Japan Cosmetic Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, Cosmetic Type, and Region, 2026-2034

Japan Cosmetic Packaging Market Overview:

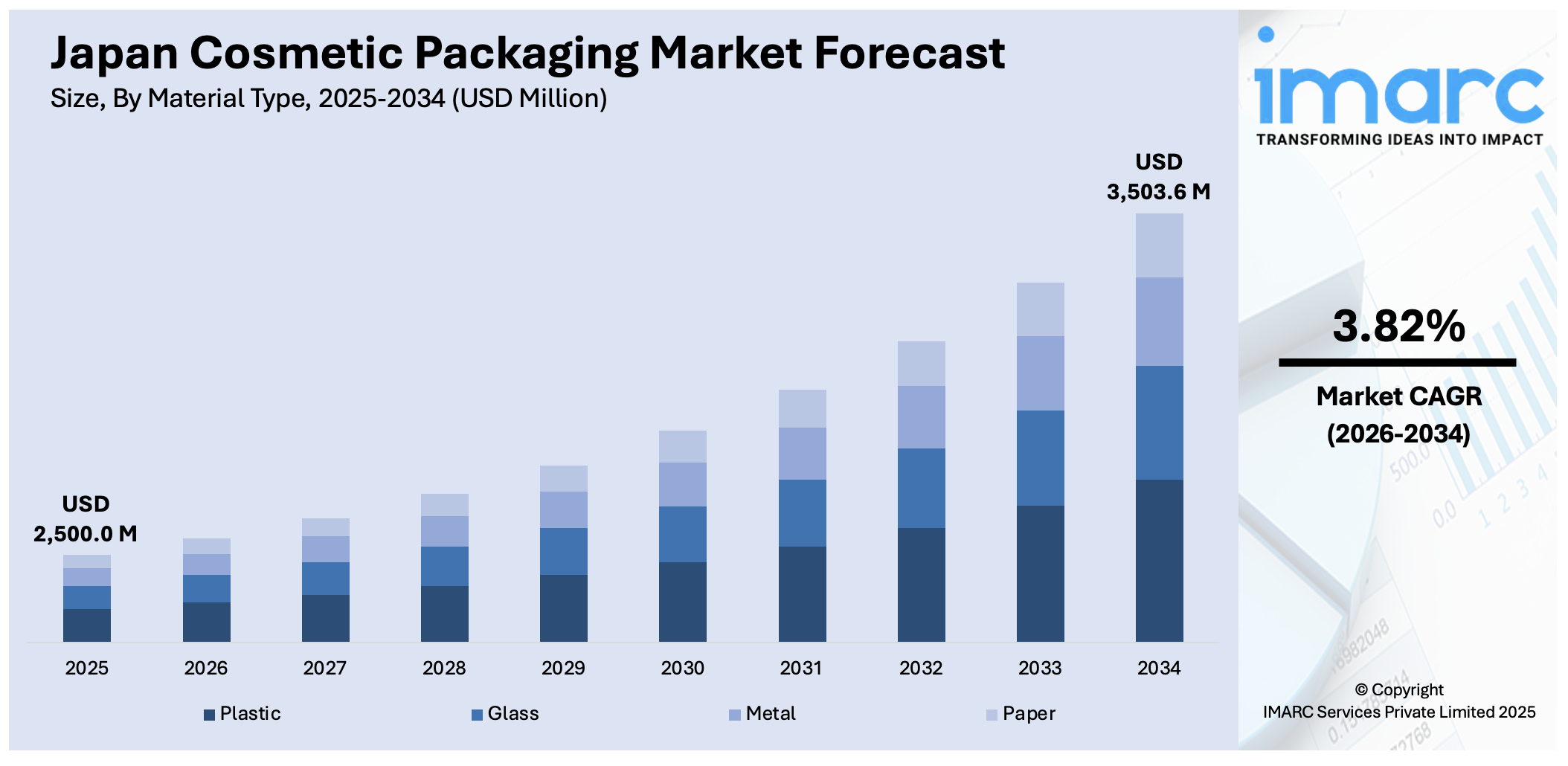

The Japan cosmetic packaging market size reached USD 2,500.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,503.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.82% during 2026-2034. The market is driven by the increasing demand for eco-friendly and sustainable packaging, as consumers increasingly seek green solutions. The expansion in the personal care and beauty sector increases the requirement for innovative and appealing packaging solutions to engage a broad customer base. Packaging material technology and customization advancements enable better functionality, beauty, and consumer interaction, further increasing the Japan cosmetic packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,500.0 Million |

| Market Forecast in 2034 | USD 3,503.6 Million |

| Market Growth Rate 2026-2034 | 3.82% |

Japan Cosmetic Packaging Market Trends:

