Japan Excavators Market Size, Share, Trends and Forecast by Product, Mechanism Type, Power Range, Application, and Region, 2026-2034

Japan Excavators Market Overview:

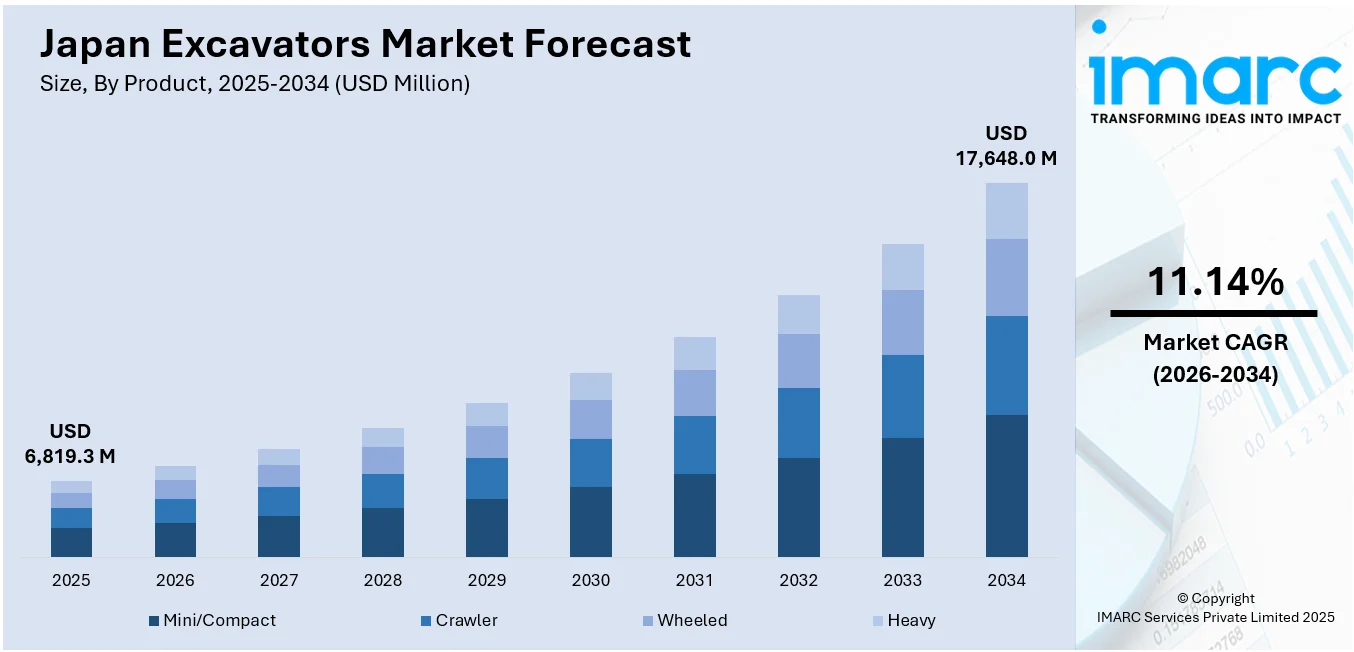

The Japan excavators market size reached USD 6,819.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 17,648.0 Million by 2034, exhibiting a growth rate (CAGR) of 11.14% during 2026-2034. The market is driven by continuous infrastructure development and urban expansion, creating steady demand for excavation machinery. Additionally, advancements in technology, such as electric-powered excavators and telematics systems, are enhancing operational efficiency and reducing environmental impact. Government regulations on emissions and the push for more sustainable machinery further augment the Japan excavators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,819.3 Million |

| Market Forecast in 2034 | USD 17,648.0 Million |

| Market Growth Rate 2026-2034 | 11.14% |

Japan Excavators Market Trends:

