Japan Cloud Kitchen Market Size, Share, Trends and Forecast by Type, Product Type, Nature, and Region, 2026-2034

Japan Cloud Kitchen Market Overview:

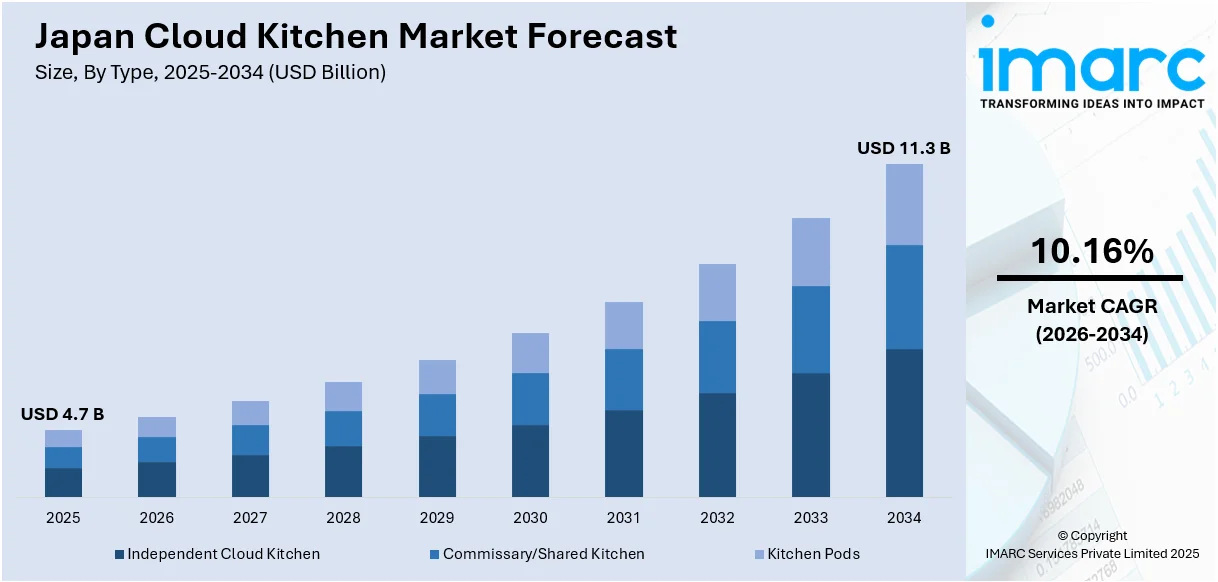

The Japan cloud kitchen market size reached USD 4.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.3 Billion by 2034, exhibiting a growth rate (CAGR) of 10.16% during 2026-2034. The rising demand for food delivery services, urban lifestyle shifts, high smartphone penetration, growing preference for convenience, expansion of third-party delivery platforms, increasing number of small food entrepreneurs, cost-efficient kitchen models, digital ordering trends, and evolving consumer behavior are some of the major factors augmenting Japan cloud kitchen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.7 Billion |

| Market Forecast in 2034 | USD 11.3 Billion |

| Market Growth Rate 2026-2034 | 10.16% |

Japan Cloud Kitchen Market Trends:

Rising Collaboration Between Traditional Restaurants and Cloud Kitchen Operators

The collaboration between established dine-in restaurant brands and cloud kitchen operators is strengthening the Japan cloud kitchen market growth. According to industry reports, total sales within Japan’s hotel, restaurant, and institutional food service (HRI) industry rose by approximately 16 percent year-on-year, reaching USD 226.2 Billion in 2023, signaling a strong recovery in consumer demand and heightened food service activity. As part of this momentum, several brick-and-mortar restaurants are strategically leveraging cloud kitchen networks to broaden their geographic footprint while avoiding the high fixed costs associated with traditional expansion. This approach is particularly prevalent in densely populated urban centers such as Tokyo and Osaka, where elevated commercial rents and persistent labor shortages pose operational challenges for physical outlets. Several well-known izakayas, ramen chains, and curry outlets are adopting this hybrid strategy to serve a younger, digitally native audience. The model also offers operators the advantage of reducing downtime during off-peak hours by renting kitchen space to multiple brands simultaneously. This mutual benefit model is helping traditional restaurants transition into a more delivery-centric business without compromising brand integrity.

To get more information on this market Request Sample

Technological Integration in Operations and Consumer Interfaces

Continual technological advancements are positively impacting Japan cloud kitchen market outlook, from order processing to supply chain management and customer engagement. Operators are integrating artificial intelligence (AI) powered demand forecasting tools to optimize inventory procurement and reduce food waste. Backend systems also feature centralized dashboards for managing orders from multiple food delivery platforms, allowing efficient routing, kitchen workflow balancing, and real-time performance tracking. Robotics and automation are entering prep stages, particularly in repetitive tasks like rice cooking, portioning, and packaging. On the consumer-facing side, augmented reality (AR) is experimented with for interactive menu previews, while loyalty integration with cashless payment systems such as Suica and PayPay enhances repeat purchases. This digitization allows cloud kitchens to scale operations with minimal human intervention while offering personalized service based on user behavior. In addition, kitchen location planning increasingly relies on geospatial analytics to identify high-demand delivery zones, ensuring faster delivery windows and competitive positioning on aggregator platforms.

