Japan Fleet Leasing Market Size, Share, Trends and Forecast by Lease Type, Vehicle Type, Lease Duration, End Use Industry, and Region, 2026-2034

Japan Fleet Leasing Market Overview:

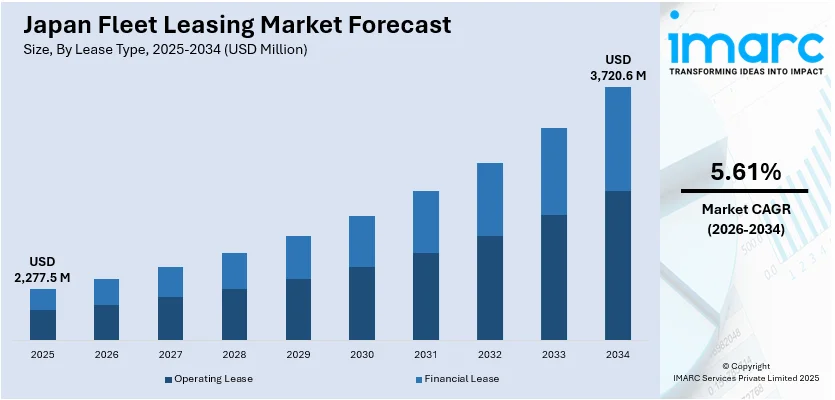

The Japan fleet leasing market size reached USD 2,277.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,720.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.61% during 2026-2034. Rising demand for cost-effective mobility solutions, increasing corporate adoption of fleet services, stringent environmental regulations promoting EV fleets, technological advancements in telematics, and a focus on operational efficiency, risk management, and predictable vehicle lifecycle costs are some of the factors contributing to Japan fleet leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,277.5 Million |

|

Market Forecast in 2034

|

USD 3,720.6 Million |

| Market Growth Rate 2026-2034 | 5.61% |

Japan Fleet Leasing Market Trends:

Expansion of Electrified Fleet Leasing through Strategic Investments

The Japan fleet leasing market is witnessing a growing emphasis on electrified vehicles and sustainable mobility solutions. Key industry players are strategically investing in and partnering with fleet management companies to enhance their leasing portfolios and expand business opportunities. This approach addresses increasing regulatory demands for lower emissions and rising corporate interest in eco-friendly fleets. By incorporating electric and hybrid vehicles into their offerings, companies provide cost-efficient and environmentally responsible options tailored to evolving customer needs. These investments also enable broader sales channels and access to innovative fleet technologies, supporting operational efficiency and risk management. Overall, this focus on electrification and strategic collaboration is driving innovation and strengthening the competitive landscape of the Japanese fleet leasing market, positioning it for long-term sustainable growth. These factors are intensifying the Japan fleet leasing market growth. For example, in June 2024, Mitsubishi Motors acquired a 5.01% stake in FleetPartners Group, a fleet management company, signaling strategic interest in expanding fleet leasing operations. The move reflects Mitsubishi’s broader focus on fleet services and electrified vehicles. It supports its global push, including in Japan, for sustainable mobility solutions and growth in the fleet leasing sector through innovation and expanded business channels.

To get more information on this market Request Sample

Data-Driven Solutions Accelerating Fleet Electrification

The fleet leasing market in Japan is increasingly adopting advanced optimization technologies to support the shift toward electric vehicles. Cutting-edge software enables fleet operators, leasing companies, and charging infrastructure providers to simulate and analyze various electrification scenarios, including optimal EV and battery sizes, charging requirements, and cost comparisons with diesel fleets. This data-driven approach helps streamline decision-making, reduce operational costs, and improve overall fleet efficiency. By customizing solutions to the unique operational patterns of commercial logistics, companies can better plan and deploy electric fleets that align with sustainability goals and regulatory requirements. These innovations foster a more efficient transition to greener commercial transportation, positioning Japan’s fleet leasing sector for sustainable growth and enhanced competitiveness. For instance, in April 2024, eMotion Fleet Inc. partnered with the UK’s Dynamon Ltd. to introduce the ZERO fleet optimization software in Japan, enhancing fleet electrification. Leveraging advanced data-driven simulations, ZERO helps Japanese fleet operators, leasing companies, and infrastructure providers optimize EV deployment, charging, and costs. This collaboration supports Japan’s transition to sustainable commercial fleets by enabling efficient, cost-effective electric vehicle operations tailored to local logistics and leasing market needs.

