Japan Car Subscription Market Size, Share, Trends and Forecast by Service Provider, Vehicle Type, Subscription Period, End Use, and Region, 2026-2034

Japan Car Subscription Market Overview:

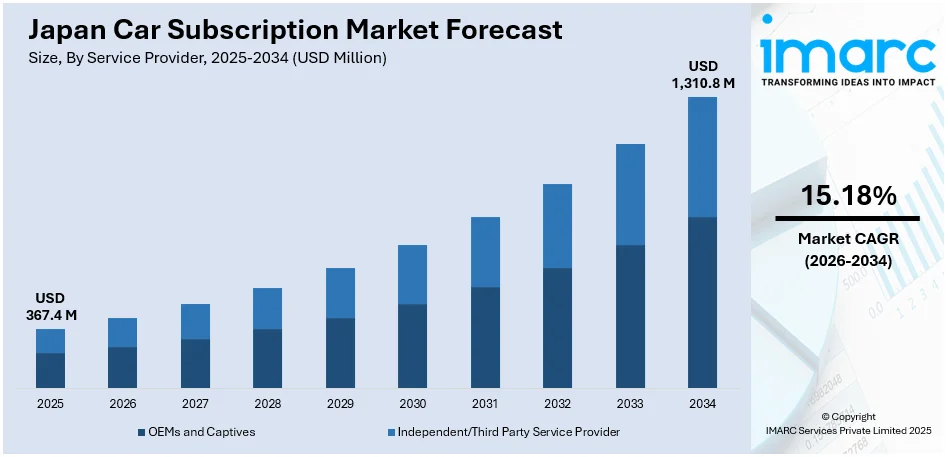

The Japan car subscription market size reached USD 367.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,310.8 Million by 2034, exhibiting a growth rate (CAGR) of 15.18% during 2026-2034. The market is gaining momentum, driven by shifting consumer preferences toward flexible mobility solutions and reduced vehicle ownership responsibilities. The rise of urbanization, digital platforms, and demand for cost-effective transportation options are fueling adoption. Automakers and mobility providers are expanding offerings to attract tech-savvy users seeking convenience and variety, contributing to the evolving landscape of the Japan car subscription market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 367.4 Million |

| Market Forecast in 2034 | USD 1,310.8 Million |

| Market Growth Rate 2026-2034 | 15.18% |

Japan Car Subscription Market Trends:

Increased Demand for Flexible Vehicle Ownership Models

The growing preference for flexible ownership models is considerably impacting the auto industry in Japan. Customers, particularly city dwellers and the younger population, are opting for access to cars rather than ownership, emphasizing convenience, predictability of costs, and choice. Car subscription schemes provide an inclusive package that commonly includes insurance, maintenance, and taxes, taking the hassle off users. This flexibility is becoming an essential aspect in highly populated cities where car ownership can be inconvenient. Additionally, short-term commitments enable consumers to align their mobility requirements with life adjustments like career changes or way of life modifications. The outlook for the Japan car subscription market is favorable as culture continues to adopt flexible mobility at the expense of prolonged ownership. For instance, in March 2025, Toyota introduced the all-new Crown Estate in Japan under its KINTO subscription service, further reinforcing flexible ownership models and increasing the Japan Car Subscription Market share. Moreover, as attitudes in society continue to shift towards placing greater importance on experience and functionality rather than ownership, car subscription services are poised to be an ever-greater part of the larger mobility ecosystem, contributing to redefine standards of personal mobility in Japan.

To get more information on this market Request Sample

Growing Demand for Electric and Hybrid Cars in Subscriptions

Green sustainability is taking a pivotal position in transforming consumer demand in Japan's automobile industry. With increasing recognition of climate change and carbon footprint, most consumers are going out of their way to find greener options. Car subscription services are an easy point of entry for hybrid and electric cars, obviating the issues of high upfront costs of purchase and worries about battery lifespan. Subscriptions make it possible for people to try new technologies and green options without commitment. This trend is complemented by country policies promoting low-emission transportation options, mainstreaming green mobility. The integration of electric and hybrid cars in subscription fleets is also attractive to environmentally aware consumers who value sustainability in their way of life. This shift is further fueling the Japan car subscription market growth as consumers and policymakers alike demand cleaner urban transport. In the long run, electric and hybrid car offerings under subscription formats will boost by leaps and bounds to satisfy amplifying demand.

