Japan Digital Learning Platforms Market Size, Share, Trends and Forecast by Type of Platform, End User, and Region, 2026-2034

Japan Digital Learning Platforms Market Summary:

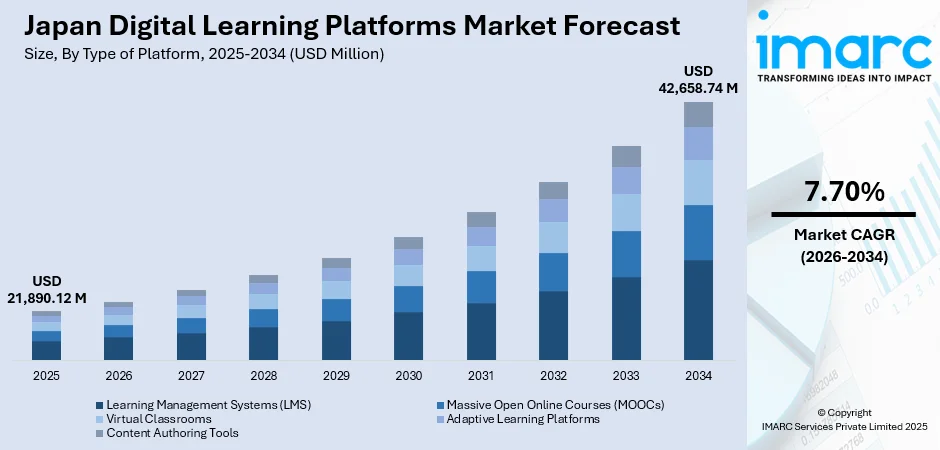

The Japan digital learning platforms market size was valued at USD 21,890.12 Million in 2025 and is projected to reach USD 42,658.74 Million by 2034, growing at a compound annual growth rate of 7.70% from 2026-2034.

The Japan digital learning platforms market is experiencing robust growth as the government accelerates digital transformation initiatives across the education sector and corporations prioritize workforce upskilling. Growing demand for personalized and flexible learning solutions, expanding adoption of AI-powered adaptive platforms, and increasing integration of virtual classrooms are reshaping educational practices. Advancements in learning management systems, rising investments in corporate e-learning, and emerging trends like gamification and metaverse-based learning environments are strengthening Japan digital learning platforms market share.

Key Takeaways and Insights:

- By Type of Platform: Learning Management Systems (LMS) hold the largest market share at 37.6% in 2025, serving as the foundational infrastructure for delivering, tracking, and managing digital learning content across Japan's educational institutions and corporations.

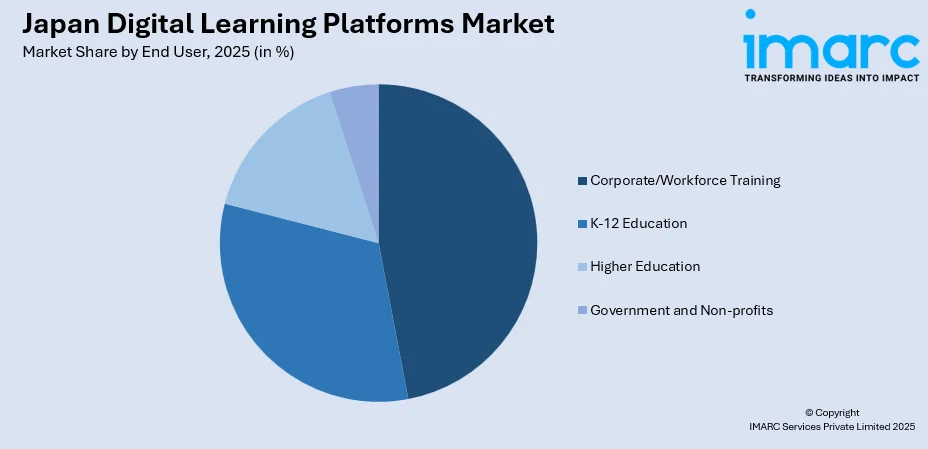

- By End User: Corporate/Workforce Training dominates the market with a share of 47.6% in 2025, reflecting the strong emphasis Japanese enterprises place on continuous employee development and digital skills acquisition to maintain competitive advantage.

