Japan Autocatalyst Market Expected to Reach USD 1,191.7 Million by 2033 - IMARC Group

Japan Autocatalyst Market Statistics, Outlook and Regional Analysis 2025-2033

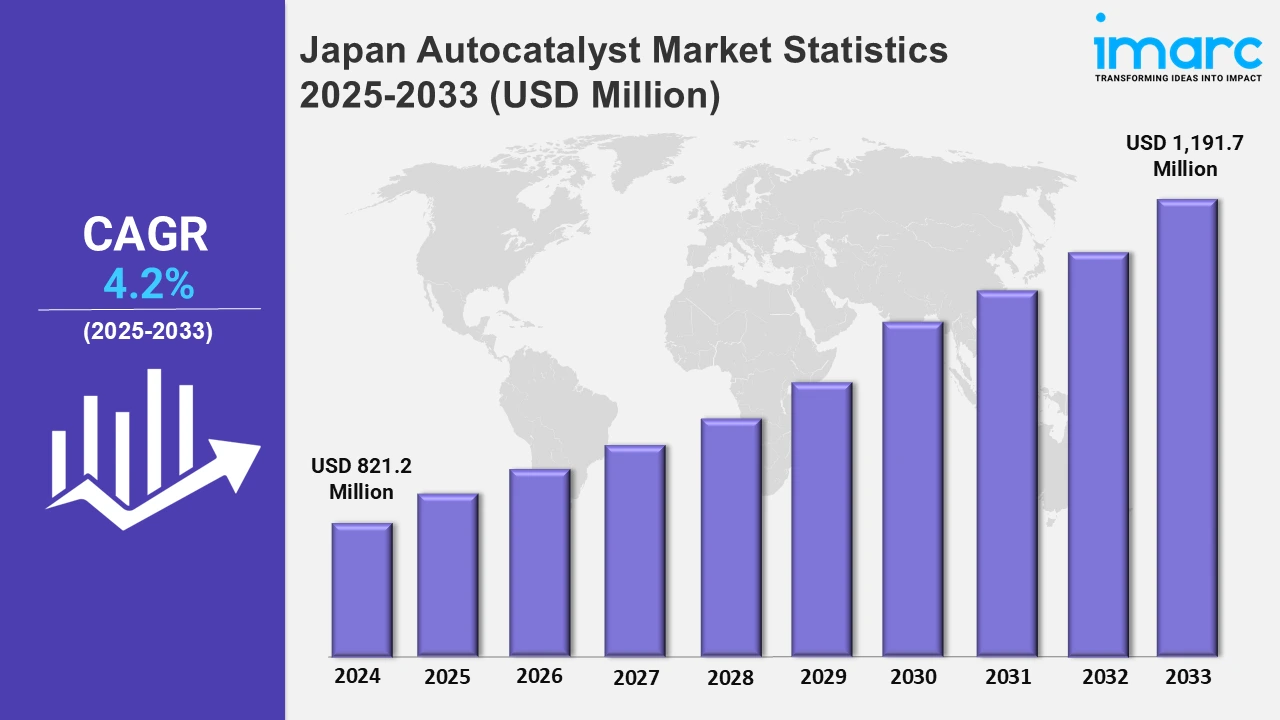

The Japan autocatalyst market size was valued at USD 821.2 Million in 2024, and it is expected to reach USD 1,191.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% from 2025 to 2033.

To get more information on this market, Request Sample

Collaboration between ASEAN and Japan is driving progress in decarbonizing the automotive sector, with a significant emphasis on emissions reduction. These activities are consistent with advancements in the autocatalyst sector, which emphasize on cleaner solutions to promote a greener and more sustainable automotive future. For example, in December 2024, the Economic Research Institute for ASEAN and East Asia (ERIA) sponsored a workshop in association with the Institute of Developing Economies-Japan External Trade Organization (IDE-JETRO) to discuss the potential for ASEAN-Japan cooperation in decarbonizing the automotive industry.

