Japan Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Japan Craft Spirits Market Overview:

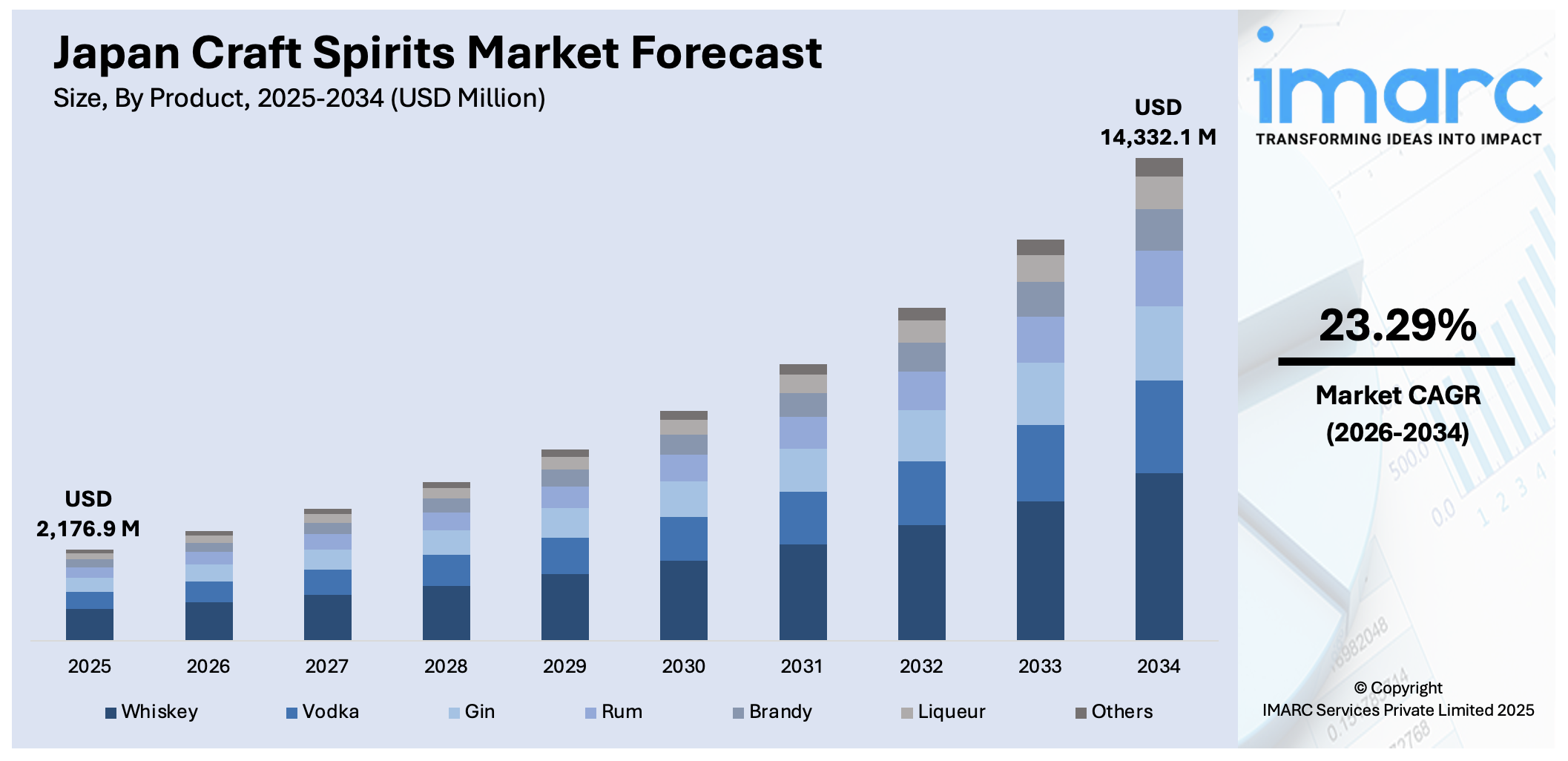

The Japan craft spirits market size reached USD 2,176.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,332.1 Million by 2034, exhibiting a growth rate (CAGR) of 23.29% during 2026-2034. Rising demand from customers for craft and premium items, the country's heritage of craftsmanship and the use of local ingredients, and worldwide acceptability of Japanese whisky are supporting the market growth. Furthermore, an expansion in cocktail culture, the rising popularity of ready-to-drink beverages, and export support by the government are supporting the market growth. Apart from this, the shift to sustainable production practices, new distillation technologies, the boom in experiential drinking, young high-income customer segments, the increase in Japan's tourism, global trends toward premiumization, and increasing global focus towards Japanese spirits are propelling the Japan craft spirits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,176.9 Million |

