Japan Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2026-2034

Japan Electric Two-Wheeler Market Overview:

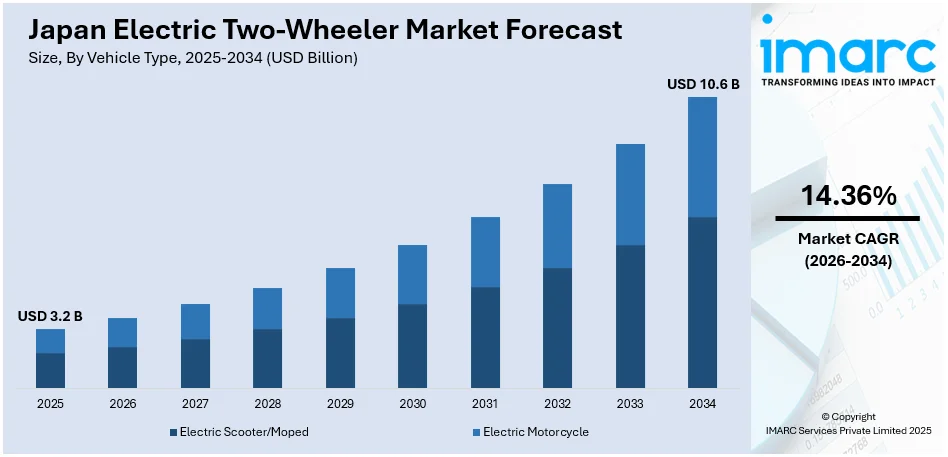

The Japan electric two-wheeler market size reached USD 3.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.6 Billion by 2034, exhibiting a growth rate (CAGR) of 14.36% during 2026-2034. The market is growing steadily, fueled by innovations in battery technology, smart connectivity, and sustainable infrastructure, cementing its position in urban mobility and helping the nation move toward low-emission and energy-efficient means of transportation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2034 | USD 10.6 Billion |

| Market Growth Rate 2026-2034 | 14.36% |

Japan Electric Two-Wheeler Market Trends:

Technological Advancements in Battery Efficiency

The Japan electric two-wheeler market is witnessing notable advancements in battery technology, with a strong focus on enhancing energy density, charging speed, and overall longevity. Continuous research and development (R&D) efforts are driving the transition towards high-performance lithium-ion and solid-state batteries, reducing charging times while extending the range of electric two-wheelers. For instance, In March 2025, Yamaha Motor Co. launched the TY-E 3.0, a cutting-edge electric trial bike with improved technology, upgraded performance, and lessons from past variations, solidifying its commitment to creating high-performance electric motorcycles for racing and business purposes. Moreover, improved thermal management systems and battery swapping solutions are also being integrated, ensuring enhanced safety and convenience for users. These advancements are playing a crucial role in shaping the market by addressing efficiency concerns and contributing to the broader adoption of electric mobility. As Japan prioritizes sustainability and energy conservation, the growing efficiency of battery technology is expected to facilitate the widespread deployment of electric two-wheelers, reinforcing their position as a viable alternative to traditional fuel-powered models. The emphasis on longer-lasting and high-capacity energy storage solutions is expected to be a key factor influencing the long-term Japan electric two-wheeler growth trajectory.

To get more information on this market Request Sample

Integration of Smart and Connected Features

The development of intelligent and connected technologies is revolutionizing the Japan electric two-wheeler market outlook, offering users better functionality, safety, and convenience. For example, in June 2023, Harley-Davidson declared the release of its electric motorcycles LiveWire in Japan in 2024, with cutting-edge technology, bigger designs, and strong performance to vie in the high-end electric two-wheeler market. Moreover, the use of Internet of Things (IoT) based monitoring systems, real-time diagnostic capabilities, and GPS tracking enables is improving user experience while maintaining optimized vehicle performance. Advanced digital dashboards and smartphone connectivity enable riders to view key vehicle information, monitor energy consumption, and get predictive maintenance notifications. In addition, the deployment of artificial intelligence (AI) based analytics is facilitating enhanced navigation, traffic management, and customized riding experiences. These smart features not only are optimizing the efficiency of electric two-wheelers but also complementing Japan's increasing emphasis on smart mobility solutions. With digitalization now intensely reshaping the transportation space, connected technology integration will support the enhanced pickup of electric two-wheelers and position them firmly as an indispensable part of India's shifting urban mobility framework.

