Japan E-Mobility Market Size, Share, Trends and Forecast by Product, Voltage, Battery, and Region, 2025-2033

Japan E-Mobility Market Overview:

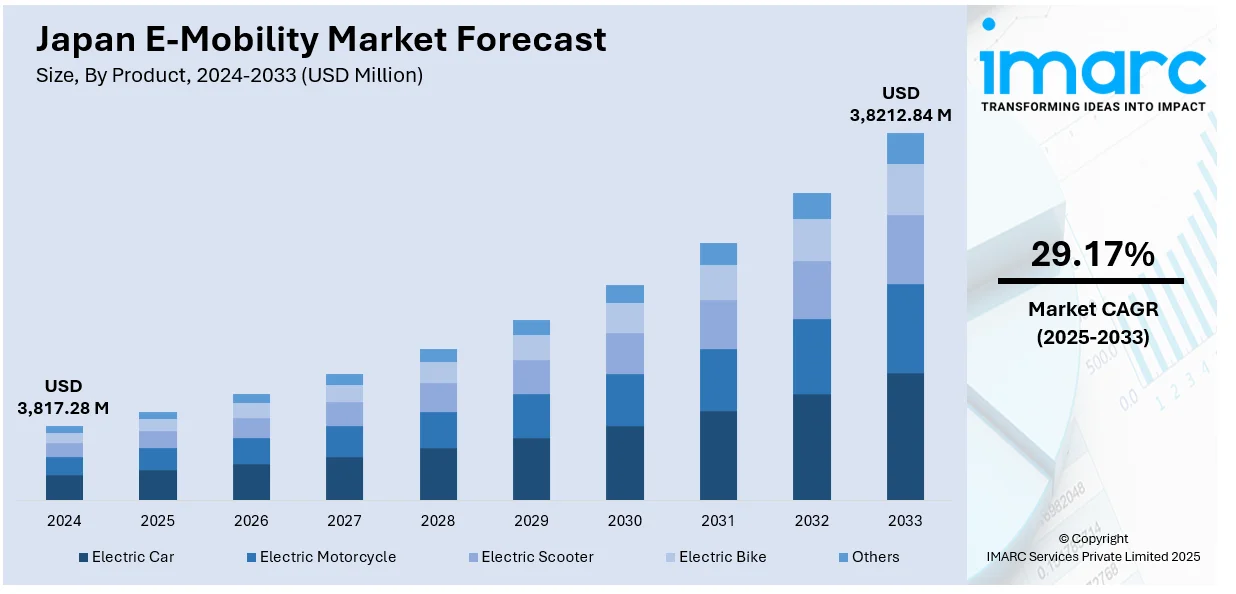

The Japan e-mobility market size reached USD 3,817.28 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,8212.84 Million by 2033, exhibiting a growth rate (CAGR) of 29.17% during 2025-2033. At present, with an increase in electric vehicle (EV) production driven by government initiatives, the need for a dependable and easily accessible charging network is growing swiftly. Besides this, rising public awareness campaigns, which aid in educating people about the benefits and importance of switching to EVs, are contributing to the expansion of the Japan e-mobility market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,817.28 Million |

| Market Forecast in 2033 | USD 3,8212.84 Million |

| Market Growth Rate 2025-2033 | 29.17% |

Japan E-Mobility Market Trends:

Expansion of charging infrastructure

Charging infrastructure expansion is positively influencing the market in Japan. As EV production continues to rise in response to government policies and automaker strategies, the demand for a reliable and accessible charging network is growing rapidly. According to the IMARC Group, the Japan EV market size reached USD 53.8 Billion in 2024. Japan is investing in building fast-charging stations along highways, urban areas, and public spaces to reduce range anxiety and encourage people to shift from conventional vehicles towards EVs. The government is promoting the installation of home and workplace chargers through subsidies and incentives, making daily EV use more convenient. Utility companies and private firms are collaborating to integrate smart e-mobility systems that optimize energy utilization and provide real-time data. These advancements ensure that EV owners experience minimal disruption while traveling, thus enhancing user confidence. The expansion of charging infrastructure is also benefiting electric public transportation and last-mile delivery services, supporting broader urban sustainability goals. The integration of renewable energy into charging stations is promoting environmental benefits, aligning with Japan’s carbon neutrality targets. As charging is becoming more accessible and efficient, user hesitation about EV ownership is decreasing, catalyzing the demand for e-mobility solutions.

Increasing public awareness campaigns

Rising public awareness campaigns are impelling the Japan e-mobility market growth. These campaigns highlight how EVs reduce carbon emissions, lower fuel costs, and support a cleaner environment, making them appealing to environmentally conscious citizens. Through informative events, school programs, and community outreach, the public is becoming more aware about how e-mobility contributes to national sustainability goals. Social media advertising also plays a crucial part by reaching younger audiences and urban populations with engaging content about EV features, government incentives, and charging convenience. Data released in Meta’s planning tools indicated that possible ad penetration of Instagram in Japan grew by 2.00 Million from January 2024 to January 2025. As more people see positive messages about electric mobility through social media platforms, interest and trust in EV technology are rising. Public campaigns often collaborate with automakers, influencers, and environmental organizations to amplify their reach and credibility. These efforts help dispel common concerns, such as range anxiety or cost, by providing clear, relatable information. As public understanding is improving, user readiness to adopt EVs is increasing, supporting overall growth in the e-mobility sector.

