Japan Baby Apparel Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Age Group, End User, and Region, 2026-2034

Japan Baby Apparel Market Overview:

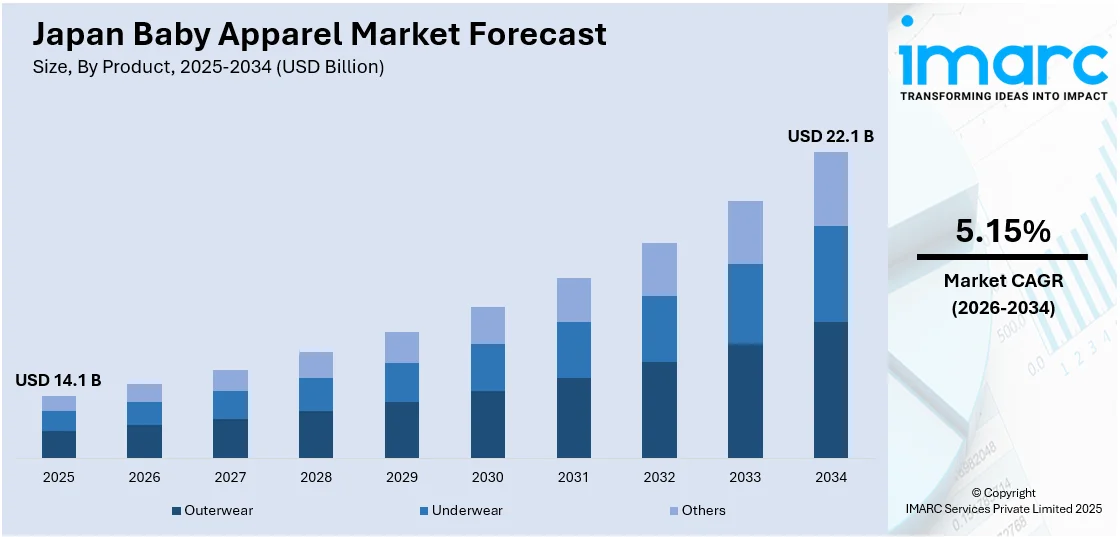

The Japan baby apparel market size reached USD 14.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 22.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034. The market is driven by the growing consumer preference for quality, sustainable, and culturally sensitive clothes, bolstered by innovative aesthetics, changing lifestyles of parents, and luxury demand, translating to steady demand throughout urban and suburban areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.1 Billion |

| Market Forecast in 2034 | USD 22.1 Billion |

| Market Growth Rate 2026-2034 | 5.15% |

Japan Baby Apparel Market Trends:

Sustainable Fabric Innovation Reshaping Consumer Preferences

Consumers in Japan increasingly view sustainability as a top consideration when making purchasing decisions, especially when it comes to babywear. They are increasingly demanding clothes that use organic cotton, bamboo fabric, and other biodegradable fabrics that offer low environmental footprints while keeping infants soft and safe. Japanese parents, who are very sensitive to health and environmental concerns, are consciously opting for clothing that does not contain dangerous dyes and man-made fibers. This phenomenon has backing through advances in textile production which entail both environmentally friendly processing as well as body-friendly design. For instance, in March 2024, Makip introduced Unisize for Kids a digital fitting solution that employs growth algorithms to assist parents in choosing the right clothing sizes online, making it easier and lessening return rates. Moreover, products with temperature regulation, sun protection, and natural antibacterial capabilities are becoming the norm. Japan baby apparel market outlook mirrors this consumer shift, with a significant increase in the uptake of sustainable fashion choices through urban and suburban retail outlets. Ethical fashion is not just shaping product innovation but also impacting advertising approaches and retail shelf mixes across the country.

To get more information on this market Request Sample

Rise of Functional and Multi-Use Baby Clothing

Japanese families are showing an increasing inclination towards practical and multi-purpose baby clothing that accommodates active lifestyles and space-saving parenting. Apparel that performs well over changing seasons, with extendable elements, or with multiple functions e.g., sleepwear also used as casual apparel—has been in high demand among consumers. Parents want apparel that makes everyday routines easier while providing comfort and functionality. This tendency is also seen in the use of easy-to-clean, fast-drying materials and wear with fewer fasteners to make dressing easier. In keeping with Japan's dense urban lifestyle and strong emphasis on functionality, multi-functional products suit consumer demands for convenience and durability. Japan baby apparel market share is mostly dominated by these versatile styles, especially in urban centers where consumers base behavior on convenience and wise buying. The mass popularity of functional clothing is also inspiring new product innovation and raising the bar for performance in infantwear.

