Japan Aquafeed Market Size, Share, Trends and Forecast by End User, Ingredient, and Product Form, 2026-2034

Japan Aquafeed Market Summary:

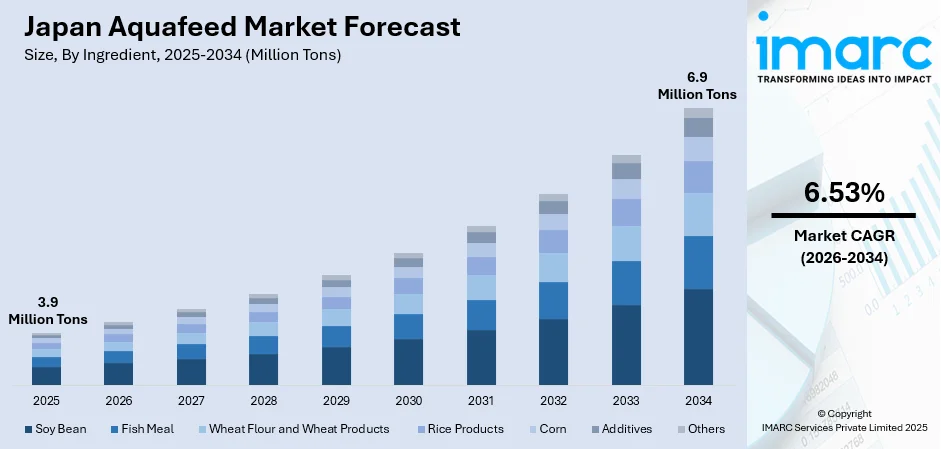

The Japan aquafeed market size reached 3.9 Million Tons in 2025 and is projected to reach 6.9 Million Tons by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

Japan's aquafeed market is experiencing robust growth driven by the country's deeply rooted seafood culture and escalating demand for high-quality farmed fish. The market is shaped by continuous advancements in feed formulation technologies that enhance nutritional profiles and optimize fish growth rates. Rising consumer awareness regarding the health benefits of seafood consumption, coupled with government initiatives to modernize the aquaculture sector, continues to strengthen market prospects. Expanding investments in sustainable aquaculture practices and the growing adoption of recirculating aquaculture systems are reshaping the industry landscape, positioning Japan as a significant player in the Asia Pacific aquafeed market share.

Key Takeaways and Insights:

-

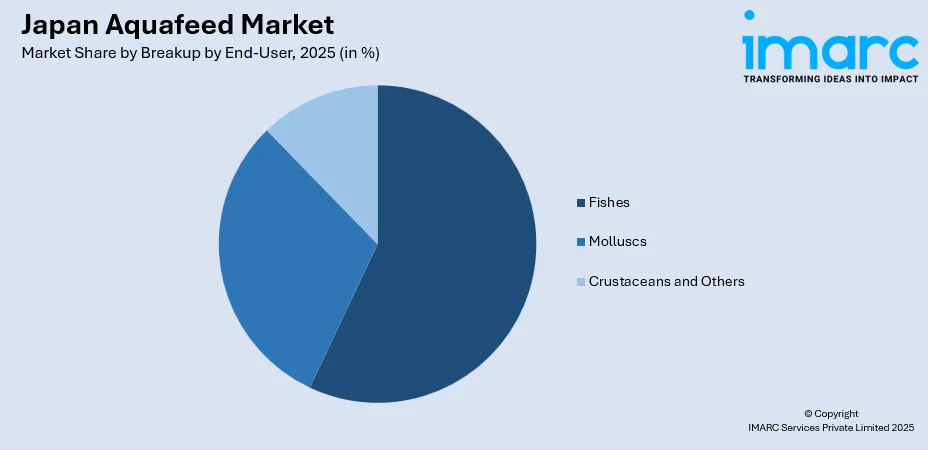

By End User: Fishes dominate the market with a share of 65% in 2025, owing to Japan's strong cultural affinity for fish-based cuisine, established marine finfish farming infrastructure, and sustained consumer demand for premium species including yellowtail, red seabream, and bluefin tuna across domestic and export markets.

-

By Ingredient: Fish meal leads the market with a share of 40% in 2025. This dominance is driven by fish meal's superior protein quality, excellent amino acid profile, high digestibility, and palatability that make it the preferred protein source for carnivorous marine species cultivated extensively throughout Japan.

