Japan Diagnostic Labs Market Size, Share, Trends and Forecast by Provider Type, Test Type, Sector, End User, and Region, 2026-2034

Japan Diagnostic Labs Market Overview:

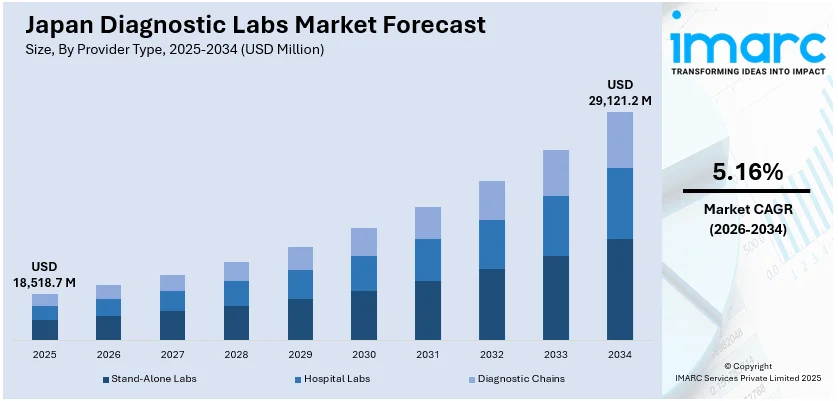

The Japan diagnostic labs market size reached USD 18,518.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 29,121.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.16% during 2026-2034. The market is witnessing steady growth, driven by an aging population, rising chronic disease incidence, and growing demand for early disease detection. Additionally, government health initiatives and private sector investment, and advancements in molecular diagnostics, automation, and personalized medicine are improving testing accuracy and efficiency, thereby contributing to the steady rise in Japan diagnostic labs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18,518.7 Million |

| Market Forecast in 2034 | USD 29,121.2 Million |

| Market Growth Rate 2026-2034 | 5.16% |

Japan Diagnostic Labs Market Trends:

Growth in Molecular and Genetic Testing

Molecular and genetic testing are gaining strong momentum in Japan as healthcare providers and patients increasingly prioritize precision medicine. With the rising burden of chronic diseases, cancer, and rare genetic disorders, there is growing reliance on highly specific and sensitive diagnostic methods that enable earlier and more accurate disease detection. Laboratories are expanding their capabilities to offer next-generation sequencing (NGS), polymerase chain reaction (PCR), and other molecular platforms to meet this demand. For instance, in August 2023, Sysmex’s PrismGuide™ IRD Panel System became Japan's first gene panel testing system for inherited retinal dystrophy, receiving insurance coverage. Riken Genesis will offer testing, helping identify causative genes to improve treatment and care for patients experiencing symptoms of this progressive disease. Genetic screening for conditions like inherited cancers and rare diseases is becoming part of routine diagnostics, supported by government initiatives and insurance coverage expansions. Companies are also developing non-invasive tests that improve patient comfort and screening uptake. This shift is transforming diagnostic labs into critical players in personalized healthcare, significantly enhancing patient outcomes and boosting the technological sophistication of Japan’s diagnostic landscape.

To get more information on this market Request Sample

Growing Geriatric Population

Japan’s steadily aging population is leading to a sharp rise in demand for routine health screenings and diagnostics related to chronic and age-associated conditions. Japan's elderly population reached a record 36.25 million, with those aged 65 or older comprising nearly 30% of the population. Out of this, 20.53 million are women and 15.72 million are men. Older adults commonly experience multiple health concerns, including cardiovascular issues, diabetes, neurodegenerative disorders, and cancers, all of which require ongoing monitoring and early detection. Diagnostic labs play a critical role in this continuum of care, offering services that support timely interventions and disease management. The healthcare system’s focus on preventive care and regular checkups is also encouraging greater utilization of lab-based testing. With the rise in geriatric patients, there is growing pressure on laboratories to expand capacity, improve turnaround times, and adopt patient-friendly technologies. These developments are positioning diagnostic labs as essential healthcare infrastructure, ensuring continuous support for an aging society and contributing significantly to Japan diagnostics labs market growth.

Japan Diagnostic Labs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on provider type, test type, sector, and end user.

Provider Type Insights:

- Stand-Alone Labs

- Hospital Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes stand-alone labs, hospital labs, and diagnostic chains.

Test Type Insights:

- Pathology

- Radiology

A detailed breakup and analysis of the market based on the test type have also been provided in the report. This includes pathology and radiology.

Sector Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes urban and rural.

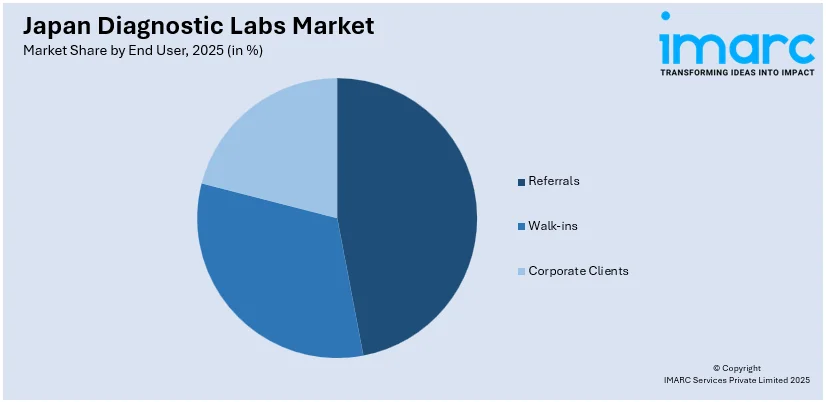

End User Insights:

Access the comprehensive market breakdown Request Sample

- Referrals

- Walk-ins

- Corporate Clients

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes referrals, walk-ins, and corporate clients.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Diagnostic Labs Market News:

- In January 2025, Taiwan's Advanced Genomics APAC Co. announced its partnership with Cancer Precision Medicine Inc. to introduce the GALEAS Bladder cancer screening test in Japan. This non-invasive test analyzes genomic DNA from urine using next-generation sequencing, offering high sensitivity and accuracy while reducing the need for invasive procedures like cystoscopy.

- In April 2024, C₂N Diagnostics announced its partnership with Mediford Corporation to expand its Precivity™ blood testing for Alzheimer's disease into Japan. This collaboration aims to enhance access to advanced biomarker research, addressing the high prevalence of Alzheimer's in the country, while supporting clinical trials and treatment monitoring for better patient outcomes.

Japan Diagnostic Labs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Provider Types Covered | Stand-Alone Labs, Hospital Labs, Diagnostic Chains |

| Test Types Covered | Pathology, Radiology |

| Sectors Covered | Urban, Rural |

| End Users Covered | Referrals, Walk-ins, Corporate Clients |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diagnostic labs market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan diagnostic labs market on the basis of provider type?

- What is the breakup of the Japan diagnostic labs market on the basis of test type?

- What is the breakup of the Japan diagnostic labs market on the basis of sector?

- What is the breakup of the Japan diagnostic labs market on the basis of end user?

- What is the breakup of the Japan diagnostic labs market on the basis of region?

- What are the various stages in the value chain of the Japan diagnostic labs market?

- What are the key driving factors and challenges in the Japan diagnostic labs market?

- What is the structure of the Japan diagnostic labs market and who are the key players?

- What is the degree of competition in the Japan diagnostic labs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diagnostic labs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diagnostic labs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diagnostic labs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)