Japan Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2026-2034

Japan Family Offices Market Overview:

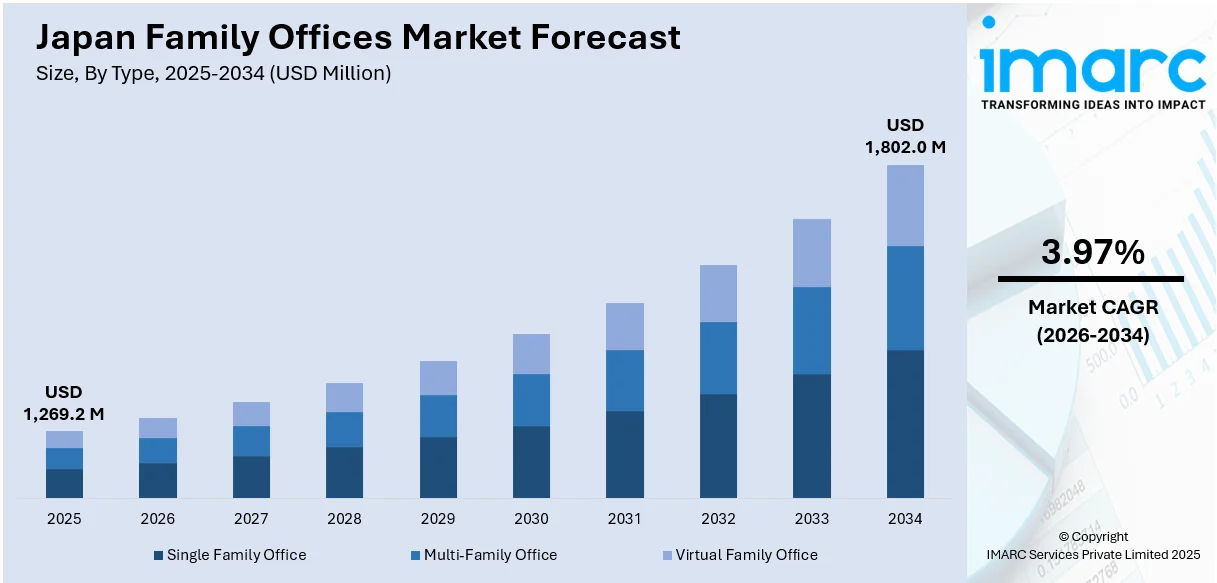

The Japan family offices market size reached USD 1,269.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,802.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.97% during 2026-2034. Rising high-net-worth individuals, increasing generational wealth transfer, growing demand for succession planning, expanding investment opportunities, evolving regulatory landscape, technological advancements in wealth management, rising interest in alternative investments, and increasing focus on philanthropy are expanding the Japan family office market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,269.2 Million |

| Market Forecast in 2034 | USD 1,802.0 Million |

| Market Growth Rate 2026-2034 | 3.97% |

Japan Family Offices Market Trends:

Rise of Multi-Generational Wealth Preservation through Family Offices

Japan’s aging population and the increase in generational wealth transfer are significantly contributing to the rise of family offices focused on long-term asset preservation. As ultra-high-net-worth (UHNW) families prepare to hand over financial legacies, the demand for structured succession planning and intergenerational governance has increased. Multi-generational offices are gaining traction as they enable families to create continuity in investment strategies, philanthropy, and family values. These offices are not only offering wealth management but are also incorporating educational programs to prepare heirs for stewardship responsibilities. Additionally, legal complexities and rising inheritance taxes are prompting wealthy families to establish formalized governance structures. For instance, as per a recent industry report, rising costs, stagnant incomes, and strict tax laws are putting a growing amount of strain on Japanese households. Japan's basic inheritance tax deduction was ¥50 Million (about USD 336,000) + ¥10 Million (around USD 67,000) for each heir until 2015. The inheritance tax burden for households increased dramatically in 2015 when these deductions were cut to ¥30 Million (about USD 202,000) + ¥6 Million (about USD 40,400) per heir. With cultural emphasis on legacy and familial duty, Japan’s family offices are increasingly integrating strategic planning with emotional intelligence, making them vital for sustainable wealth continuity, fostering Japan family offices market growth. This trend is set to grow as more founder-led businesses transition leadership and seek customized wealth management solutions.

