Japan Asphalt Pavers Market Size, Share, Trends and Forecast by Type, Paving Range, and Region, 2026-2034

Japan Asphalt Pavers Market Summary:

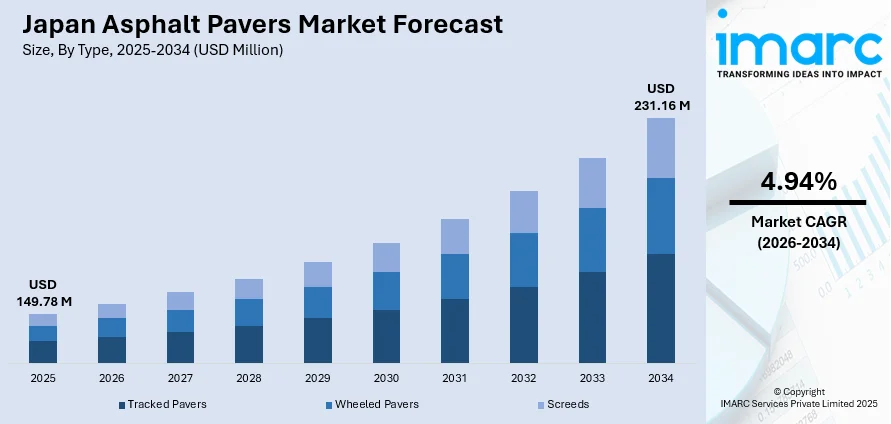

The Japan asphalt pavers market size was valued at USD 149.78 Million in 2025 and is projected to reach USD 231.16 Million by 2034, growing at a compound annual growth rate of 4.94% from 2026-2034.

The Japan asphalt pavers market is gaining momentum as the country intensifies efforts to modernize its aging road infrastructure and prepare for major events. Rising investments in transportation corridors, coupled with the need to maintain roadways, are driving sustained demand for advanced paving machinery. Technological innovations emphasizing operator safety, ergonomic convenience, and environmental sustainability are reshaping product development priorities. Additionally, the growing international recognition of Japanese road-building technologies is creating export opportunities and reinforcing Japan asphalt pavers market share in global construction equipment supply chains.

Key Takeaways and Insights:

- By Type: Tracked pavers dominate the market with a share of 55% in 2025, driven by their superior stability, traction capabilities, and suitability for large-scale highway and infrastructure projects across challenging terrains.

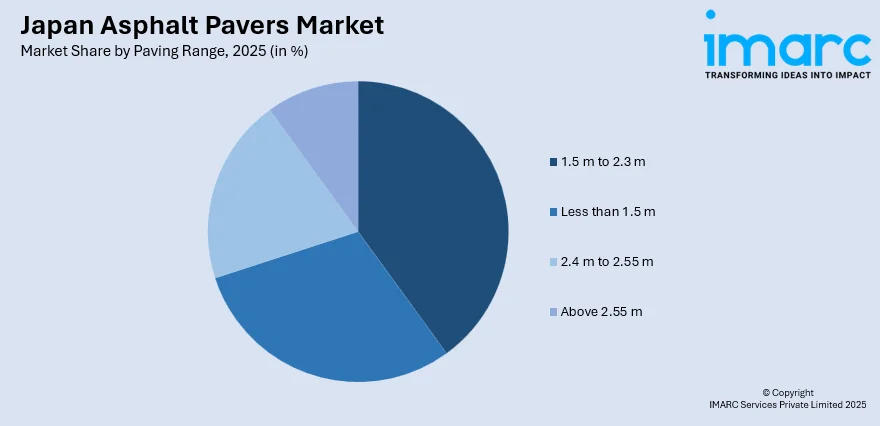

- By Paving Range: The 1.5 m to 2.3 m segment leads the market with a share of 38% in 2025, reflecting strong demand for versatile mid-range pavers suited for urban roadwork, municipal maintenance, and regional infrastructure development.