- By Region: Kanto Region leads with a share of 33.2% 2025, driven by the concentration of major corporations, educational institutions, and technology companies in the Tokyo metropolitan area.

- Key Players: The Japan digital learning platforms market features leading providers investing heavily in AI integration, adaptive learning technologies, content personalization, and strategic partnerships with educational institutions to expand their platform capabilities and user base.

To get more information on this market Request Sample

The Japan digital learning platforms market is expanding as government bodies, educational institutions, and companies increasingly adopt technology-based learning solutions to meet changing academic and professional development needs. A key recent development: in September 2025 a working group under Central Council for Education approved the official use of digital textbooks, meaning that from fiscal 2030, public elementary and junior high schools in Japan may adopt digital textbooks in place of paper ones. National initiatives continue to strengthen digital infrastructure in classrooms, encouraging wider use of interactive and resource-rich content. At the same time, organizations are investing in flexible training platforms that support skill development and continuous learning for employees. Together, these efforts are creating favorable conditions for the growth of digital learning ecosystems, fostering innovation in tools, content delivery methods, and personalized learning experiences across the country.

Japan Digital Learning Platforms Market Trends:

Integration of AI-Powered Personalized Learning

AI-enabled learning platforms are reshaping how students and professionals engage with digital education in Japan. For example, in November 2025 NTT West and Ritsumeikan University announced a joint initiative to integrate generative AI into education, covering about 50,000 current students and 400,000 alumni, combining e-textbooks and LMS platforms to deliver competency-based, individually optimized learning. These systems track learner behavior, pinpoint strengths and weaknesses, and adjust content difficulty to create tailored learning experiences. By offering adaptive lessons, real-time feedback, and automated study pathways, AI enhances engagement and supports more efficient knowledge retention, strengthening the role of personalized learning across Japan’s digital education ecosystem.

Government-Led Digital Transformation in Education

Government efforts are steadily advancing digital transformation across Japan’s education sector by improving access to devices, strengthening connectivity, and promoting modern classroom technologies. A concrete recent step: under GIGA School Program (and its successor NEXT GIGA), average student-to-device ratio shifted from about 6.1 students per device in 2019 to 1.1 in 2023, and ordinary classrooms’ wireless-LAN coverage rose from 43.4% to 95.4%. These initiatives encourage broader adoption of interactive learning tools, online educational materials, and digitally supported teaching methods. As schools integrate technology more deeply into everyday instruction, they foster a balanced mix of digital and traditional learning, enhance resource accessibility, and support the long-term development of technology-driven education nationwide.

Rise of Virtual and Metaverse-Based Learning Environments

Virtual and metaverse-based platforms are introducing immersive, interactive learning experiences that go beyond traditional classroom settings in Japan. For example, in 2024 Tohoku University partnered with VRChat to integrate metaverse-based education into its hybrid and HyFlex classrooms, enabling students to connect with international peers in virtual reality, use head-mounted displays, and join classes through 3D avatars. Students can explore 3D environments, participate through avatars, and engage with content in highly visual and experiential ways. These digital spaces enable remote learning, collaborative activities, and simulated real-world scenarios, making education more engaging and adaptable while supporting the growing interest in immersive learning technologies nationwide.

Market Outlook 2026-2034:

The Japan digital learning platforms market is set for steady growth as digital transformation deepens across education and corporate training. Expansion will be supported by strong government focus on improving digital infrastructure, rising demand among enterprises for flexible and scalable learning tools, and rapid advances in AI-driven adaptive technologies. The continued shift toward digital textbooks and blended learning environments is expected to accelerate platform adoption, strengthening the role of digital solutions across schools, universities, and professional development settings. The market generated a revenue of USD 21,890.12 Million in 2025 and is projected to reach a revenue of USD 42,658.74 Million by 2034, growing at a compound annual growth rate of 7.70% from 2026-2034.

