Japan Artisanal Dairy Products Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, End User, and Region, 2026-2034

Japan Artisanal Dairy Products Market Summary:

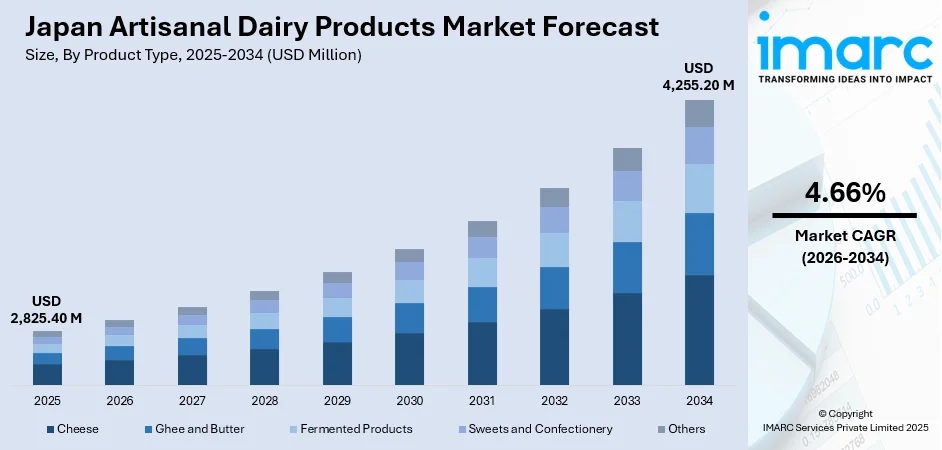

The Japan artisanal dairy products market size was valued at USD 2,825.40 Million in 2025 and is projected to reach USD 4,255.20 Million by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034.

The market is expanding as consumers increasingly seek high-quality, locally crafted cheese, butter, and yogurt. Demand is rising for natural, organic, and small-batch dairy items that emphasize authenticity and regional character. Health-conscious buyers prefer minimally processed products with functional benefits, supporting steady market growth. Regional artisanal producers are gaining wider recognition as consumers show strong interest in provenance, purity, and distinctive flavor profiles, further strengthening the Japan artisanal dairy products market share.

Key Takeaways and Insights:

- By Product Type: Cheese dominates the market with a share of 32% in 2025, driven by the concentration of artisanal cheesemakers across Japan's dairy-producing regions, growing consumer appreciation for locally crafted varieties, and increasing demand for premium cheese in gourmet food service establishments.

- By Raw Material: Cow milk leads the market with a share of 80% in 2025, owing to its widespread availability across Japanese dairy farms, established supply chain infrastructure, consumer familiarity with cow milk-based products, and consistent quality standards maintained by local producers.

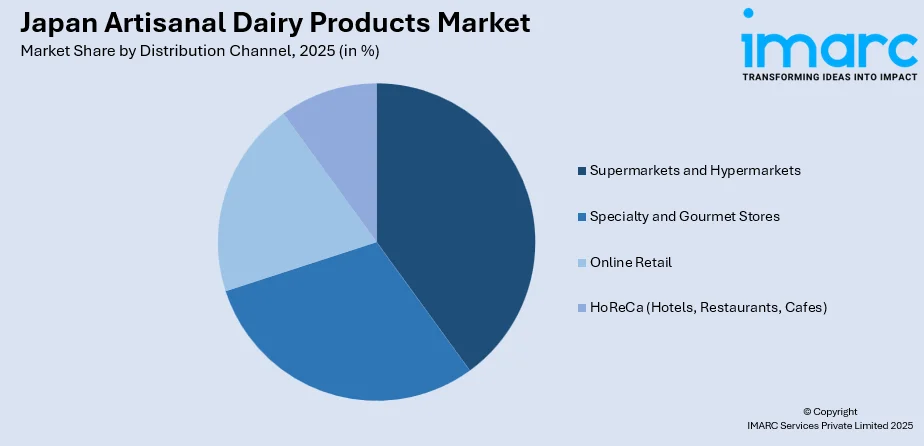

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 35% in 2025, driven by convenient one-stop shopping experiences, extensive product assortment, competitive pricing strategies, and increasing shelf space allocation for premium artisanal dairy products.

- By End User: Household consumers dominate the market with a share of 60% in 2025, attributed to rising health consciousness among Japanese families, growing preference for natural and organic dairy options, and increasing household spending on premium food products.

