Japan Cargo Security and Surveillance Market Size, Share, Trends and Forecast by Security Type, Mode of Transport, Technology, End User, and Region, 2026-2034

Japan Cargo Security and Surveillance Market Summary:

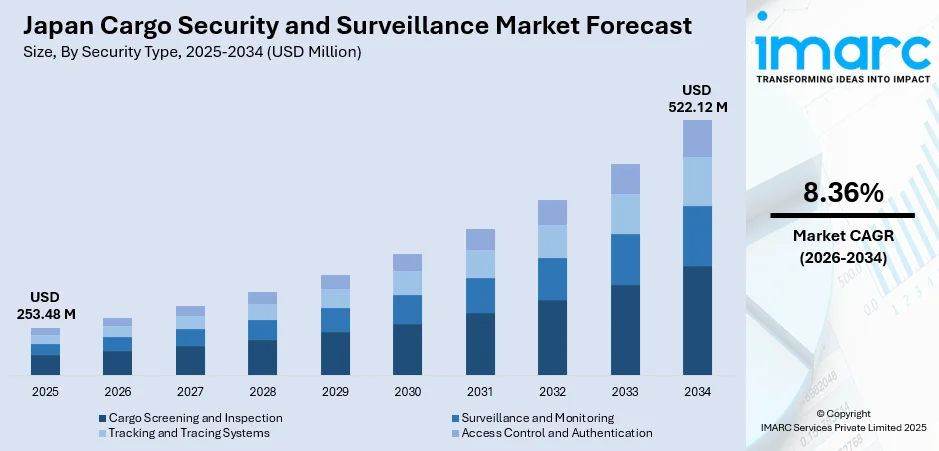

The Japan cargo security and surveillance market size was valued at USD 253.48 Million in 2025 and is projected to reach USD 522.12 Million by 2034, growing at a compound annual growth rate of 8.36% from 2026-2034.

The growth of the Japan cargo security and surveillance market is fueled by rising security concerns across air, maritime, and land transportation networks. The strategic positioning of the country as a primary global trade hub presents a dire need to implement technologically proficient cargo screening and monitoring infrastructure to protect the supply chains. Increasingly growing volumes of e-commerce, strict regulatory frameworks, and updating the infrastructure of logistics facilities are driving demand for state-of-the-art security technologies, including advanced X-ray scanners, video surveillance systems, and real-time tracking solutions throughout the Japan cargo security and surveillance market share.

Key Takeaways and Insights:

- By Security Type: Cargo Screening and Inspection dominates the market with a share of 32% in 2025, driven by mandatory regulatory compliance requirements and the widespread deployment of advanced inspection technologies at major transportation hubs across Japan.

- By Mode of Transport: Air Cargo Security leads the market with a share of 33% in 2025, owing to Japan's extensive international aviation network and stringent security protocols implemented at major airports including Narita, Haneda, and Kansai International.

- By Technology: X-ray Scanners represent the largest segment with a market share of 35% in 2025, attributed to their reliability in threat detection and the ongoing deployment of next-generation computed tomography scanning systems at airports and logistics facilities.

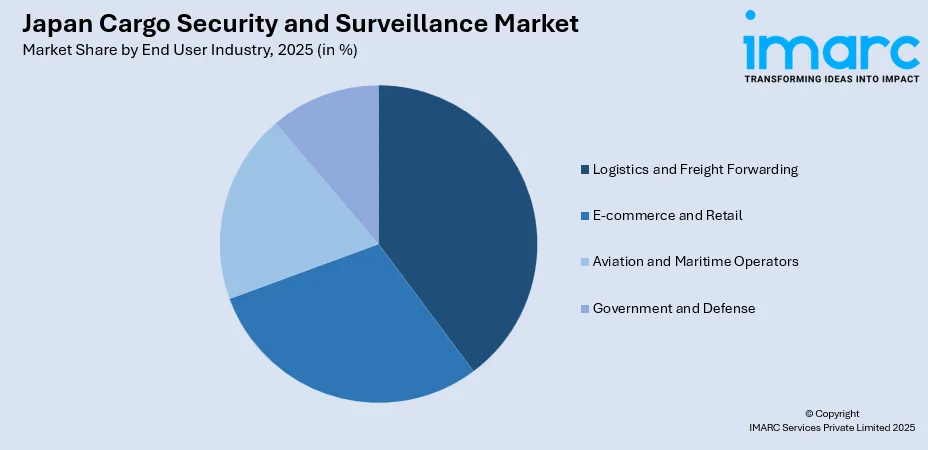

- By End User Industry: Logistics and Freight Forwarding accounts for the largest share of 30% in 2025, reflecting the sector's critical role in Japan's supply chain infrastructure and increasing investments in cargo protection technologies.

