Japan Dietary Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, End-Use, and Region, 2026-2034

Japan Dietary Supplements Market Overview:

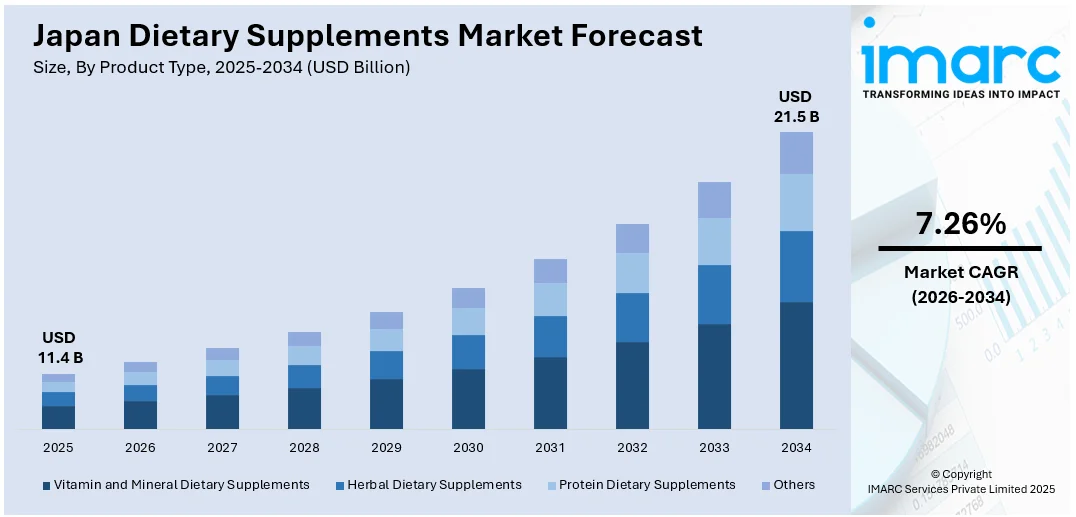

The Japan dietary supplements market size reached USD 11.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 21.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.26% during 2026-2034. An aging population, emphasis on long-term vitality, demand for age-specific health solutions, strong brand loyalty among seniors, rise of personalized nutrition, integration of biotech and digital tools, and expansion of direct-to-consumer platforms are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.4 Billion |

| Market Forecast in 2034 | USD 21.5 Billion |

| Market Growth Rate 2026-2034 | 7.26% |

Japan Dietary Supplements Market Trends:

Aging Population and Health-Preserving Lifestyles

Japan’s demography continues to be shaped by an aging population, with nearly one-third of citizens now over the age of 65. As life expectancy increases, health preservation has become a key priority for older adults managing long-term wellness. This has driven widespread interest in dietary supplements designed to address specific age-related issues such as osteoporosis, joint pain, poor circulation, and memory decline. Collagen, glucosamine, vitamin D, and DHA supplements are particularly popular among seniors aiming to maintain mobility and independence. Additionally, many retirees are actively engaged in preventive routines, using supplements not only to treat deficiencies but also to support overall vitality. This emphasis on aging well is reinforced by campaigns from healthcare providers, insurers, and senior-focused retail networks. Consumers in this age group also display strong brand loyalty and preference for certified, research-backed products. In a Japan-based clinical trial, pancreatic cancer patients received 250 mg/day of Nichi BRITE Beta 1,3-1,6 Glucan for 22 days, with no adverse effects reported. Produced in a GMP-certified facility, the supplement improved immune markers, reduced cancer biomarkers, and extended mean survival when used as an adjuvant to standard care. With growing purchasing power among Japan’s elderly and a cultural emphasis on longevity, the Japan dietary supplements market share continues to widen, especially across pharmacy and direct mail channels that cater to this age demographic. Supplement adherence among older Japanese adults has become normalized, resulting in steady repeat purchases and consistent consumption cycles across the most demanded health categories.

