Japan Cold Pressed Juices Market Size, Share, Trends and Forecast by Category, Distribution Channel, and Region, 2026-2034

Japan Cold Pressed Juices Market Overview:

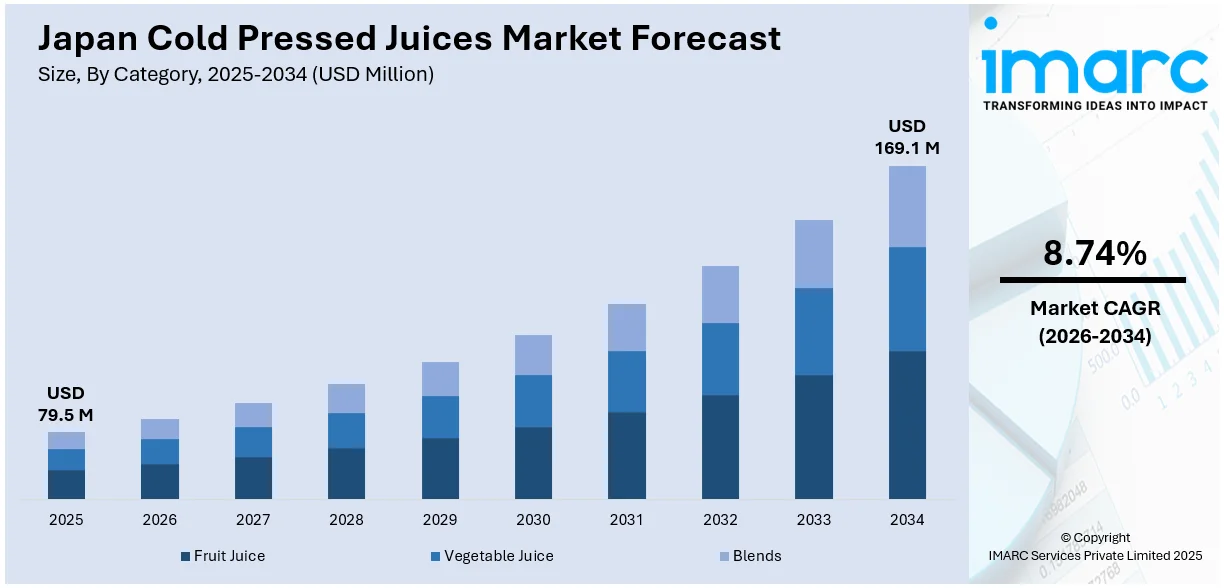

The Japan cold pressed juices market size reached USD 79.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 169.1 Million by 2034, exhibiting a growth rate (CAGR) of 8.74% during 2026-2034. The market is influenced by increasing health consciousness, escalating demand for clean-label beverages, and rising interest in functional nutrition. Consumers are also favoring minimally processed drinks that preserve natural nutrients and support wellness goals. These evolving consumption patterns continue to shape the competitive dynamics of the Japan cold pressed juices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.5 Million |

| Market Forecast in 2034 | USD 169.1 Million |

| Market Growth Rate 2026-2034 | 8.74% |

Japan Cold Pressed Juices Market Trends:

Demand for Natural and Clean-Label Products

Japanese consumers place a high value on product transparency, purity, and natural ingredients. This cultural preference fuels the demand for clean-label beverages like cold pressed juices, which are free from preservatives, artificial flavors, and added sugars. Japanese people prefer their meals to be simple and genuine, which fits their approach to food safety. Sharing the method of sourcing, details about production, and nutritional facts makes the brand more trustworthy in the eyes of consumers. Cold pressed juices are part of Japan’s healthy eating trend, attracting both professionals and families alike. As consumers grow more discerning, the demand for natural and honest products continues to push manufacturers to adopt transparent labeling and maintain high-quality standards, thus driving the cold pressed juices market growth.

To get more information on this market Request Sample

Premiumization and Lifestyle Trends

Premiumization is a strong market driver in Japan, where consumers often associate higher-priced goods with superior quality and health benefits. Cold pressed juices that are nutritious and not processed are considered excellent wellness products when they use locally sourced or organic items. People living in big cities like Tokyo are eager to buy healthy products even if they cost more. This trend is further supported by the growing popularity of fitness clubs, yoga studios, and natural cafes, which often feature cold pressed juices on their menus. These lifestyle shifts have created a niche market for premium beverages, reinforcing the perception of cold pressed juices as both fashionable and beneficial.

