Japan Diesel Engine Market Size, Share, Trends and Forecast by Power Rating, End User, and Region, 2026-2034

Japan Diesel Engine Market Overview:

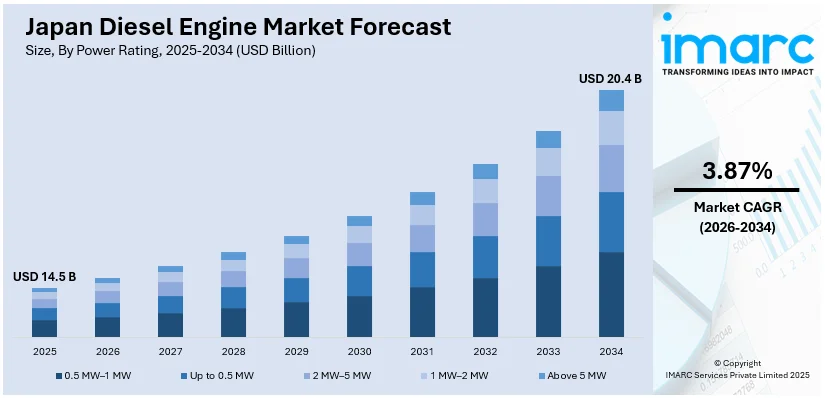

The Japan diesel engine market size reached USD 14.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.87% during 2026-2034. Increasing demand for reliable power due to frequent natural disasters causing power outages and the significant electricity consumption of the large industrial and commercial sectors are some of the factors contributing to Japan diesel engine market share. The growing urban population also contributes to this demand for stable power sources.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2034 | USD 20.4 Billion |

| Market Growth Rate 2026-2034 | 3.87% |

Japan Diesel Engine Market Trends:

New Player in Commercial Vehicle Powertrain

A significant change is unfolding in the Japanese medium-duty truck engine market. A newly developed diesel engine has emerged from a partnership between prominent automotive entities. This engine is slated for integration into a key line of medium-duty trucks destined for the Japanese market. This collaborative effort signifies the introduction of a global engine producer into the Japanese on-highway vehicle sector. Vehicles featuring this jointly engineered powertrain are anticipated to become available in the Asia Pacific region and other international markets later this year, potentially impacting the competitive landscape of engine supply for commercial vehicles in these areas. These factors are intensifying the Japan diesel engine market growth. For example, in May 2024, Cummins Inc. and Isuzu Motors Limited jointly developed a new 6.7-liter diesel engine, the "Isuzu DB6A," for Isuzu's medium-duty trucks. This marks Cummins' entry into the Japanese on-highway market. The engine would power Isuzu's FORWARD trucks for the Japan market, with availability in Asia Pacific and other global markets later this year.

To get more information on this market Request Sample

Broadening Powertrain Choices in Utility Vehicles

A significant evolution is occurring within the Japanese utility vehicle market, marked by the expansion of a well-established vehicle family. This expansion introduces a fresh series, accompanied by special launch editions. Importantly, this new series presents a direct injection turbo diesel engine paired with a sophisticated automatic transmission, alongside a gasoline-powered alternative. Both engine options are designed to deliver robust performance while adhering to ecological standards, catering to the domestic demand for resilient and economical vehicles. This development signals an ongoing emphasis on diesel technology within the utility vehicle category in Japan. For instance, in April 2024, Toyota expanded its Land Cruiser lineup in Japan with the addition of the "250" series, including special edition ZX "First Edition" and VX "First Edition" models, limited to 8,000 units. Notably, the "250" series offers a 2.8-liter direct injection turbo diesel engine paired with Direct Shift-8AT, alongside a 2.7-liter gasoline engine. Both powertrains aim to deliver powerful driving and adhere to environmental standards, catering to the demand for robust and efficient vehicles in Japan.

Japan Diesel Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on power rating and end user.

Power Rating Insights:

- 0.5 MW–1 MW

- Up to 0.5 MW

- 2 MW–5 MW

- 1 MW–2 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0.5 MW–1 MW, up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, and above 5 MW.

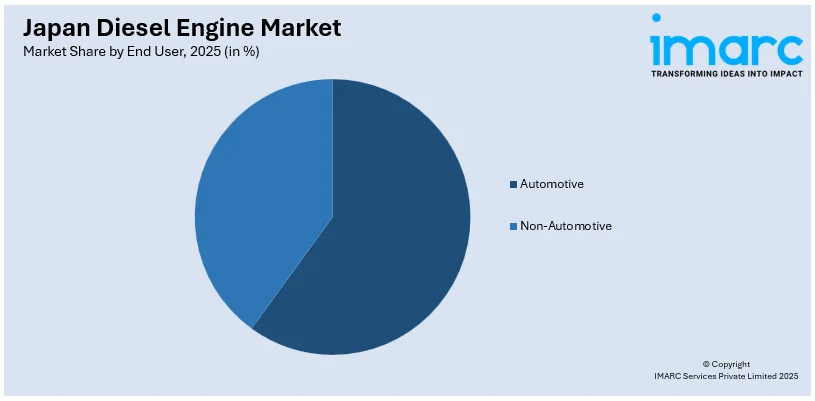

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off Road

- Industrial/Construction Equipment

- Agriculture Equipment

- Marine Applications

- On-Road

- Non-Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive [on-road (light vehicles, medium/heavy trucks, and light trucks) and off road (industrial/construction equipment, agriculture equipment, and marine applications)] and non-automotive.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Diesel Engine Market News:

- In March 2025, Japan commissioned the "Raigei," its fourth Taigei-class diesel-electric submarine, built by Kawasaki Heavy Industries. This advanced vessel features an ultra-quiet diesel-electric propulsion system utilizing both a diesel engine and lithium-ion batteries. Designed for stealth operations in Japan's surrounding waters, the Raigei reflects the nation's preference for conventional submarines.

Japan Diesel Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | 0.5 MW–1 MW, Up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, Above 5 MW |

| End Users Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diesel engine market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan diesel engine market on the basis of power rating?

- What is the breakup of the Japan diesel engine market on the basis of end user?

- What is the breakup of the Japan diesel engine market on the basis of region?

- What are the various stages in the value chain of the Japan diesel engine market?

- What are the key driving factors and challenges in the Japan diesel engine market?

- What is the structure of the Japan diesel engine market and who are the key players?

- What is the degree of competition in the Japan diesel engine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diesel engine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diesel engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diesel engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)