- Key Players: The market features a competitive mix of long-established regional producers and emerging craft dairies focused on premium, small-batch offerings. The market is characterized by strong product differentiation, emphasis on quality, and rising investment in unique regional flavors, strengthening competition across the value chain.

To get more information on this market Request Sample

The Japan artisanal dairy products market is experiencing robust growth propelled by evolving consumer preferences toward natural, organic, and locally sourced dairy items. Japanese consumers are increasingly prioritizing product authenticity, transparency in sourcing, and traditional production methods that preserve natural flavors and nutritional integrity. The rising health and wellness consciousness among urban populations has accelerated demand for probiotic-rich dairy products, particularly yogurt and fermented items that support digestive health and immunity. Additionally, the cultural appreciation for regional craftsmanship and food provenance has strengthened consumer connections with local artisanal producers who emphasize quality over mass production. The expanding food tourism sector further amplifies interest in authentic regional dairy specialties, while growing awareness of sustainable farming practices reinforces preference for small-batch production methods. In April 2025, Japan unveiled a five-year policy to modernise its dairy and beef sectors, focusing on resilient supply chains, upgraded facilities, and reduced dependence on imported feed to ensure long-term stability.

Japan Artisanal Dairy Products Market Trends:

Rising Premiumization of Dairy Consumption

Japanese consumers are demonstrating a pronounced shift toward premium artisanal dairy products that offer distinctive flavor profiles, superior quality, and authentic production heritage. This premiumization trend reflects broader changes in consumption patterns where quality supersedes quantity, and consumers willingly pay higher prices for products that deliver exceptional taste experiences. The emphasis on craftsmanship and traditional techniques resonates strongly with discerning consumers who value the artistry behind small-batch production. Specialty dairy items featuring unique aging processes, regional ingredients, and limited availability are gaining traction among affluent urban demographics seeking differentiated culinary experiences. In December 2023, Japan’s MAFF introduced financial incentives for dairy producers and manufacturers to boost domestic cheese production, improve sustainability, and enhance local cheese competitiveness.

Expansion of Functional and Wellness-Oriented Dairy

The integration of functional health benefits into artisanal dairy products represents a significant market trend reshaping product development and consumer purchasing decisions. Producers are increasingly incorporating probiotics, fortified nutrients, and gut-health promoting cultures into traditional dairy formulations to address growing wellness priorities among Japanese consumers. In May 2025, Nomura Dairy Products, in collaboration with Probi, launched a probiotic‑enhanced carrot juice under the “My Flora” brand, targeting health-conscious Japanese consumers. Moreover, this convergence of artisanal quality with functional benefits appeals to health-conscious demographics seeking preventive nutrition solutions through everyday food choices. The emphasis on digestive wellness, immune support, and overall vitality is driving innovation in fermented dairy categories and specialty yogurt products.

Growing Emphasis on Local Sourcing and Traceability

Transparency in supply chains and emphasis on regional provenance have become defining characteristics of consumer expectations within Japan's artisanal dairy sector. Consumers increasingly seek products with clear origin stories, traceable ingredient sourcing, and connections to specific farming communities and traditional production regions. Furthermore, this trend reflects broader societal values around sustainability, supporting local economies, and preserving traditional agricultural practices. Producers highlighting their relationships with local farmers, sustainable grazing practices, and minimal environmental footprint are gaining competitive advantages among environmentally conscious consumer segments.

Market Outlook 2026-2034:

The Japan artisanal dairy products market is set for steady revenue growth, supported by strong premiumization trends and wider availability across retail and specialty channels. Rising consumer appreciation for authentic, locally crafted cheese, butter, and yogurt continues to strengthen demand. Investments in artisanal production, improved cold chain systems, and closer collaboration between producers and retailers are enhancing market reach. Preference for natural ingredients, functional benefits, and sustainably sourced dairy will further support long-term expansion. The market generated a revenue of USD 2,825.40 Million in 2025 and is projected to reach a revenue of USD 4,255.20 Million by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034.

Japan Artisanal Dairy Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Cheese | 32% |

| Raw Material | Cow Milk | 80% |

| Distribution Channel | Supermarkets and Hypermarkets | 35% |

| End User | Household Consumers | 60% |

Product Type Insights:

- Cheese

- Ghee and Butter

- Fermented Products

- Sweets and Confectionery

- Others

The cheese dominates with a market share of 32% of the total Japan artisanal dairy products market in 2025.