Japan E-Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, voltage, and battery.

Product Insights:

- Electric Car

- Electric Motorcycle

- Electric Scooter

- Electric Bike

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric car, electric motorcycle, electric scooter, electric bike, and others.

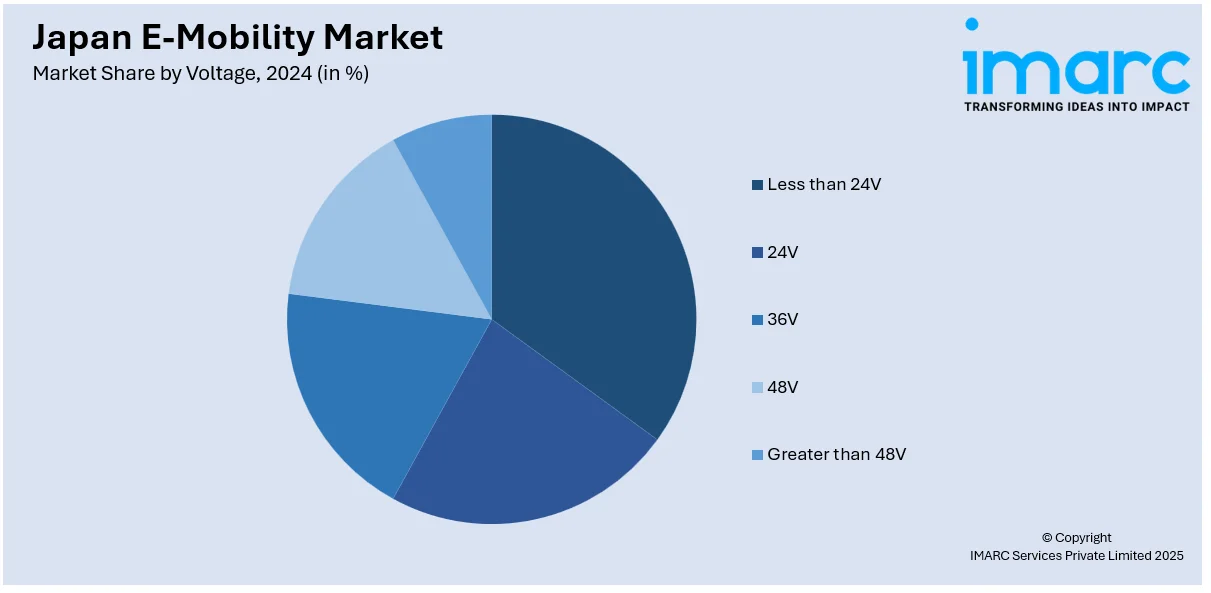

Voltage Insights:

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes less than 24V, 24V, 36V, 48V, and greater than 48V.

Battery Insights:

- Sealed Lead Acid

- Li-ion

- NiMH

The report has provided a detailed breakup and analysis of the market based on the battery. This includes sealed lead acid, Li-ion, and NiMH.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan E-Mobility Market News:

- In December 2024, May Mobility, a company specializing in autonomous driving (AD) technology, unveiled a corporate autonomous vehicle (AV) service that employed Toyota's e-Palette mobility-as-a-service (MaaS) vehicle platform in Fukuoka, Japan, specifically at Toyota Motor Kyushu Co.'s (TMK) Miyata factory. It utilized a tailored model of the e-Palette battery-electric vehicle (BEV), offering a reliable transportation solution for factory workers and visitors.

- In June 2024, e-Mobility Power (eMP), Japan’s leading CPO, revealed its plans to create a next-gen super fast charger with a peak output of 400kW using CHAdeMO technology, in collaboration with the Japanese charger producer Takaoka Toko, known for its sales of approximately 5,000 DC fast chargers in Japan. The two firms aimed to enhance usability by decreasing the connector weight by 30%, cable thickness by 10%, and cable weight by 20%, allowing for one-handed use.

Japan E-Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Car, Electric Motorcycle, Electric Scooter, Electric Bike, Others |

| Voltages Covered | Less than 24V, 24V, 36V, 48V, Greater than 48V |

| Batteries Covered | Sealed Lead Acid, Li-ion, NiMH |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan e-mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan e-mobility market on the basis of product?

- What is the breakup of the Japan e-mobility market on the basis of voltage?

- What is the breakup of the Japan e-mobility market on the basis of battery?

- What is the breakup of the Japan e-mobility market on the basis of region?

- What are the various stages in the value chain of the Japan e-mobility market?

- What are the key driving factors and challenges in the Japan e-mobility market?

- What is the structure of the Japan e-mobility market and who are the key players?

- What is the degree of competition in the Japan e-mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan e-mobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan e-mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan e-mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)