-

By Product Form: Pellets represent the largest segment with a market share of 68% in 2025, reflecting widespread adoption across Japanese aquaculture operations due to their consistent nutritional delivery, ease of handling, reduced wastage, and suitability for automated feeding systems deployed in modern fish farming facilities.

-

Key Players: Key players drive the Japan aquafeed market by expanding production capacities, developing specialized feed formulations, and investing in research for sustainable ingredient alternatives. Their focus on quality enhancement, technological innovation, and strategic partnerships strengthens market positioning across diverse aquaculture segments. Some of the key players operating in the market include Marubeni Nisshin Feed Co. Ltd., Nosan Corporation (Mitsubishi Corporation) and Skretting (Nutreco N.V.).

To get more information on this market Request Sample

The Japan aquafeed market is undergoing significant transformation as the country strengthens its aquaculture sector to address declining wild fish catches and growing domestic seafood demand. Rising seafood imports have surpassed domestic production levels, underscoring the urgency to expand aquaculture output. Government fisheries policies outline strategic priorities including improving feed self-sufficiency and increasing production of strategic species. Major manufacturers are responding with substantial investments in production capacity and innovation, developing advanced capabilities for alternative protein formulations and sustainable feed solutions. This strategic positioning reflects the industry's commitment to sustainable growth while meeting evolving nutritional requirements of Japan's diverse aquaculture species.

Japan Aquafeed Market Trends:

Expansion of Land-Based Aquaculture Systems

Japan is witnessing substantial growth in land-based recirculating aquaculture systems that offer controlled environments and year-round productivity regardless of climate conditions. These advanced facilities enable precise management of water quality, temperature, and disease prevention while reducing environmental footprint. Major investments in Atlantic salmon and other high-value species production are expanding across the country. This trend supports the Japan aquafeed market growth through increased demand for specialized feeds optimized for controlled aquaculture environments.

Development of Sustainable Feed Formulations

The aquafeed industry is accelerating research into alternative protein sources and sustainable ingredients to reduce dependence on traditional fish meal. Feed manufacturers are exploring insect protein, plant-based alternatives, and fermentation-derived proteins that maintain nutritional efficacy while addressing environmental concerns. Japanese universities including Tokyo University of Marine Science and Technology and Kindai University are conducting extensive research on plant protein and plant oil alternatives. This shift toward sustainable formulations responds to both resource constraints and growing consumer demand for environmentally responsible aquaculture products.

Integration of Smart Technology in Feed Management

Japanese aquaculture operations are increasingly adopting digital technologies including artificial intelligence, IoT sensors, and automated feeding systems to optimize feed utilization and reduce waste. These smart aquaculture solutions enable real-time monitoring of fish behavior, water conditions, and feed conversion rates. Leading industry players are developing advanced facilities utilizing cutting-edge AI and IoT technology for precision farming. This technological integration enhances feeding precision, improves growth performance, and supports sustainable intensification of aquaculture production.

Market Outlook 2026-2034:

The Japan aquafeed market outlook remains positive as aquaculture assumes increasing importance in meeting domestic seafood consumption requirements and supporting export growth ambitions. Government policies emphasizing food security, sustainability, and rural coastal revitalization continue to attract significant investments in modern aquaculture infrastructure. The market size was estimated at 3.9 Million Tons in 2025 and is expected to reach 6.9 Million Tons by 2034, reflecting a compound annual growth rate of 6.53% over the forecast period 2026-2034. Manufacturers are focusing on developing specialized feeds for emerging farmed species and high-value seafood to capitalize on evolving market opportunities.

Japan Aquafeed Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| End User | Fishes | 65% |

| Ingredient | Fish Meal | 40% |

| Product Form | Pellets | 68% |

Breakup by End-User:

Access the comprehensive market breakdown Request Sample

- Molluscs

- Japanese Scallop

- Pacific Oyster

- Fishes

- Yellowtail

- Red Seabream

- Greater Amberjack

- Bluefin Tuna

- Others

- Crustaceans and Others

Fishes dominate with 65% of the total Japan aquafeed market in 2025.

The fishes segment commands the largest share of Japan's aquafeed market, reflecting the country's extensive marine finfish aquaculture operations and deep-rooted cultural preference for fish-based cuisine. Japan's aquaculture industry has developed significantly over decades, with major species including yellowtail, red seabream, greater amberjack, and bluefin tuna driving substantial feed demand. Farmed fish production accounts for a significant portion of domestic seafood supplies, demonstrating the scale of fish farming operations that require high-quality aquafeed formulations tailored to species-specific nutritional requirements.