Japan Digital Learning Platforms Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Platform | Learning Management Systems (LMS) | 37.6% |

| End User | Corporate/Workforce Training | 47.6% |

| Region | Kanto Region | 33.2% |

Type of Platform Insights:

- Learning Management Systems (LMS)

- Massive Open Online Courses (MOOCs)

- Virtual Classrooms

- Adaptive Learning Platforms

- Content Authoring Tools

The learning management systems (LMS) dominates with a market share of 37.6% of the total Japan digital learning platforms market in 2025.

Learning management systems (LMS) hold the largest share of Japan’s digital learning platforms market because they provide a centralized and structured environment for managing training content. Institutions and businesses rely on LMS solutions to organize course materials, automate administrative tasks, and monitor learner progress through integrated dashboards and reporting tools. According to reports, a 2023 survey by the University ICT Promotion Council found that among universities, usage of LMS systems was the most common form of ICT-based learning support

These platforms also support flexible learning pathways, enabling self-paced modules, blended formats, and continuous skill development. LMS adoption is further strengthened by their ability to integrate with third-party tools, support digital assessments, and ensure consistent content delivery across stakeholders, making them the core infrastructure for technology-enabled education and training.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- K-12 Education

- Higher Education

- Corporate/Workforce Training

- Government and Non-profits

The corporate/workforce training leads with a share of 47.6% of the total Japan digital learning platforms market in 2025.

Corporate and workforce training represents the largest end-user segment as companies prioritize continuous skill development to stay competitive. For instance, a recent 2025 report by Yano Research Institute found that the B2B portion of Japan’s e-learning market, i.e., corporate training, increased by 7.8% in FY2024, underscoring stronger enterprise demand for digital training solutions. Organizations use digital learning platforms to train employees on compliance, technical skills, leadership, and role-specific capabilities. The shift toward remote and hybrid work environments has further increased demand for scalable digital solutions.

These platforms allow businesses to standardize training across departments, track employee performance, and reduce costs associated with traditional classroom programs. Personalized learning paths, microlearning modules, and data-driven insights support HR teams in aligning learning initiatives with organizational goals, resulting in higher engagement and improved capability development across the workforce.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 33.2% share of the total Japan digital learning platforms market in 2025.

The Kanto region leads the market due to its dense concentration of educational institutions, technology companies, and corporate headquarters. High digital readiness and strong infrastructure support rapid adoption of advanced online learning tools across schools, universities, and businesses. The region’s focus on innovation contributes to strong demand for integrated and scalable learning platforms.

Kanto’s large workforce population also drives widespread corporate usage, supporting both skill development and compliance-based training. With a diverse mix of learners and industries, the region continues to serve as a hub for testing, adopting, and expanding new digital learning solutions that enhance efficiency and improve learning outcomes.

Market Dynamics:

Growth Drivers:

Why is the Japan Digital Learning Platforms Market Growing?

Government Initiatives for Digital Education Infrastructure

The Japanese government continues to play a central role in advancing digital education by strengthening its nationwide learning infrastructure. A recent development highlights this effort: in September 2025, MEXT approved a plan allowing public schools to adopt fully digital textbooks as official teaching materials, with rollout expected from fiscal 2030. Efforts focus on expanding device access, improving connectivity, and integrating technology into everyday classroom activities. These initiatives aim to create a unified digital learning environment that supports interactive content, fosters student engagement, and enhances teaching effectiveness. Emphasis is placed on ensuring equal access to digital tools for students across both urban and rural areas. By promoting technology-enabled learning, the government is building a foundation that supports long-term modernization of the education ecosystem and encourages seamless adoption of digital platforms.

Rising Corporate Investment in Workforce Digital Upskilling

Japanese companies are increasingly adopting digital learning platforms to support continuous workforce development and address emerging skill requirements. As businesses undergo rapid digital transformation, they are prioritizing training programs that develop expertise in areas such as data-driven decision-making, cybersecurity awareness, and advanced technologies. Corporations are embracing structured learning pathways, industry partnerships, and internal training ecosystems to empower employees with relevant competencies. These initiatives help organizations remain competitive, strengthen innovation capabilities, and build resilient teams equipped for future challenges. The growing emphasis on lifelong learning reinforces the role of digital platforms as essential tools for cultivating a skilled and adaptable workforce.

