Japan Aluminum Cans Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Japan Aluminum Cans Market Overview:

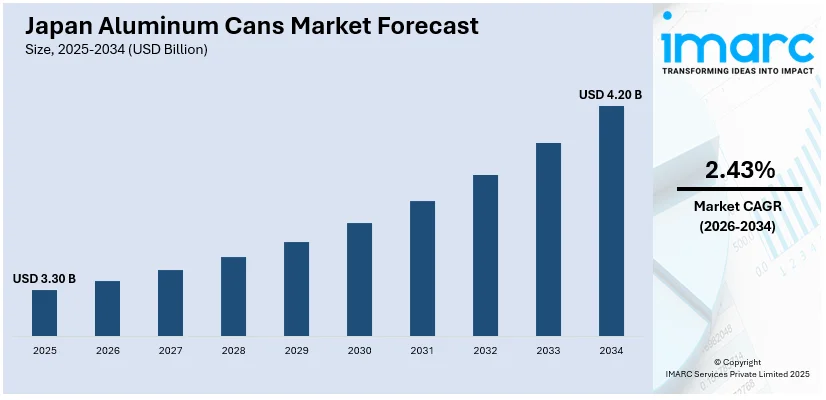

The Japan aluminum cans market size reached USD 3.30 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.20 Billion by 2034, exhibiting a growth rate (CAGR) of 2.43% during 2026-2034. The market is driven by the national focus on sustainability and circular economy principles, increasing consumption of ready-to-drink (RTD) products, functional drinks, and alcoholic drinks, and rising innovations in can-making and material technology like lightweighting, enhanced barrier coatings, and digital printing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.30 Billion |

| Market Forecast in 2034 | USD 4.20 Billion |

| Market Growth Rate 2026-2034 | 2.43% |

Japan Aluminum Cans Market Trends:

Rising Environmental Awareness and Recycling Initiatives

Japan's aluminum can industry is largely influenced by the national focus on sustainability and circular economy principles. The nation has a high recycling rate of aluminum cans, due to well-developed collection and processing networks. Public-private partnerships and environmental policies encourage efficient recycling, hence aluminum cans being a desirable packaging solution from an environmental perspective. Government-initiated programs and corporate social responsibility drives are raising consumers' awareness about environment friendly packaging. Manufacturers are also more motivated to utilize aluminum because it can be recycled without a loss in quality. Also, recycled aluminum uses less energy compared to manufacturing new aluminum, lowering the carbon footprint overall. This is consistent with Japan's overall decarbonization efforts and creates brand loyalty for people who are eco-aware. According to the aluminum recycling initiative report by LIXIL, Japan plans to increase the proportion of recycled aluminum up to fifty percent by 2050.

To get more information on this market Request Sample

Rise in Beverage Consumption and Product Diversification

The increasing consumption of ready-to-drink (RTD) products, functional drinks, and alcoholic drinks is driving the demand for alumininum cans in Japan. Portability, quick chilling, and better product preservation are the benefits that aluminum cans provide, and these are highly favorable in Japan's busy urban lifestyle. The Japanese food and beverage (F&B) market is diversifying categories of drinks with new products including canned coffee, sparkling water, craft beers, and health-driven drinks. These products often target niche demographics like health-conscious millennials or time-constrained professionals, and aluminum packaging supports convenient on-the-go consumption. Moreover, beverage businesses are investing more in high-end can designs and limited-series packaging to make their products stand out in a competitive retail market. Not only does this strategy drive aluminum can demand but also increases the perception of canned goods from functional to desirable. In 2024, Toyo Seikan Co., Ltd. created the world’s lightest*1 aluminum beverage can, the 190 ml 202 SOT (Stay-on-Tab) can, which employs only 6.1 g of aluminum per container. This can was chosen by Coca-Cola for its 185 g Georgia*2 coffee brand can items, and mass manufacturing initiated in the Kanto region.

Technological Advancements in Can Manufacturing and Design

Innovations in can-making and material technology is bolstering the market growth in Japan. Technologies like lightweighting, enhanced barrier coatings, and digital printing have improved the functionality, visual appearance, and affordability of aluminum cans. Such advancements make the cans more sustainable and competitive compared to other forms of packaging such as plastics or glass. Lightweight cans save on transportation and environmental costs without sacrificing strength, which is essential in Japan's logistics-driven market. Moreover, digital printing technology allows for short-run, high-quality custom designs, enabling brands to quickly respond to changing market trends or promotional opportunities. This flexibility supports targeted marketing and product differentiation, both of which are critical in Japan's highly segmented consumer market. The IMARC Group predicts that the Japan digital printing market size is expected to reach USD 2.5 Billion by 2033.

Japan Aluminum Cans Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on application.

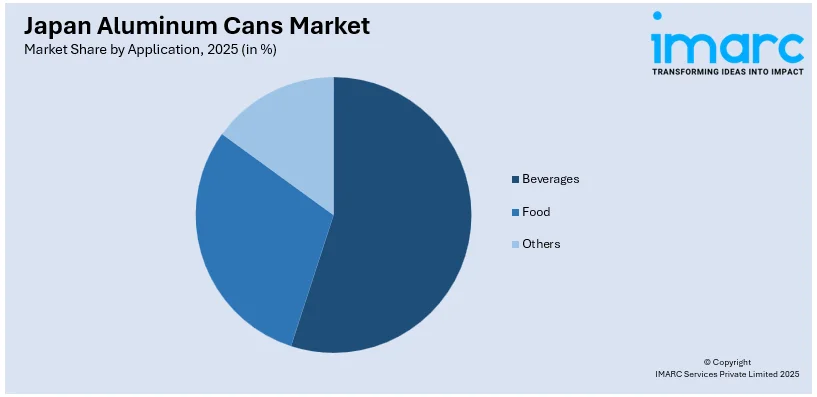

Application Insights:

Access the comprehensive market breakdown Request Sample

- Beverages

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, food, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Aluminum Cans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan aluminum cans market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan aluminum cans market on the basis of application?

- What is the breakup of the Japan aluminum cans market on the basis of region?

- What are the various stages in the value chain of the Japan aluminum cans market?

- What are the key driving factors and challenges in the Japan aluminum cans market?

- What is the structure of the Japan aluminum cans market and who are the key players?

- What is the degree of competition in the Japan aluminum cans market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan aluminum cans market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan aluminum cans market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan aluminum cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)