Shift Towards Short-Term Ownership and Mobility Customization

Japanese customers are demonstrating a strong affinity towards short-term vehicle availability and mobility customization. Contrary to conventional financing or leasing, automobile subscription solutions allow users the liberty to easily transition between the types of automobiles according to changing requirements, i.e., going for a city car for commuting daily or a sport utility vehicle for family excursions. Flexibility, customization, and low long-term cash outlays are becoming primary needs, particularly from technology-embracing and youthful customers who believe in experiences more than ownership. For example, in September 2024, PARK24 CO., LTD. rolled out Japan's first pilot ride-hailing service with Times CAR car-sharing vehicles in collaboration with Uber, to fill the lack of taxi drivers. Furthermore, car subscriptions provide the ability to drive various car brands and models without the attachment of a single investment. Japan's car subscription market share is expected to rise steadily as an increasing number of consumers adopt flexible, customizable mobility solutions. The emphasis on user-centric flexibility aligns with broader consumer trends favoring personalization and convenience. This shift is anticipated to be a key driver in shaping the future trajectory of Japan's automotive services sector.

Japan Car Subscription Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service provider, vehicle type, subscription period, and end use.

Service Provider Insights:

- OEMs and Captives

- Independent/Third Party Service Provider

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes OEMs and captives and independent/third party service provider.

Vehicle Type Insights:

- IC Powered Vehicle

- Electric Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes IC powered vehicle and electric vehicle.

Subscription Period Insights:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

The report has provided a detailed breakup and analysis of the market based on the subscription period. This includes 1 to 6 months, 6 to 12 months, and more than 12 months.

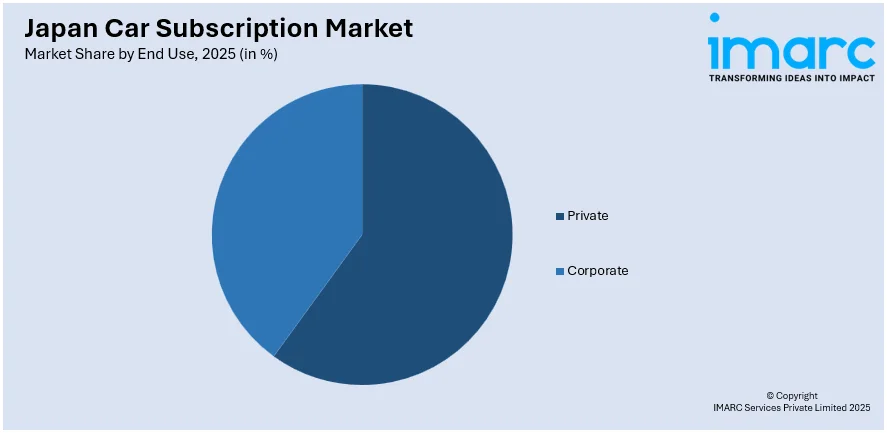

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Corporate

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes private and corporate.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Car Subscription Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan car subscription market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan car subscription market on the basis of service provider?

- What is the breakup of the Japan car subscription market on the basis of vehicle type?

- What is the breakup of the Japan car subscription market on the basis of subscription period?

- What is the breakup of the Japan car subscription market on the basis of end use?

- What is the breakup of the Japan car subscription market on the basis of region?

- What are the various stages in the value chain of the Japan car subscription market?

- What are the key driving factors and challenges in the Japan car subscription?

- What is the structure of the Japan car subscription market and who are the key players?

- What is the degree of competition in the Japan car subscription market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan car subscription market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan car subscription market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan car subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)