Japan Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Japan Co-Working Office Space Market Overview:

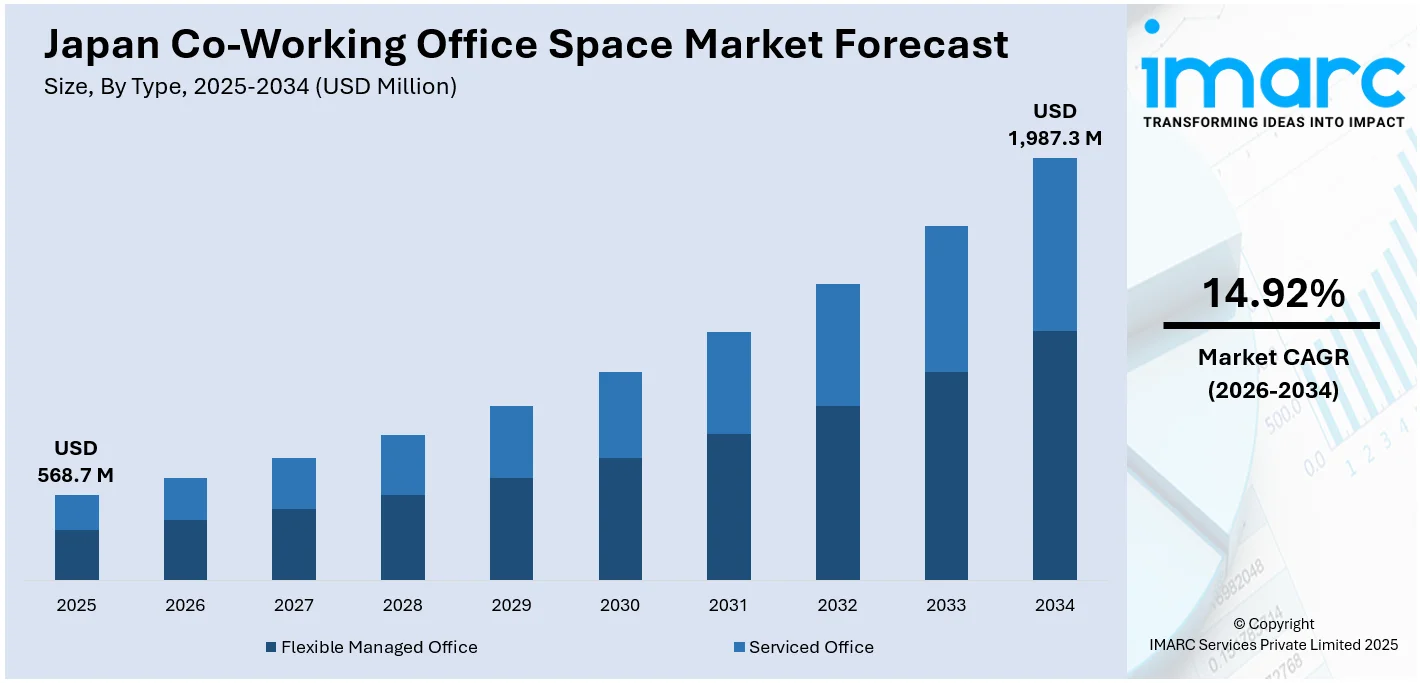

The Japan co-working office space market size reached USD 568.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,987.3 Million by 2034, exhibiting a growth rate (CAGR) of 14.92% during 2026-2034. The market is witnessing significant growth, driven by rising demand from startups, innovative SMEs, and freelancers actively seeking flexible, cost-effective solutions. Major cities like Tokyo and Osaka continue to dominate, with increasing offerings from diverse global and local providers. This shift clearly reflects broader trends toward remote work and hybrid working models. As flexible working styles gain immense popularity, the Japan co-working office space market share is projected to expand significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 568.7 Million |

|

Market Forecast in 2034

|

USD 1,987.3 Million |

| Market Growth Rate 2026-2034 | 14.92% |

Japan Co-Working Office Space Market Trends:

Rising Demand for Flexible Workspaces

Increased demand for co-working spaces is one of the major drivers in Japan's co-working office space market. With increased adoption of flexible office spaces by companies, the use of traditional long-term leases is on the decline as businesses choose more flexible options that enable them to scale office space up or down depending on their needs. The trend is most welcoming to startups, small firms, and remote teams and provides affordable solutions without the constraints of fixed commitments. Co-working facilities are evolving by providing modular office designs, temporary leasing plans, and on-demand services. Also, companies are gaining from access to common amenities including meeting rooms, high-speed broadband, and office equipment. For instance, in November 2024, Compass Offices announced the pre-launch of the "Compass Office WTC annex" in Minato-ku, Tokyo, set to open in March 2025. This new flexible workspace will occupy two floors, featuring modern amenities and enterprise solutions, enhancing the area's business ecosystem while promoting a collaborative environment for various organizations. This flexibility reduces overhead and fosters collaboration, making co-working spaces an attractive option for businesses in Japan. As a result, the Japan co-working office space market growth continues to gain momentum, meeting the evolving demands of modern businesses.