Japanese fish farming has achieved global recognition for quality and innovation, particularly in bluefin tuna aquaculture where researchers accomplished groundbreaking advancements in closed-cycle cultivation techniques. The success of premium fish farming operations has stimulated demand for specialized compound feeds that optimize growth rates, enhance flesh quality, and support the health of valuable marine species. Leading aquaculture enterprises cultivate substantial volumes of high-value fish across multiple farming sites, serving both domestic consumption and expanding international export markets.

Ingredient Insights:

- Soybean

- Fish Meal

- Wheat Flour and Wheat Products

- Rice Products

- Corn

- Additives

- Vitamins and Minerals

- Amino Acids

- Feed Acidifiers

- Antibiotics

- Others

- Others

Fish meal leads with a share of 40% of the total Japan aquafeed market in 2025.

Fish meal maintains its position as the predominant protein source in Japanese aquafeed formulations due to its exceptional nutritional properties that closely match the dietary requirements of carnivorous marine species. The ingredient provides high-quality protein with an optimal essential amino acid profile, excellent digestibility, and natural palatability that stimulates feed intake in cultivated fish. Fish meal's balanced composition of essential fatty acids, vitamins, and minerals further enhances its value as a foundational component in aquafeed production. The ingredient supports rapid growth rates, improves feed conversion efficiency, and contributes to the overall health and disease resistance of farmed aquatic species.

Japanese aquafeed manufacturers are actively investing in research to reduce fish meal dependency while maintaining nutritional efficacy. The industry is exploring alternative protein sources including plant-based ingredients, insect meal, and fermentation-derived proteins that can partially substitute fish meal without compromising feed performance. These efforts aim to address supply volatility concerns, manage production costs, and align with sustainability objectives driving the evolution of modern aquaculture practices across Japan.

Product Form Insights:

- Pellets

- Extruded

- Powdered

- Liquid

Pellets exhibits a clear dominance with a 68% share of the total Japan aquafeed market in 2025.

Pellet feeds have become the predominant product form in Japanese aquaculture due to their versatility, consistent nutritional delivery, and compatibility with modern farming operations. Available in both dry pellet and extruded pellet variants, these feeds offer optimal nutritional design tailored to specific fish species and life stages. The transition from traditional moist feeds mixed with frozen fish to compound pellet feeds has accelerated due to benefits including stable supply, enhanced biosecurity, reduced environmental impact, and improved farm management efficiency.

Japanese feed manufacturers have developed sophisticated pellet technologies addressing diverse aquaculture requirements. Companies are engaged in producing specialized pellet formulations ranging from micro-pellets for fish fry to larger pellets for grow-out phases of species including trout, carp, eel, red seabream, yellowtail, and amberjack. Extruded pellets featuring improved digestibility and absorption characteristics are gaining preference for high-fat feed applications and large-diameter requirements.

Market Dynamics:

Growth Drivers:

Why is the Japan Aquafeed Market Growing?

Rising Domestic Demand for Farmed Seafood

Japan's aquafeed market is experiencing growth driven by increasing domestic demand for farmed seafood as wild fish catches continue to decline. The country's strong cultural affinity for seafood consumption, combined with concerns over overfishing and resource depletion, has positioned aquaculture as an essential component of Japan's food security strategy. Consumer preferences for fresh, high-quality seafood that meets stringent safety standards favor domestically farmed products over imports. The government's initiatives to promote sustainable aquaculture and increase certified seafood production are stimulating investments across the value chain. Growing awareness of the health benefits associated with seafood consumption continues to support demand for farmed fish products that require quality aquafeed for optimal growth and nutritional content.

Government Support and Policy Initiatives

Government policy support represents a significant driver of Japan's aquafeed market expansion through targeted initiatives promoting aquaculture development. The Basic Plan for Fisheries outlines strategic priorities including streamlined permitting, financing support, and construction assistance for aquaculture investments. Low-interest loans and funding programs are available for ventures deploying advanced technologies or contributing to rural coastal job creation. Government plans targeting substantial increases in fishery exports are creating significant growth opportunities for the aquafeed industry. These policy frameworks are encouraging private sector investment in modern aquaculture infrastructure and supporting the adoption of innovative feed technologies.