| Market Forecast in 2034 | USD 14,332.1 Million |

| Market Growth Rate 2026-2034 | 23.29% |

Japan Craft Spirits Market Trends:

Rise in Consumer Demand for Premium and Handcrafted Products

Over the last few years, Japanese consumers have been seeking more and more high-quality, premium, and artisanal products, including craft spirits. The premium movement is driven by consumers' growing desire for authenticity and specificity in what they eat and drink. Unlike mass-produced beverages, craft spirits are made in small lots, allowing for a more intense level of attention and quality. Consumers are not just looking for a liquor item; they are looking for an experience that provides them with access to a local heritage and culture. This corresponds with broader international consumer needs for artisanal and customized items. Artisanal spirits, such as Japanese whisky and gin, meet these evolving tastes by using handcrafted ingredients and creative distillation methods. Furthermore, of course, higher-quality craft spirits are typically viewed as a luxury product and as such are highly attractive to more affluent younger consumers who value quality over quantity.

To get more information on this market Request Sample

Rich Craftsmanship and Locally Sourced Ingredients Tradition

Japan is rich in the tradition of craftsmanship, particularly in the areas of ceramics, textiles, and food. That cultural appreciation for the quality and precision translates quite naturally into the craft spirits market. Japanese craft distilleries are largely focused on the use of locally sourced ingredients such as rice, barley, and indigenous botanicals to create distinctive spirits that reflect regional flavor. This feeling of land affinity not only highlights Japan's cultural heritage but also enhances the authenticity of its craft spirits. Utilizing ingredients native to Japan, these spirits give a unique identity of flavor that diverges from their global counterparts. Japanese gin, for example, has a tendency to be flavored with botanicals like yuzu, sansho pepper, and green tea, making it truly Japanese. The customers are drawn to these spirits since they feel they are drinking a part of Japan's heritage. Moreover, the emphasis on quality in the distillation and maturation process is a reflection of the skill handed down from generation to generation of craftsmen, and therefore the product's quality is guaranteed.

Global Acceptance of Japanese Whisky

International popularity of Japanese whisky brought about a hype for other Japanese craft spirits. Japanese whisky has been winning high-end awards for decades and received acclaim from critics and consumers alike as excellent, smooth, and well-crafted spirits. Suntory and Nikka distilleries have home brand names around the world, further evidence of Japan's ability to produce world-class spirits. All such appreciation has increased the level of Japanese craft spirits and prompted individuals to look beyond whisky to experiment with gins, rums, and other craft spirits. All such international appreciation of Japanese whisky has also prompted the latest generations of distilleries in Japan to begin experimenting with old and new production methods alike, thus increasing the number of craft spirits. With whisky drinkers reversing their decisions and venturing into other spirits, Japanese craft gin or shochu with a whisky background is in highest demand. The way international recognition of the Japanese whiskies has been strengthening Japan as a nation in producing the top-quality spirits itself makes it simple for craft distilleries to position themselves on the global marketplace and secure an international marketplace.

Japan Craft Spirits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes whiskey, vodka, gin, rum, brandy, liqueur, and others.

