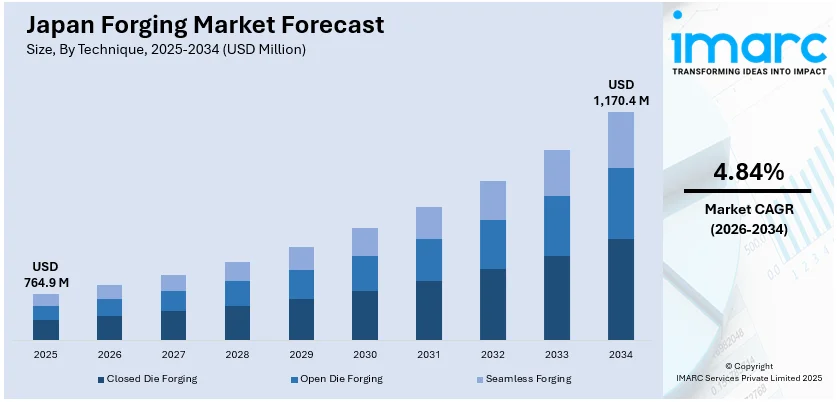

Japan Forging Market Size, Share, Trends and Forecast by Technique, Material, Industry, and Region, 2026-2034

Japan Forging Market Overview:

The Japan forging market size reached USD 764.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,170.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.84% during 2026-2034. The market is spurred by the increasing demand in the automotive, aerospace, and industrial machinery industries. Forging process advancements in technology, a greater focus on lightweight materials, and demand for high-performance, long-lasting components also support the Japan forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 764.9 Million |

| Market Forecast in 2034 | USD 1,170.4 Million |

| Market Growth Rate 2026-2034 | 4.84% |

Japan Forging Market Trends:

Shift Toward Lightweight Materials in Automotive Sector

One of the major trends propelling Japan forging market growth is the automobile industry's move towards lightweight materials. With automobile manufacturers in need of enhancing fuel efficiency and minimizing carbon emissions, the demand for light forged parts from advanced material such as aluminum and high-strength steel continues to increase. The material presents a combination of durability and weight savings necessary for enhancing car performance. The growing use of electric vehicles (EVs) also presents new application opportunities for forged components in battery systems, motors, and structural parts. As Japan remains a center for worldwide automobile manufacturing, demand for advanced forged products will increase, subsequently driving the Japan forging market growth. For instance, in June 2024, Super Screws Pvt Ltd signed a Memorandum of Understanding (MoU) with Mitsuchi Corporation of Japan to form a joint venture for manufacturing cold forged parts in India. The partnership aims to leverage Mitsuchi’s advanced technology and Super Screws’ engineering capabilities to produce high-quality components for the Indian market and global exports, particularly for the automotive and industrial sectors.

To get more information on this market Request Sample

Technological Advancements in Forging Processes

Technological innovation in forging operations is another driving force for the forging industry in Japan. Precision forging, closed-die forging, and additive manufacturing processes are enhancing product quality, operational effectiveness, and customization. The new technologies enable manufacturers to create highly complex, high-performance parts with lower material waste. The use of automation and robotics in forging operations is also improving the capacity of production, accuracy, and cost-effectiveness. For instance, Ohmi Press Works and Forging in Japan has ordered a new, energy-efficient ring rolling machine from SMS group, marking its sixth machine purchase. The RAW EH machine, set to operate in 2024, will produce seamless rings up to 4,500 millimeters in diameter with reduced energy consumption. Featuring the electrohydraulic direct drive concept, it will lower energy usage by up to 50%, improving production efficiency while meeting high-quality standards in industries such as automotive, aerospace, and shipbuilding. As Japan continues to adopt these advanced technologies, the market for forged products will expand, particularly in industries like aerospace and heavy machinery where precision and reliability are critical. These developments are crucial to strengthening Japan’s position in the global forging industry, contributing to overall market growth.

Japan Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on technique, material, and industry.

Technique Insights:

- Closed Die Forging

- Open Die Forging

- Seamless Forging

The report has provided a detailed breakup and analysis of the market based on the technique. This includes closed die forging, open die forging, and seamless forging.

Material Insights:

- Nickel-based Alloys

- Titanium Alloys

- Aluminum Alloys

- Steel Alloys

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes nickel-based alloys, titanium alloys, aluminum alloys, and steel alloys.

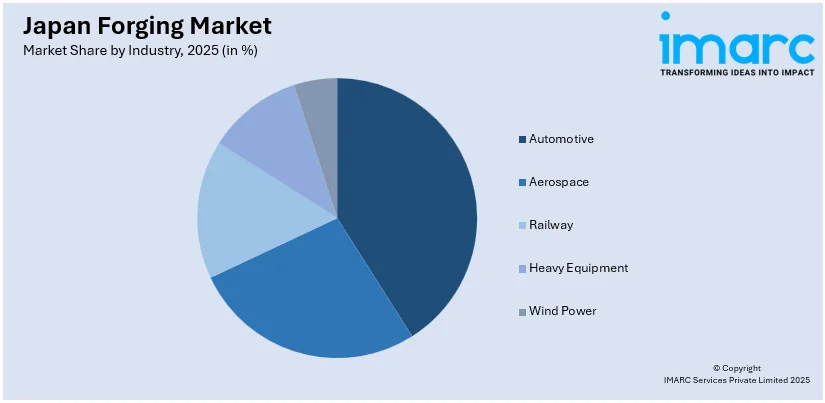

Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace

- Railway

- Heavy Equipment

- Wind Power

The report has provided a detailed breakup and analysis of the market based on the industry. This includes automotive, aerospace, railway, heavy equipment, and wind power.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Forging Market News:

- In May 2025, Usha Martin Limited signed a technical assistance agreement with Japan's Aichi Steel Corporation to improve operational efficiency and steel product quality. The partnership aims to enhance Usha Martin's production of higher-value steel products and expand its presence in the passenger vehicle market. Aichi Steel's expertise will help Usha Martin achieve excellence in manufacturing.

Japan Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Closed Die Forging, Open Die Forging, Seamless Forging |

| Materials Covered | Nickel-Based Alloys, Titanium Alloys, Aluminum Alloys, Steel Alloys |

| Industries Covered | Automotive, Aerospace, Railway, Heavy Equipment, Wind Power |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan forging market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan forging market on the basis of technique?

- What is the breakup of the Japan forging market on the basis of material?

- What is the breakup of the Japan forging market on the basis of industry?

- What is the breakup of the Japan forging market on the basis of region?

- What are the various stages in the value chain of the Japan forging market?

- What are the key driving factors and challenges in the Japan forging market?

- What is the structure of the Japan forging market and who are the key players?

- What is the degree of competition in the Japan forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan forging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)