Japan Automotive Steering System Market Expected to Reach USD 3.6 Billion by 2033 - IMARC Group

Japan Automotive Steering System Market Statistics, Outlook and Regional Analysis 2025-2033

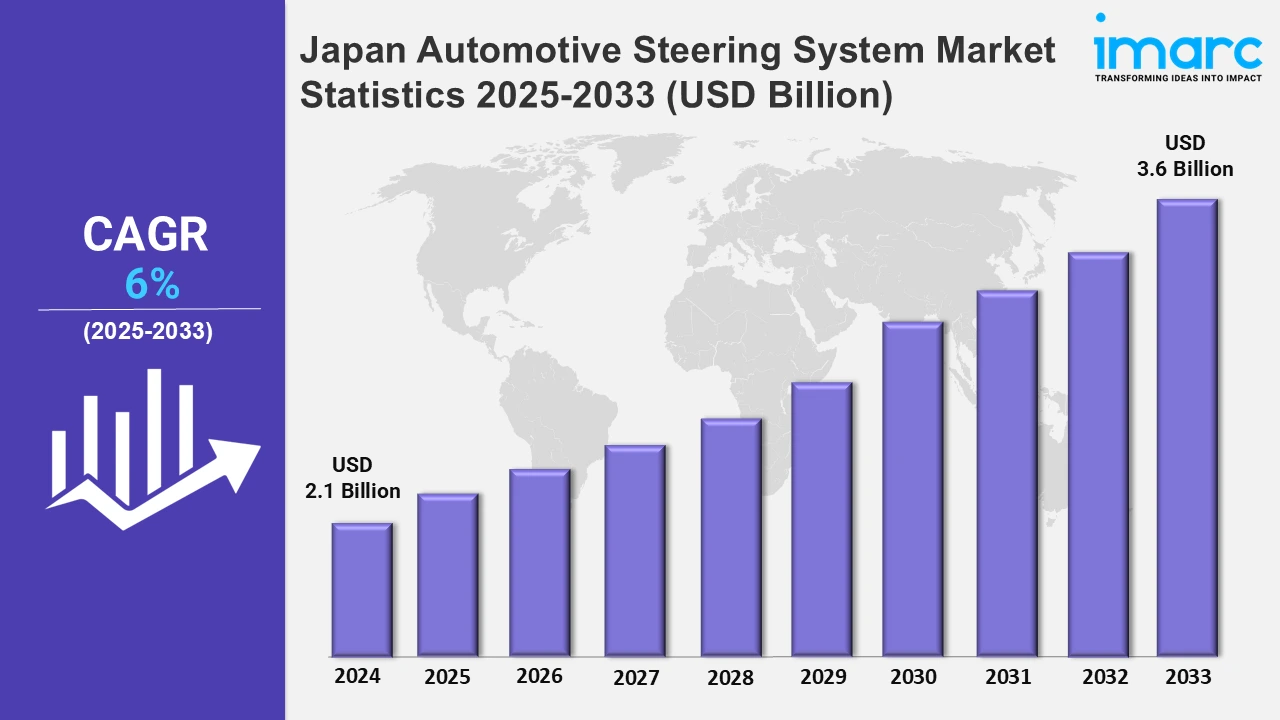

The Japan automotive steering system market size was valued at USD 2.1 Billion in 2024, and it is expected to reach USD 3.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6% from 2025 to 2033.

To get more information on this market, Request Sample

The rise of hybrid and electric vehicles is driving the market expansion, as these automobiles demand innovative steering technologies to enhance performance, safety, and comfort. Increased requirements for fuel-efficient and eco-friendly cars are elevating automakers to incorporate sophisticated steering systems, thereby contributing to market expansion. For instance, in January 2025, Toyota launched its new Vellfire and Alphard plug-in hybrid electric vehicle (PHEV) models in the nation, further driving the demand for advanced product variants.

Additionally, ongoing innovations such as electric power steering (EPS) are replacing traditional hydraulic systems, as they assist in offering enhanced fuel efficiency, reduced weight, and greater precision in vehicle control. Additionally, the rise of autonomous vehicles is fostering innovations in steering systems to accommodate self-driving technology. Advanced technologies like the stabilizer with disconnection mechanism (SDM) are also being introduced, offering improved handling and driving comfort, particularly in off-road vehicles. For instance, in April 2024, Toyota launched the new "250" series land cruiser in Japan, along with limited-edition ZX and VX first-edition models, capped at 8,000 units. They feature electric power steering (EPS) and a stabilizer with a disconnection mechanism (SDM) for enhanced performance. These innovations reflect the country's focus on elevating performance, sustainability, and user experience, driving the adoption of EPS in more vehicle segments, including premium and specialty models.