Growth of Specialty Retail and Online Distribution

The expansion of specialty health food stores, juice bars, and organic markets in Japan has increased the visibility and accessibility of cold pressed juices. These outlets cater specifically to health-conscious consumers and often promote curated selections of fresh, high-quality juices. Additionally, the rise of e-commerce and mobile food delivery apps in Japan allows cold pressed juice brands to reach a wider audience without relying solely on traditional retail. Subscription-based models and direct-to-consumer delivery services provide added convenience and foster regular consumption. Enhanced cold chain logistics and packaging innovations have also improved product freshness during transport. This evolving distribution landscape supports sustained market growth by aligning with consumers’ demand for convenience and quality.

Japan Cold Pressed Juices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on category and distribution channel.

Category Insights:

- Fruit Juice

- Vegetable Juice

- Blends

The report has provided a detailed breakup and analysis of the market based on the category. This includes fruit juice, vegetable juice, and blends.

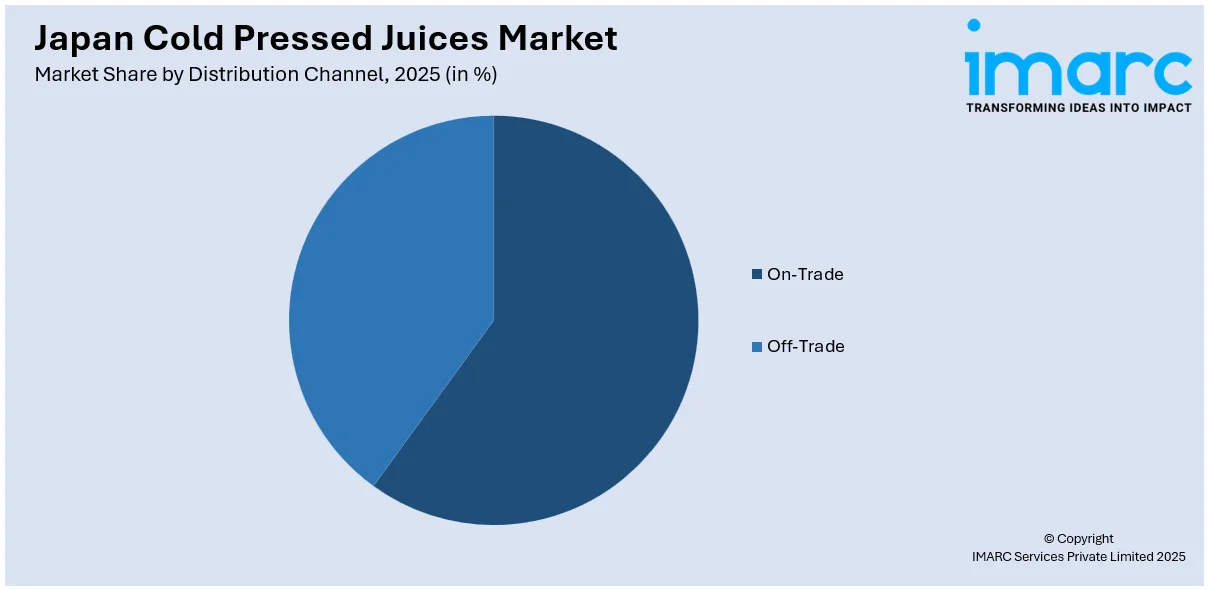

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade (supermarkets/hypermarkets, convenience/grocery stores, online stores, and others).

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cold Pressed Juices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Fruit Juice, Vegetable Juice, Blends |

| Distribution Channels Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cold pressed juices market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cold pressed juices market on the basis of category?

- What is the breakup of the Japan cold pressed juices market on the basis of distribution channel?

- What is the breakup of the Japan cold pressed juices market on the basis of region?

- What are the various stages in the value chain of the Japan cold pressed juices market?

- What are the key driving factors and challenges in the Japan cold pressed juices market?

- What is the structure of the Japan cold pressed juices market and who are the key players?

- What is the degree of competition in the Japan cold pressed juices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cold pressed juices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cold pressed juices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cold pressed juices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)