Technological Advancements in Feed Formulation

Continuous technological advancement in aquafeed formulation and manufacturing is driving market growth by enabling more efficient and sustainable fish production. Innovations in precision nutrition allow feed manufacturers to develop species-specific formulations optimized for different life stages and growth objectives. Research into alternative protein sources, functional additives, and improved processing technologies is expanding the range of available feed solutions. Moreover, technological improvements enhance feed conversion ratios, support fish health, and reduce environmental impact while maintaining the nutritional quality demanded by Japanese aquaculture operations.

Market Restraints:

What Challenges the Japan Aquafeed Market is Facing?

Volatile Fish Meal Prices and Supply Constraints

The Japan aquafeed market faces challenges from fish meal price volatility and supply uncertainty as global demand increases while fishery resources face pressure. Feed manufacturers must navigate fluctuating raw material costs that impact production economics and pricing strategies. The high dependence on imported fish meal creates exposure to international market dynamics, currency fluctuations, and supply chain disruptions.

Labor Shortages in Aquaculture Operations

Japan's aging population and declining rural workforce present significant challenges for aquaculture operations and related industries including aquafeed distribution. The shortage of skilled labor in fishing communities affects farm productivity and limits industry expansion potential. These demographic constraints necessitate increased automation and technological solutions that require substantial capital investment.

Environmental and Regulatory Compliance Requirements

Stringent environmental regulations and sustainability requirements impose compliance costs and operational constraints on aquafeed manufacturers and aquaculture operators. The industry must address concerns regarding water quality impacts, waste management, and chemical usage while meeting evolving certification standards. Balancing environmental stewardship with production efficiency requires ongoing investment in sustainable practices and technologies.

Competitive Landscape:

The Japan aquafeed market features a competitive landscape comprising established domestic manufacturers and international players serving diverse aquaculture segments. Leading companies compete through product innovation, manufacturing efficiency, distribution network strength, and technical support capabilities. Strategic focus areas include developing specialized formulations for premium species, expanding sustainable ingredient utilization, and enhancing feed performance through precision nutrition technologies. Industry participants are investing in production capacity expansion and research infrastructure to capture growth opportunities arising from aquaculture sector modernization. Partnerships between feed manufacturers, aquaculture operators, and research institutions facilitate knowledge exchange and accelerate innovation in feed solutions tailored to evolving market requirements.

Some of the key players include:

- Marubeni Nisshin Feed Co. Ltd.

- Nosan Corporation (Mitsubishi Corporation)

- Skretting (Nutreco N.V.)

Recent Developments:

- In November 2025, NTT Green & Food announced a land-based aquaculture project in Kesennuma City, Miyagi Prefecture, utilizing advanced Recirculating Aquaculture Systems (RAS) technology in collaboration with AquaBioTech Group. Upon completion in 2026, the facility is expected to produce approximately 310 Tons of market-size trout salmon annually, as well as about 260 Tons of intermediate-size Coho salmon for offshore aquaculture.

- In April 2025, Kawasaki Heavy Industries successfully harvested 850 trout salmon from its MINATOMAE aquaculture project near Kobe Port, achieving one of Japan's highest farming densities at 60 kg/m³ in a closed containment environment. The harvest marked a milestone in the company's sustainable aquaculture system development partnership with Maruha Nichiro Corporation.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End-Users Covered |

|

| Ingredients Covered |

|

| Product Forms Covered | Pellets, Extruded, Powdered, Liquid |

| Companies Covered | Marubeni Nisshin Feed Co. Ltd., Nosan Corporation (Mitsubishi Corporation) and Skretting (Nutreco N.V.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan aquafeed market size reached 3.9 Million Tons in 2025.

The Japan aquafeed market is expected to grow at a compound annual growth rate of 6.53% from 2026-2034 to reach 6.9 Million Tons by 2034.

Fishes dominated the market with a share of 65%, driven by Japan's extensive marine finfish aquaculture operations and sustained consumer demand for premium species including yellowtail, red seabream, and bluefin tuna.

Key factors driving the Japan aquafeed market include rising domestic demand for farmed seafood, supportive government policies promoting aquaculture development, technological advancements in feed formulation, expansion of land-based aquaculture systems, and growing focus on sustainable feed ingredients.

Major challenges include volatile fish meal prices and supply constraints, labor shortages in aquaculture operations, stringent environmental compliance requirements, high capital investment needs for modern aquaculture infrastructure, and the ongoing need to develop cost-effective alternative protein sources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)