- Key Players: The Japan asphalt pavers market features established domestic manufacturers alongside international competitors, with companies focusing on technological innovation, safety features, and sustainable solutions to strengthen market positioning and meet evolving construction requirements.

To get more information on this market Request Sample

The Japan asphalt pavers market continues to evolve as construction practices shift toward greater efficiency, sustainability, and worker safety. Government-backed infrastructure renewal programs, combined with private sector investments, are creating stable demand for paving equipment across all regions. Japanese manufacturers have established leadership through advanced technologies such as dual-layer paving systems and precision screed designs. Strategic international partnerships in emerging Asian markets demonstrate Japan's expanding global role, and this technology-driven growth is expected to sustain market expansion throughout the forecast period.

Japan Asphalt Pavers Market Trends:

Operator Safety and Ergonomic Innovation

Japan's asphalt pavers market is increasingly driven by the need to ensure operator safety and ergonomic convenience amid complex construction environments. With long working hours common on infrastructure sites, manufacturers are focusing on features that reduce physical strain, streamline control systems, and enhance visibility. In August 2024, Vögele launched its Dash 5 Asphalt Paver series featuring ground-level commissioning through the Paver Access Control function, integrated LED lighting for night operations, and smart automation for screed and hardtop functions. These developments are setting new benchmarks for equipment design, contributing to Japan asphalt pavers market growth.

Global Recognition of Japanese Road Technology

The growing acceptance of Japanese road-building methods in overseas markets is becoming a key growth driver. Japan's long-established technologies are gaining attention abroad for blending durability with environmental benefits, making them attractive for regions facing budgetary and ecological constraints. In October 2024, SAKAI's Cement-Asphalt Emulsion (CAE) Method, developed in Japan and used since the 1980s, received official approval from Indonesia's Binamarga agency following field demonstrations and laboratory tests conducted under JICA's SDG Business Supporting Survey. This international recognition is opening doors for similar Japanese paving techniques to enter emerging markets.

Sustainable Material Integration in Paving Operations

Environmental sustainability is reshaping the Japan asphalt pavers market as manufacturers and contractors prioritize eco-friendly construction solutions. The integration of recycled materials and advanced additives into paving operations is gaining momentum, driven by Japan's commitment to achieve carbon neutrality by 2050. In December 2024, Kao Corporation introduced NEWTLAC, an asphalt additive made from recycled PET bottles, in Thailand. Developed in Japan, this innovation enhances road durability while reducing plastic waste, positioning Japan's asphalt paving sector as a contributor to sustainable, high-performance road construction globally.

Market Outlook 2026-2034:

The Japan asphalt pavers market outlook remains positive as infrastructure modernization efforts accelerate and construction activities expand across urban and regional centers. The Government's ongoing focus on disaster resilience, transportation efficiency, and sustainable construction practices will continue driving equipment upgrades. The market generated a revenue of USD 149.78 Million in 2025 and is projected to reach a revenue of USD 231.16 Million by 2034, growing at a compound annual growth rate of 4.94% from 2026-2034.

Japan Asphalt Pavers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Tracked Pavers | 55% |

| Paving Range | 1.5 m to 2.3 m | 38% |

Type Insights:

- Tracked Pavers

- Wheeled Pavers

- Screeds

Tracked pavers dominate the Japan asphalt pavers market with a 55% share of total revenue in 2025

Tracked pavers have established clear dominance in Japan's asphalt pavers market due to their superior performance characteristics on challenging terrains and large-scale infrastructure projects. These machines offer enhanced stability, better traction, and consistent paving quality, making them ideal for highway construction, airport runway maintenance, and expressway development. At Haneda Airport, multiple Sumitomo HA60W tracked pavers have been deployed simultaneously to pave wide sections using hot-to-hot joint techniques, demonstrating the segment's capability for precision operations under strict time constraints and reinforcing contractor preference for tracked configurations.