Rising Infrastructure and Urbanization in Japan

The market is largely driven by the country's continuous infrastructure development and urbanization activities. Japan's dedication to upgrading its infrastructure, such as transportation systems, energy initiatives, and urban regeneration, has resulted in a consistent demand for excavation machinery. The establishment of new airports, highways, bridges, railways, and other infrastructures calls for the employment of heavy equipment such as excavators to perform activities like land clearing, trenching, and material handling. Moreover, Japan's aging infrastructure requires major renovation and reconstruction, also propelling the demand for excavator machines to perform extensive earthworks. Urbanization patterns, including metropolitan area expansion and smart city development, also drive the increasing demand for excavators. Such projects generally require accurate excavation and grading, processes performed effectively and efficiently by excavators. On April 18, 2024, Volvo Construction Equipment (Volvo CE) announced the launch of the EC230 Electric excavator in Japan, marking its largest electric machine for the country. The EC230 Electric, with an operating weight between 23,000 and 26,100 kg, a bucket capacity of 0.48-1.44 m³, and a lifting capacity of 7,560 kg, will be showcased at the CSPI-Expo in May 2024. The machine offers a battery capacity of 264 kWh and a runtime of up to 5 hours, providing reduced noise and vibration, making it ideal for sustainability-focused construction sites. Available for rental through Yamazaki Machinery starting in May, the EC230 Electric will help meet growing demand for zero-emission equipment in Japan. The need for robust and reliable equipment is amplified by Japan's challenging terrain, which includes mountainous regions and seismic activity that require specialized machinery. As these development efforts continue to expand, the demand for excavators in the country is expected to remain strong, ensuring steady Japan excavators market growth.

To get more information on this market Request Sample

Government Regulations and Environmental Concerns

Government regulations and environmental considerations have a significant impact on the market. Japan has implemented strict emissions standards to combat climate change and reduce environmental pollution. The Japanese government’s commitment to sustainable development and its efforts to reduce the carbon footprint of construction activities align with these trends. On May 8, 2025, Hitachi Construction Machinery, Nihon Techno, Koatsu Gas Kogyo, and Dowa Thermotech announced Japan's first demonstration of "Atmospheric Pressure Smart Carburizing Technology," aimed at eliminating direct CO2 emissions during the gear manufacturing process for hydraulic excavators. This technology, applied to gears for 20-ton class excavators, improves wear resistance and fatigue strength while reducing CO2 emissions by 56 tons per furnace annually. Additionally, the government's focus on infrastructure resilience in the wake of natural disasters, such as earthquakes and typhoons, has led to investments in more durable and reliable excavation equipment. Excavators are crucial for post-disaster recovery efforts, including debris removal and site preparation. These regulatory and environmental pressures are steering the market towards more advanced, cleaner, and safer technologies, ensuring that excavators meet both operational and environmental standards. With further regulations likely to be introduced in the future, demand for compliant and efficient excavation equipment will continue to shape the market.

Japan Excavators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, mechanism type, power range, and application.

Product Insights:

- Mini/Compact

- Crawler

- Wheeled

- Heavy

The report has provided a detailed breakup and analysis of the market based on the product. This includes mini/compact, crawler, wheeled, and heavy.

Mechanism Type Insights:

- Electric

- Hydraulic

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the mechanism type. This includes electric, hydraulic, and hybrid.

Power Range Insights:

- Up to 300 HP

- 301-500 HP

- 501 HP and Above

The report has provided a detailed breakup and analysis of the market based on the power range. This includes up to 300 HP, 301-500 HP, and 501 HP and above.

