Japan Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Japan Commercial Real Estate Market Overview:

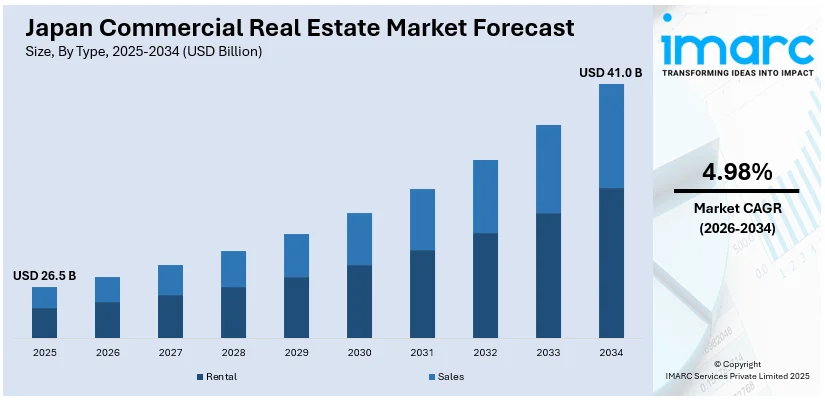

The Japan commercial real estate market size reached USD 26.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 41.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.98% during 2026-2034. The market is driven by hybrid work trends, enhancing demand for flexible office spaces, and e-commerce growth, driving logistics property investments. Corporate cost-cutting and remote work adoption are reducing traditional office demand, while last-mile delivery needs and automation are expanding warehouse requirements. Low vacancy rates and rising rents in prime locations are further expanding the Japan commercial real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 26.5 Billion |

| Market Forecast in 2034 | USD 41.0 Billion |

| Market Growth Rate 2026-2034 | 4.98% |

Japan Commercial Real Estate Market Trends:

Rising Demand for Flexible Office Spaces in Urban Centers

The change in workstyles, which has intensified over the pandemic, has seen a rise in demand for flexible office space. Most businesses are downsizing their conventional office footprint and switching to coworking and serviced offices, as hybrid models are now the business model of preference. A 2024 survey in Japan showed that 51.2% of workers have access to remote work options, with 27.4% working remotely on a regular basis. Additionally, 57.2% believe that remote work will continue to be around in the future, and 41.5% prefer a hybrid work model. This growing demand for flexible work arrangements indicates the need for flexible office spaces to equip workers with the competencies necessary for success in remote and hybrid work environments. To address growing needs, regional operators and service providers are venturing into large business districts such as Umeda in Osaka and Marunouchi in Tokyo. Besides, foreign companies and start-ups are increasingly looking to flexible leases for greater flexibility. Landlords are responding to the trends by providing tenants with shorter leasing terms and shared facilities in order to compete. This trend is transforming office space design, incorporating collaborative spaces and technology-enabled workspaces. As companies continue to adopt remote work, flexible office space solutions will probably remain one of the market's highest-growth areas.

To get more information on this market Request Sample

Growth in Logistics and Warehouse Properties Due to E-Commerce Expansion

The rapid growth of e-commerce in Japan is fueling strong demand for logistics and warehouse properties, particularly in Greater Tokyo and Osaka. Therefore, this is also favoring the Japan commercial real estate market growth. Internet retail sales are at a record high, and companies and third-party logistics operators are rapidly building out their distribution networks, leading to rising investments in modern, high-specification warehouses, such as automation and cold storage capabilities. From 2017 to 2022, the e-commerce market in Japan witnessed a staggering growth of 43.5%, with a cumulative value of USD 148 Billion. This highlights the growing need for technology-driven commercial real estate, including smart warehouses and last-mile logistics centers across Japan. In addition, demand for last-mile delivery efficiency-driven logistics is creating demand for urban logistics centers near major transportation hubs. Institutional investors and REITs are also increasingly buying logistics assets, viewing them as high-yield, stable investments. Even as vacancy rates for prime logistics space decline, vacancy rates for core logistics space remain low, which is maintaining upward pressure on rental rates. The logistics real estate market is expected to remain among Japan's most rapidly growing markets as e-commerce penetration continues to rise.

Japan Commercial Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Rental

- Sales

The report has provided a detailed breakup and analysis of the market based on the type. This includes rental and sales.

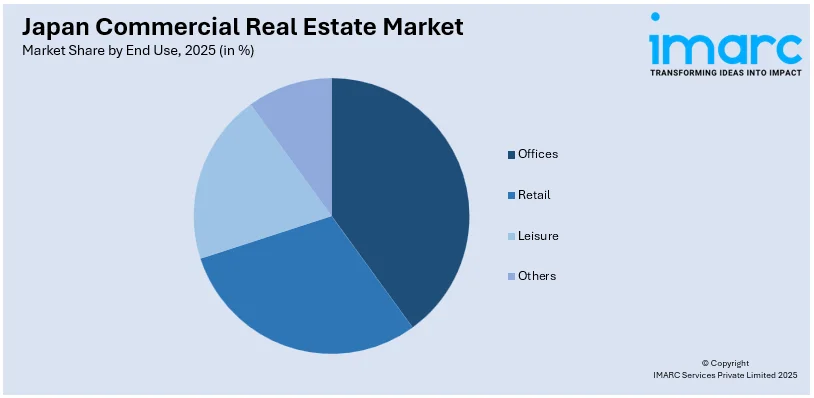

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Offices

- Retail

- Leisure

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes offices, retail, leisure, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Commercial Real Estate Market News:

- January 27, 2025: Brookfield Asset Management completed two major property investments in Japan worth USD 1.6 billion. It included acquiring a stake in Tokyo's Gajoen complex as well as securing land near Nagoya for a logistics development. These deals highlight growing foreign interest in the commercial real estate market of Japan, driven by stable returns and strategic urban opportunities.

Japan Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan commercial real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan commercial real estate market on the basis of type?

- What is the breakup of the Japan commercial real estate market on the basis of end use?

- What is the breakup of the Japan commercial real estate market on the basis of region?

- What are the various stages in the value chain of the Japan commercial real estate market?

- What are the key driving factors and challenges in the Japan commercial real estate market?

- What is the structure of the Japan commercial real estate market and who are the key players?

- What is the degree of competition in the Japan commercial real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan commercial real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan commercial real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)