- Key Players: The Japan cargo security and surveillance market exhibits a competitive landscape characterized by the presence of both global security technology providers and domestic manufacturers, with companies focusing on advanced screening solutions, integrated surveillance platforms, and AI-enabled security systems.

To get more information on this market Request Sample

The Japan cargo security and surveillance market is witnessing transformative growth driven by technological innovation and evolving security requirements. The nation's position as the third-largest economy globally and its extensive international trade relationships necessitate robust cargo protection infrastructure. Government initiatives promoting smart logistics and digital transformation are accelerating the adoption of integrated security solutions. For instance, the Ministry of Land, Infrastructure, Transport and Tourism has implemented comprehensive security frameworks requiring advanced screening at international container hubs and air cargo facilities. In addition, a recent development underlines how seriously Japan is upgrading its logistics infrastructure, in February 2025, Mitsubishi Logisnext delivered a new advanced‑function container terminal gate at the Port of Osaka’s Yumeshima Container Terminal, under an MLIT‑backed modernisation project. The integration of artificial intelligence and machine learning technologies is revolutionizing threat detection capabilities, enabling real-time analysis and automated response systems. Additionally, the ongoing modal shift from road transportation to air freight, driven by logistics sector reforms, is generating substantial demand for aviation security equipment and sophisticated cargo monitoring systems across transportation networks.

Japan Cargo Security and Surveillance Market Trends:

Integration of Artificial Intelligence in Surveillance Systems

The deployment of AI-powered video analytics is transforming cargo security operations across Japan's transportation infrastructure. Advanced machine learning algorithms enable real-time threat detection, facial recognition, and anomaly identification at airports, seaports, and logistics facilities. For instance, in October 2025, Fujitsu partnered with ARYA, Inc. to roll out a high‑precision video‑analytic security solution capable of instant detection of suspicious behaviors and real‑time tracking across multiple cameras at large facilities such as airports and transport hubs. Security camera systems equipped with edge-AI capabilities are gaining prominence, allowing on-device processing that reduces latency and bandwidth requirements while enhancing response times. This technological evolution supports Japan's smart city initiatives and addresses workforce shortages in security operations through automated monitoring solutions.

Deployment of Next-Generation CT X-ray Scanning Technology

Japanese airports are increasingly adopting computed tomography X-ray scanners that produce high-resolution three-dimensional images for enhanced baggage and cargo assessment. For example, in October 2024, Smiths Detection supplied its HI‑SCAN 6040 CTiX 3D X‑ray scanners along with automated tray‑return systems to Kansai International Airport, allowing passengers to keep electronics and liquids in bags during screening, while improving throughput and threat detection. These advanced screening systems allow electronics and liquids to remain in bags during inspection, significantly improving passenger throughput while maintaining stringent security standards. The technology delivers lower false-alarm rates and enables more efficient threat detection, supporting Japan's efforts to modernize airport security infrastructure and accommodate growing international travel and cargo volumes.

Modal Shift Driving Air Cargo Security Investments

Japan's logistics sector transformation, prompted by workforce regulations and driver shortage challenges, is accelerating the shift from road transportation to air freight for long-distance cargo movement. The country is facing a dramatic shortage of truck drivers, and by 2030, it is projected to have 36% fewer drivers than needed under current freight-volume demands. This modal transition is generating substantial demand for airport cargo security infrastructure, including X-ray inspection systems and explosive detection equipment. Airlines and cargo handlers are expanding their screening capabilities to accommodate increased freight volumes, with government policy supporting the installation of advanced cargo security systems at regional airports throughout Japan.

Market Outlook 2026-2034:

The Japan cargo security and surveillance market is poised for sustained expansion throughout the forecast period, supported by ongoing infrastructure modernization and technological advancement initiatives. The convergence of AI-enabled analytics, IoT-connected devices, and cloud-based management platforms is reshaping security operations across transportation and logistics sectors. Government investments in smart port infrastructure and airport security upgrades continue to drive market momentum, while private sector adoption of integrated surveillance solutions accelerates. The market generated a revenue of USD 253.48 Million in 2025 and is projected to reach a revenue of USD 522.12 Million by 2034, growing at a compound annual growth rate of 8.36% from 2026-2034.