Japan Fleet Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on lease type, vehicle type, lease duration, and end use industry.

Lease Type Insights:

- Operating Lease

- Financial Lease

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes operating lease and financial lease.

Vehicle Type Insights:

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicles, light commercial vehicles (LCVS), and heavy commercial vehicles (HCVS).

Lease Duration Insights:

- Short-Term Leasing (Less than 12 months)

- Medium-Term Leasing (1-3 years)

- Long-Term Leasing (More than 3 years)

The report has provided a detailed breakup and analysis of the market based on the lease duration. This includes short-term leasing (less than 12 months), medium-term leasing (1-3 years), and long-term leasing (more than 3 years).

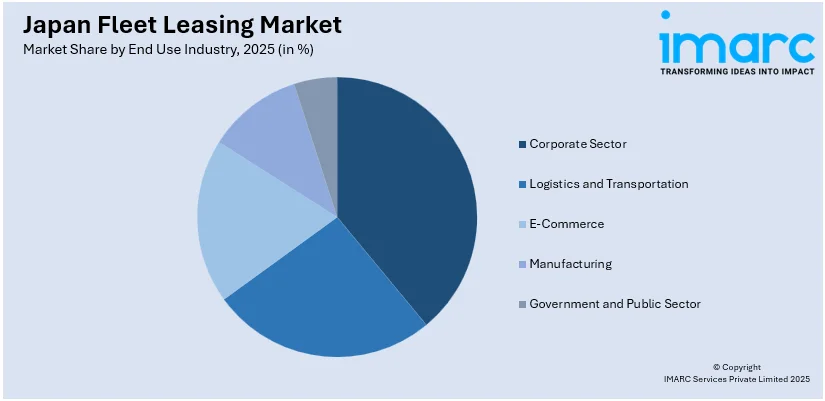

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Corporate Sector

- Logistics and Transportation

- E-Commerce

- Manufacturing

- Government and Public Sector

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes corporate sector, logistics and transportation, e-commerce, manufacturing, and government and public sector.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fleet Leasing Market News:

- In June 2024, Marubeni Corporation made a strategic minority investment in North American fleet leader Wheels, alongside Lithia & Driveway. This move reinforces Marubeni’s presence in the global fleet leasing sector and supports its growth strategy through collaboration and innovation. With deep industry ties and access to funding channels in Japan, Marubeni’s involvement strengthens its role in shaping the evolving fleet leasing landscape, including potential synergies within the Japanese market.

Japan Fleet Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lease Types Covered | Operating Lease, Financial Lease |

| Vehicle Types Covered | Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) |

| Lease Durations Covered | Short-Term Leasing (Less than 12 months), Medium-Term Leasing (1-3 years), Long-Term Leasing (More than 3 years) |

| End Use Industries Covered | Corporate Sector, Logistics and Transportation, E-Commerce, Manufacturing, Government and Public Sector |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fleet leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan fleet leasing market on the basis of lease type?

- What is the breakup of the Japan fleet leasing market on the basis of vehicle type?

- What is the breakup of the Japan fleet leasing market on the basis of lease duration?

- What is the breakup of the Japan fleet leasing market on the basis of end use industry?

- What is the breakup of the Japan fleet leasing market on the basis of region?

- What are the various stages in the value chain of the Japan fleet leasing market?

- What are the key driving factors and challenges in the Japan fleet leasing market?

- What is the structure of the Japan fleet leasing market and who are the key players?

- What is the degree of competition in the Japan fleet leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fleet leasing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fleet leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fleet leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)