Japan Cable Management Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2026-2034

Japan Cable Management Market Overview:

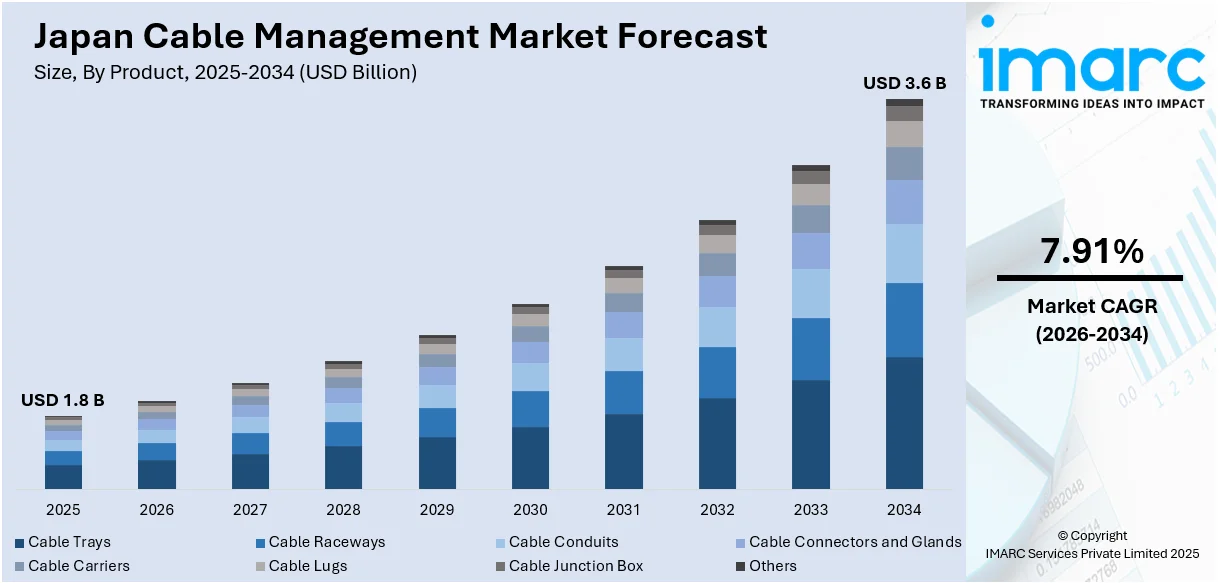

The Japan cable management market size reached USD 1.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.6 Billion by 2034, exhibiting a growth rate (CAGR) of 7.91% during 2026-2034. The market is being driven by growth in industrial automation, expansion of data centers, and development in the telecommunication industry. Additionally, the growing demand for energy-efficient products, material technology advancements, and metropolitan city construction boom are propelling the market. Furthermore, safety and compliance standards, renewable energy installations, electric vehicle infrastructure development, growing e-commerce, and awareness among consumers about electrical system maintenance are the factors influencing the Japan cable management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.8 Billion |

| Market Forecast in 2034 | USD 3.6 Billion |

| Market Growth Rate 2026-2034 | 7.91% |

Japan Cable Management Market Trends:

Higher Industrial Automation

Japanese industrial automation has seen tremendous progress over the last two years, and this has called for high-end cable management systems. As industries are automating, especially manufacturing and production processes, there is a sudden demand for cable management. Automated machinery, robots, and controls are based on a vast array of cables that need to be routed, insulated, and maintained. The Japanese industrial automation market has continued to increase steadily, with Japan leading the world in the adoption of automation and robot technologies. As there are increasing automated systems, managing the growing number of cables and wires has become complex. This growth is compelling industries to invest in effective cable management systems that can ensure safe and organized cabling and minimize the likelihood of accidents and equipment breakdowns. Cable trays, conduits, and coverings are gradually being implemented to prevent cable damage, particularly in high-movement or heavy machinery areas, which is further driving the Japan cable management market growth. In March 2024, Mitsubishi Electric announced the launch of its new industrial automation systems integrating advanced cable management features aimed at optimizing factory efficiency and safety.

To get more information on this market Request Sample

Rise of Data Centers

The growth of data centers in Japan has been the primary driver for the cable management industry. With digitalization, the speed in each segment has picked up pace, and the requirement to store and process data has multiplied manifold. This high demand for data processing has led to the establishment of more data centers, which requires a gigantic infrastructure to accommodate the large power and data cables. Moreover, Japan is one of the largest markets for colocation services in Asia. The rate at which data centers is expanding has surged the demand for premium-quality cable management solutions that keep cables in order, free from damage, and easily accessible when upgrading or performing maintenance. As data centers expand with greater reliance on cloud computing and digital services, cable management solutions will grow with the sophistication of data and power distribution systems within the centers.

