Japan Electric Commercial Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Application, Battery Type, Battery Capacity, and Region, 2026-2034

Japan Electric Commercial Vehicle Market Overview:

The Japan electric commercial vehicle market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 29.6 Billion by 2034, exhibiting a growth rate (CAGR) of 33.26% during 2026-2034. The growing advancements in battery technology to improve the driving range, partnerships and collaborations among key player to create new car models and exchange technology, and the introduction of affordable and practical electric models are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 29.6 Billion |

| Market Growth Rate (2026-2034) | 33.26% |

Access the full market insights report Request Sample

Japan Electric Commercial Vehicle Market Trends:

Strategic Partnerships and Collaborations

After strategic partnerships and collaborations among automotive corporations, technology companies, and logistics firms, the surge in growth of the market in Japan is analyzed. Companies are going in for new designs of cars, sharing technologies, and developing charging infrastructures. The possibility of pooling the resources and expertise collaborates in speeding up the process of innovation while considerably lowering the associated costs in developing and bringing electric commercial vehicles to the market. Additionally, automotive manufacturers are partnering with battery technology firms to enhance battery performance and lifespan, while logistics companies are collaborating with tech firms to integrate advanced software for fleet management and route optimization. These collaborations not only assist in overcoming barriers in technology and finance but also establish a more unified environment that encourages the use of electric vehicles (EVs) in different industries. In 2024, HD Renewable Energy (HDRE) collaborated with Shihlin Electric to grow its EV charging business in Taiwan and Japan. The companies plan to establish joint ventures focusing on production and sales, targeting the growing EV market and charging infrastructure needs in both countries. This partnership involves coordinating hardware and software to enhance charging solutions and meet particular market needs.

Introduction of Affordable and Practical Electric Models

Many manufacturers are introducing EV models that cater specifically to the needs of small businesses and urban delivery services. These vehicles are created to fulfill the unique needs of the commercial sector, providing characteristics like reasonable driving distance, improved safety, and convenience, all at a price point that makes them accessible to a broader range of businesses. The convenience of these vehicles for short trips makes them more appealing. Manufacturers are continuously refining and expanding their offerings, focusing on cost-effective solutions for commercial operators. The availability of such tailored options encourages businesses to transition from traditional vehicles to electric alternatives. For instance, Mitsubishi Motors revealed the introduction of the new Minicab EV, an electric commercial vehicle in the kei-car class, which was released in Japan on December 21, 2023. The Minicab EV provided a range of 180 km on a single charge, upgraded safety options, and added convenience for business clients.

Advancements in Battery Technology

Enhanced battery capacity and energy density influences the driving range of EVs, alleviating range anxiety and making them more practical for long-distance logistics and delivery operations. Quicker charging rates also improve convenience by reducing waiting time and enabling faster turnaround times, which is essential for businesses that have busy schedules. Additionally, advancements in battery recycling and reuse are lowering the overall life cycle expenses of batteries, making EVs more cost-effective over time compared to their gasoline and diesel counterparts. These advancements not only make electric commercial vehicles more practical for daily use but also reduce their total cost of ownership. In 2024, Mitsubishi Fuso started testing battery-swapping technology for its electric eCanter trucks with a public road demonstration in Kyoto, Japan. The trial, carried out in collaboration with Yamato Transport, utilizes Ample's automated battery swap stations, enabling quick battery exchanges in only five minutes. This project seeks to assess whether battery-swapping technology is both viable and scalable for use in commercial EVs.

Japan Electric Commercial Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on vehicle type, propulsion type, application, battery type, and battery capacity.

Vehicle Type Insights:

.webp)

To get detailed segment analysis of this market Request Sample

- Electric Bus

- Electric Pickup Truck

- Electric Truck

- Electric Van

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric bus, electric pickup truck, electric truck, and electric van.

Propulsion Type Insights:

- Cargo

- Passenger

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes cargo and passenger.

Application Insights:

- BEV

- HEV

- FCEV

- PHEV

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes BEV, HEV, FCEV, and PHEV.

Battery Type Insights:

- Lithium-Nickel -Manganese -Cobalt Oxide Batteries

- Lithium-Iron-Phosphate Batteries

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-nickel -manganese -cobalt oxide batteries, lithium-iron-phosphate batteries, and others.

Battery Capacity Insights:

- Less than 50kWh

- 50-250 kWh

- Above 250 kWh

A detailed breakup and analysis of the market based on the battery capacity have also been provided in the report. This includes less than 50kWh, 50-250 kWh, and above 250 kWh.