To get more information on this market Request Sample

Expansion in Tier 2 Cities

The Japan co-working office space market is witnessing a shift as interest grows beyond major cities like Tokyo and Osaka. Traditionally dominated by these urban centers, the co-working trend is now expanding into Tier 2 cities such as Fukuoka, Sapporo, and Nagoya. For instance, in May 2024, Japan’s largest startup support center, Station Ai, opened in Nagoya, Aichi Prefecture. The seven-story facility will provide co-working spaces and tech labs for 1,000 startups. Supported by the prefectural government, it aims to foster regional development and innovation, particularly in the automotive sector. This shift is driven by several factors, including the rise of remote and hybrid work models, lower operational costs, and a more relaxed lifestyle in these cities. Many businesses, especially startups and SMEs, are looking for affordable and flexible office spaces that allow them to tap into local talent without the high expenses associated with larger cities. Additionally, local governments and property owners are investing in infrastructure, making Tier 2 cities increasingly attractive for co-working operators. As a result, the Japan co-working office space market is broadening its reach and fueling growth in previously underserved areas.

Japan Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

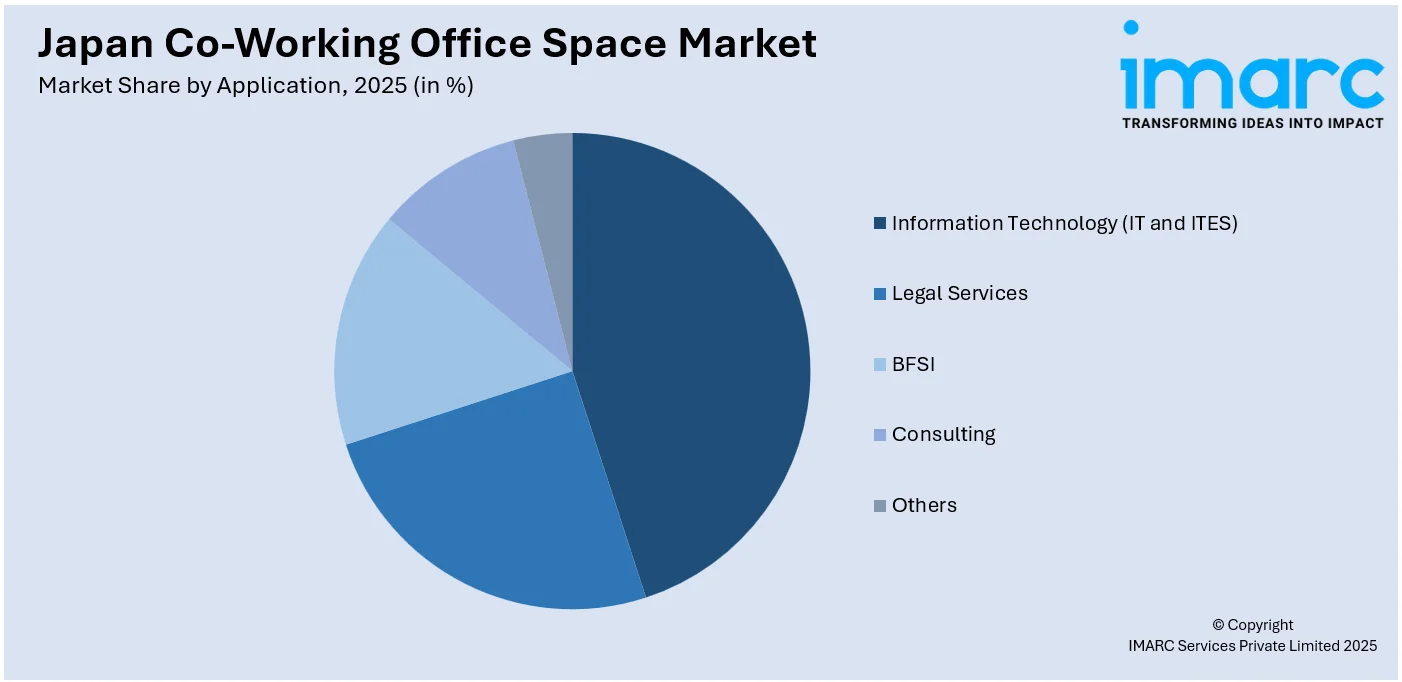

Application Insights:

Access the comprehensive market breakdown Request Sample

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Co-Working Office Space Market News:

- In March 2025, JustCo launched its luxury coworking brand, “THE COLLECTIVE,” with its first location in Tokyo’s GranTokyo South Tower. Inspired by the “Voyage” concept, the space offers exceptional hospitality, premium amenities, and an elegant design, aiming to enhance work engagement and attract top talent in the evolving workspace landscape.

Japan Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan co-working office space market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan co-working office space market on the basis of type?

- What is the breakup of the Japan co-working office space market on the basis of application?

- What is the breakup of the Japan co-working office space market on the basis of end user?

- What is the breakup of the Japan co-working office space market on the basis of region?

- What are the various stages in the value chain of the Japan co-working office space market?

- What are the key driving factors and challenges in the Japan co-working office space market?

- What is the structure of the Japan co-working office space market and who are the key players?

- What is the degree of competition in the Japan co-working office space market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan co-working office space market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)