Increasing Adoption of Flexible and Hybrid Learning Models

The growing popularity of flexible and hybrid work environments has accelerated the shift toward digital learning platforms that support anytime, anywhere access to training. Reflecting this trend, the Japan corporate training market reached USD 22,887.57 Million in 2024 and is expected to reach USD 42,575.96 Million by 2033. These platforms deliver consistent learning experiences across remote, in‑office, and blended settings, offering personalized learning paths, interactive modules, and collaborative tools that help employees build essential skills at their own pace. The flexibility of digital learning enables companies to meet diverse workforce needs while improving productivity and engagement, playing an increasingly important role in supporting continuous learning and adaptation to dynamic workplace expectations."

Market Restraints:

What Challenges the Japan Digital Learning Platforms Market is Facing?

Teacher Training and Digital Literacy Gaps

Many educators still lack the skills and confidence to effectively use digital learning tools in classrooms. Training often focuses on basic ICT usage rather than practical, classroom-ready methods. As a result, teachers feel unprepared to integrate technology into lessons or guide students in digital learning, underscoring the need for stronger, continuous professional development.

Infrastructure Disparities Between Urban and Rural Areas

Urban regions generally benefit from better connectivity and access to digital tools, while rural communities struggle with limited internet coverage and outdated infrastructure. These differences restrict equal access to digital learning opportunities. Enhancing connectivity, device availability, and support systems in remote areas remains essential to reducing the digital divide.

High Implementation Costs and Budget Constraints

Schools and smaller businesses often face financial hurdles when adopting digital learning platforms. Expenses related to devices, software, maintenance, and technical support can exceed available budgets. Concerns also persist about added workload for educators and possible health implications for students as digital materials become more prominent.

Competitive Landscape:

The competitive landscape is shaped by a mix of established digital learning providers and emerging technology innovators offering flexible, user-centric platforms. Competition centers on the ability to deliver intuitive interfaces, scalable architectures, and strong content ecosystems that meet diverse learner needs. Providers differentiate through adaptive learning features, data-driven insights, and integration with institutional systems. Growing demand for personalized learning, mobile accessibility, and seamless analytics encourages continuous innovation, while price sensitivity and implementation complexity push vendors to enhance support services. Strategic partnerships, localized solutions, and ongoing platform upgrades further define competitive positioning.

Recent Developments:

- In April 2025, Fujitsu introduced a new employee-training platform for Seven-Eleven Japan, following its rollout in select directly managed stores on March 25. The system supports store digitalization through real-time skill tracking, improved employee readiness, and reduced training loads for franchise owners, highlighting EdTech’s growing role in Japan’s retail sector.

- In March 2025, learningBOX announced that over 1,500 organizations were using its cloud-based e-learning platform on paid plans. The system allows companies of all sizes to create training content, track learner progress, and run online exams without technical expertise, reflecting rising demand for scalable, user-friendly LMS solutions in Japan.

Japan Digital Learning Platforms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Platform Covered | Learning Management Systems (LMS), Massive Open Online Courses (MOOCs), Virtual Classrooms, Adaptive Learning Platforms, Content Authoring Tools |

| End Users Covered | K-12 Education, Higher Education, Corporate/Workforce Training, Government and Non-profits |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan digital learning platforms market size was valued at USD 21,890.12 Million in 2025.

The Japan digital learning platforms market is expected to grow at a compound annual growth rate of 7.70% from 2026-2034 to reach USD 42,658.74 Million by 2034.

Learning Management Systems (LMS), holding 37.6% market share, represent the largest segment in the Japan digital learning platforms market, serving as essential infrastructure for content delivery, learner tracking, and assessment management across educational institutions and corporations.

Key factors driving the Japan digital learning platforms market include AI-driven personalization, government-backed digital transformation, and emerging virtual or metaverse-based environments are collectively enhancing engagement, accessibility, and immersive learning experiences across Japan’s rapidly evolving digital education ecosystem.

Major challenges include teacher training and digital literacy gaps, infrastructure disparities between urban and rural areas, high implementation costs and budget constraints, concerns about screen time and health impacts on students, and the need for culturally adapted content and interface design.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)