Japan Biodegradable Sanitary Napkins Market Size, Share, Trends and Forecast by Material Type, Distribution Channel, and Region, 2026-2034

Japan Biodegradable Sanitary Napkins Market Overview:

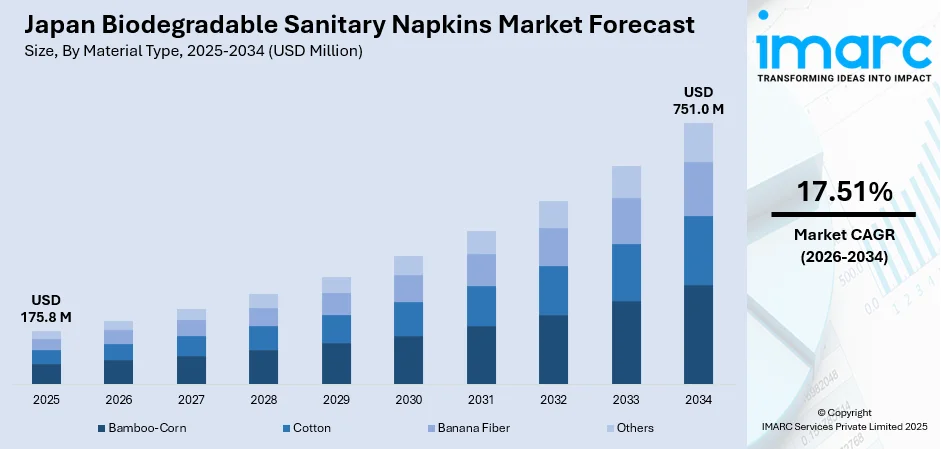

The Japan biodegradable sanitary napkins market size reached USD 175.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 751.0 Million by 2034, exhibiting a growth rate (CAGR) of 17.51% during 2026-2034. The rising environmental awareness, increased demand for chemical-free and skin-friendly products, government support for sustainable practices, and growing consumer preference for ethical brands are some of the kay factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 175.8 Million |

| Market Forecast in 2034 | USD 751.0 Million |

| Market Growth Rate 2026-2034 | 17.51% |

Japan Biodegradable Sanitary Napkins Market Trends:

Rising Demand for Eco-Friendly Menstrual Products

Younger generations of Japanese consumers are becoming more environmentally aware, driving demand for eco-friendly menstrual products. Biodegradable sanitary napkins, produced using natural fibers such as bamboo, organic cotton, and cornstarch-based films, are becoming popular alternatives to plastic-based sanitary napkins. This trend is being driven by increasing awareness of plastic pollution and its long-term environmental consequences. Additionally, government and NGO-driven sustainability campaigns also drive purchasing behavior. Eco-friendly brands that focus on responsible sourcing, and lower carbon footprints receive greater visibility. Retailers also market green hygiene products in specialized eco-sections. With consumers looking for products that mirror their values, biodegradable napkins emerge as a lifestyle product instead of a niche product and help drive a gradual growth in Japan biodegradable sanitary napkins market share.

To get more information on this market Request Sample

Innovation in Product Performance and Comfort

To compete with conventional sanitary napkins, biodegradable options in Japan are undergoing continuous innovation to improve both functionality and sustainability. Companies are investing in research and development (R&D) to enhance absorbency, softness, breathability, and leak protection while maintaining eco-credentials. One key advancement is the development of plant-based superabsorbent polymers (SAPs) from natural feedstocks, aiming to match the absorption capacity of synthetic SAPs, which can absorb up to 200 times their weight. Additionally, biodegradable adhesives and hypoallergenic, chemical-free materials are being used to ensure skin-friendliness. Packaging is also evolving, with compostable wrappers and minimalist designs reinforcing the product’s green appeal. These innovations are critical as consumers prioritize performance alongside sustainability. As product reliability improves, biodegradable napkins are becoming suitable for daily and overnight use, accelerating their adoption and contributing to market growth across Japan’s environmentally conscious demographic.

