?

- What are the key driving factors and challenges in the Japan aircraft line maintenance market?

- What is the structure of the Japan aircraft line maintenance market and who are the key players?

- What is the degree of competition in the Japan aircraft line maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan aircraft line maintenance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan aircraft line maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)