Japan Data Center Chip Market Size, Share, Trends and Forecast by Chip Type, Data Center Size, Industry Vertical, and Region, 2026-2034

Japan Data Center Chip Market Overview:

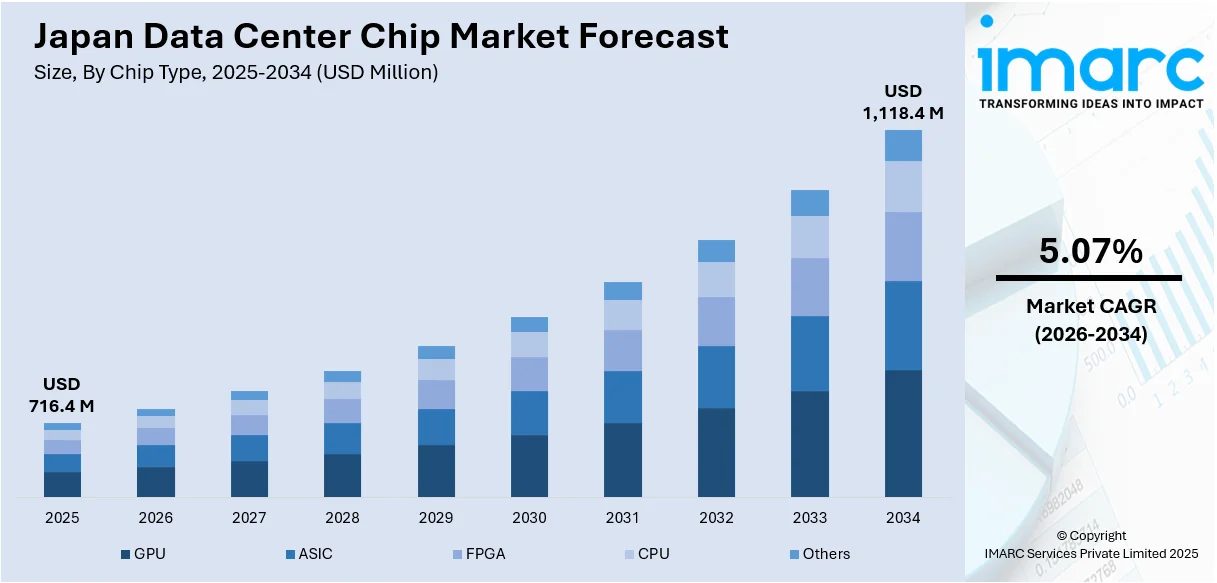

The Japan data center chip market size reached USD 716.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,118.4 Million by 2034, exhibiting a growth rate (CAGR) of 5.07% during 2026-2034. Japan's market is expanding due to rising AI workloads, cloud adoption, and national digital strategies. Demand for high-performance GPUs and AI accelerators is growing, driven by generative AI, hyperscale infrastructure, and investments in localized chip supply and advanced data center facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 716.4 Million |

| Market Forecast in 2034 | USD 1,118.4 Million |

| Market Growth Rate 2026-2034 | 5.07% |

Japan Data Center Chip Market Trends:

Rising AI Workloads Demanding Chip Innovation

Japan’s expanding focus on AI development is driving demand for advanced chips tailored to handle high-volume, low-latency workloads. The country’s enterprise and public sectors are increasingly integrating generative AI into operations, prompting a shift toward purpose-built chips like GPUs and AI accelerators designed for model training and inference. These chips must support performance at scale while managing energy consumption and thermal efficiency. This transition reflects the rising need for specialized infrastructure capable of handling AI-heavy tasks across cloud and edge environments. In March 2025, Japan’s alt Inc. and Highreso Co. Ltd. jointly launched the alt GPU Cloud, incorporating Nvidia H100 and H200 chips in AI-optimized data centers. This initiative underlines Japan’s commitment to strengthening domestic AI capabilities through cutting-edge hardware integration. As demand grows, Japanese data center operators are expected to adopt more diversified chip architectures that can deliver flexible, scalable performance across AI platforms. This will be especially relevant for sectors like autonomous mobility, robotics, financial modeling, and national research initiatives. The country’s evolving AI landscape will require continual investment in chip innovation to ensure infrastructure remains aligned with rising computational needs.