To get more information on this market Request Sample

Technological Innovation and Personalized Supplement Delivery

Innovation in biotechnology and digital tools is redefining how dietary supplements are positioned and consumed in Japan. Personalization is a rapidly emerging trend, as companies leverage genetic testing, microbiome analysis, and AI-based dietary profiling to offer consumers customized nutrition plans. These solutions are particularly attractive to younger, tech-literate consumers, as well as busy professionals seeking convenience and relevance. Mobile applications now integrate purchase histories, health goals, and daily intake reminders to support long-term compliance. These developments have significantly influenced Japan dietary supplements market growth, particularly in metropolitan regions such as Tokyo and Osaka where digital adoption is high. Packaging is also evolving as daily pouches and subscription kits tailored to personal health data are increasingly popular in online sales. Retailers and brands are investing in virtual storefronts, interactive product recommendations, and cross-platform loyalty programs. Moreover, domestic and global brands are accelerating investment into direct-to-consumer channels to streamline fulfillment and deepen customer relationships. As per a 2023 research article, Japan had registered 4,548 Food with Function Claims (FFC) products in 2022, with 76.5% classified as dietary supplements and annual registrations rising from 466 in 2015 to 823 in 2021. Leading claims target probiotics, cognitive and vision health, stress relief, and bone support, with major players including Kirin, Fancl, Yakult, Otsuka, and Suntory. Given the alignment between technological capabilities and consumer openness to customization, the Japan dietary supplements market outlook is highly favorable. With expanding access to diagnostic tools and sustained innovation in product formats, the market is expected to maintain a stable, long-term growth trajectory driven by personalization and digital fluency.

Japan Dietary Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, form, distribution channel, application, and end-use.

Product Type Insights:

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others.

Form Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gel Caps

The report has provided a detailed breakup and analysis of the market based on the form. This includes tablets, capsules, powders, liquids, soft gels, and gel caps.

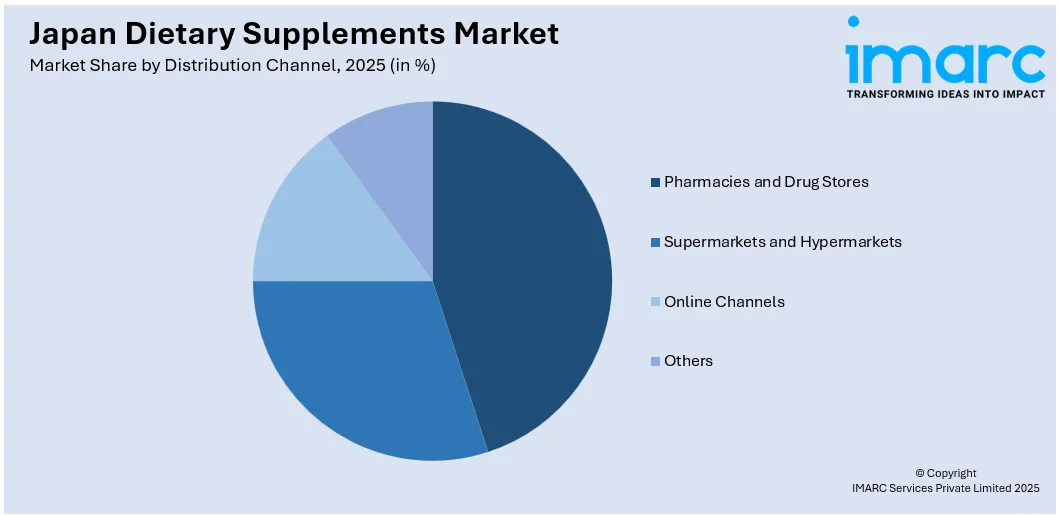

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes pharmacies and drug stores, supermarkets and hypermarkets, online channels, and others.

Application Insights:

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

The report has provided a detailed breakup and analysis of the market based on the application. This includes additional supplements, medicinal supplement, and sports nutrition.

End-Use Insights:

- Infant

- Children

- Adults

- Pregnant Women

- Old-Aged

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes infant, children, adults, pregnant women, and old-aged.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Dietary Supplements Market News:

-

On November 7, 2024, DSM-Firmenich launched a new multivitamin solution tailored for Japanese seniors, designed to support healthy aging and daily nutritional needs. The formula includes clinically studied levels of essential vitamins and minerals aligned with regional dietary gaps. The launch strengthens the company’s position in the Japan dietary supplements market targeting older demographics.

Japan Dietary Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin and Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, Others |

| Forms Covered | Tablets, Capsules, Powders, Liquids, Soft Gels, Gel Caps |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Channels, Others |

| Applications Covered | Additional Supplements, Medicinal Supplement, Sports Nutrition |

| End-Uses Covered | Infant, Children, Adults, Pregnant Women, Old-Aged |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan dietary supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan dietary supplements market on the basis of product type?

- What is the breakup of the Japan dietary supplements market on the basis of form?

- What is the breakup of the Japan dietary supplements market on the basis of distribution channel?

- What is the breakup of the Japan dietary supplements market on the basis of application?

- What is the breakup of the Japan dietary supplements market on the basis of end-use?

- What is the breakup of the Japan dietary supplements market on the basis of region?

- What are the various stages in the value chain of the Japan dietary supplements market?

- What are the key driving factors and challenges in the Japan dietary supplements market?

- What is the structure of the Japan dietary supplements market and who are the key players?

- What is the degree of competition in the Japan dietary supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan dietary supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan dietary supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan dietary supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)