Cultural Aesthetics Driving Premium and Personalized Designs

In Japan, infant clothing serves not only a functional purpose but also reflects cultural significance and aesthetic sensibilities. Modern designs frequently feature traditional Japanese motifs, soft pastel hues, and minimalist styling, aligning closely with the broader national aesthetic. These cultural trends are particularly prominent in gift-giving rituals, such as "Oshichiya" (7th day naming ceremony) and "Okuizome" (first meal ceremony), where baby apparel has symbolic meaning. Personalization is another growing trend, with parents preferring personalized embroidery, zodiac signs, or local fabric to make bespoke outfits. This meeting of cultural awareness and contemporary craftsmanship is driving a new niche of high-end, emotionally engaging products. Japan baby apparel market growth is particularly notable in the high-end segment, driven by increasing consumer willingness to invest in meaningful, high-quality clothing for their children. For example, in June 2024, Baby Baby Cool, an organic kidswear brand from Taiwan, opened in Japan through Hankyu and Isetan department stores, pushing GOTS-certified cotton and fashionable, health-savvy kids' fashion. Furthermore, the trend highlights the cultural values remaining as a force that shapes purchasing habits, creating a market culture that is both traditional and sophisticated.

Japan Baby Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product, material, distribution channel, age group, and end user.

Product Insights:

- Outerwear

- Underwear

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes outerwear, underwear, and others.

Material Insights:

- Cotton

- Wool

- Silk

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes cotton, wool, and silk.

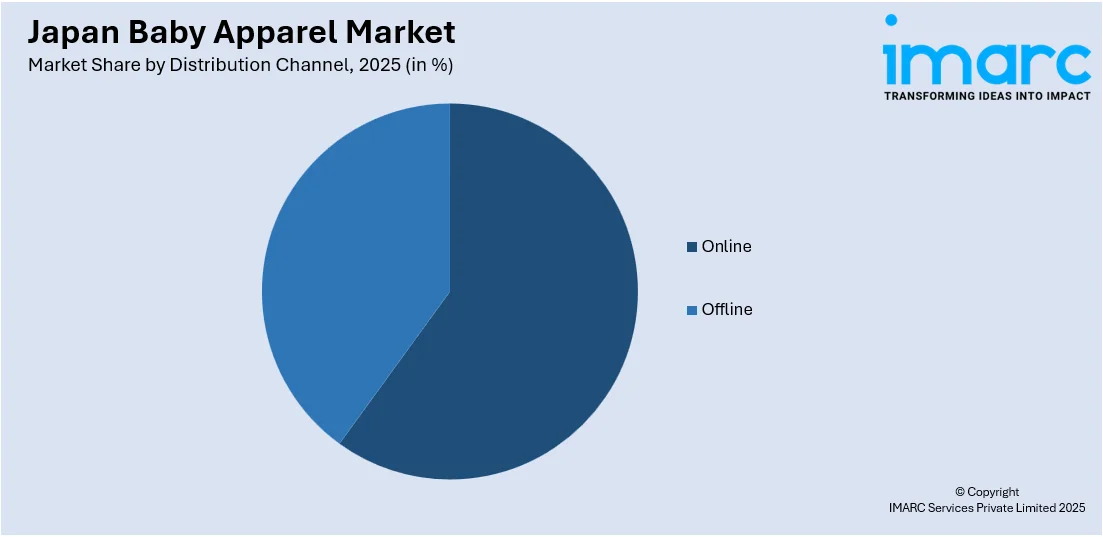

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Age Group Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 0–12 months, 12–24 months, and 2–3 years.

End User Insights:

- Girls

- Boys

The report has provided a detailed breakup and analysis of the market based on the end user. This includes girls and boys.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Baby Apparel Market News:

- In May 2024, Zara rolled out a children's wear capsule collection inspired by Japan with organic cotton "jinbei" rompers and baby two-piece sets. The capsule aids Zara's expansion push in Asia and enhances its kidswear segment after Inditex's acquisition of Kiddy's Class.

Japan Baby Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Outerwear, Underwear, Others |

| Materials Covered | Cotton, Wool, Silk |

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0-12 Months, 12-24 Months, 2-3 Years |

| End Users Covered | Girls, Boys |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan baby apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan baby apparel market on the basis of product?

- What is the breakup of the Japan baby apparel market on the basis of material?

- What is the breakup of the Japan baby apparel market on the basis of distribution channel?

- What is the breakup of the Japan baby apparel market on the basis of age group?

- What is the breakup of the Japan baby apparel market on the basis of end user?

- What is the breakup of the Japan baby apparel market on the basis of region?

- What are the various stages in the value chain of the Japan baby apparel market?

- What are the key driving factors and challenges in the Japan baby apparel?

- What is the structure of the Japan baby apparel market and who are the key players?

- What is the degree of competition in the Japan baby apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan baby apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan baby apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan baby apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)