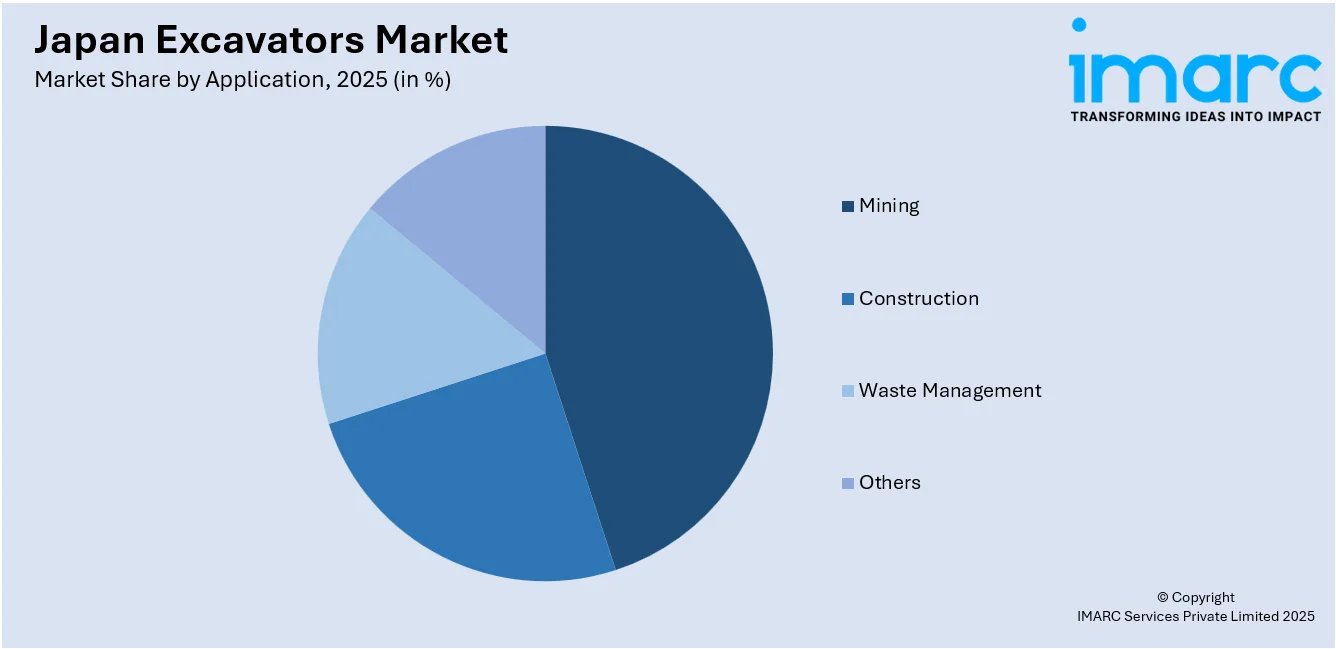

Application Insights:

Access the comprehensive market breakdown Request Sample

- Mining

- Construction

- Waste Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes mining, construction, waste management, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Excavators Market News:

- On April 4, 2025, Kubota announced an OEM agreement with Sumitomo Construction Machinery to procure 14-ton hydraulic excavators for the European market, expanding its product lineup beyond mini excavators. These short tail swing models, ideal for compact construction sites, will be exhibited at bauma 2025 and are set for release in spring 2026. The collaboration aims to meet growing demand for larger machinery in civil engineering, road construction, and urban infrastructure projects.

Japan Excavators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mini/Compact, Crawler, Wheeled, Heavy |

| Mechanism Types Covered | Electric, Hydraulic, Hybrid |

| Power Ranges Covered | Up to 300 HP, 301-500 HP, 501 HP and Above |

| Applications Covered | Mining, Construction, Waste Management, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan excavators market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan excavators market on the basis of product?

- What is the breakup of the Japan excavators market on the basis of mechanism type?

- What is the breakup of the Japan excavators market on the basis of power range?

- What is the breakup of the Japan excavators market on the basis of application?

- What is the breakup of the Japan excavators market on the basis of region?

- What are the various stages in the value chain of the Japan excavators market?

- What are the key driving factors and challenges in the Japan excavators market?

- What is the structure of the Japan excavators market and who are the key players?

- What is the degree of competition in the Japan excavators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan excavators market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan excavators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan excavators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)