Japan Factory Automation Market Size, Share, Trends and Forecast by Component, System Type, Industry Vertical, and Region, 2026-2034

Japan Factory Automation Market Overview:

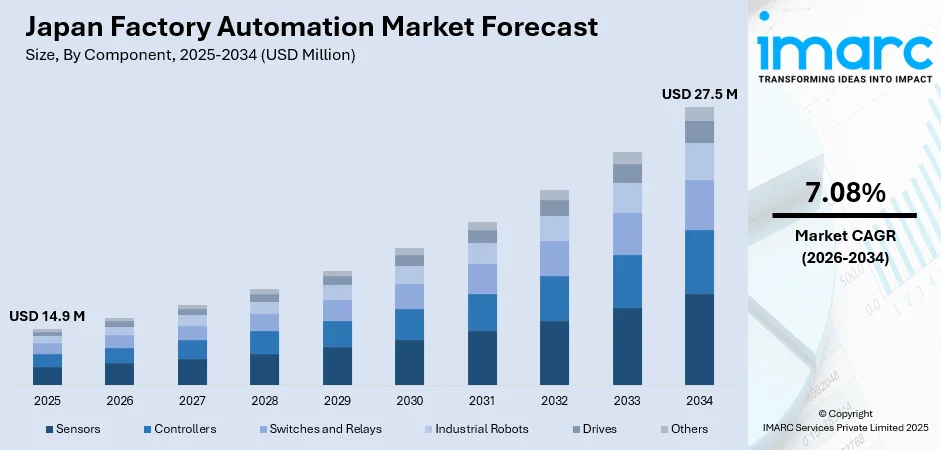

The Japan factory automation market size reached USD 14.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 27.5 Million by 2034, exhibiting a growth rate (CAGR) of 7.08% during 2026-2034. The market is driven by technological innovations as well as the rising adoption of Industry 4.0 principles, enabling Japanese manufacturers to optimize their production processes. Additionally, rising labor costs and an aging workforce are pushing the need for automation solutions to ensure continued productivity and efficiency. Government support for innovations and automation technologies is further accelerating the Japan factory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.9 Million |

| Market Forecast in 2034 | USD 27.5 Million |

| Market Growth Rate 2026-2034 | 7.08% |

Japan Factory Automation Market Trends:

Advancements in Technology and Industry 4.0 Adoption

Advances in technology are a primary stimulus for the expansion of the market. With one of the world's leading positions in technology, Japan has been the early adopter of Industry 4.0 practices, integrating automation, robotics, the Internet of Things (IoT), as well as artificial intelligence (AI) into production processes. The drive for digitalization has prompted Japanese businesses to implement sophisticated automation solutions to enhance production lines, lower the cost of operations, and enhance product quality. Manufacturing industries in Japan, like automotive, electronics, and precision machinery, are largely based on automation systems to stay competitive. The emergence of smart factories, in which machines talk to one another and production processes are constantly monitored and optimized, has allowed manufacturers to enhance operational efficiency and agility. On July 18, 2023, ABB secured its ninth automation contract with TOYO Engineering to supply DCS solutions for the Wakayama Gobo Biomass Power Plant in Japan, set to generate 50 MW of renewable energy. This plant, utilizing wood pellets and agricultural byproducts, will power 110,000 households annually, and ABB’s Symphony® Plus system will provide real-time operational visibility for optimized production. As robotics technology continues to evolve, the requirement for collaborative robots (cobots) that can work alongside human operators, is also increasing. These advancements in technology and the continued evolution of automation systems are expected to foster the Japan factory automation market growth.