To get more information on this market Request Sample

Diversification of Investment Portfolios Boosting Alternative Asset Allocations

Family offices in Japan are increasingly diversifying their portfolios to include alternative investments such as private equity, venture capital, hedge funds, and real estate. This shift is driven by prolonged low interest rates, equity market volatility, and a desire for higher yield returns. Traditionally risk-averse, Japanese family offices are now seeking access to global innovation and emerging startups through direct investments and co-investment opportunities. There’s also a growing interest in ESG-compliant and impact investments, reflecting the younger generation’s preference for values-driven finance. These alternative investments are being managed by specialized investment offices within family structures, which focus on risk assessment and long-term value creation, which in turn is positively influencing Japan family offices market outlook. The proliferation of fintech platforms and global asset management services has further facilitated this shift. For instance, the Canadian fintech company Nuvei Corporation stated on January 27, 2025, that it was expanding into Japan by purchasing Paywiser Japan Limited. Nuvei is able to provide direct acquisition capabilities across major card schemes and alternative payment ways in Japan as a result of this calculated action. As a result, the Japan family office landscape is evolving from a conservative model to one characterized by strategic diversification and an increasingly international investment outlook.

Japan Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

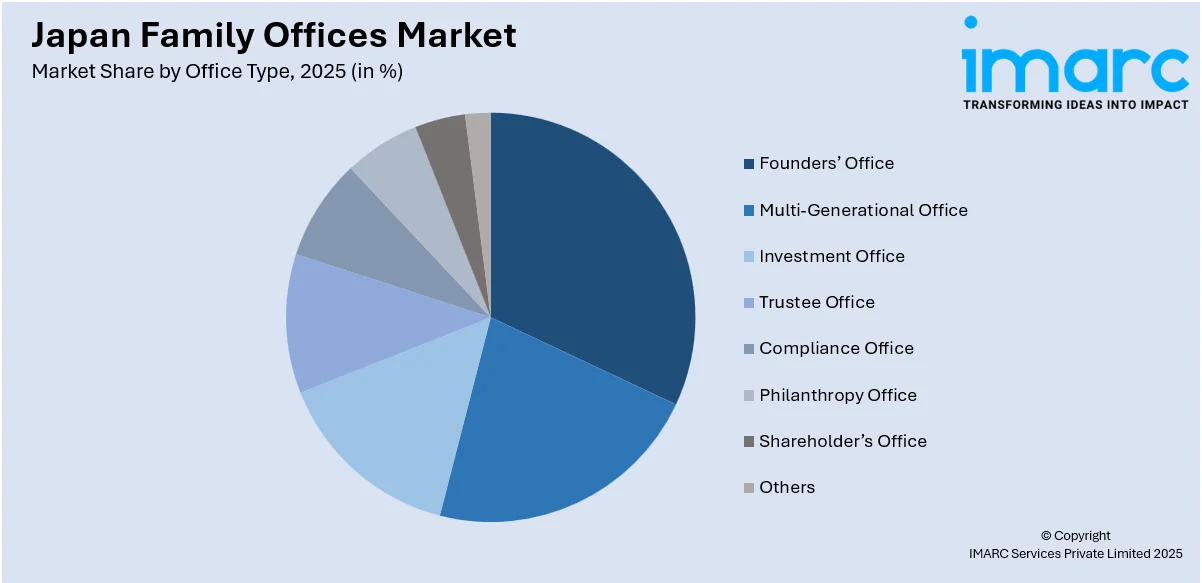

Office Type Insights:

Access the comprehensive market breakdown Request Sample

- Founders’ Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

The report has provided a detailed breakup and analysis of the market based on the office type. This includes founders’ office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash or Cash Equivalents

A detailed breakup and analysis of the market based on the asset class have also been provided in the report. This includes bonds, equities, alternative investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Family Offices Market News:

- On March 6, 2024, a joint venture, Money Forward PrivateBANK, Inc., was established by Money Forward, Inc. and PrivateBANK Co., Ltd. to offer family office services to ultra-high-net-worth people with assets surpassing ¥1 Billion (approximately USD 6.7 Million). The company wants to provide individualized asset management consulting services including both non-financial issues like business succession and education as well as financial ones like inheritance and gifts.

Japan Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founders’ Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equities, Alternative Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan family offices market on the basis of office type?

- What is the breakup of the Japan family offices market on the basis of asset class?

- What is the breakup of the Japan family offices market on the basis of service type?

- What is the breakup of the Japan family offices market on the basis of region?

- What are the various stages in the value chain of the Japan family offices market?

- What are the key driving factors and challenges in the Japan family offices market?

- What is the structure of the Japan family offices market and who are the key players?

- What is the degree of competition in the Japan family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan family offices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)