The cheese segment holds a dominant position in Japan’s artisanal dairy landscape due to strong consumer interest in premium, locally crafted varieties. For example, in September 2024, Meiji, in collaboration with Savencia Fromage & Dairy, launched the “Saint-Moret” dessert cheese nationwide in Japan, introducing premium French cream cheese flavors for the first time. Furthermore, Japanese producers combine European cheesemaking traditions with regional ingredients to create distinctive flavors that appeal to sophisticated palates. Growing enthusiasm for cheese pairings with wine and gourmet cuisine has broadened consumption occasions and elevated the cultural appreciation of artisanal cheese.

Regional specialties from key dairy-producing areas have gained nationwide recognition for their craftsmanship, quality, and unique character. Consumers are increasingly interested in understanding cheese varieties, aging methods, and production techniques, which strengthens demand across premium retail and foodservice channels. Gourmet stores, specialty markets, and fine-dining establishments continue enhancing their artisanal cheese selections to meet the rising expectations of an increasingly discerning audience.

Raw Material Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Mixed-Milk Products

The cow milk leads with a share of 80% of the total Japan artisanal dairy products market in 2025.

Cow milk remains the leading raw material in Japan’s artisanal dairy sector, supported by a well-developed farming base that ensures steady access to high-quality milk. In August 2024, Morinaga Milk Industry launched a series of functional foods, including the PURESU fermented vinegar drink, yogurt, and milk formulas, leveraging high-quality cow milk to support nutrition and wellness for Japan’s ageing population. Producers rely on this dependable supply to craft a wide range of premium dairy items. Strong consumer preference for cow milk products continues to reinforce demand across multiple artisanal categories throughout the country.

Artisanal makers highlight the distinctive qualities of locally sourced cow milk, often emphasizing practices that enhance taste and texture. The segment benefits from refined production methods, reliable farm partnerships, and growing commitment to elevated dairy standards. Continued focus on premium farming approaches strengthens the raw material base, supporting innovation and diversification in artisanal dairy offerings.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Specialty and Gourmet Stores

- Supermarkets and Hypermarkets

- Online Retail

- HoReCa (Hotels, Restaurants, Cafes)

The supermarkets and hypermarkets exhibit a clear dominance with a 35% share of the total Japan artisanal dairy products market in 2025.

Supermarkets and hypermarkets act as the leading distribution channel for artisanal dairy products due to their wide reach and convenience. These retailers increasingly showcase premium dairy selections to meet rising consumer interest. As of May 2025, a guide to Japanese supermarkets noted that major chains are emphasising freshness, seasonal products and gourmet‑style sections to attract shoppers interested in high‑quality dairy and artisanal items. Curated shelf placement, in-store promotions, and accessible pricing help introduce artisanal varieties to mainstream shoppers while supporting greater product visibility across diverse urban and suburban locations.

The channel benefits from established purchasing habits, broad assortment capabilities, and strong logistical systems that protect product integrity. Retailers are strengthening their artisanal dairy presence through collaborations with regional producers and the expansion of gourmet zones. Reliable cold chain infrastructure allows consistent quality maintenance, enabling these outlets to deliver fresh, high-standard artisanal dairy options to consumers nationwide.

End User Insights:

- Household Consumers

- Institutional Buyers

- Food Service Industry

The household consumers dominate with a market share of 60% of the total Japan artisanal dairy products market in 2025.

Household consumers form the largest end-user group, sustaining strong demand for artisanal dairy products throughout Japan. According to reports, in 2023, Japan consumed 194,414 tons of natural cheese, with households representing 29.7% of total usage, highlighting strong home demand for artisanal and processed cheeses. Further, growing health awareness encourages families to choose premium, natural dairy options viewed as wholesome and trustworthy. Evolving lifestyle preferences centered on quality cooking ingredients and balanced nutrition further reinforce the appeal of artisanal cheese, butter, and yogurt within everyday home consumption.

Rising household purchasing power supports increased spending on thoughtfully crafted dairy products. Expanding consumer understanding of production practices, ingredient integrity, and functional qualities enhances willingness to select artisanal alternatives. Interest in home-focused culinary experiences and appreciation for locally crafted goods continues to strengthen household engagement with Japan’s artisanal dairy offerings.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto is Japan’s largest artisanal dairy market, led by Tokyo’s dense, affluent population. High disposable incomes, sophisticated tastes, and extensive specialty retail and foodservice networks support premium dairy consumption. Consumers increasingly seek gourmet products, artisanal cheeses, and small-batch dairy, driving growth in metropolitan areas and encouraging producers to offer high-quality, distinctive dairy items.