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

The growing demand for sustainable and eco-friendly packaging solutions is a key driver for the cosmetic packaging market in Japan. As environmental awareness increases among consumers, particularly among younger generations, there is a rising preference for cosmetic products packaged in environmentally friendly materials. In response, cosmetic brands in Japan are focusing on packaging solutions that are recyclable, biodegradable, or made from renewable resources. On September 3, 2024, JEPLAN Group’s PET refine technology announced the brand name "HELIX" for its recycled PET resin, produced using proprietary PET chemical recycling technology. The resin has been adopted by major Japanese companies, including Kao Corporation, Shiseido, and KOSÉ, as part of their efforts to incorporate sustainable materials into packaging. Japan's goal is to increase Bottle-to-Bottle recycling to over 50% of PET bottles by 2030, in line with growing global demand for recycled materials, especially as the European Union deliberates regulations for a 30% minimum recycled content by 2030 and 50% by 2040. This shift is partly driven by government initiatives aimed at reducing plastic waste and encouraging recycling, such as Japan’s plastic waste reduction policies and waste management regulations. As part of the country’s broader sustainability goals, consumers are increasingly seeking products with minimal environmental impact, which in turn pressures brands to adopt green packaging alternatives. The adoption of materials like glass, aluminum, and bioplastics, as well as packaging designs that reduce waste, are becoming common choices. Additionally, advancements in biodegradable materials and refillable packaging systems align with consumer demand for more sustainable solutions, contributing to the Japan cosmetic packaging market growth.

To get more information on this market Request Sample

Growth of the Beauty and Personal Care Industry

The expansion of Japan's beauty and personal care industry is significantly influencing the demand for cosmetic packaging. Japan has a long-standing reputation for innovation and quality in the beauty sector, with a strong market for both skincare and color cosmetics. As the Japanese population continues to age, the demand for anti-aging products, skincare solutions, and cosmetics catering to diverse skin types is increasing, thereby driving packaging demand. In addition, the increasing influence of Korean beauty (K-beauty) trends and global beauty standards has led to a surge in both domestic and international brands entering the Japanese market. Packaging plays a pivotal role in the appeal of cosmetic products in Japan, where aesthetics is of paramount importance. The emphasis on functional, elegant, and innovative packaging designs is critical to stand out in a highly competitive market. Packaging is often seen as an extension of the product’s quality and luxury, with consumers willing to pay a premium for packaging that conveys exclusivity and sophistication. On May 13, 2025, SUQQU launched a sustainable makeup compact made from Eastman Cristal™ One copolyester, offering a recyclable alternative to traditional materials like acrylonitrile butadiene styrene (ABS). The new compact has exceeded sales expectations, achieving 187% of its monthly target since the February launch, highlighting strong market demand for sustainable cosmetic packaging. This initiative aligns with evolving global sustainability regulations. The growth of e-commerce and online beauty retail further accelerates the demand for attractive and practical packaging, as it helps to enhance the customer experience and attract attention in a crowded market.

Japan Cosmetic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on material type, product type, and cosmetic type.

Material Type Insights:

- Plastic

- Glass

- Metal

- Paper

The report has provided a detailed breakup and analysis of the market based on the material type. This includes plastic, glass, metal, and paper.