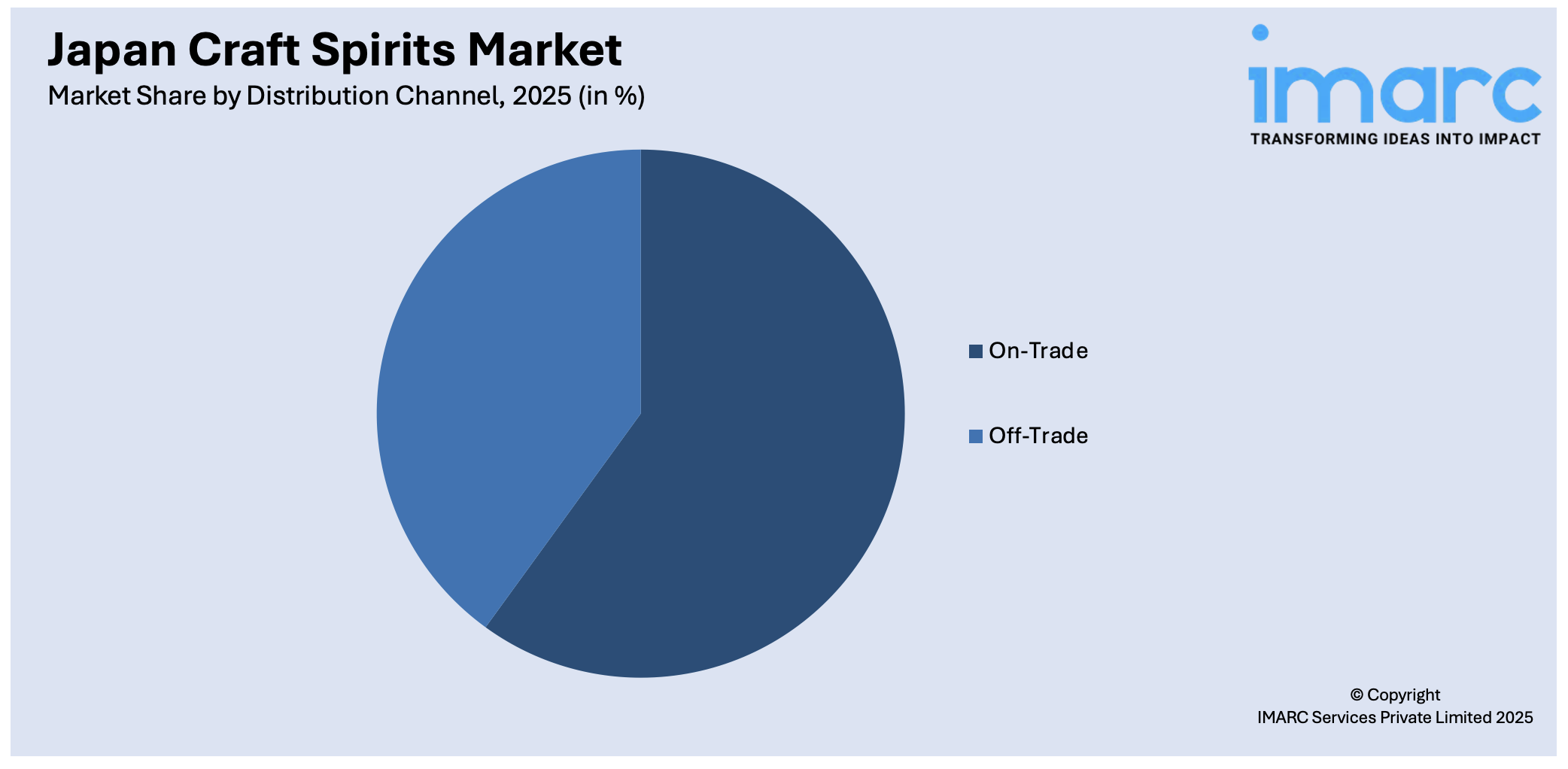

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Craft Spirits Market News:

- In 2025, Suntory announced a ¥6.5 billion (USD 41 million) investment in its Osaka Plant to boost gin production, particularly for its Roku Gin. This includes a new distillery and visitor center, aiming to double spirits output and expand Japan's gin market to ¥45 billion (USD 0.31 billion USD) by 2030.

Japan Craft Spirits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan craft spirits market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan craft spirits market on the basis of product?

- What is the breakup of the Japan craft spirits market on the basis of distribution channel?

- What is the breakup of the Japan craft spirits market on the basis of region?

- What are the various stages in the value chain of the Japan craft spirits market?

- What are the key driving factors and challenges in the Japan craft spirits?

- What is the structure of the Japan craft spirits market and who are the key players?

- What is the degree of competition in the Japan craft spirits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan craft spirits market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan craft spirits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)