Japan Commercial Insurance Market Report by Type (Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, and Others), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), Distribution Channel (Agents and Brokers, Direct Response, and Others), Industry Vertical (Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, and Others), and Region 2026-2034

Market Overview:

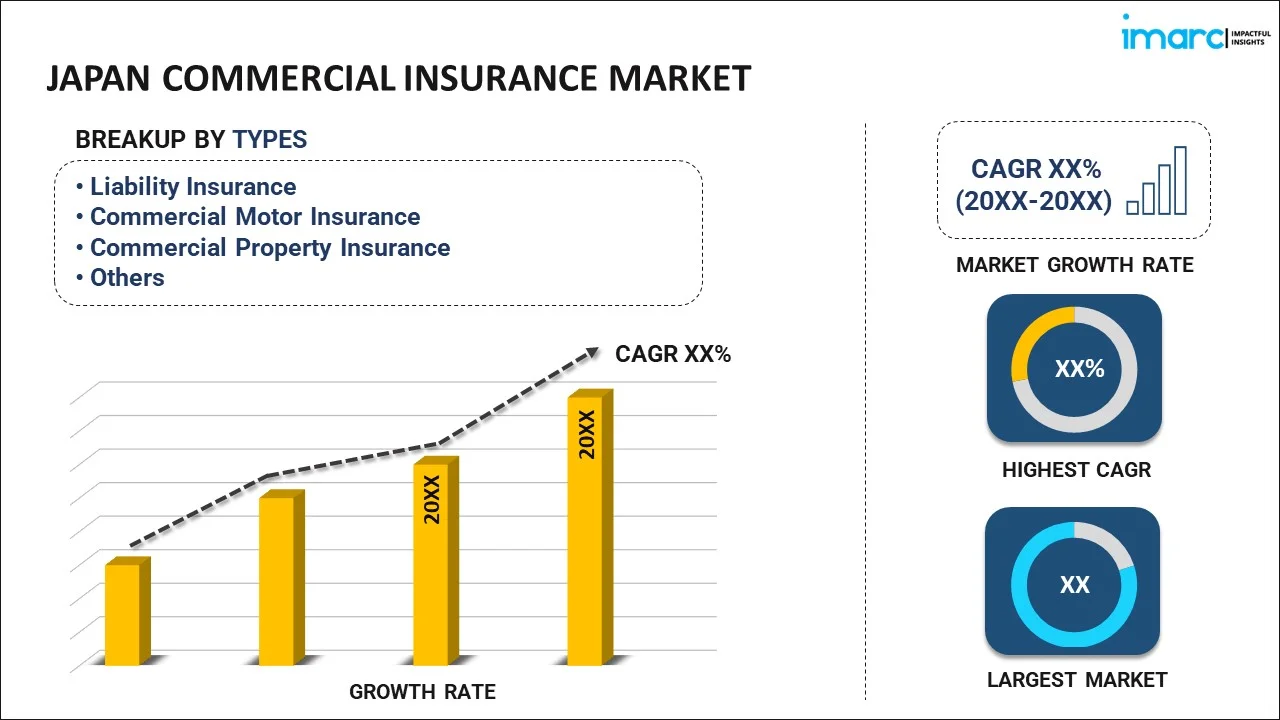

Japan commercial insurance market size reached USD 59,358.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 122,265.8 Million by 2034, exhibiting a growth rate (CAGR) of 8.36% during 2026-2034. The market is experiencing growth due to a combination of factors, including heightened awareness of business risks, evolving regulatory demands, the emergence of technology-driven risk assessment, the escalating influence of natural disasters and climate change, and the surge in cyber threats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 59,358.7 Million |

| Market Forecast in 2034 | USD 122,265.8 Million |

| Market Growth Rate (2026-2034) | 8.36% |

Access the full market insights report Request Sample

Commercial insurance is a specialized insurance category aimed at providing businesses and organizations with protection against a diverse range of risks and liabilities that could lead to financial losses. It plays a crucial role in safeguarding businesses, shielding them from potential financial devastation. Commercial insurance encompasses various types of coverage, each designed to address specific requirements. These include property insurance, which offers protection against damage to physical assets like buildings and equipment; liability insurance, which covers legal expenses and settlements in the event of third-party claims; and workers' compensation, which provides benefits to employees injured while performing job-related duties. In line with this, the benefits of commercial insurance are multifaceted and include mitigating financial risks stemming from unexpected events, accidents, or legal disputes, as well as ensuring business continuity even when faced with adversity. Consequently, it is gaining traction across Japan.

