Japan Bedsheet Market Size, Share, Trends and Forecast by Type, Application, Sales Channel, and Region, 2026-2034

Japan Bedsheet Market Summary:

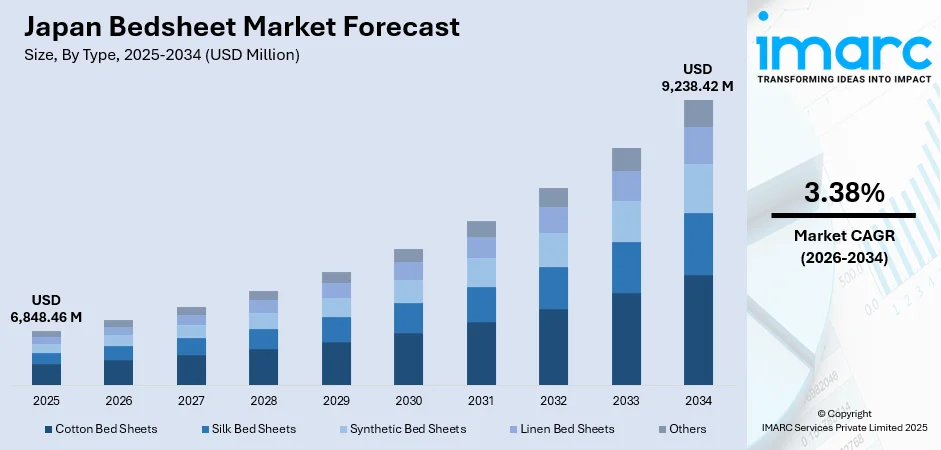

The Japan bedsheet market size was valued at USD 6,848.46 Million in 2025 and is projected to reach USD 9,238.42 Million by 2034, growing at a compound annual growth rate of 3.38% from 2026-2034.

The Japan bedsheet market is experiencing steady growth driven by rising consumer focus on sleep quality, increasing urbanization, and the country's rapidly aging population seeking comfortable bedding solutions. The incorporation of innovative textile technologies, including antimicrobial and temperature-regulating fabrics, is reshaping product offerings across the market. Growing awareness of home aesthetics combined with the influence of Western lifestyle trends continues to fuel demand for premium and coordinated bedsheet products. Additionally, the expansion of e-commerce platforms and sustainable fabric innovations are accelerating Japan bedsheet market share.

Key Takeaways and Insights:

- By Type: Cotton bed sheets dominate the market with a share of 48% in 2025, driven by consumer preference for natural fibers offering breathability, comfort, and hypoallergenic properties ideal for Japan's humid climate.

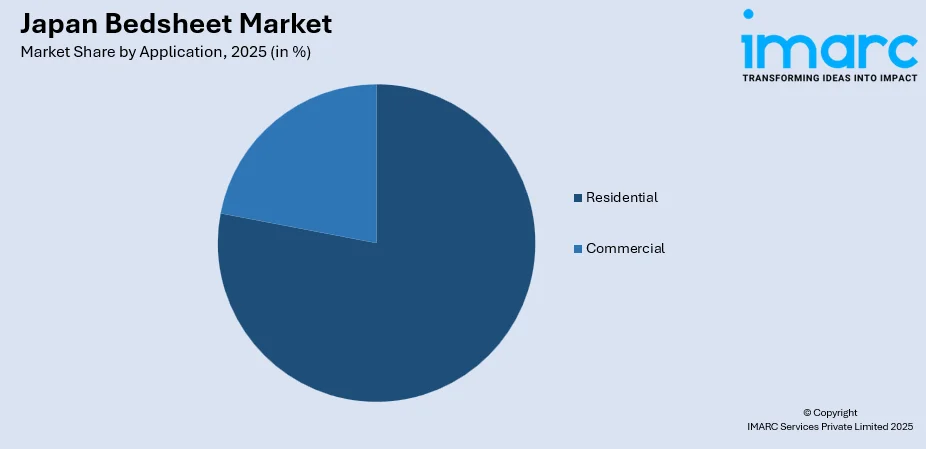

- By Application: Residential segment leads the market with a share of 78% in 2025, propelled by increasing household investments in quality bedding and the growing emphasis on creating comfortable home environments.

- By Sales Channel: Supermarket/hypermarket holds the largest share of 41% in 2025, owing to convenient one-stop shopping experiences and the ability to physically assess fabric quality before purchase.