To get more information on this market Request Sample

Rising Labor Costs and Aging Workforce

Rising labor costs and the aging workforce in Japan are significant factors driving the adoption of factory automation solutions. Japan is facing a demographic shift, with a rapidly aging population and a shrinking workforce. This has led to labor shortages, particularly in sectors that rely on manual labor for production processes. To combat these challenges, Japanese manufacturers are increasingly turning to automation to fill the gaps left by a diminishing labor pool. Automation technologies, such as robotics, AI-powered systems, and automated assembly lines, offer an effective solution by improving operational efficiency without being reliant on human labor. Furthermore, automation systems can handle repetitive and hazardous tasks that are physically demanding, allowing human workers to focus on higher-value, strategic roles. This shift not only helps mitigate labor shortages but also reduces the long-term costs associated with hiring, training, and retaining workers. The increased use of warehouse automation and mobile robots is helping to alleviate logistical challenges by automating tasks like loading and unloading cargo, boosting productivity by up to 25% during a shift. As labor costs continue to rise and the workforce continues to age, the adoption of factory automation in Japan is likely to accelerate, contributing significantly to the market's expansion.

Japan Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, system type, and industry vertical.

Component Insights:

- Sensors

- Controllers

- Switches and Relays

- Industrial Robots

- Drives

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, controllers, switches and relays, industrial robots, drives, and others.

System Type Insights:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition System (SCADA)

- Manufacturing Execution System (MES)

- Systems Instrumented System (SIS)

- Programmable Logic Controller (PLC)

- Human Machine Interface (HMI)

The report has provided a detailed breakup and analysis of the market based on the system type. This includes distributed control system (DCS), supervisory control and data acquisition system (SCADA), manufacturing execution system (MES), systems instrumented system (SIS), programmable logic controller (PLC), and human machine interface (HMI).

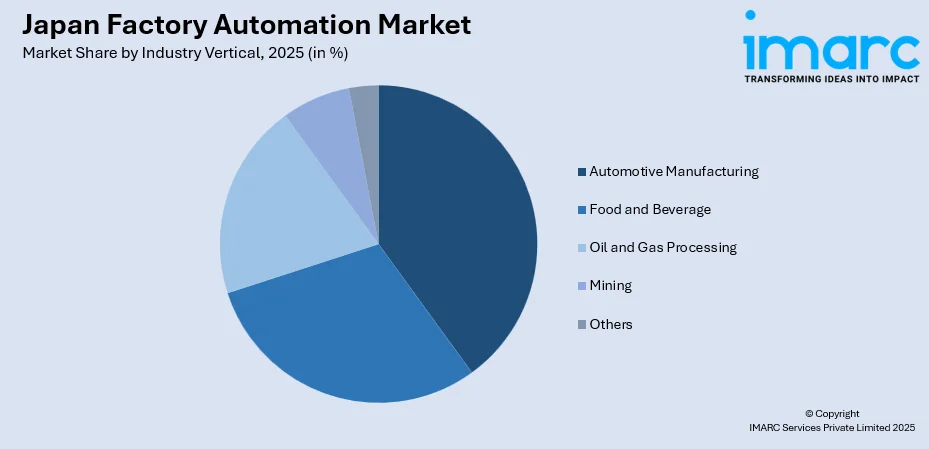

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Automotive Manufacturing

- Food and Beverage

- Oil and Gas Processing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes automotive manufacturing, food and beverage, oil and gas processing, mining, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Factory Automation Market News:

- On September 9, 2024, DENSO announced the construction of a next-generation factory automation plant at its Zenmyo site in Nishio City, Japan. The plant, set for completion by January 2027, will focus on producing large-scale integrated ECUs for electrification and ADAS systems, featuring 24-hour unmanned operation with automated production lines and digital twin technology for improved efficiency and sustainability.

Japan Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Sensors, Controllers, Switches and Relays, Industrial Robots, Drives, Others |

|

Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented System (SIS), Programmable Logic Controller (PLC), Human Machine Interface (HMI) |

| Industry Verticals Covered | Automotive Manufacturing, Food and Beverage, Oil and Gas Processing, Mining, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan factory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan factory automation market on the basis of component?

- What is the breakup of the Japan factory automation market on the basis of system type?

- What is the breakup of the Japan factory automation market on the basis of industry vertical?

- What is the breakup of the Japan factory automation market on the basis of region?

- What are the various stages in the value chain of the Japan factory automation market?

- What are the key driving factors and challenges in the Japan factory automation market?

- What is the structure of the Japan factory automation market and who are the key players?

- What is the degree of competition in the Japan factory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan factory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)