Japan Automotive Steering System Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The increasing adoption of electric vehicles is positively impacting the demand for steering systems, particularly EPS, which offers lower energy consumption.

Kanto Region Automotive Steering System Market Trends:

The expanding adoption of electric power steering systems is driving the market growth in the Kanto region. Tokyo is the largest automotive hub, with the presence of various key players like Honda. The growing shift towards electric vehicles and automotive driving technologies is propelling the demand for EPS.

Kansai/Kinki Region Automotive Steering System Market Trends:

The growing innovation in steering technology in cities like Osaka is escalating the growth of the market across the Kansai region. Various key companies like Mazda are developing advanced steering systems. This focus on adopting high-performance vehicles is driving the investment in automotive research and development centers in the region.

Central/Chubu Region Automotive Steering System Market Trends:

The Central/Chubu region is adopting hydraulic power steering. With Toyota's headquarters in Aichi Prefecture, the area is at the forefront of hybrid powertrains. Besides this, the region is prioritizing improvements in fuel efficiency, which is further contributing to the growing demand for HPS in Central/Chubu.

Kyushu-Okinawa Region Automotive Steering System Market Trends:

Kyushu-Okinawa region is emphasizing the development of a steering system that caters to the growing demand for electric vehicles. The presence of key corporations in Fukuoka has fueled advancements in EPS. In addition to this, the region is also investing in advancing smart steering technologies to integrate vehicle-to-vehicle communication.

Tohoku Region Automotive Steering System Market Trends:

Tohoku, with its industrial roots, focuses on automated and autonomous vehicle steering systems. Companies like Hitachi Astemo, Ltd. are innovating systems like automated lane-keeping, which works with advanced steering technology. Tohoku's focus on the development of safety features for steering systems, especially in harsh weather conditions that are typical in the region, makes it distinct in contributing to autonomous vehicles.

Chugoku Region Automotive Steering System Market Trends:

The Chugoku region, notably in Hiroshima, has a distinct focus on steering systems for environmentally friendly vehicles. Mazda, a major player in the region, emphasizes steering technologies that support fuel-efficient cars, including lightweight and compact EPS systems that can reduce overall vehicle weight. Additionally, there is an increasing focus on integrated product variants for hybrid vehicles to align with the eco-friendly goals of the region.

Hokkaido Region Automotive Steering System Market Trends:

In the Hokkaido region, there is an increasing development of specialized steering systems designed for cold temperatures. Various key manufacturers across the area are focusing on hydraulic power steering that is less prone to freezing in cold conditions. In addition to this, improved traction control systems integrated with steering are becoming popular in the Hokkaido region as they enhance vehicle stability on icy roads.

Shikoku Region Automotive Steering System Market Trends:

Shikoku is known for its regional focus on steering systems in compact and affordable vehicles. Companies like Honda manufacture more budget-friendly cars in this area, leading to a demand for affordable steering systems. There is also a strong emphasis on easy-to-maintain systems catering to the region’s rural and semi-rural demographics.

Top Companies Leading in the Japan Automotive Steering System Industry

Some of the businesses in Japan have been encompassed. In January 2025, Toyota launched its new Vellfire and Alphard plug-in hybrid electric vehicle (PHEV) models in the nation, further driving the demand for advanced product variants. Furthermore, the company also introduced the new "250" series land cruiser in the country that is integrated with novel systems.

Japan Automotive Steering System Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into electric power steering (EPS), hydraulic power steering (HPS), electro-hydraulic power steering (EHPS), and manual steering. EPS generally adopts an electric motor to aid the driver in steering the vehicle. Moreover, hydraulic power steering is less energy efficient and relies on hydraulic pumps. Furthermore, EHPS combines elements of both hydraulic and electric systems.

- Based on the component, the market has been bifurcated into steering column, steering wheel speed sensors, electric motors, hydraulic pumps, and others. The steering column links the wheel to the steering mechanism. Moreover, steering wheel speed sensors measure the rotational speed of the steering wheel. Furthermore, electric motors are central to electric power steering systems.

- On the basis of the vehicle type, the market has been bifurcated into passenger cars, light commercial vehicles, and heavy commercial vehicles. The steering system is a crucial component in these vehicles, as it ensures precise control. Apart from this, the inflating need for safety and optimal automobile handling is elevating the segment’s growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), Manual Steering |

| Components Covered | Steering Column, Steering Wheel Speed Sensors, Electric Motors, Hydraulic Pumps, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Automotive Steering System Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)