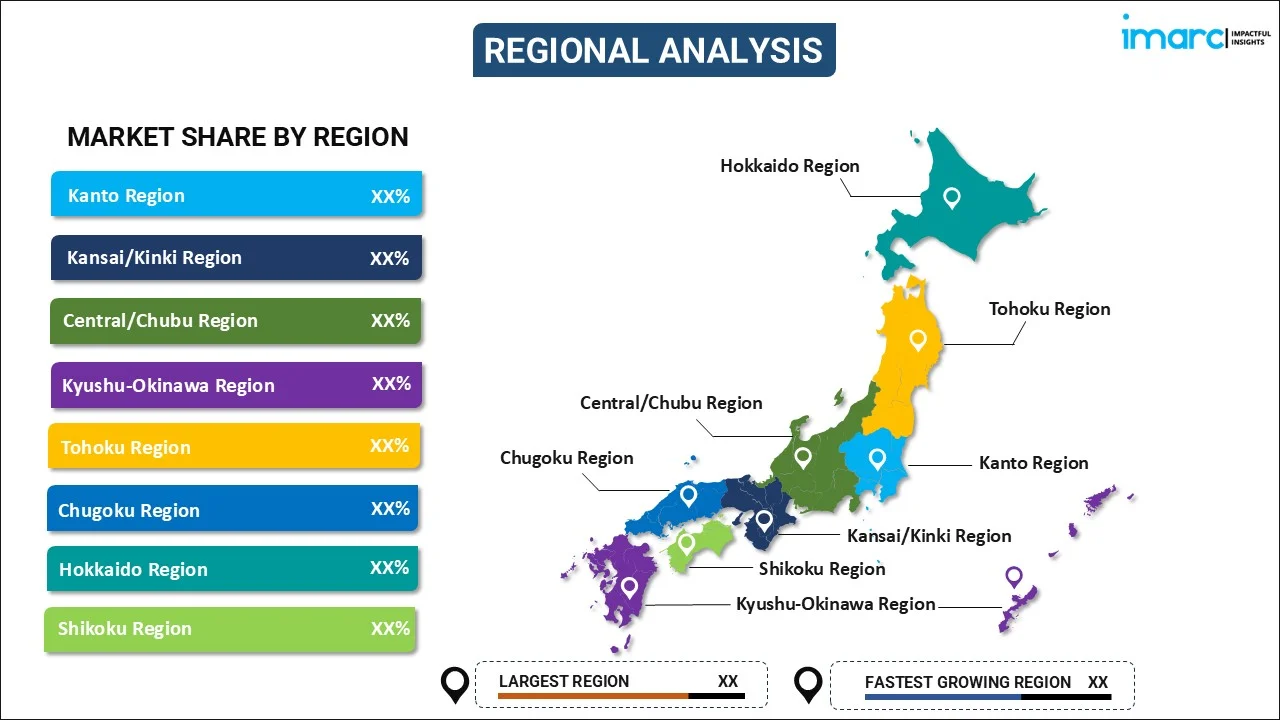

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Electric Commercial Vehicle Market News:

- June 2024: Honda revealed the release date for its latest electric commercial mini-vehicle, the N-VAN e: that will be available for purchase in Japan starting October 10, 2024. The N-VAN e: offers a range of 245 km per charge, advanced safety features, and several variations.

- July 2024: Hyundai introduced the Elec City Town, a medium-sized electric bus, in Japan. The bus is equipped with a 145 kWh battery that provides a range of up to 330 km, as well as advanced safety features and contemporary amenities.

Japan Electric Commercial Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Bus, Electric Pickup Truck, Electric Truck, Electric Van |

| Propulsion Types Covered | Cargo, Passenger |

| Applications Covered | BEV, HEV, FCEV, PHEV |

| Battery Types Covered | Lithium-Nickel -Manganese -Cobalt Oxide Batteries, Lithium-Iron-Phosphate Batteries, Others |

| Battery Capacities Covered | Less than 50kWh, 50-250 kWh, Above 250 kWh |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan electric commercial vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan electric commercial vehicle market on the basis of vehicle type?

- What is the breakup of the Japan electric commercial vehicle market on the basis of propulsion type?

- What is the breakup of the Japan electric commercial vehicle market on the basis of application?

- What is the breakup of the Japan electric commercial vehicle market on the basis of battery type?

- What is the breakup of the Japan electric commercial vehicle market on the basis of battery capacity?

- What is the breakup of the Japan electric commercial vehicle market on the basis of Japan?

- What are the various stages in the value chain of the Japan electric commercial vehicle market?

- What are the key driving factors and challenges in the Japan electric commercial vehicle?

- What is the structure of the Japan electric commercial vehicle market and who are the key players?

- What is the degree of competition in the Japan electric commercial vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric commercial vehicle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan electric commercial vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric commercial vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)