Japan Commercial Insurance Market Trends:

The Japan commercial insurance market is experiencing significant growth, primarily driven by a heightened awareness of the advantages offered by commercial insurance policies among business proprietors. Commercial insurance provides vital security for business operations, safeguarding a company's reputation and ensuring the welfare of its employees. The proliferation of small- and medium-sized enterprises (SMEs) worldwide is another key factor contributing to market expansion. Furthermore, leading market players are embracing advanced technologies like machine learning (ML) and artificial intelligence (AI) to deliver improved services, including personalized and convenient insurance plans at reduced premium costs, enhancing customer loyalty. This technological integration, coupled with supportive government policies encouraging employers and business owners to invest in various coverage types, is exerting a positive influence on market growth. Additionally, the growing presence of commercial insurance providers, the widespread adoption of telematics devices across various industries, and the rapid pace of industrialization are anticipated to fuel the market growth over the forecasted period.

Japan Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes transportation and logistics, manufacturing, construction, IT and telecom, healthcare, energy and utilities, and others.

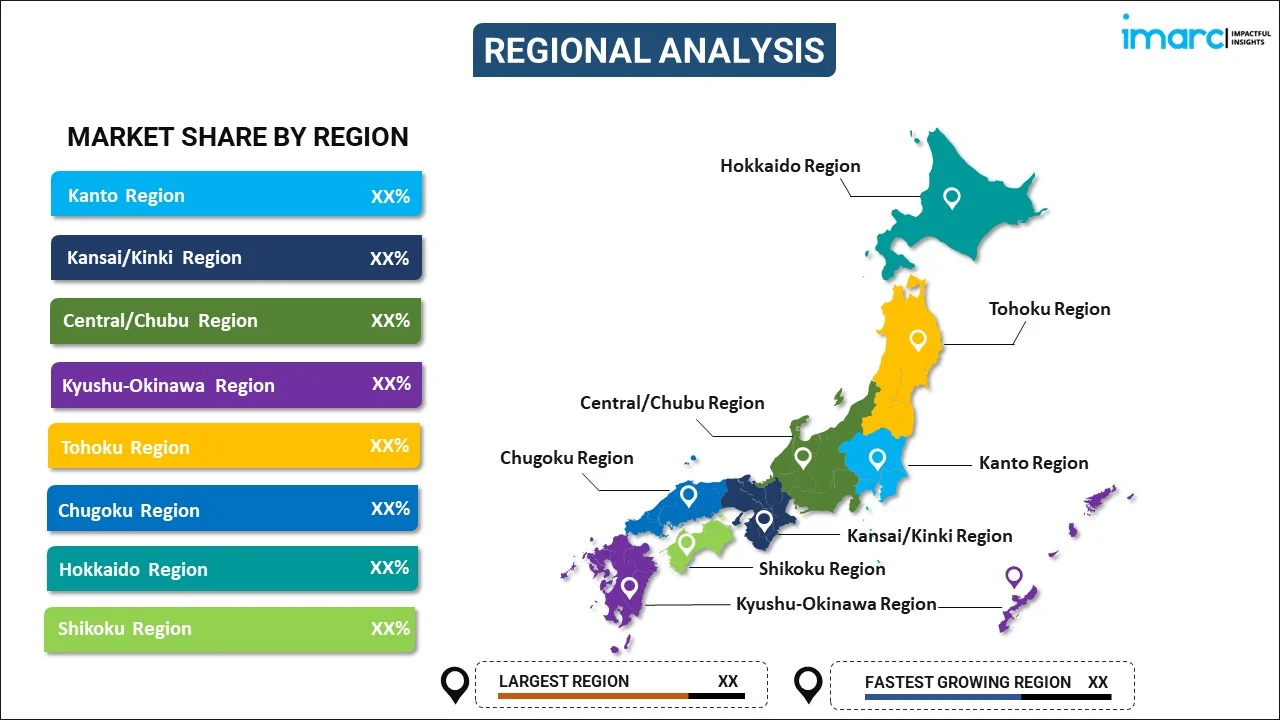

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan commercial insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan commercial insurance market?

- What is the breakup of the Japan commercial insurance market on the basis of type?

- What is the breakup of the Japan commercial insurance market on the basis of enterprise size?

- What is the breakup of the Japan commercial insurance market on the basis of distribution channel?

- What is the breakup of the Japan commercial insurance market on the basis of industry vertical?

- What are the various stages in the value chain of the Japan commercial insurance market?

- What are the key driving factors and challenges in the Japan commercial insurance?

- What is the structure of the Japan commercial insurance market and who are the key players?

- What is the degree of competition in the Japan commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan commercial insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan commercial insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)