Japan Cargo Security and Surveillance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Security Type | Cargo Screening and Inspection | 32% |

| Mode of Transport | Air Cargo Security | 33% |

| Technology | X-ray Scanners | 35% |

| End User Industry | Logistics and Freight Forwarding | 30% |

Security Type Insights:

- Cargo Screening and Inspection

- Surveillance and Monitoring

- Tracking and Tracing Systems

- Access Control and Authentication

The cargo screening and inspection dominates with a market share of 32% of the total Japan cargo security and surveillance market in 2025.

Cargo screening and inspection technologies form the cornerstone of Japan's security infrastructure across airports, seaports, and logistics facilities. The segment encompasses advanced X-ray systems, explosive detection equipment, and chemical trace detectors that ensure compliance with international aviation and maritime security regulations.

Japanese airports have extensively deployed computed tomography scanners that produce three-dimensional volumetric images for comprehensive threat assessment. For example, in January 2025, Fukuoka International Airport announced the installation of seven new CT-based baggage-screening scanners (alongside automated tray-return systems) as part of its terminal renovation — a move that underlines growing adoption of volumetric-imaging tech for safer and faster security. These systems enable security personnel to identify prohibited items with greater accuracy while reducing false alarm rates, thereby improving operational efficiency at busy cargo terminals and passenger checkpoints throughout the nation.

Mode of Transport Insights:

- Air Cargo Security

- Maritime Cargo Security

- Rail Cargo Security

- Road Cargo Security

The air cargo security leads with a share of 33% of the total Japan cargo security and surveillance market in 2025.

Air cargo security represents the largest transportation segment, driven by Japan's position as a major international aviation hub with extensive passenger and freight networks. According to 2023 data from the International Civil Aviation Organization (ICAO), Japan handled 2,000 thousand tonnes of freight via scheduled services, with 43% of its international air freight transported by all-cargo aircraft, underscoring the scale of its air-cargo business. The segment benefits from stringent regulatory requirements mandating advanced screening of all air cargo shipments, ensuring compliance with both domestic and international safety standards.

Japanese airlines and airport operators continue investing in next-generation security equipment to accommodate growing cargo volumes while meeting international safety requirements. The ongoing modal shift from road transportation to air freight, prompted by logistics sector reforms addressing driver shortages, is generating additional demand for aviation security infrastructure at both major international gateways and regional airports throughout the country. These developments are further encouraging innovation in cargo screening technologies and operational efficiency enhancements.

Technology Insights:

- X-ray Scanners

- Explosive Detection Systems (EDS)

- Video Surveillance Systems

- RFID & GPS-based Tracking

The X-ray scanners dominate with a market share of 35% of the total Japan cargo security and surveillance market in 2025.

X-ray scanner technology dominates the Japan cargo security market, serving as the primary screening method at airports, seaports, and logistics facilities nationwide. Advanced dual-view and computed tomography X-ray systems offer superior threat detection capabilities through high-resolution three-dimensional imaging. Japanese airports have increasingly adopted CT scanners that eliminate the need for passengers to remove electronics and liquids from carry-on bags, significantly improving screening throughput. These systems feature enhanced energy efficiency, reduced noise output, and faster belt speeds compared to conventional scanners, contributing to improved operational performance while maintaining rigorous security standards across cargo and passenger screening operations.

End User Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Logistics and Freight Forwarding

- E-commerce and Retail

- Aviation and Maritime Operators

- Government and Defense

The logistics and freight forwarding leads with a share of 30% of the total Japan cargo security and surveillance market in 2025.

The logistics and freight forwarding sector drives strong demand for cargo security solutions, as companies invest in protecting valuable shipments across the supply chain. In fact, in November 2023, VIVOTEK rolled out a large‑scale surveillance system at Japan’s largest logistics centre operated by one of the country’s biggest logistics firms, deploying 105 360° cameras inside the warehouse and 14 perimeter cameras to enable centralized, blind‑spot‑free monitoring of pallet stacking, transport, and storage. Japan's role as a global trade hub requires comprehensive security at warehouses, distribution centers, and transportation terminals, ensuring both physical safety and regulatory compliance.

Freight forwarders are adopting integrated platforms combining video surveillance, access control, and real-time tracking. Digital transformation initiatives, including IoT sensors and cloud-based monitoring, are modernizing security operations, enhancing efficiency, and safeguarding high-value cargo throughout the logistics network.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, centered on Tokyo, represents Japan's largest logistics hub and dominates the cargo security market with cutting-edge infrastructure and extensive transportation networks. The region houses Narita International Airport and the Port of Tokyo, which handle substantial volumes of international freight requiring advanced security screening capabilities. Major logistics centers throughout Greater Tokyo support both domestic distribution and international trade operations, driving sustained demand for cargo security technologies.

