Japan Auto Financing Market Size, Share, Trends and Forecast by Type, Source Type, Vehicle Type, and Region, 2026-2034

Japan Auto Financing Market Summary:

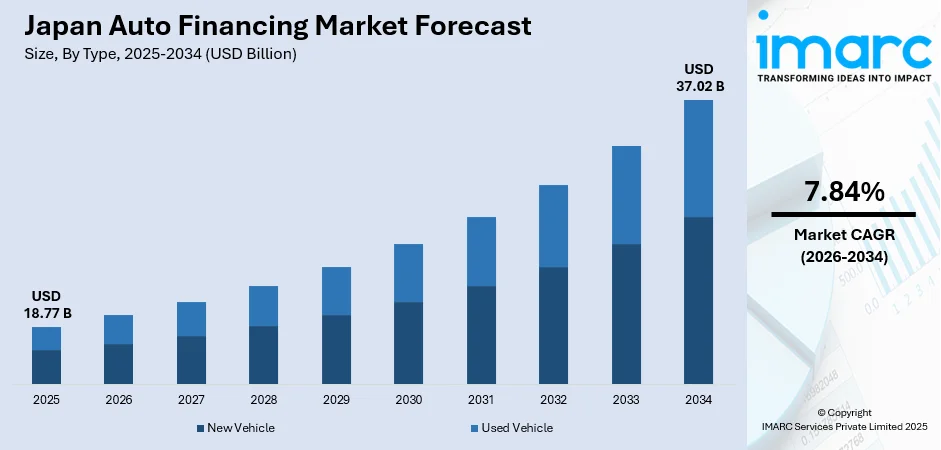

The Japan auto financing market size was valued at USD 18.77 Billion in 2025 and is projected to reach USD 37.02 Billion by 2034, growing at a compound annual growth rate of 7.84% from 2026-2034.

The market is driven by rising vehicle ownership costs, increasing preference for flexible payment options, and the growing popularity of leasing alternatives over traditional ownership. Favorable interest rate policies, expanding digital financing platforms, and strong demand in the used vehicle segment are fueling market expansion. Additionally, government incentives promoting eco-friendly vehicles and tailored loan packages for electric and hybrid automobiles are encouraging consumers to leverage financing solutions. The growing urbanization and evolving consumer preferences toward subscription-based models further contribute to the expanding Japan auto financing market share.

Key Takeaways and Insights:

- By Type: Used vehicle dominates the market with a share of 55.9% in 2025, driven by the affordability advantages of pre-owned automobiles, shorter depreciation cycles releasing high-quality inventory, and consumers seeking budget-friendly alternatives amid rising new vehicle prices.

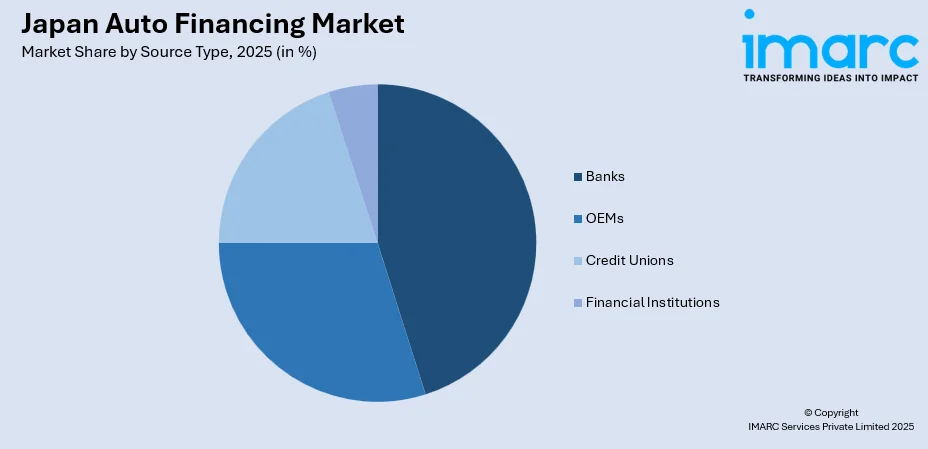

- By Source Type: Banks leads the market with a share of 45.2% in 2025, owing to their well-established presence, competitive interest rates, consumer trust, and extensive branch networks offering personalized services and flexible repayment terms across the nation.