To get more information on this market Request Sample

Cross-Border Expansion Strengthening Chip Ecosystems

International collaboration is becoming a cornerstone of Japan’s strategy to build a more resilient and agile chip ecosystem, particularly for AI infrastructure. With growing data center capacity and rising AI adoption, Japan is positioning itself as a regional hub for next-generation computing. The government and private sector are encouraging cross-border partnerships to bring in specialized expertise, shorten chip supply chains, and accelerate time-to-market for advanced hardware solutions. These efforts are also aligned with national strategies for digital resilience and economic security. In March 2025, South Korea’s AI chip startup Rebellions set up a new unit in Tokyo to tap into Japan’s expanding AI data center market. This move points to Japan’s growing appeal as a destination for chipmakers seeking proximity to AI infrastructure developers and enterprise users. Such cross-border setups not only improve access to high-performance chips but also help transfer technical know-how and localize support services. For Japan, these collaborations enhance the ability to deploy AI-ready chips rapidly across critical sectors, including healthcare, manufacturing automation, and digital government platforms. Strengthening local chip ecosystems through international engagement will support Japan’s goal of maintaining technological leadership in AI infrastructure.

Japan Data Center Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on chip type, data center size, and industry vertical.

Chip Type Insights:

- GPU

- ASIC

- FPGA

- CPU

- Others

The report has provided a detailed breakup and analysis of the market based on the chip type. This includes GPU, ASIC, FPGA, CPU, and others.

Data Center Size Insights:

- Small and Medium Size

- Large Size

A detailed breakup and analysis of the market based on the data center size have also been provided in the report. This includes small and medium size and large size.

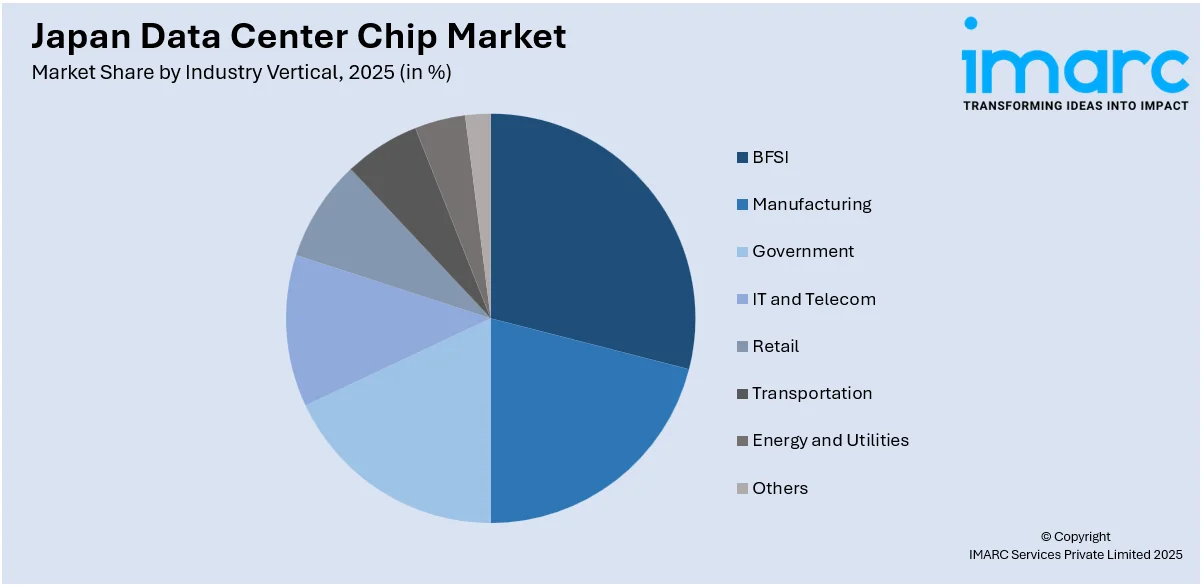

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Manufacturing

- Government

- IT and Telecom

- Retail

- Transportation

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, manufacturing, government, IT and telecom, retail, transportation, energy and utilities, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Data Center Chip Market News:

- March 2025: Mitsubishi Corp. and JFE announced plans to build an AI-focused data center in Kawasaki, Japan, using high-performance semiconductors. This development supported growing demand for data center chips, driven by generative AI workloads and Japan’s strategic repurposing of industrial sites for digital infrastructure.

- January 2025: ESR and CloudHQ launched a USD 2 Billion joint venture for the Cosmosquare Data Centre in Osaka, Japan. This boosted demand for advanced data center chips to support 130 MW capacity across phases, driven by cloud growth, AI adoption, and digital infrastructure expansion.

Japan Data Center Chip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FPGA, CPU, Others |

| Data Center Sizes Covered | Small and Medium Size, Large Size |

| Industry Verticals Covered | BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan data center chip market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan data center chip market on the basis of chip type?

- What is the breakup of the Japan data center chip market on the basis of data center size?

- What is the breakup of the Japan data center chip market on the basis of industry vertical?

- What are the various stages in the value chain of the Japan data center chip market?

- What are the key driving factors and challenges in the Japan data center chip market?

- What is the structure of the Japan data center chip market and who are the key players?

- What is the degree of competition in the Japan data center chip market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan data center chip market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan data center chip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan data center chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)