Moreover, Japan is playing a leading role in advancing energy reform and decarbonization throughout Asia. Through strategic collaborations and creative solutions, the country is supporting regional cooperation and improving sustainable energy systems to accomplish long-term environmental and energy goals together. For instance, in August 2024, Japan signed around 70 memorandums of understanding (MOUs) on energy transformation at the Asia Zero Emission Community (AZEC) ministerial summit in Jakarta. Furthermore, the Japan autocatalyst industry is growing as manufacturers attempt to fulfill strict pollution rules and enhance vehicle economy. With the government's goal of reducing greenhouse gas emissions, the industry offers tremendous prospects for innovative autocatalyst solutions. High-performance autocatalysts are gaining popularity over standard systems because of their increased durability and efficiency. For example, Japanese automakers such as Toyota and Honda are investing extensively in autocatalyst technology to meet carbon neutrality targets. Toyota's developments in hybrid and hydrogen fuel cell technology use cutting-edge autocatalysts to dramatically reduce pollutants. Similarly, Honda's development of hybrid engines focuses on efficient catalytic systems to fulfill growing environmental demands. These advances not only contribute to global decarbonization efforts but also meet growing customer demand for ecologically friendly automobiles with improved performance and endurance.

Japan Autocatalyst Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Robust technological advancements in autocatalyst designs in various regions of Japan are significantly driving the growth of the market.

Kanto Region Autocatalyst Market Trends:

The Kanto region, with Tokyo as its capital, has strict pollution standards, which drive innovation in the autocatalyst industry. Leading firms, like Cataler Corporation, are developing solutions to minimize nitrogen oxides and particulate matter emissions. Urban settings, with their dense populations and heavy car utilization, necessitate high-performing catalysts. These developments help clean the air and coincide with the government's objective of being carbon neutral through better automobile emission control systems.

Kinki Region Autocatalyst Market Trends:

Autocatalyst technology is being advanced in the Kinki region, which centers around Osaka, owing to joint efforts between automobile manufacturers and research institutes. For example, Sumitomo Metal Mining Co., Ltd. collaborates with local research universities to create next-generation catalysts that improve fuel economy while fulfilling stringent pollution rules. These collaborations demonstrate the region's commitment to meeting sustainability targets and supporting Japan's leadership in environmentally friendly automobile technology.

Central/Chubu Region Autocatalyst Market Trends:

The Central/Chubu region, home to major automobile manufacturers such as Toyota in Nagoya, is a hub of research in hybrid and electric car autocatalysts. Toyota Motor Corporation is rapidly investing in technology that caters to various powertrains, such as advanced catalysts for hybrid cars and fuel cells, to ensure compliance with changing worldwide pollution requirements. This strengthens the region's position as a pillar of Japan's automotive sector and its drive toward decarbonization.

Kyushu-Okinawa Region Autocatalyst Market Trends:

The Kyushu-Okinawa region focuses on sustainability through recycling. Tanaka Kikinzoku Kogyo in Fukuoka has established facilities to extract precious metals like platinum and palladium from used autocatalysts. These activities promote a circular economy and minimize reliance on raw material imports, which aligns with Japan's decarbonization objectives. The region is emerging as a sustainable practice leader, balancing industrial expansion with environmental responsibilities.

Tohoku Region Autocatalyst Market Trends:

The Tohoku region, which comprises Sendai, is a focus for nanotechnology-based autocatalyst research. Tohoku University works with manufacturers such as Hitachi Metals to produce catalysts with larger surface areas, increasing efficiency and minimizing dependency on precious metals. This invention helps to reduce costs while also aligning with national aims for making autocatalyst technology more sustainable and accessible.

Chugoku Region Autocatalyst Market Trends:

The Chugoku region, which includes Hiroshima as its industrial hub, is taking proactive measures to reduce pollution by upgrading current automobiles with improved autocatalysts. Mazda Motor Corporation, located in Hiroshima, is pioneering efforts to incorporate modern catalyst technology into its engines to fulfill stricter emission standards ahead of national deadlines. These projects demonstrate the region's commitment to environmental responsibility, establishing it as a leader in sustainable automobile operations.