- By Vehicle Type: Passenger cars represent the largest segment with a market share of 75.0% in 2025, propelled by the high individual mobility demand, preference for personal transportation in suburban areas, and diverse financing options catering to individual consumer requirements.

- By Region: Kanto Region commands the market with a share of 34.8% in 2025, driven by the concentration of economic activity in Tokyo and surrounding prefectures, higher disposable incomes, and robust presence of financial institutions and automobile dealerships.

- Key Players: The market is highly competitive, featuring a mix of traditional banks, specialized lending institutions, and emerging digital platforms. Key players focus on offering flexible financing solutions, enhancing customer experience, and leveraging technology to differentiate themselves and capture diverse consumer segments.

To get more information on this market Request Sample

The Japan auto financing market is experiencing robust expansion driven by multiple converging factors that are reshaping consumer purchasing behavior and financial service offerings. The increasing cost of new vehicles has made financing solutions essential for consumers seeking mobility without substantial upfront capital expenditure. Low-interest rate policies maintained by financial institutions have created favorable borrowing conditions, encouraging individuals to opt for auto loans and leasing arrangements. The proliferation of digital banking platforms and fintech innovations has streamlined the loan application process, making financing more accessible and convenient. Furthermore, the shift toward eco-friendly vehicles, supported by government incentives and subsidies for electric and hybrid automobiles, has stimulated demand for specialized financing products. In September 2024, Japan announced subsidies of up to $2.4 billion to support 12 EV battery projects, including Toyota, aiming to strengthen the domestic battery supply chain. Moreover, the growing appeal of subscription-based ownership models and flexible leasing options is attracting younger urban consumers who prioritize convenience over long-term commitments. These factors collectively contribute to sustained growth in the financing sector.

Japan Auto Financing Market Trends:

Rising Adoption of Subscription-Based Vehicle Ownership

The Japanese market is witnessing a significant shift toward subscription-based vehicle ownership models that offer unprecedented flexibility to consumers. For example, in July 2025, Daihatsu launched its Tsukinori used-car subscription service across 12 new sales companies, offering monthly access to certified vehicles with insurance and maintenance included. Further, under this arrangement, individuals pay recurring fees encompassing vehicle usage, maintenance, insurance, and taxation without requiring conventional loans or leases. This approach particularly appeals to younger urban dwellers who value mobility without the financial burden of long-term ownership commitments. Automotive manufacturers and financial institutions are increasingly partnering to offer these plans as part of their evolving product portfolios. The subscription model not only streamlines the ownership cycle but also promotes quicker vehicle renewal cycles and faster adoption of newer models with advanced features.

Accelerated Digital Transformation in Lending Services

Financial institutions across Japan are rapidly embracing digital transformation to enhance their auto financing offerings and improve customer experience. Online loan platforms, mobile applications, and automated approval systems are becoming standard features among leading lenders, enabling consumers to compare offers, submit applications, and receive approvals from their preferred locations. According to reports, in January 2025, Nextage’s survey found over 40% of Japanese auto-loan users were in their 40s, mostly earning ¥4–6 million annually, prioritizing low monthly repayments and flexible down payments. Moreover, artificial intelligence (AI) and advanced analytics are being deployed for credit assessment and risk evaluation, reducing processing times and improving accuracy. The integration of blockchain technology is enhancing transparency and security in financial transactions. This digital evolution is particularly attractive to tech-savvy consumers who prefer seamless, paperless processes over traditional branch-based interactions.

Growing Focus on Green Vehicle Financing Solutions

Environmental consciousness and government decarbonization initiatives are driving substantial growth in financing products tailored for electric and hybrid vehicles. Financial service providers are offering attractive incentives including reduced interest rates, extended loan tenures, and special subsidies for environmentally conscious buyers. These green financing solutions align with broader sustainability goals and Environmental, Social, and Governance frameworks adopted by financial institutions. The expanding availability of affordable eco-friendly vehicle loans not only supports national climate commitments but also influences borrower preferences toward next-generation automobiles. For instance, in September 2025, Honda began sales of the all-new N-ONE e: mini-EV in Japan, offering a WLTC range of 295 km and government subsidies applied to support eco-friendly vehicle financing. This trend is expected to strengthen innovation and consumer confidence in sustainable mobility solutions.