- Key Players: The Japan bedsheet market exhibits moderate concentration with established domestic manufacturers competing alongside international brands. Leading players leverage extensive retail networks, innovative product development, and strong brand heritage to maintain competitive positioning across premium and value segments.

To get more information on this market Request Sample

The Japan bedsheet market benefits from the country's strong consumer culture that prioritizes quality craftsmanship and attention to detail in home textiles. According to the government reports, Japan consistently ranks as having the oldest population in the world, with over 10% of its citizens being 80 years of age or older as of September 2023, creating substantial demand for bedding products that offer enhanced comfort and health benefits. Japanese manufacturers are responding with innovations in fabric technology, including cooling treatments for summer months and moisture-wicking properties for year-round comfort. Additionally, the industry is witnessing a trend toward eco-friendly and sustainable materials, with consumers who care about the environment becoming more interested in organic cotton and bamboo-blend textiles. Furthermore, the incorporation of smart textile technologies, such as temperature-regulating bedding developed by companies like Nishikawa, represents the next frontier in product innovation.

Japan Bedsheet Market Trends:

Integration of Smart and Functional Textile Technologies

The Japan bedsheet market is undergoing significant transformation through advanced textile technology integration. Manufacturers are developing bedding products featuring temperature-regulating properties, antimicrobial treatments, and moisture-wicking capabilities to meet growing consumer demands for enhanced sleep quality. These innovations address Japan's distinct seasonal climate patterns, offering cooling solutions for humid summers and warmth retention during colder months. This technological advancement demonstrates the industry's commitment to combining traditional comfort with modern functionality, positioning functional bedding as essential for health-conscious consumers.

Rising Demand for Sustainable and Organic Materials

Environmental consciousness is reshaping consumer preferences in the Japan bedsheet market, with growing demand for organic cotton and sustainably sourced fabrics. Consumers increasingly prioritize bedding products that minimize environmental impact while delivering superior comfort and hypoallergenic properties. Japanese manufacturers are responding by expanding certified organic cotton collections and adopting eco-friendly production processes that reduce water consumption and eliminate harmful chemicals. This sustainability focus is driving innovation across textile manufacturing and product development, aligning with broader national commitments to environmental conservation and responsible consumption practices.

E-commerce Expansion Transforming Distribution Channels

The rapid expansion of digital commerce is fundamentally transforming bedsheet distribution in Japan. As per the IMARC Group estimates, Japan e-commerce market size is expected to reach USD 692.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. This enables consumers to access broader product selections and premium international brands previously unavailable through traditional retail. Major players are investing in enhanced online shopping experiences, virtual product demonstrations, and convenient delivery services to capture the growing segment of digitally native consumers.

Market Outlook 2026-2034:

The Japan bedsheet market is positioned for sustained growth over the forecast period, supported by evolving consumer lifestyles and technological advancements in textile manufacturing. The intersection of demographic shifts, urbanization trends, and increasing health consciousness will continue driving demand for premium and functional bedding products. Manufacturers focusing on innovation, sustainability, and omnichannel distribution strategies are expected to capture significant market opportunities. The market generated a revenue of USD 6,848.46 Million in 2025 and is projected to reach a revenue of USD 9,238.42 Million by 2034, growing at a compound annual growth rate of 3.38% from 2026-2034.

Japan Bedsheet Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Cotton Bed Sheets | 48% |

| Application | Residential | 78% |

| Sales Channel | Supermarket/Hypermarket | 41% |

Type Insights:

- Cotton Bed Sheets

- Silk Bed Sheets

- Synthetic Bed Sheets

- Linen Bed Sheets

- Others

The cotton bed sheets segment dominates with a market share of 48% of the total Japan bedsheet market in 2025.

Cotton bed sheets maintain their dominant position in Japan's bedsheet market due to their superior breathability, natural comfort, and hypoallergenic properties that align with consumer health consciousness. The material's versatility in adapting to Japan's distinct seasonal climate patterns, offering coolness in humid summers and warmth retention during winters, reinforces its market leadership. Premium Egyptian and organic cotton variants command price premiums, appealing to quality-focused Japanese consumers who prioritize durability and tactile comfort in their bedding selections.

The growing sustainability movement in Japan further strengthens cotton's market position, with Japan organic cotton market size expected to reach USD 826.49 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. Japanese manufacturers are responding to this trend by introducing GOTS-certified organic cotton bedsheet collections that combine environmental responsibility with traditional quality craftsmanship. In May 2025, Nishikawa introduced the Newmine silk and cotton bedding series featuring washable fabrics priced at JPY 55,000, demonstrating the premium positioning of natural fiber bedding in the Japanese market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential segment leads with a share of 78% of the total Japan bedsheet market in 2025.