Paving Range Insights:

Access the Comprehensive Market Breakdown Request Sample

- Less than 1.5 m

- 1.5 m to 2.3 m

- 2.4 m to 2.55 m

- Above 2.55 m

The 1.5 m to 2.3 m paving range segment leads the market with a 38% share in 2025

The 1.5 m to 2.3 m paving range segment holds the largest market share, reflecting strong demand for versatile mid-range pavers suited to Japan's diverse infrastructure requirements. These pavers offer optimal flexibility for urban roadwork, municipal maintenance projects, residential developments, and regional transportation networks. Sumitomo's J-paver screed design offers hydraulic extension capabilities without requiring bolt-on extensions, reducing setup time and improving operational efficiency. This technology has proven particularly valuable for airport maintenance and urban infrastructure projects where time constraints and precision requirements are paramount.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates Japan's asphalt pavers market, driven by Tokyo's extensive metropolitan infrastructure projects and ongoing transportation network expansions. The Tokyo Outer Ring Road (Gaikan Expressway) project continues generating significant equipment demand as authorities work to improve regional connectivity and alleviate urban traffic congestion across the capital and surrounding prefectures.

The Kansai/Kinki Region is experiencing accelerated construction activity as preparations intensify for the 2025 Osaka World Expo on Yumeshima Island. Major infrastructure investments in transportation corridors, commercial developments, and tourism-related facilities are driving robust demand for asphalt paving equipment across Osaka, Kyoto, and neighboring prefectures throughout the forecast period.

The Central/Chubu Region benefits from ongoing highway network enhancements and infrastructure development supporting the planned Chuo Shinkansen maglev line connecting Tokyo and Nagoya. Industrial expansion in manufacturing hubs, combined with regional road maintenance programs, sustains consistent demand for asphalt pavers across this economically vital central corridor of Japan.

The Kyushu-Okinawa Region experiences steady market growth driven by government programs focused on disaster resilience infrastructure and transportation network improvements. Strategic investments in port connectivity, tourism infrastructure, and regional road rehabilitation projects across the southern islands create sustained demand for paving equipment and related construction machinery throughout the region.

The Tohoku Region continues benefiting from post-disaster reconstruction initiatives and ongoing infrastructure resilience programs following historical natural disasters. Government investments in earthquake-resistant road networks, coastal protection infrastructure, and regional connectivity improvements drive consistent demand for asphalt pavers across the northeastern prefectures, supporting long-term market stability in the region.

The Chugoku Region maintains stable asphalt paver demand through ongoing road maintenance programs and infrastructure modernization initiatives connecting major urban centers. Industrial corridor developments, port facility enhancements, and regional transportation network improvements across prefectures including Hiroshima and Okayama support consistent equipment requirements for paving contractors operating throughout western Honshu.

The Hokkaido Region presents unique market characteristics due to harsh winter conditions requiring specialized paving solutions and intensive road maintenance programs. Infrastructure investments supporting tourism development, agricultural logistics networks, and urban expansion in Sapporo generate consistent demand for asphalt pavers capable of operating efficiently in challenging northern climate conditions.

The Shikoku Region experiences moderate market growth driven by regional road network maintenance and connectivity improvement projects linking the island to mainland Japan. Government initiatives addressing aging infrastructure, combined with investments in tourism-related developments and disaster resilience programs, sustain steady demand for asphalt paving equipment across the island's four prefectures.

Market Dynamics:

Growth Drivers:

Why is the Japan Asphalt Pavers Market Growing?

Government Infrastructure Investment Programs

Government-led infrastructure investment programs are significantly driving the Japan asphalt pavers market as authorities prioritize transportation network modernization and disaster resilience improvements. The Japanese government's multi-year infrastructure plans allocate substantial budgets for road construction, maintenance, and rehabilitation projects across all regions. Domestic preparations for major international events and ongoing metropolitan development initiatives are generating sustained demand for advanced paving equipment. Strategic funding directed toward expressway expansions, urban road improvements, and regional connectivity projects continues supporting the market's growth trajectory. These coordinated public investment efforts ensure stable equipment procurement cycles and reinforce long-term market expansion prospects.