Growth in the Telecommunications Sector

Japan's telecommunication sector is one of the market leaders in the cable management market, particularly with the installation of fifth-generation (5G) networks and the need for upgraded communication infrastructure. Japan's drive for 5G technology installation is driving demand for cable management solutions as the telecommunication sector requires more robust and well-organized cable systems for high-speed data communication. The country is one of the pioneers in 5G adoption, with telcos vying to expand their 5G coverage. In 2025, Japan has recorded some of the highest 5G speeds globally, with average speeds exceeding 2 Gbps in certain regions. As a result, telecommunication organizations require efficient cable management to ensure network integrity, minimize signal interference, and allow for the large bandwidth requirements of 5G technology. Installation and maintenance of 5G base stations, data centers, and other related infrastructure require organized and structured cable systems to ensure seamless connectivity and network stability, which is further fostering the market growth.

Japan Cable Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, material, and end user.

Product Insights:

- Cable Trays

- Cable Raceways

- Cable Conduits

- Cable Connectors and Glands

- Cable Carriers

- Cable Lugs

- Cable Junction Box

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cable trays, cable raceways, cable conduits, cable connectors and glands, cable carriers, cable lugs, cable junction box, and others.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic and non-metallic.

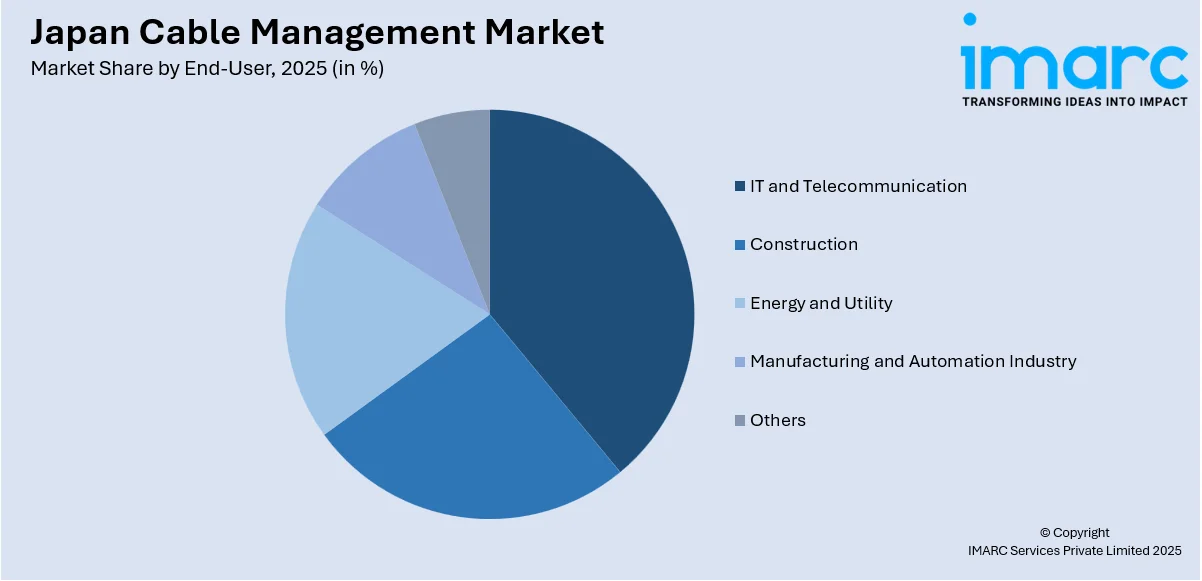

End-User Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecommunication

- Construction

- Energy and Utility

- Manufacturing and Automation Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes IT and telecommunication, construction, energy and utility, manufacturing and automation industry, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku regions.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cable Management Market News:

- In 2025, ARTERIA Networks Corporation, in collaboration with other industry leaders, launched the Topaz submarine cable, marking a significant step in improving global connectivity. This cable, which connects Japan with Canada, aims to provide ultra-low-latency and high-speed internet services, focusing on enhancing data transmission capabilities for both enterprise and consumer markets

- In 2023, Japan Aviation Electronics Industry Ltd. (JAE) acquired a stake in AIO Core Co. Ltd., forming a capital and business alliance to jointly develop automotive active optical cables (AOCs), anticipating the shift to optical in-vehicle networks.

Japan Cable Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Covered | Cable Trays, Cable Raceways, Cable Conduits, Cable Connectors and Glands, Cable Carriers, Cable Lugs, Cable Junction Box, Others |

| Materials Covered | Metallic, Non-Metallic |

| End User Covered | IT and Telecommunication, Construction, Energy and Utility, Manufacturing and Automation Industry, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cable management market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cable management market on the basis of product?

- What is the breakup of the Japan cable management market on the basis of material?

- What is the breakup of the Japan cable management market on the basis of end user?

- What is the breakup of the Japan cable management market on the basis of region?

- What are the various stages in the value chain of the Japan cable management market?

- What are the key driving factors and challenges in the Japan cable management market?

- What is the structure of the Japan cable management market and who are the key players?

- What is the degree of competition in the Japan cable management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cable management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cable management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cable management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)