Proliferation of Multi-Brand Virtual Restaurants Under Single Operators

A growing Japan cloud kitchen market trend is the emergence of multi-brand virtual restaurant portfolios operated by a single entity. Instead of focusing on one cuisine or dining concept, cloud kitchen companies are launching a suite of distinct virtual brands from a single kitchen facility, targeting different consumer segments and eating occasions. For instance, a single operator may offer separate menus for sushi, bento boxes, Korean BBQ, vegan ramen, and dessert items, each marketed under its own digital identity across food delivery platforms. This diversification reduces operational risk, enhances utilization rates, and helps capture a broader share of the delivery market. These virtual brands are built with strong branding elements, including distinctive packaging, logos, and app listings to simulate a real restaurant experience. Data analytics is extensively used to track the performance of each brand, allowing quick adaptation of menus and pricing. The scalability of this model has led to its popularity among venture-backed food-tech firms aiming for rapid expansion in metropolitan areas.

Japan Cloud Kitchen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, product type, and nature.

Type Insights:

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

The report has provided a detailed breakup and analysis of the market based on the type. This includes independent cloud kitchen, commissary/shared kitchen, and kitchen pods.

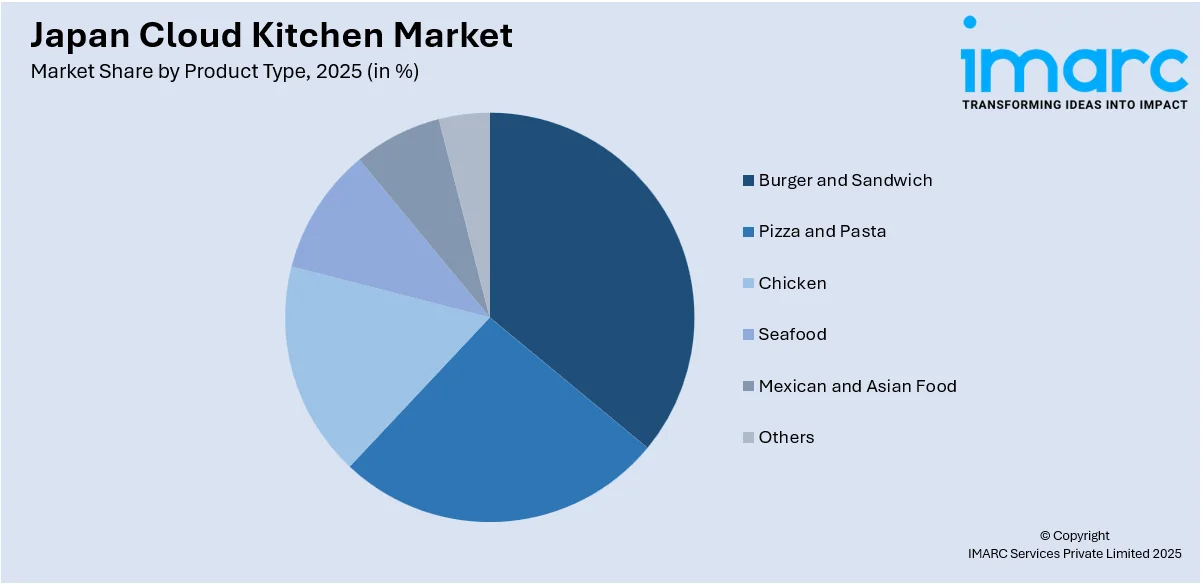

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Burger and Sandwich

- Pizza and Pasta

- Chicken

- Seafood

- Mexican and Asian Food

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes burger and sandwich, pizza and pasta, chicken, seafood, mexican and asian food, and others.

Nature Insights:

- Franchised

- Standalone

The report has provided a detailed breakup and analysis of the market based on the nature. This includes franchised and standalone.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cloud Kitchen Market News:

- On February 24, 2023, TGAL, a prominent Japanese food tech company with a network of over 1,400 host kitchens and 120 brands, announced an exclusive partnership with Village Food Courts (VFC), India's largest food and beverage aggregator. This collaboration aims to introduce renowned Japanese culinary brands to Indian consumers through VFC's nationwide platform, encompassing food courts and hybrid ghost kitchen facilities. The initiative seeks to make authentic Japanese cuisine more accessible and affordable in India, featuring offerings such as cutlets, Japanese curry, ramen, miso soup, teriyaki burgers, and sushi.

Japan Cloud Kitchen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods |

| Product Types Covered | Burger and Sandwich, Pizza and Pasta, Chicken, Seafood, Mexican and Asian Food, Others |

| Natures Covered | Franchised, Standalone |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cloud kitchen market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cloud kitchen market on the basis of type?

- What is the breakup of the Japan cloud kitchen market on the basis of product type?

- What is the breakup of the Japan cloud kitchen market on the basis of nature?

- What is the breakup of the Japan cloud kitchen market on the basis of region?

- What are the various stages in the value chain of the Japan cloud kitchen market?

- What are the key driving factors and challenges in the Japan cloud kitchen market?

- What is the structure of the Japan cloud kitchen market and who are the key players?

- What is the degree of competition in the Japan cloud kitchen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cloud kitchen market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cloud kitchen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cloud kitchen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)