The residential segment's commanding market share reflects the Japanese cultural emphasis on home comfort and the importance placed on quality sleep environments. With Japan's aging population reaching record levels, there is heightened focus on bedding products that enhance sleep quality and overall well-being. The residential segment benefits from increased consumer spending on home improvement and interior aesthetics, particularly as remote work arrangements continue influencing lifestyle choices. Japanese households increasingly invest in premium bedsheet sets that complement interior design while delivering functional benefits including temperature regulation and allergen resistance.

Rising urbanization in major metropolitan areas like Tokyo and Osaka drives demand for compact, multifunctional bedding solutions optimized for smaller living spaces. In 27 prefectures, the proportion of single-person families is predicted to rise above 40% by 2050, creating sustained demand for individual bedsheet purchases. The residential segment also benefits from seasonal product replacement cycles, with Japanese consumers traditionally updating bedding for summer and winter seasons, as exemplified by the strong market reception of Nitori's N-Cool summer bedding series featuring contact-cooling technology.

Sales Channel Insights:

- Supermarket and Hypermarket

- Specialty Store

- Online

The supermarket and hypermarket segment holds the largest share of 41% of the total Japan bedsheet market in 2025.

Supermarkets and hypermarkets in Japan play a steady role in bedsheet sales, as shoppers often pick up home textiles during routine grocery trips. These stores draw families who prefer seeing fabric quality in person and comparing prices quickly. Bedsheets are usually placed near seasonal items or household basics, which helps move mid-priced cotton and blended goods through regular foot traffic without relying on special promotions. This keeps sales steady year-round.

Hypermarkets have wider floorspace that lets them carry deeper bedsheet assortments, including larger sizes for urban apartments and family homes. Shoppers often explore these aisles during weekend stock-up trips, giving brands a chance to highlight softness, weave, and easy-care finishes. Many chains adjust displays with small lifestyle cues to match local tastes, which nudges buyers toward new patterns while still keeping trusted staples in sight, for steady demand across regions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo and surrounding prefectures, commands the largest market share driven by high population density and strong consumer spending power. Urban living constraints create demand for space-efficient, compact bedding solutions while higher disposable incomes support premium product purchases.

The Kansai/Kinki region blends traditional Japanese aesthetics with modern functionality in bedding preferences. Cities like Osaka and Kyoto show strong demand for bedsheets that complement both contemporary and traditional interior designs, with Kyoto's hospitality sector driving additional commercial demand.

The Central/Chubu region demonstrates strong preference for sustainable and eco-friendly bedding products. Manufacturing heritage in the region influences consumer appreciation for quality craftsmanship and locally produced textiles with environmental certifications.

Kyushu-Okinawa region is driven by growing tourism infrastructure and expanding residential developments. The subtropical climate creates demand for lightweight, breathable bedding materials suited to warmer temperatures.

The Tohoku region's colder climate drives demand for warmer bedding products including thermal sheets and insulating fabric blends. Seasonal bedding replacement cycles are particularly pronounced, with winter-weight options commanding significant market share.

Chugoku region exhibits moderate market growth with consumer preferences balancing value and quality considerations. The region's textile manufacturing heritage supports appreciation for domestically produced bedding products with emphasis on durability.

Hokkaido region’s harsh winters create specialized demand for heavy-weight, thermally insulating bedsheet products. The region shows strong preference for natural materials like wool blends and flannel cotton that provide superior warmth retention during extended cold seasons.

Shikoku region represents a smaller but stable market segment with consumer preferences reflecting rural and semi-urban lifestyle patterns. Traditional bedding formats including futon-compatible sheets maintain relevance alongside modern fitted sheet designs.

Market Dynamics:

Growth Drivers:

Why is the Japan Bedsheet Market Growing?

Aging Population Driving Demand for Health-Focused Bedding Solutions

Japan's rapidly aging demographic profile is fundamentally reshaping bedsheet market dynamics, creating substantial demand for products that address the unique comfort and health requirements of elderly consumers. With the population aged 65 and older reaching an all-time high of 36.2 million, manufacturers are developing specialized bedding with enhanced softness, hypoallergenic properties, and ease of maintenance. The elderly population segment prioritizes fabrics that promote better sleep quality, reduce pressure points, and minimize skin irritation. This demographic shift has prompted companies like Nishikawa to invest heavily in sleep science research, with the company operating Japan's first private sleep research laboratory since 1984.