Expansion of Sustainable Mobility Infrastructure

The expansion of sustainable mobility networks plays a significant role in the electrification of two-wheelers in Japan, providing a conducive ecosystem for their long-term viability. The installation of large-scale charging infrastructure, battery-swapping platforms, and integration of renewable energy is facilitating ease of use of electric two-wheelers in urban and peri-urban regions. Government initiatives to favor carbon neutrality and less use of fossil fuels are further driving the use of green modes of transportation. The synergy between ecofriendly urban planning and electric mobility solutions will most likely further strengthen Japan's commitment to a low-emission transport system. With policy backing and the development of charging technology, the electric two-wheeler market share is poised for long-term growth, offering a cleaner and more efficient alternative to conventional motorized transport.

Japan Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

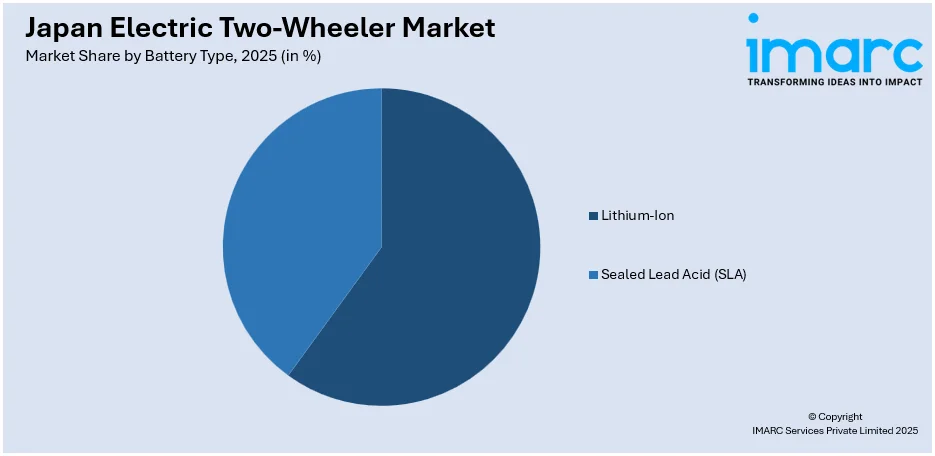

Battery Type Insights:

Access the comprehensive market breakdown Request Sample

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

The report has provided a detailed breakup and analysis of the market based on the voltage type. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

The report has provided a detailed breakup and analysis of the market based on the battery technology. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Electric Two-Wheeler Market News:

- In September of 2024, Lime debuted its electric scooter-sharing service in Japan, opening more than 200 micro-mobility units in six Tokyo wards. The service features Lime's own branded electric seatboards, which were created for stability and comfort, and helmet bonuses. Lime also expects to further expand with additional ports and coverage areas in subsequent months.

- In October 2023, Suzuki unveiled the e-BURGMAN electric scooter prototype at the Japan Mobility Show 2023 as part of its carbon-neutral vision. The 125cc equivalent scooter, integrated with Gachaco's battery-swapping technology, is undergoing real-world testing to refine Suzuki’s future electric motorcycle offerings based on commuter usage data.

Japan Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Japan electric two-wheeler market on the basis of battery type?

- What is the breakup of the Japan electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Japan electric two-wheeler market on the basis of peak power?

- What is the breakup of the Japan electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Japan electric two-wheeler market on the basis of motor place,ent?

- What is the breakup of the Japan electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Japan electric two-wheeler market?

- What are the key driving factors and challenges in the Japan electric two-wheeler?

- What is the structure of the Japan electric two-wheeler market and who are the key players?

- What is the degree of competition in the Japan electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric two-wheeler market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)