Japan Cold Chain Warehousing Market Size, Share, Trends and Forecast by Type of Storage, Temperature Range, Ownership, End Use Industry, and Region, 2026-2034

Japan Cold Chain Warehousing Market Overview:

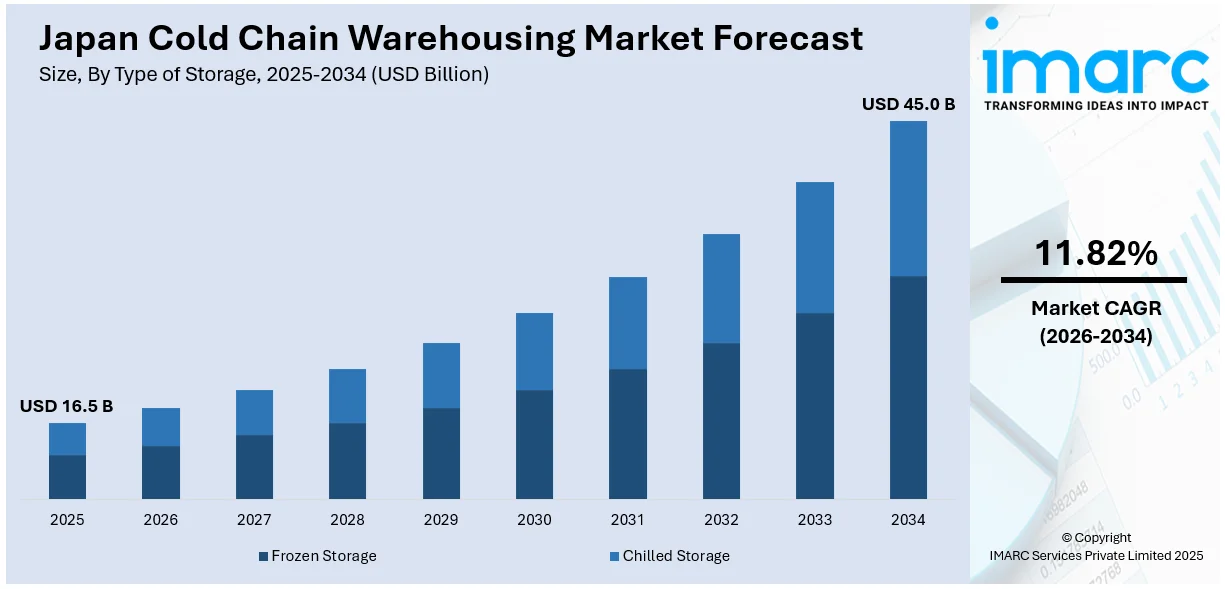

The Japan cold chain warehousing market size reached USD 16.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 45.0 Billion by 2034, exhibiting a growth rate (CAGR) of 11.82% during 2026-2034. Rising demand for temperature-sensitive products in food, pharmaceuticals, and e-commerce sectors, stricter food safety regulations, technological advancements in temperature control, and increasing consumer preference for fresh and perishable goods are some of the factors contributing to Japan cold chain warehousing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.5 Billion |

| Market Forecast in 2034 | USD 45.0 Billion |

| Market Growth Rate 2026-2034 | 11.82% |

Japan Cold Chain Warehousing Market Trends:

Expansion of Multi-Temperature Logistics in Cold Chain Warehousing

The need for high-quality, temperature-controlled logistics is driving strategic acquisitions in the cold chain warehousing industry. Companies are working on improving their multi-temperature logistics services, notably in the foodservice industry, to meet rising market demand. This change aims to expand distribution networks and enhance supply chain capabilities across geographies. With the growing demand for efficient, dependable cold storage and transportation solutions, businesses are spending more in cold chain infrastructure to satisfy the changing demands of the food and nutrition industries. These efforts enable businesses to broaden their reach and expedite temperature-sensitive product handling, ensuring quality control across the supply chain. These factors are intensifying the Japan cold chain warehousing market growth. For example, in October 2024, Mitsui & Co. agreed to acquire all shares in HAVI's supply chain business in Japan and Taiwan, focusing on multi-temperature logistics for the foodservice industry. This acquisition would strengthen Mitsui’s distribution and logistics capabilities in Japan. The move aligns with Mitsui's strategic goal of expanding its food and nutrition business, enhancing its cold chain logistics services and supporting the growing demand for high-quality, temperature-controlled supply chains.

To get more information on this market Request Sample

Investment in Energy-Efficient Cold Chain Facilities

There is a rising emphasis on energy-efficient cold chain logistics, with major expenditures going into the construction of modern cold storage facilities. The large investment in cold chain infrastructure aims to improve the capacity and sustainability of temperature-controlled storage systems. New cold storage facilities, particularly in large urban locations, are adopting energy-efficient designs to suit the growing need for ecologically friendly operations. The industry is experiencing a surge of joint ventures and strategic alliances aimed at meeting both local and worldwide demand for temperature-sensitive items. These investments promote the growth of cold chain warehouses, providing better logistical solutions to satisfy the growing demands of industries such as food and pharmaceuticals. For instance, in June 2024, Fosun Hive Capital Management partnered with Idera Capital Management to invest in a cold storage logistics project in Greater Osaka. The JV would deploy JPY 15 Billion (USD 100 Million) in equity for cold chain assets, starting with an energy-efficient facility of over 10,000 square meters, set for completion in 2025. This marks Fosun Hive and Idera's first joint venture in Japan’s growing cold chain warehousing sector, alongside other recent investments in Osaka and Tokyo.