Aging Infrastructure Requiring Comprehensive Renovation

Japan's extensive road network requires continuous maintenance and renovation as infrastructure ages beyond optimal service life. Surveys by government ministries have identified significant numbers of bridges, tunnels, and road sections awaiting urgent repairs across the country. A substantial portion of critical transportation structures are approaching or exceeding their designed service lifespans, necessitating comprehensive investment in pavement rehabilitation and reconstruction programs. This aging infrastructure creates consistent baseline demand for asphalt pavers across Japan's regional markets. Ongoing renovation requirements support stable growth in equipment sales and maintenance services, ensuring sustained market activity throughout the forecast period.

Technological Advancement in Paving Equipment

Continuous technological advancement in paving equipment is driving market growth as Japanese manufacturers develop innovative solutions that enhance operational efficiency, precision, and sustainability. Advanced features including 3D paving control systems, GPS-guided operations, automated screed controls, and remote diagnostics are becoming standard expectations among contractors seeking competitive advantages. Sumitomo Construction Machinery's dual-layer paving technology using the Multi-Asphalt Paver (MAP) enables simultaneous application of binder and wearing courses, achieving construction cost reductions of approximately 10% while reducing tire/road noise. These technological innovations attract contractors seeking efficiency improvements, driving equipment upgrades and supporting sustained market expansion.

Market Restraints:

What Challenges the Japan Asphalt Pavers Market is Facing?

Skilled Labor Shortage and Aging Workforce

Japan's construction industry faces severe labor shortages due to an aging workforce and declining birth rates. New overtime regulations have exacerbated staffing challenges, causing project delays and increased operational costs. These workforce constraints indirectly affect equipment utilization rates and market demand predictability, creating uncertainty for manufacturers and contractors alike.

High Equipment and Maintenance Costs

The substantial capital investment required for advanced asphalt pavers poses challenges for smaller contractors and regional construction firms. Integration of sophisticated technologies including automated controls and emission reduction features increases both acquisition costs and maintenance complexity. These financial barriers may limit market penetration and encourage rental models over direct purchases.

Rising Raw Material and Operational Costs

Geopolitical tensions and global supply chain disruptions have elevated raw material costs affecting construction equipment manufacturing and operations. Fluctuating prices for steel, components, and fuel impact both equipment production expenses and contractor operational budgets. These cost pressures may constrain infrastructure project funding and affect the pace of equipment procurement decisions.

Competitive Landscape:

The Japan asphalt pavers market features a competitive landscape with established domestic manufacturers holding significant market positions alongside international equipment suppliers. Companies are actively pursuing strategies including technological innovation, product diversification, and service network expansion to strengthen competitive advantages. Domestic manufacturers leverage deep understanding of local market requirements and long-standing contractor relationships. International competitors compete through advanced technology platforms and global service capabilities. The market continues evolving as participants focus on operator safety features, sustainability initiatives, and digital integration to meet emerging customer requirements.

Japan Asphalt Pavers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tracked Pavers, Wheeled Pavers, Screeds |

| Paving Ranges Covered | Less than 1.5 m, 1.5 m to 2.3 m, 2.4 m to 2.55 m, Above 2.55 m |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan asphalt pavers market size was valued at USD 149.78 Million in 2025.

The Japan asphalt pavers market is expected to grow at a compound annual growth rate of 4.94% from 2026-2034 to reach USD 231.16 Million by 2034.

Tracked pavers dominate the market with a 55% share, driven by their superior stability, traction capabilities, and suitability for large-scale highway and infrastructure projects across challenging terrains in Japan.

Key factors include government infrastructure investment programs, aging road infrastructure requiring renovation, technological advancement in paving equipment, and the growing international recognition of Japanese road-building technologies.

Major challenges include skilled labor shortages and an aging workforce, high equipment and maintenance costs, rising raw material expenses due to supply chain disruptions, and new overtime regulations affecting construction project timelines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)