Market Outlook 2026-2034:

The Japan auto financing market is expected to experience significant revenue growth during the forecast period, fueled by rising vehicle ownership costs and growing demand for flexible financing solutions. Expansion is supported by digital lending platforms, innovative financial products, and strong used vehicle financing demand. Government incentives for electric and hybrid vehicles will create new revenue opportunities, while subscription-based and leasing models gain popularity among urban consumers. Metropolitan regions with concentrated economic activity will continue driving market growth as financial institutions enhance their digital capabilities and expand geographically. The market generated a revenue of USD 18.77 Billion in 2025 and is projected to reach a revenue of USD 37.02 Billion by 2034, growing at a compound annual growth rate of 7.84% from 2026-2034.

Japan Auto Financing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Used Vehicle | 55.9% |

| Source Type | Banks | 45.2% |

| Vehicle Type | Passenger Cars | 75.0% |

| Region | Kanto Region | 34.8% |

Type Insights:

- New Vehicle

- Used Vehicle

The used vehicle dominates with a market share of 55.9% of the total Japan auto financing market in 2025.

The used vehicle segment dominates the Japan auto financing market due to its affordability and accessibility, attracting a broad spectrum of consumers. Many buyers prefer used cars as a cost-effective alternative to new vehicles, especially in urban areas where high vehicle prices and limited parking space influence purchasing decisions. Financing options for used cars provide flexibility, allowing consumers to manage monthly payments while accessing reliable transportation. This preference is particularly strong among first-time car buyers and middle-income households seeking practical mobility solutions without incurring substantial upfront costs.

The prominence of the used vehicle segment also stems from the availability of certified pre-owned programs and extended warranties offered by dealerships, which enhance consumer confidence in quality and longevity. Financial institutions have tailored auto loans and leasing solutions specifically for used cars, incorporating flexible repayment structures and lower interest rates to meet diverse customer needs. This segment benefits from a well-established secondary market, enabling quicker turnover and accessibility for buyers who prioritize value and utility. According to reports, in 2023, Japan retailed an estimated 2,601 thousand used cars, highlighting strong consumer preference for affordable second-hand vehicles amid improving supply chains and stable market conditions. Consequently, used vehicles remain a cornerstone of Japan’s auto financing landscape, reflecting practical consumer preferences and financial planning considerations.

Source Type Insights:

Access the comprehensive market breakdown Request Sample

- OEMs

- Banks

- Credit Unions

- Financial Institutions

The banks lead with a share of 45.2% of the total Japan auto financing market in 2025.

Banks maintain their dominant position in the Japan auto financing landscape, leveraging their established infrastructure, consumer trust, and competitive interest rate offerings. The extensive branch networks of traditional banking institutions provide personalized services and face-to-face consultations that many consumers prefer when making significant financial decisions. Banks offer comprehensive loan products with transparent terms, regulatory compliance, and robust customer protection mechanisms that instill confidence among borrowers.

The banking sector has successfully integrated digital channels to complement traditional services, offering online applications, loan simulators, and mobile banking features that enhance convenience. In February 2024, Mitsubishi UFJ Financial Group launched a fully digital car-loan platform nationwide in Japan, enabling faster online applications and approvals, strengthening its position in the auto financing sector. Additionally, banks benefit from strong liquidity positions and diversified funding sources that enable them to offer attractive interest rates and flexible repayment structures. Their relationships with automobile dealerships and manufacturers facilitate streamlined financing processes for consumers. The regulatory oversight by financial authorities ensures fair lending practices that reinforce consumer trust in bank-originated auto loans.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The passenger cars exhibit a clear dominance with a 75.0% share of the total Japan auto financing market in 2025.

