Japan Edtech Hardware Market Size, Share, Trends and Forecast by Sector, End User, and Region, 2026-2034

Japan Edtech Hardware Market Overview:

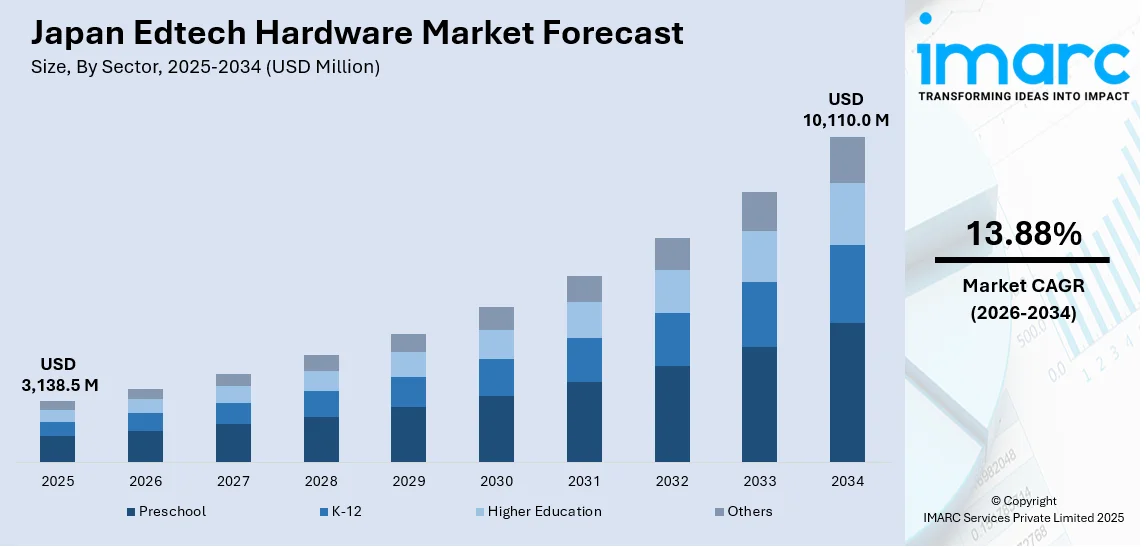

The Japan edtech hardware market size reached USD 3,138.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 10,110.0 Million by 2034, exhibiting a growth rate (CAGR) of 13.88% during 2026-2034. The market is being driven by strong government investments and support for digital education programs, an expanding demand for blended and remote models, and ongoing innovation from hardware vendors. The drive for digital equity among regions and the rising demand for next-generation, flexible devices in educational institutions are further increasing the Japan edtech hardware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,138.5 Million |

| Market Forecast in 2034 | USD 10,110.0 Million |

| Market Growth Rate 2026-2034 | 13.88% |

Japan Edtech Hardware Market Trends:

Government Investment and Policy Support

The Japanese government has been at the forefront of promoting the use of technology in education through a series of strategic initiatives aimed at modernizing the nation’s educational infrastructure. Programs such as the "GIGA School Program," launched to provide every student in Japan with access to a personal computing device, have been pivotal in encouraging the widespread adoption of educational hardware. On May 8, 2024, MediaTek highlighted its role in driving innovation in the Japanese education sector through its involvement in the GIGA School Program. The company has collaborated with Google for Education and top Chromebook makers such as ASUS, Dynabook, HP, and Lenovo to develop powerful, efficient laptop processors that enhance teaching and learning. MediaTek's chipsets, particularly the Kompanio series, offer remarkable power efficiency, enabling long battery life and seamless multitasking, which are crucial for modern classrooms. These government-led efforts focus on creating a digital learning environment by providing schools with the necessary hardware tools such as laptops, tablets, and interactive displays. The government's focus on ensuring equitable access to technology is particularly evident in rural areas, where efforts are being made to bridge the urban-rural divide in terms of digital literacy and access to resources. Additionally, policy reforms and funding allocation are continuously aligning with Japan's educational goals, ensuring that technological investments contribute to enhancing the quality of education. By providing schools with grants and subsidies for tech purchases, the government plays a significant role in making advanced educational hardware accessible to all educational institutions, contributing to steady Japan edtech hardware market growth.