Japan Cold Chain Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type of storage, temperature range, ownership, and end use industry.

Type of Storage Insights:

- Frozen Storage

- Chilled Storage

The report has provided a detailed breakup and analysis of the market based on the type of storage. This includes frozen storage and chilled storage.

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Deep-Frozen

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes ambient, refrigerated, frozen, and deep-frozen.

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes private warehouses, public warehouses, and bonded warehouses.

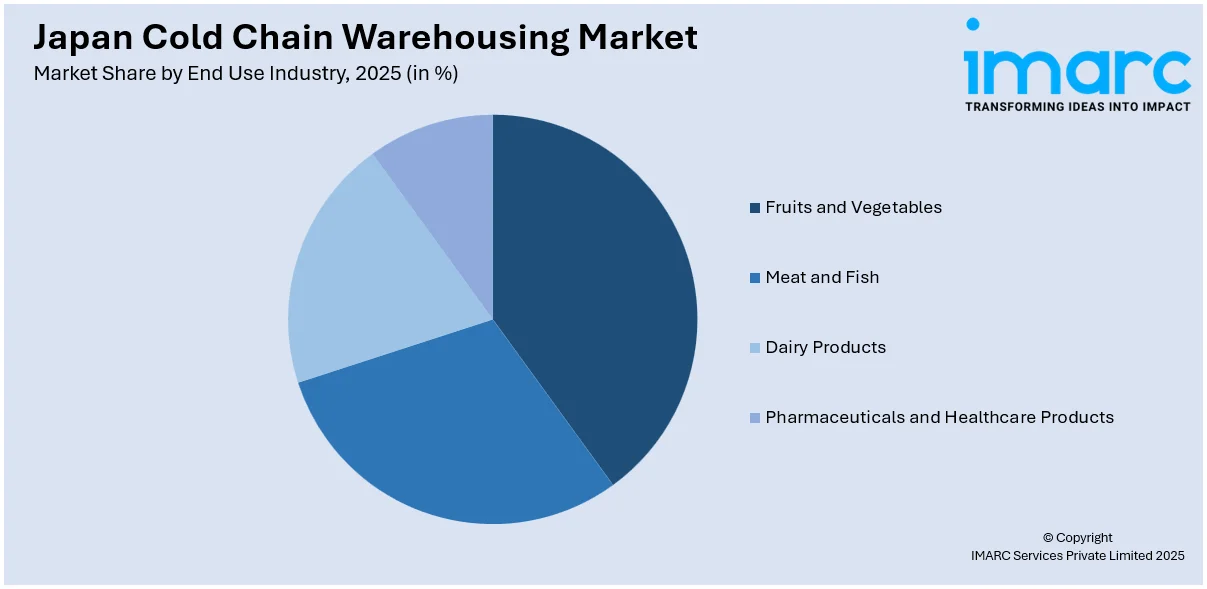

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Meat and Fish

- Dairy Products

- Pharmaceuticals and Healthcare Products

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes fruits and vegetables, meat and fish, dairy products, and pharmaceuticals and healthcare products.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cold Chain Warehousing Market News:

- In March 2025, GLP Japan opened one of Japan’s largest cold storage warehouses in Kobe, a key logistics hub. The five-story, 46,000-square-meter facility, built with a JPY 15 Billion (USD 100 Million) investment, offers temperature ranges from -25°C to +10°C and is fully occupied by three tenants. Amid rising demand for frozen food and increasing construction costs, GLP Japan plans to invest an additional JPY 200 Billion (USD 1.34 Billion) over the next few years to expand its cold chain infrastructure.

Japan Cold Chain Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Storage Covered | Frozen Storage, Chilled Storage |

| Temperature Ranges Covered | Ambient, Refrigerated, Frozen, Deep-Frozen |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| End Use Industries Covered | Fruits and Vegetables, Meat and Fish, Dairy Products, Pharmaceuticals and Healthcare Products |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cold chain warehousing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cold chain warehousing market on the basis of type of storage?

- What is the breakup of the Japan cold chain warehousing market on the basis of temperature range?

- What is the breakup of the Japan cold chain warehousing market on the basis of ownership?

- What is the breakup of the Japan cold chain warehousing market on the basis of end use industry?

- What is the breakup of the Japan cold chain warehousing market on the basis of region?

- What are the various stages in the value chain of the Japan cold chain warehousing market?

- What are the key driving factors and challenges in the Japan cold chain warehousing market?

- What is the structure of the Japan cold chain warehousing market and who are the key players?

- What is the degree of competition in the Japan cold chain warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cold chain warehousing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cold chain warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cold chain warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)