Japan Aluminium Powder Market Report by Technology (Air Atomization, and Others), End-Use (Industrial, Automotive, Chemical, Construction, Explosives, Defense and Aerospace, and Others), Raw Material (Aluminium Ingots, Aluminium Scrap), and Region 2025-2033

Market Overview:

The Japan aluminium powder market size reached 32,620 Tons in 2024. The market is projected to reach 41,068 Tons by 2033, exhibiting a growth rate (CAGR) of 2.6% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 32,620 Tons |

| Market Forecast in 2033 | 41,068 Tons |

| Market Growth Rate (2025-2033) | 2.6% |

Aluminum powder refers to a fine and odorless reactive powder. It is obtained by stamping and ball-milling aluminum in the presence of fatty lubricants, such as edible vegetable oil, stearic acid, and food-grade fatty acids. It is commercially available in various forms, like atomized, flake powder, paste, and pigment aluminum powder. This substance is lightweight and highly flammable in nature. Due to these properties, aluminum powder is extensively used to formulate chemicals, explosives, paints, reflective roof coatings, printing inks, and autoclaved aerated concrete.

The positive growth of the aluminium powder market in Japan can be accredited to its widespread adoption across various end-use industries and the rapid economic and industrial expansion in the country. Aluminum powder releases flammable hydrogen gas when contacted with water, alcohol, and strong acids and bases, due to which it is increasingly being utilized in the military and aerospace sector to launch rockets. Apart from this, the rising environmental concerns and the growing need to reduce energy and utility costs have prompted key players to adopt green manufacturing techniques, which, in turn, is creating a positive outlook for the market in the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Japan aluminium powder market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on technology, end-use and raw material.

Breakup by Technology:

- Air Atomization

- Others

Breakup by End-Use:

- Industrial

- Automotive

- Chemical

- Construction

- Explosives

- Defense and Aerospace

- Others

Breakup by Raw Material:

- Aluminium Ingots

- Aluminium Scrap

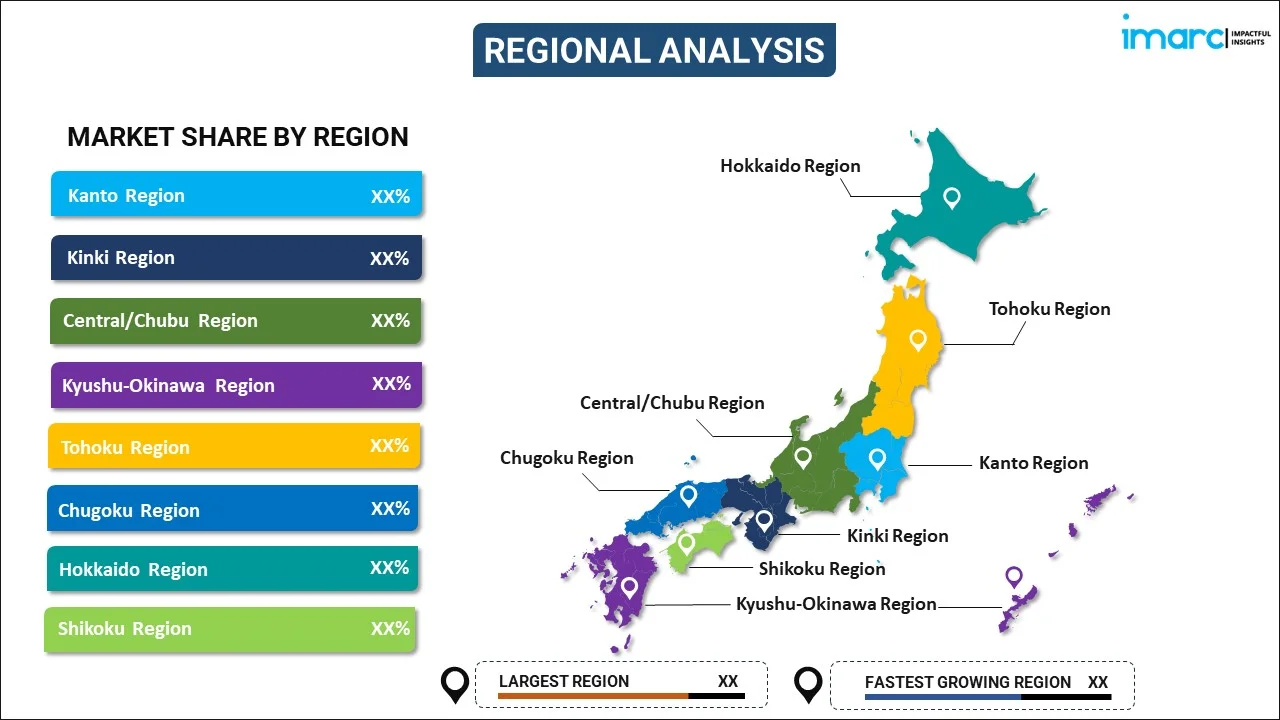

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Japan Aluminium Powder Market News:

- December 2024: Researchers from Tohoku University's Institute for Materials Research and New Industry Creation Hatchery Center achieved significant advances in multi-material 3D printing, demonstrating its capacity to produce lightweight yet sturdy car parts. The goal of this study was to develop a steel-aluminum alloy that was lightweight while maintaining strength. The research team used Laser Powder Bed Fusion (L-PBF), a popular metal 3D printing process that employed a laser to selectively melt metallic powders.

- September 2024: The 2024 World Powder Metallurgy Congress & Exhibition was set to be held at the PACIFICO Yokohama, Japan, from October 13 to 17. Hosted by the Japan Powder Metallurgy Association alongside the Japan Society of Powder and Powder Metallurgy, the conference would feature several sessions, covering discussions about aluminum powder with excellent sinterability without pressure.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Segment Coverage | Technology, End-Use, Raw Material, Region |

| Region Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The aluminium powder market in Japan reached 32,620 Tons in 2024.

Japan's strong focus on advanced manufacturing and materials innovations is driving the demand for aluminium powder in additive manufacturing and 3D printing applications. Additionally, its use in pyrotechnics, paints, and coatings is adding to its market presence. Besides this, the growing emphasis on sustainability and recycling is promoting the utilization of aluminium-based products due to their environmental benefits.

The Japan aluminium powder market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching 41,068 Tons by 2033.

Air atomization accounted for the largest Japan aluminium powder technology market share because it offers cost-effective, efficient, and scalable production with consistent particle size and shape, making it suitable for diverse industrial applications like metallurgy, coatings, and additive manufacturing.

Kanto Region represented the largest Japan aluminium powder market share, driven by its strong industrial base, advanced manufacturing facilities, and high concentration of automotive and electronics companies. The region's infrastructure and increasing demand for high-performance materials are supporting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)