To get more information on this market Request Sample

Shift Toward Blended and Remote Learning Models

Japan's educational institutions have increasingly shifted toward blended and remote learning models, which have been accelerated by the COVID-19 pandemic. This transformation has driven a heightened demand for educational hardware, particularly devices such as laptops, tablets, and smartboards. The necessity for interactive learning environments that facilitate both in-class and virtual interactions has become more pronounced, requiring institutions to invest in high-performance, adaptable devices. Higher education institutions, in particular, have integrated more online learning platforms, requiring hardware that is not only reliable but also capable of handling large-scale virtual classrooms. At the K-12 level, Japanese schools are prioritizing devices that enable seamless connectivity to e-learning platforms, where students can access educational content and participate in online activities. On March 26, 2025, the Japanese Ministry of Education announced that starting in fiscal 2026, nearly all high school textbooks will feature QR codes linking to digital resources such as video and audio learning aids. This initiative, aligned with Japan's GIGA School Program, aims to enhance digital learning by providing students with access to interactive educational materials. The program is part of a broader effort to address the growing digital divide in education, current statistics show that 28.4% of sixth graders in Japan use digital devices daily for learning. The growth in digital content delivery, online assessments, and virtual collaboration tools is pushing educational institutions to invest in hardware that supports these technologies. This ongoing trend has ensured that educational hardware is a core element of Japan’s modern learning ecosystem, with institutions increasingly relying on advanced technological tools to maintain continuity in education, further strengthening the demand in the market.

Japan Edtech Hardware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on sector and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

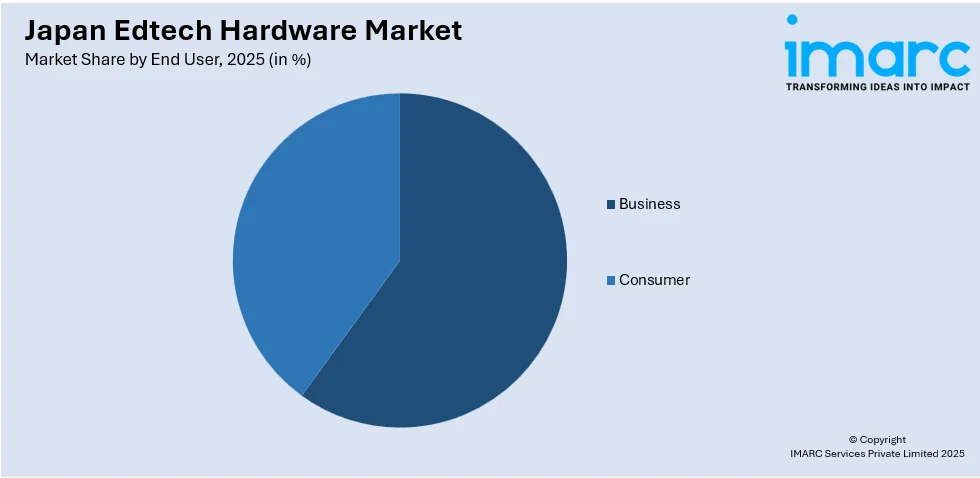

End User Insights:

Access the comprehensive market breakdown Request Sample

- Business

- Consumer

The report has provided a detailed breakup and analysis of the market based on the end user. This includes business and consumer.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Edtech Hardware Market News:

- On March 12, 2025, Sony and New York University (NYU) announced the launch of the Sony Audio Institute, a collaboration designed to foster innovation at the intersection of technology, music, and business. Located within NYU’s Steinhardt School, the institute will utilize cutting-edge Sony audio technologies, including 360 Reality Audio and the 360 Virtual Mixing Environment, to provide students with immersive learning experiences.

Japan Edtech Hardware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| End Users Covered | Business, Consumer |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan edtech hardware market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan edtech hardware market on the basis of sector?

- What is the breakup of the Japan edtech hardware market on the basis of end user?

- What is the breakup of the Japan edtech hardware market on the basis of region?

- What are the various stages in the value chain of the Japan edtech hardware market?

- What are the key driving factors and challenges in the Japan edtech hardware market?

- What is the structure of the Japan edtech hardware market and who are the key players?

- What is the degree of competition in the Japan edtech hardware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan edtech hardware market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan edtech hardware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan edtech hardware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)