The Kansai region, anchored by Osaka, serves as a significant player in maritime logistics with major ports handling substantial import and export volumes. Kansai International Airport continues expanding its security infrastructure with advanced CT X-ray scanners and automated screening systems. The region's blend of industrial base and logistics capabilities ensures its prominent role in Japan's cargo security market, supporting diverse manufacturing and distribution activities.

The Chubu region, centered on Nagoya, thrives as an industrial and logistics hub particularly for automotive manufacturing and related supply chains. The region's strategic location between Tokyo and Osaka positions it as a critical distribution corridor requiring comprehensive cargo security infrastructure. Central Japan International Airport and Nagoya Port support both domestic and international freight operations with modern security systems.

The Kyushu-Okinawa region serves as Japan's gateway to Asia with strategic port facilities and growing air cargo operations. Fukuoka Airport has recently upgraded its security infrastructure with advanced three-dimensional X-ray scanning technology. The region's proximity to major Asian markets drives investment in cargo security systems to support expanding international trade and logistics operations.

The Tohoku region focuses on agricultural and industrial logistics requiring reliable cargo security solutions for transporting goods to major metropolitan markets. Regional airports and port facilities serve domestic distribution networks with security infrastructure designed to protect agricultural products and manufactured goods throughout the supply chain.

The Chugoku region serves as an industrial center with port facilities supporting both domestic and international cargo movements. The region's manufacturing base generates consistent demand for cargo security technologies to protect shipments of industrial goods and components moving through regional transportation networks.

Hokkaido's logistics sector focuses on distributing agricultural and seafood products to markets throughout Japan using a combination of air, sea, and road transportation. Sapporo coordinates regional logistics operations with security infrastructure designed to ensure safe transport of perishable goods despite seasonal challenges, maintaining reliable supply chains for the nation's food distribution network.

The Shikoku region emphasizes inter-island connectivity and niche market support in logistics operations. Industries including citrus farming and paper production rely on efficient transport networks with appropriate security measures. Port facilities ensure timely shipping of local goods across Japan, with security solutions supporting specialized regional logistics requirements.

Market Dynamics:

Growth Drivers:

Why is the Japan Cargo Security and Surveillance Market Growing?

Stringent Government Regulations and Aviation Security Mandates

Japan enforces comprehensive regulatory frameworks to ensure cargo security across airports, seaports, and logistics facilities. Strict mandates require certified screening technologies, advanced inspection systems, and surveillance solutions to comply with international standards. In its 2023 annual report, Japan Customs highlighted that it has begun using AI‑assisted analysis of X‑ray inspection images to speed up detection of illicit cargo at major ports, improving both accuracy and throughput. Airlines, shipping companies, and logistics operators are compelled to continuously upgrade security infrastructure, incorporating explosive trace detection, access control, and monitoring systems. These regulations drive sustained investment in modern cargo screening technologies, enabling safe handling of shipments, maintaining supply chain integrity, and protecting against potential threats while meeting evolving operational requirements.

Rising E-commerce Volumes and Logistics Industry Expansion

Japan’s e-commerce sector is growing rapidly, leading to a significant rise in shipments requiring secure handling throughout distribution networks. As part of a broader governmental push to modernize the logistics industry, the Japanese government in 2024 adopted a new “policy package for logistics innovation” aimed at strengthening logistics‑network infrastructure, including support for the development of relay hubs and enhanced logistics facilities. Logistics companies are adopting automated screening systems, real-time tracking, and integrated monitoring solutions to manage high parcel volumes efficiently while maintaining security standards. Expansion of fulfillment centers and last-mile delivery infrastructure introduces additional points needing surveillance and access control. This growth encourages logistics operators to modernize cargo security, combining monitoring, screening, and tracking capabilities to ensure shipment safety, operational efficiency, and reliable service.

Smart City Initiatives and Digital Transformation in Transportation

Japan’s focus on smart city development and digital transformation is driving the adoption of advanced security technologies in transportation hubs. AI-enabled systems, IoT sensors, and cloud-based platforms are enhancing real-time monitoring, threat detection, and operational efficiency. Ports and logistics centers are integrating secure, contactless access controls with digital management platforms, reducing physical touchpoints while maintaining high security standards. These initiatives are creating opportunities for comprehensive, data-driven security solutions that combine video analytics, automated screening, and monitoring to support efficient, safe, and streamlined cargo operations.