Kansai/Kinki, centered on Osaka and Kyoto, exhibits strong demand for artisanal dairy, reflecting the region’s rich culinary heritage. Consumers prioritize quality ingredients, traditional production methods, and authentic flavors. Thriving hospitality and foodservice sectors provide opportunities for premium suppliers, while regional food culture encourages experimentation with locally inspired, high-quality dairy products that appeal to discerning consumers.

Central/Chubu's artisanal dairy market is growing, supported by urban expansion and rising consumer sophistication. Nagoya’s economic prosperity encourages premium consumption, while regional tourism increases exposure to specialty dairy products. Proximity between producers and consumers facilitates efficient distribution. Local producers benefit from opportunities to introduce high-quality, small-batch dairy products that combine traditional methods with innovative flavors to meet evolving consumer preferences.

Kyushu-Okinawa presents emerging opportunities for artisanal dairy driven by tourism growth and evolving consumer preferences. Regional agricultural traditions support local milk production, while unique flavor demands encourage development of distinctive products. Expansion of the hospitality sector further stimulates demand, providing channels for premium, locally produced dairy items. Consumers increasingly appreciate innovative offerings reflecting regional taste profiles.

Tohoku combines strong dairy production capacity with rising local artisanal consumption. Agricultural heritage and farming traditions supply high-quality raw materials. Regional revitalization and food tourism initiatives enhance market development, increasing awareness and demand for local artisanal dairy products. Producers benefit from growing interest in authentic, small-batch cheeses, yogurts, and specialty dairy items rooted in regional craftsmanship.

Chugoku demonstrates steady artisanal dairy demand, supported by urban centers and tourism. Consumers value high-quality products and local specialties, encouraging market growth. Expanding distribution networks link producers to retail and foodservice channels, enabling broader access to premium dairy. Opportunities exist for producers offering regional flavors, traditional production techniques, and high-quality artisanal products that meet evolving consumer expectations.

Hokkaido is Japan’s premier dairy region, known for high-quality milk and artisanal products. Favorable climate, extensive pasturelands, and dairy expertise support premium production. Regional specialties gain national recognition, driving strong local consumption and wide distribution. Consumers increasingly seek artisanal cheeses, yogurts, and dairy items reflecting traditional craftsmanship, quality ingredients, and distinctive regional flavors, supporting market expansion.

Shikoku offers niche opportunities for artisanal dairy within a smaller, quality-conscious consumer base. Tourism and pilgrimage routes enhance exposure to local specialties. Small-scale producers emphasizing traditional methods and locally sourced ingredients cater to dedicated consumers seeking authentic regional products. Unique flavors, craftsmanship, and sustainable production practices appeal to those valuing artisanal quality and regional culinary heritage.

Market Dynamics:

Growth Drivers:

Why is the Japan Artisanal Dairy Products Market Growing?

Rising Health Consciousness and Wellness Prioritization

Japanese consumers are increasingly prioritizing health and wellness in their dietary choices, creating substantial demand for artisanal dairy products perceived as healthier alternatives to mass-produced options. The growing awareness of gut health, immune function, and preventive nutrition has elevated interest in probiotic-rich dairy products and fermented items. In October 2024, Meiji introduced Probio Yogurt R‑1 Drink The GOLD, a high‑EPS probiotic yogurt aimed at supporting digestive health and immune function, aligning with the growing Japanese consumer demand for functional dairy products. Additionally, consumers associate artisanal production methods with minimal processing, natural ingredients, and preserved nutritional integrity. This health-focused mindset extends across demographic segments, from young professionals seeking functional benefits to elderly consumers prioritizing digestive wellness. The emphasis on clean labels, transparent ingredient lists, and absence of artificial additives aligns perfectly with artisanal product positioning. Producers emphasizing health benefits and nutritional advantages are capturing significant consumer attention and loyalty.

Growing Appreciation for Local Craftsmanship and Authenticity

The cultural value placed on craftsmanship and regional authenticity in Japan strongly supports artisanal dairy market growth. Consumers demonstrate increasing preference for products with clear provenance, traditional production heritage, and connections to specific geographic regions. This appreciation extends beyond mere product quality to encompass the stories, traditions, and skilled expertise behind artisanal production. Local producers emphasizing their heritage, family traditions, and community connections resonate deeply with consumers seeking meaningful food experiences. The desire for authentic, distinctive products differentiates artisanal offerings from standardized commercial alternatives. Food tourism and regional exploration further amplify consumer exposure to and appreciation for local dairy specialties.