Technological Innovation in Functional Textile Manufacturing

Advanced textile technologies are revolutionizing the Japan bedsheet market by enabling manufacturers to develop products with enhanced functional properties addressing specific consumer needs. Temperature-regulating fabrics, antimicrobial treatments, and moisture-wicking technologies represent key innovation areas driving market growth. Japanese manufacturers leverage the country's advanced manufacturing capabilities to produce bedsheets incorporating smart textile features previously unavailable in traditional bedding products. These innovations include contact-cooling technologies for summer comfort, thermal retention for winter warmth, and antibacterial finishes promoting healthier sleep environments throughout the year.

Rising Consumer Focus on Sleep Quality and Wellness

Growing awareness of sleep's importance to overall health and productivity is driving Japanese consumers to invest in higher-quality bedding products. Scientific research linking sleep quality to physical and mental well-being has elevated consumer willingness to pay premium prices for bedsheets that promise improved rest. This wellness-driven purchasing behavior extends across demographic segments, with younger consumers increasingly viewing quality bedding as an investment in personal health rather than a discretionary expense. The integration of sleep tracking technologies with bedding products, as demonstrated by companies embedding sensors into mattress and sheet systems, represents the convergence of health consciousness with textile innovation. Corporate wellness programs in Japanese companies are also contributing to market growth by promoting employee sleep health and recommending quality bedding investments.

Market Restraints:

What Challenges the Japan Bedsheet Market is Facing?

Declining Population and Household Formation Rates

Japan's shrinking population presents a fundamental challenge to sustained bedsheet market growth. With birth rates continuing to decline and overall population projected to decrease significantly over coming decades, the total addressable market faces long-term contraction pressures. Slower household formation rates reduce the frequency of new bedding purchases associated with establishing independent residences.

Intense Price Competition from Imported Products

The influx of competitively priced imported bedsheets, particularly from Southeast Asian manufacturing centers, creates margin pressure for domestic producers. Japanese consumers increasingly compare prices across global e-commerce platforms, challenging manufacturers to justify premium pricing through demonstrable quality differentiation. This price sensitivity is particularly pronounced in the value segment of the market.

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in cotton and other textile raw material prices create uncertainty for manufacturers and may constrain profit margins. Japan's dependence on imported cotton, with limited domestic production capacity, exposes the market to global supply chain disruptions and currency fluctuations. These factors complicate pricing strategies and inventory management for bedsheet manufacturers and retailers.

Competitive Landscape:

The Japan bedsheet market exhibits moderate concentration with established domestic manufacturers and international brands competing across diverse product segments. Leading players leverage extensive retail networks, brand heritage spanning decades, and continuous product innovation to maintain competitive positioning. Market leaders have also established strong brand recognition through consistent quality delivery and targeted marketing strategies. Competition intensifies in the premium segment where companies differentiate through advanced textile technologies, sustainable material sourcing, and specialized sleep solutions. The emergence of direct-to-consumer brands and e-commerce specialists is reshaping competitive dynamics, challenging traditional retailers to enhance digital capabilities and customer experience offerings.

Recent Developments:

- May 2025: Taiwan-based bedding brand SleepyTofu inaugurated its first Japanese flagship store, SLEEPY TOFU HOUSE, in Minami-Aoyama, Tokyo, featuring mattresses, pillows, comforters, and fitted pads within an immersive retail experience.

Japan Bedsheet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cotton Bed Sheets, Silk Bed Sheets, Synthetic Bed Sheets, Linen Bed Sheets, Others |

| Applications Covered | Residential, Commercial |

| Sales Channels Covered | Supermarket/Hypermarket, Specialty Store, Online |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan bedsheet market size was valued at USD 6,848.46 Million in 2025.

The Japan bedsheet market is expected to grow at a compound annual growth rate of 3.38% from 2026-2034 to reach USD 9,238.42 Million by 2034.

Cotton bedsheets dominated the market with a 48% share in 2025, driven by consumer preference for natural, breathable fabrics offering hypoallergenic properties and comfort suited to Japan's seasonal climate variations.

Key factors driving the Japan bedsheet market include the aging population demanding health-focused bedding solutions, technological innovations in functional textiles, rising consumer awareness of sleep quality importance, and the expansion of e-commerce distribution channels.

Major challenges include declining population and household formation rates limiting market expansion potential, intense price competition from imported products, raw material price volatility, and supply chain constraints affecting cotton availability and pricing stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)