The passenger car segment overwhelmingly dominates Japan auto financing demand, reflecting the essential role of personal transportation in Japanese society particularly outside major urban centers with limited public transit options. Individual mobility requirements drive consistent demand for passenger vehicle financing across diverse demographic segments, from young professionals to families seeking reliable transportation solutions. The variety of passenger car options ranging from compact kei-cars to premium sedans creates financing opportunities across multiple price points.

Financial institutions have developed tailored loan products addressing specific passenger car segments, including specialized offerings for eco-friendly vehicles and luxury automobiles. According to reports, in January 2024, Subaru Corporation signed a green loan agreement with Mizuho Bank to fund BEV development and manufacturing, supporting its target of 50% battery‑electric vehicle sales globally by 2030. Moreover, the passenger car segment benefits from predictable residual values that support attractive financing structures including leasing arrangements and balloon payment options. Consumer preference for newer models with advanced safety technologies and fuel efficiency drives regular vehicle replacement cycles, sustaining continuous financing demand throughout the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 34.8% of the total Japan auto financing market in 2025.

The Kanto Region maintains its leading position in Japan auto financing owing to its concentration of economic activity, population density, and robust financial services infrastructure centered around Tokyo and surrounding prefectures. The region's higher average disposable incomes enable consumers to access premium financing products and purchase higher-value vehicles. The presence of numerous financial institution headquarters and branch networks ensures comprehensive service availability and competitive product offerings.

The region benefits from well-developed dealership networks and digital infrastructure that facilitate seamless financing processes for consumers. As per sources, in July 2025, Japanese megabanks announced plans to invest over ¥1 trillion in digital transformation for the fiscal year, strengthening auto financing accessibility and services in regions such as Kanto. Additionally, urban-suburban commuting patterns in the greater Tokyo metropolitan area drive substantial passenger vehicle demand that translates into financing activity. The region serves as an innovation hub where new financing products and digital services are typically introduced before nationwide rollout, providing consumers early access to advanced offerings and competitive terms.

Market Dynamics:

Growth Drivers:

Why is the Japan Auto Financing Market Growing?

Increasing Shift Toward Flexible Ownership Models

The Japanese auto financing market is experiencing significant growth driven by the fundamental shift in consumer attitudes toward vehicle ownership. Modern consumers, particularly younger demographics, increasingly prefer flexible arrangements over traditional ownership commitments that require substantial upfront investments and long-term financial obligations. Leasing options and subscription-based models are gaining substantial traction as they allow individuals to access newer vehicles with advanced technologies without the depreciation concerns associated with ownership. In July 2025, Japan’s personal car leasing market reached 671,404 vehicles by the end of March 2024, reflecting a 115.4% increase compared with the previous fiscal year. Furthermore, financial institutions and automotive manufacturers are responding by developing innovative products that cater to these evolving preferences, offering shorter contract terms, inclusive maintenance packages, and seamless upgrade pathways. This transformation in ownership philosophy is creating sustained demand for diverse financing solutions across market segments.

Favorable Interest Rate Environment and Economic Stability

Japan's stable economic conditions and historically low-interest rate policies have created an exceptionally favorable environment for auto financing growth. The accessible borrowing costs make financing an attractive alternative to cash purchases, enabling consumers to preserve liquidity while acquiring vehicles through manageable monthly installments. In January 2025, the Bank of Japan raised its short-term policy rate from 0.25 % to 0.5 %, marking the first hike since July 2024 and the highest level in 17 years. Moreover, financial institutions leverage these conditions to offer competitive loan products with attractive terms that appeal to diverse consumer segments. The economic stability provides confidence to both lenders and borrowers, supporting longer-tenure financing arrangements and premium vehicle acquisitions. The favorable rate environment particularly benefits the used vehicle financing segment where consumers can access quality automobiles at affordable monthly payments, expanding the addressable market for financial service providers.