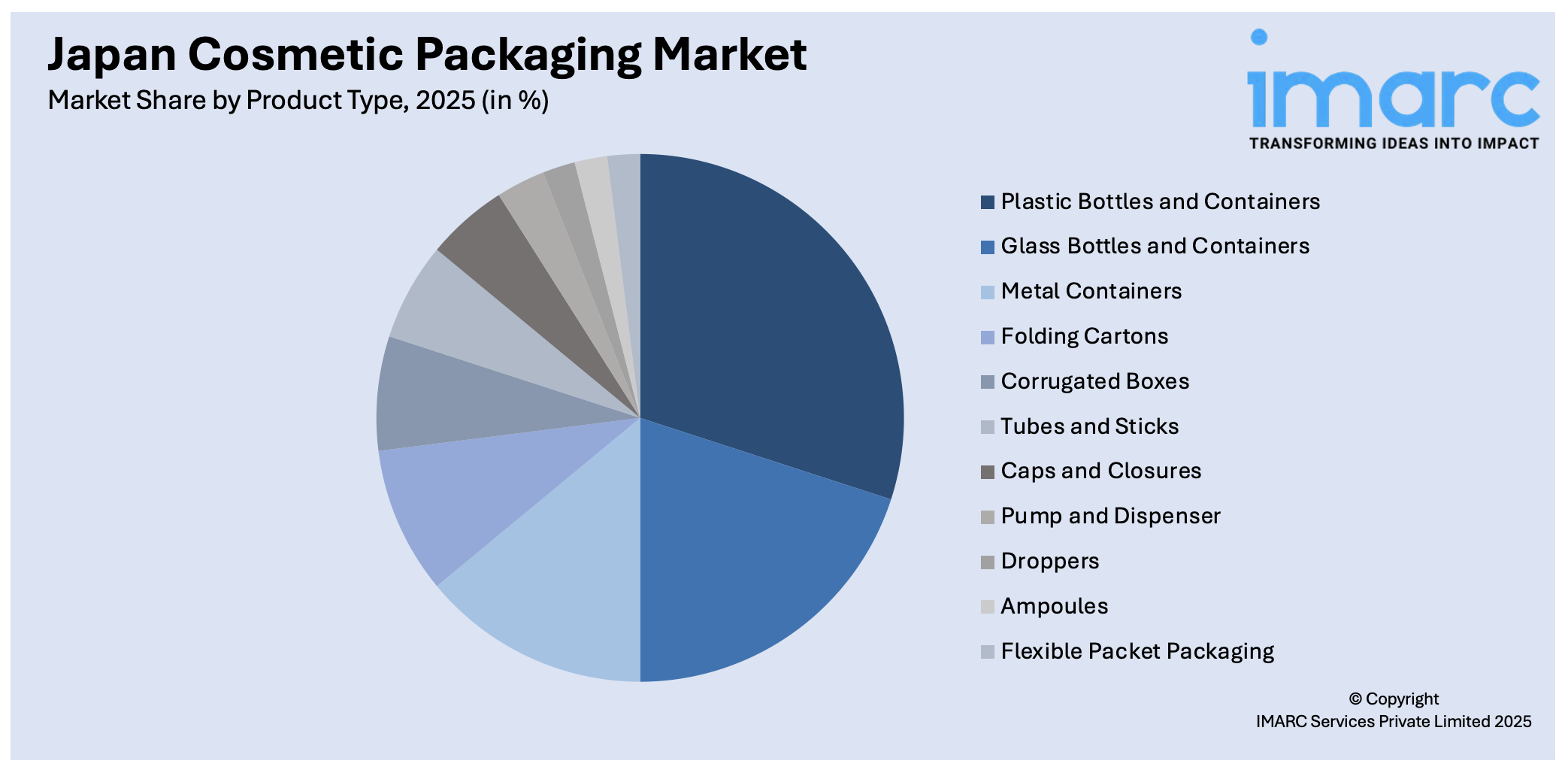

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Plastic Bottles and Containers

- Glass Bottles and Containers

- Metal Containers

- Folding Cartons

- Corrugated Boxes

- Tubes and Sticks

- Caps and Closures

- Pump and Dispenser

- Droppers

- Ampoules

- Flexible Packet Packaging

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plastic bottles and containers, glass bottles and containers, metal containers, folding cartons, corrugated boxes, tubes and sticks, caps and closures, pump and dispenser, droppers, ampoules, and flexible packet packaging.

Cosmetic Type Insights:

- Hair Care

- Color Cosmetics

- Skin Care

- Men's Grooming

- Deodorants

- Others

The report has provided a detailed breakup and analysis of the market based on the cosmetic type. This includes hair care, color cosmetics, skin care, men's grooming, deodorants, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cosmetic Packaging Market News:

- On May 13, 2025, KOSÉ, a major Japanese cosmetics company, launched its sustainability plan, aiming to reduce the carbon footprint of its products, particularly in the plastic packaging used for its beauty items. In collaboration with Neste, KOSÉ incorporated renewable bio-based materials, specifically Neste RETM, into the packaging of their SEKKISEI CLEAR WELLNESS Overnight Cream. This initiative, which uses a mass balance approach, marks the first application in Japan's cosmetics industry to integrate renewable materials into the plastic container.

- On March 13, 2025, FANCL, a Japanese cosmetics company, launched the "toiro" skincare line, featuring reusable packaging, that is created with Eastman Tritan™ copolyester. This new line incorporates shatterproof, refillable Tritan bottles, allowing consumers to purchase refill cartridges after the initial bottle purchase, significantly reducing plastic waste. The packaging's durability and resistance to breakage, combined with FANCL's commitment to sustainability, cater to environmentally-conscious consumers while maintaining the quality of FANCL’s preservative-free skincare products.

Japan Cosmetic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Plastic, Glass, Metal, Paper |

| Product Types Covered | Plastic Bottles and Containers, Glass Bottles and Containers, Metal Containers, Folding Cartoons, Corrugated Boxes, Tubes and Sticks, Caps and Closures, Pump and Dispenser, Droppers, Ampoules, Flexible Packet Packaging |

| Cosmetic Types Covered | Hair Care, Color Cosmetics, Skin Care, Men’s Grooming, Deodorants, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cosmetic packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cosmetic packaging market on the basis of material type?

- What is the breakup of the Japan cosmetic packaging market on the basis of product type?

- What is the breakup of the Japan cosmetic packaging market on the basis of cosmetic type?

- What is the breakup of the Japan cosmetic packaging market on the basis of region?

- What are the various stages in the value chain of the Japan cosmetic packaging market?

- What are the key driving factors and challenges in the Japan cosmetic packaging market?

- What is the structure of the Japan cosmetic packaging market and who are the key players?

- What is the degree of competition in the Japan cosmetic packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cosmetic packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cosmetic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cosmetic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)