Hokkaido Region Autocatalyst Market Trends:

Hokkaido, known for its cold climate, is focused on autocatalyst performance at low temperatures. Hokkaido University works with local manufacturers to produce catalysts that are effective even in harsh winter circumstances, ensuring year-round compliance with pollution requirements. This particular approach tackles regional concerns while also contributing to national efforts to advance robust and efficient autocatalyst technology.

Shikoku Region Autocatalyst Market Trends:

The Shikoku region, notably Takamatsu, prioritizes innovation in autocatalysts for two-wheelers, an important market sector. Nippon Chemical Industrial Co., Ltd. is developing cost-effective methods to minimize motorcycle emissions. These activities respond to the rising demand for cleaner transportation and are consistent with national goals of encouraging sustainability across all vehicle types.

Top Companies Leading in the Japan Autocatalyst Industry

Some of the leading Japan autocatalyst market companies have been included in the report. The report provides an in-depth competitive analysis, examining the market structure, the positioning of key players, leading strategies for success, a competitive overview dashboard, and an evaluation quadrant for assessing company performance. For example, in October 2024, Amp Energy raised about USD 145 Million in equity funding for its subsidiary, Amp Japan. The investment, led by Asia-Pacific Sustainable & Decarbonisation Infrastructure Equity, LP (supported by Aravest and SMBC Group) and Banpu NEXT Company Limited, aims to accelerate the growth of renewable energy projects, including those related to the autocatalyst sector.

Japan Autocatalyst Market Segmentation Coverage

- Based on the material, the market has been classified into platinum, palladium, rhodium, and others. Platinum efficiently converts hydrocarbons and carbon monoxide. Palladium assists in diesel applications, helping to reduce carbon monoxide and hydrocarbon emissions. Rhodium is required for both gasoline and diesel to combat dangerous nitrogen oxides.

- Based on the catalyst type, the market has been categorized into two-way, three-way, and four-way. Two-way catalysts aim to reduce carbon monoxide and hydrocarbons in gasoline engines. In gasoline and hybrid vehicles, three-way catalysts handle carbon monoxide, hydrocarbons, and nitrogen oxides. Four-way catalysts, which are less prevalent, are developed for diesel engines and target a wider range of pollutants using modern emission control technologies.

- Based on the distribution channel, the market has been divided into OEM and aftermarket. The OEM segment provides automakers with customized catalytic converters for new models. The aftermarket industry focuses on replacement components for current automobiles, which is driven by vehicle maintenance and repair requirements.

- Based on the vehicle type, the market is classified into passenger car, light commercial vehicle, heavy commercial vehicle, and others. The passenger car segment is characterized by high production and severe emissions rules. Light commercial vehicles focus on efficiency and affordability, with demand centered on logistics and smaller business operations. Heavy commercial vehicles require powerful catalysts to control greater emissions from diesel engines, which are impacted by rules aimed at reducing nitrogen oxides and particulate matter in industrial transport.

- Based on the fuel type, the market is segmented into gasoline, diesel, hybrid fuels, and hydrogen fuel cell. Gasoline is preferred owing to extensive vehicle use, while diesel is designed for business vehicles. Hybrid systems, which combine gasoline and electricity, are fast developing due to environmentally concerned demand. Hydrogen fuel cells are gaining popularity due to their zero-emission features, aided by Japan's hydrogen economy plans.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 821.2 Million |

| Market Forecast in 2033 | USD 1,191.7 Million |

| Market Growth Rate 2025-2033 | 4.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Platinum, Palladium, Rhodium, Others |

| Catalyst Types Covered | Two-Way, Three-Way, Four-Way |

| Distribution Channels Covered | OEM, Aftermarket |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Others |

| Fuel Types Covered | Gasoline, Diesel, Hybrid Fuels, Hydrogen Fuel Cell |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Autocatalyst Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)