Growing Presence of Domestic and Global Niche Brands

Japan’s biodegradable sanitary napkin market outlook is witnessing increased participation from both homegrown startups and international eco-brands. Local companies emphasize traditional Japanese values like minimalism and harmony with nature, integrating these into product design and branding. Meanwhile, foreign brands with strong sustainability credentials are entering the market, capitalizing on Japan’s demand for premium, eco-friendly products. E-commerce has played a key role, enabling small and niche players to reach broader audiences without heavy investment in retail infrastructure. Subscription models and direct-to-consumer channels are also helping brands build loyal customer bases. This growing diversity fosters healthy competition, leading to better products and competitive pricing. As consumer awareness rises, brand authenticity and transparency become key differentiators in this expanding market segment.

Japan Biodegradable Sanitary Napkins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on material type and distribution channel.

Material Type Insights:

- Bamboo-Corn

- Cotton

- Banana Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes bamboo-corn, cotton, banana fiber, and others.

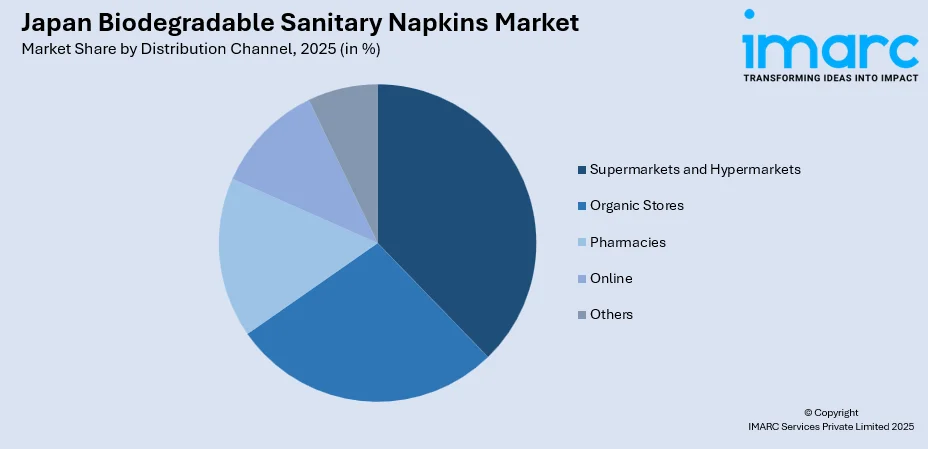

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Organic Stores

- Pharmacies

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, organic stores, pharmacies, online, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Biodegradable Sanitary Napkins Market News:

- In June 2024, Indian startup Saathi, known for its biodegradable banana fiber sanitary pads, will showcase its eco-friendly menstrual health solutions at Expo 2025 Osaka, Japan. With a women-led production model and NGO partnerships, Saathi has distributed over 2 million pads and aims to scale its impact globally. The company seeks to collaborate with governments and corporates on plastic-free, circular economy initiatives across Southeast Asia, Africa, and South America.

Japan Biodegradable Sanitary Napkins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Bamboo-Corn, Cotton, Banana Fiber, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Organic Stores, Pharmacies, Online, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan biodegradable sanitary napkins market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan biodegradable sanitary napkins market on the basis of material type?

- What is the breakup of the Japan biodegradable sanitary napkins market on the basis of distribution channel?

- What is the breakup of the Japan biodegradable sanitary napkins market on the basis of region?

- What are the various stages in the value chain of the Japan biodegradable sanitary napkins market?

- What are the key driving factors and challenges in the Japan biodegradable sanitary napkins?

- What is the structure of the Japan biodegradable sanitary napkins market and who are the key players?

- What is the degree of competition in the Japan biodegradable sanitary napkins market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan biodegradable sanitary napkins market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan biodegradable sanitary napkins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan biodegradable sanitary napkins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)