Market Restraints:

What Challenges the Japan Cargo Security and Surveillance Market is Facing?

High Implementation and Maintenance Costs

The substantial capital investment required for advanced cargo security equipment presents significant barriers for smaller logistics operators and regional facilities. Next-generation CT X-ray scanners, AI-enabled surveillance systems, and integrated security platforms demand considerable upfront expenditure plus ongoing maintenance costs. Smaller cargo handlers and regional airports may struggle to justify investments in premium security technologies, potentially creating inconsistent security standards across the transportation network.

Data Privacy and Regulatory Compliance Concerns

Japan's stringent personal information protection regulations impose constraints on the deployment of certain surveillance technologies, particularly those involving biometric data collection. Recent amendments to the Act on the Protection of Personal Information require organizations to implement data minimization practices and on-device processing to avoid transferring raw imagery offsite. These privacy requirements compel security technology providers to develop compliant solutions while potentially limiting the functionality of advanced analytics systems.

Integration Challenges with Legacy Systems

Many Japanese logistics facilities and transportation terminals operate legacy security infrastructure that presents compatibility challenges when deploying modern integrated solutions. The complexity of connecting advanced digital platforms with existing analog systems requires substantial technical expertise and customization efforts. Organizations face difficulties achieving seamless interoperability between disparate security components, potentially limiting the effectiveness of comprehensive surveillance and screening operations.

Competitive Landscape:

The Japan cargo security and surveillance market features a competitive environment with established global security technology providers competing alongside domestic manufacturers. Market participants differentiate through technological innovation, particularly in AI-enabled analytics, advanced imaging systems, and integrated security platforms. Companies focus on developing solutions that address Japan's specific requirements including high-throughput screening capabilities, energy efficiency, and compliance with stringent regulatory standards. Strategic partnerships between international security equipment manufacturers and local system integrators facilitate market penetration and customized solution delivery. The competitive landscape reflects ongoing consolidation as larger players expand their portfolios through acquisitions while smaller specialized firms target niche applications in cargo tracking and surveillance analytics.

Recent Developments:

- In March 2025, EnGenius Networks Japan unveiled its AI Cloud Surveillance Solution at RetailTech Japan 2025, combining edge‑AI and cloud intelligence for scenario recognition beyond motion detection. The platform features AI‑powered 5 MP/8 MP cameras and network video systems with unified cloud management. Enhanced Wi‑Fi 7 and contextual‑AI systems were later showcased at Interop Tokyo 2025.

- In Oct 2025, IHI Corporation announced a joint research initiative to develop a small‑satellite constellation for enhanced maritime and land surveillance, using optical, SAR, RF, IR, and hyperspectral imaging. MoUs were signed with satellite tech firms from Finland and the UK. The system aims to strengthen national security and support maritime supply‑chain monitoring.

Japan Cargo Security and Surveillance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Security Types Covered | Cargo Screening and Inspection, Surveillance and Monitoring, Tracking and Tracing Systems, Access Control and Authentication |

| Modes of Transport Covered | Air Cargo Security, Maritime Cargo Security, Rail Cargo Security, Road Cargo Security |

| Technologies Covered | X-ray Scanners, Explosive Detection Systems (EDS), Video Surveillance Systems, RFID & GPS-based Tracking |

| End User Industries Covered | Logistics and Freight Forwarding, E-commerce and Retail, Aviation and Maritime Operators, Government and Defense |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan cargo security and surveillance market size was valued at USD 253.48 Million in 2025.

The Japan cargo security and surveillance market is expected to grow at a compound annual growth rate of 8.36% from 2026-2034 to reach USD 522.12 Million by 2034.

Cargo screening and inspection leads Japan’s cargo security market, using advanced X-ray, explosive, and chemical detection systems to enhance threat detection, accuracy, and operational efficiency across airports, seaports, and logistics hubs.

Key factors driving the Japan cargo security and surveillance market include stringent government regulations mandating advanced screening technologies, rising e-commerce volumes requiring enhanced logistics security, and smart city initiatives promoting digital transformation in transportation infrastructure.

Major challenges include high implementation and maintenance costs for advanced security equipment, data privacy regulations constraining certain surveillance technologies, integration difficulties with legacy systems at existing facilities, and workforce shortages requiring increased automation investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)