Digital Transformation Enhancing Accessibility and Convenience

The comprehensive digital transformation across Japan's financial services sector is significantly expanding auto financing accessibility and driving market growth. Online platforms enable consumers to compare financing options, calculate monthly payments, and submit loan applications without visiting physical branches. Advanced digital tools including artificial intelligence (AI) driven credit assessment systems accelerate approval processes while improving accuracy and reducing operational costs for lenders. In May 2025, Sumitomo Mitsui Card and Mitsubishi UFJ NICOS joined NTT DATA’s Loan Digital Platform®, enabling fully digital personal loan applications, streamlining processes, and improving customer convenience and operational efficiency. Mobile applications provide convenient access to account management, payment scheduling, and customer support services. This technological evolution removes traditional barriers to financing access, particularly benefiting consumers in remote areas or those with time constraints. The enhanced convenience and transparency offered by digital channels are attracting new customer segments and increasing overall market penetration.

Market Restraints:

What Challenges the Japan Auto Financing Market is Facing?

Stringent Regulatory Compliance Requirements

The Japanese auto financing market operates under comprehensive regulatory frameworks imposed by financial authorities to ensure consumer protection and lending transparency. These stringent requirements create compliance burdens for financial institutions, particularly newer market entrants and non-banking finance companies seeking to expand their offerings. The extensive documentation requirements and approval processes can extend financing timelines and increase operational costs for lenders.

Geriatric Population and Demographic Challenges

Japan's demographic trends present structural challenges for auto financing market expansion as the aging population gradually reduces the active consumer base for vehicle purchases. Older demographics typically exhibit lower propensity for new vehicle acquisitions and financing utilization compared to younger age groups. The declining birth rate and shrinking working-age population constrain long-term market growth potential and require financial institutions to adapt their strategies accordingly.

Competition from Alternative Transportation Solutions

The expanding availability of alternative transportation options including ride-sharing services, car-sharing platforms, and improved public transit networks creates competitive pressure on traditional vehicle ownership and financing models. Urban consumers increasingly question the necessity of personal vehicle ownership when convenient alternatives exist. This shift in mobility preferences particularly affects metropolitan markets where public transportation infrastructure is well-developed.

Competitive Landscape:

The Japan auto financing market has a moderately competitive structure with diverse participants comprising traditional banking institutions, non-banking financial companies, captive finance arms of automobile manufacturers, credit unions, and new fintech platforms. Competition has intensified significantly since digital transformation has allowed new entrants to enter the market and compete with established players on the back of innovative products and smooth services. Traditional banks have been able to hold a good market share owing to their established infrastructures, gained consumers' trust, and competitive interest rates, while captive finance firms use their close relationships with automotive manufacturers to offer integrated purchase and finance experiences. Nonbanking financial firms try to compete on the basis of lenient lending criteria and a faster approval process that appeals to customers who cannot access credit facilities from other sources. Online lending sites and fintech solutions have further raised competition by offering transparent pricing, the convenience of digital interfaces, and very fast processing. Competition is increasingly based on differentiated product offerings for different types of vehicles, such as electric vehicles and used cars.

Recent Developments:

- In July 2024, Rating and Investment Information, Inc. reaffirmed the a-1+ CP rating of Volkswagen Financial Services Japan, citing strong support from the Volkswagen Group, solid asset quality, stable funding through securitization and commercial paper, and limited credit and liquidity risks across its auto-loan and leasing operations.

Japan Auto Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | New Vehicle, Used Vehicle |

| Source Types Covered | OEMs, Banks, Credit Unions, Financial Institutions |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan auto financing market size was valued at USD 18.77 Billion in 2025.

The Japan auto financing market is expected to grow at a compound annual growth rate of 7.84% from 2026-2034 to reach USD 37.02 Billion by 2034.

Used vehicle held the largest share of the Japan auto financing market, driven by driven by strong consumer demand for affordable options, competitive pricing, and the increasing availability of certified pre-owned vehicles across urban and regional areas.

Key factors driving the Japan auto financing market include rising vehicle ownership costs encouraging financing adoption, favorable low-interest rate policies, digital transformation enhancing accessibility, growing preference for flexible ownership models, and government incentives promoting eco-friendly vehicle financing.

Major challenges include stringent regulatory compliance requirements, aging population dynamics reducing consumer base, competition from alternative transportation solutions, high vehicle prices impacting affordability, economic uncertainties affecting consumer confidence, and increasing competition from fintech platforms disrupting traditional lending models.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)