Premiumization Trends in Food Consumption

Broader premiumization trends within Japan's food sector are significantly benefiting the artisanal dairy products market. Consumers are increasingly willing to allocate higher portions of food budgets toward quality products that deliver superior taste, authenticity, and overall experience. This shift reflects changing values where quality supersedes quantity, and food consumption becomes an expression of personal identity and lifestyle. The growing affluence of urban populations, particularly among younger demographics, enables premium product adoption. Specialty retail expansion, gourmet food sections in major retailers, and elevated dining experiences all contribute to normalizing premium pricing for artisanal products. As per sources, in December 2025, RX Japan Co., Ltd. will host JFEX at Makuhari Messe, showcasing high-value-added premium foods for gifts and mail-order, attracting department stores, high-end supermarkets, and food buyers. Moreover, the intersection of quality consciousness with disposable income growth creates favorable conditions for sustained market expansion.

Market Restraints:

What Challenges the Japan Artisanal Dairy Products Market is Facing?

Limited Production Scale and Supply Constraints

Artisanal dairy production inherently operates at smaller scales, creating supply limitations that constrain market expansion potential. The labor-intensive nature of traditional production methods, combined with requirements for specialized expertise, limits production capacity growth. Seasonal variations in milk supply and quality further complicate consistent product availability throughout the year, potentially frustrating consumer demand.

Higher Price Points and Affordability Concerns

Premium pricing associated with artisanal dairy products creates accessibility barriers for price-sensitive consumer segments. The cost implications of small-batch production, quality ingredients, and traditional methods necessitate higher retail prices compared to mass-produced alternatives. Economic uncertainties and budget constraints among certain demographics may limit market penetration beyond affluent consumer segments.

Distribution and Cold Chain Challenges

Maintaining product quality throughout distribution networks presents ongoing challenges for artisanal dairy producers. The perishable nature of dairy products requires robust cold chain infrastructure and rapid distribution timelines. Geographic constraints, particularly reaching consumers in remote or rural areas, limit market accessibility and increase distribution costs for smaller producers.

Competitive Landscape:

The Japan artisanal dairy products market exhibits a fragmented competitive structure characterized by numerous small-scale producers operating alongside established dairy cooperatives. Competition centers on product quality, regional authenticity, production heritage, and distribution capabilities rather than purely price-based differentiation. Market participants emphasize distinctive flavor profiles, traditional production techniques, and local sourcing to establish competitive positioning. Strategic partnerships with specialty retailers, gourmet food establishments, and hospitality sectors provide critical market access for smaller producers. Innovation in product development, including functional health benefits and unique flavor combinations, serves as an important competitive differentiator. The market structure supports both regional specialists with deep local connections and producers pursuing broader national distribution strategies. Brand reputation built on quality consistency and authentic production narratives strongly influences consumer preference and loyalty.

Recent Developments:

- In May 2024, Meiji Co., Ltd. launched FRESH CHEESE STUDIO, a brand highlighting freshly made cheese from Tokachi, Hokkaido. A limited-time demonstration store opened in Karuizawa from June to August, offering customers a “freshly made experience” and promoting the taste and quality of Japan’s domestic dairy products.

Japan Artisanal Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cheese, Ghee and Butter, Fermented Products, Sweets and Confectionery, Others |

| Raw Materials Covered | Cow Milk, Buffalo Milk, Goat Milk, Mixed-Milk Products |

| Distribution Channels Covered | Specialty and Gourmet Stores, Supermarkets and Hypermarkets, Online Retail, HoReCa (Hotels, Restaurants, Cafes) |

| End Users Covered | Household Consumers, Institutional Buyers, Food Service Industry |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan artisanal dairy products market size was valued at USD 2,825.40 Million in 2025.

The Japan artisanal dairy products market is expected to grow at a compound annual growth rate of 4.66% from 2026-2034 to reach USD 4,255.20 Million by 2034.

Cheese held the largest position in the market, propelled by rising consumer interest in premium, locally crafted varieties and the expansion of diverse consumption occasions that support stronger household and foodservice uptake across Japan.

Key factors driving the Japan artisanal dairy products market include rising health consciousness and wellness prioritization, growing appreciation for local craftsmanship and authenticity, premiumization trends in food consumption, and increasing demand for organic and natural dairy products.

Major challenges include limited production scale and supply constraints, higher price points creating affordability concerns, distribution and cold chain challenges, seasonal variations in milk supply, and competition from established commercial dairy producers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)