Japan Fortified Baby Food Market Size, Share, Trends and Forecast by Product Type, Ingredients, Nutritional Additives, Distribution Channel, Age Group, and Region, 2026-2034

Japan Fortified Baby Food Market Summary:

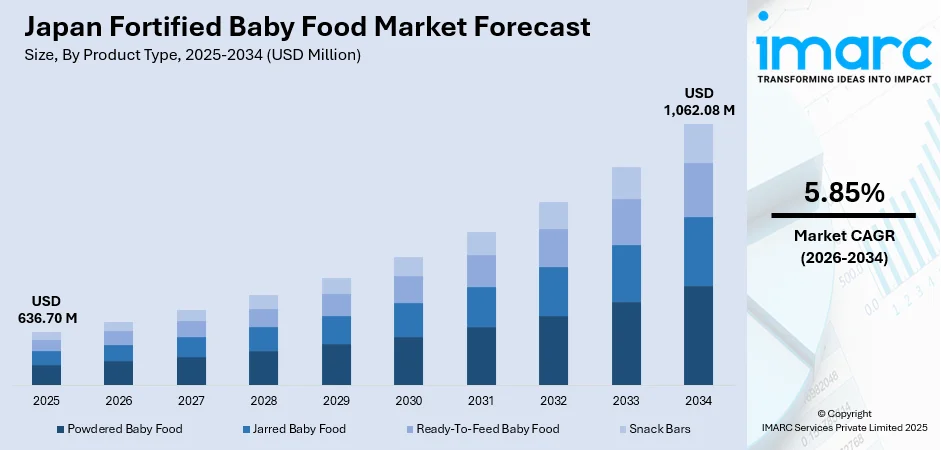

The Japan fortified baby food market size was valued at USD 636.70 Million in 2025 and is projected to reach USD 1,062.08 Million by 2034, growing at a compound annual growth rate of 5.85% from 2026-2034.

The Japan fortified baby food market is observing steady growth, buoyed by increasing parental awareness about infant nutrition, rising demand for convenient feeding solutions, and increasing focus on developmental health outcomes. The market also benefits from Japan's high standards concerning food safety and quality, sophisticated distribution networks, and premiumization trends, as parents make sure to prioritize nutritionally enhanced products for the optimal growth and development of their children.

Key Takeaways and Insights:

-

By Product Type: Powdered baby food dominates the market with a share of 45.04% in 2025, driven by its extended shelf life, convenient preparation, and cost-effectiveness that appeals to Japanese parents seeking practical and nutritious infant feeding solutions.

-

By Ingredient: Cereals lead the market with a share of 30.06% in 2025, owing to their role as essential first foods providing easily digestible carbohydrates and serving as ideal carriers for nutritional fortification.

-

By Nutritional Additive: Vitamins represent the largest segment with a market share of 40.12% in 2025, reflecting parental prioritization of essential micronutrients that support immune function, cognitive development, and overall infant health.

-

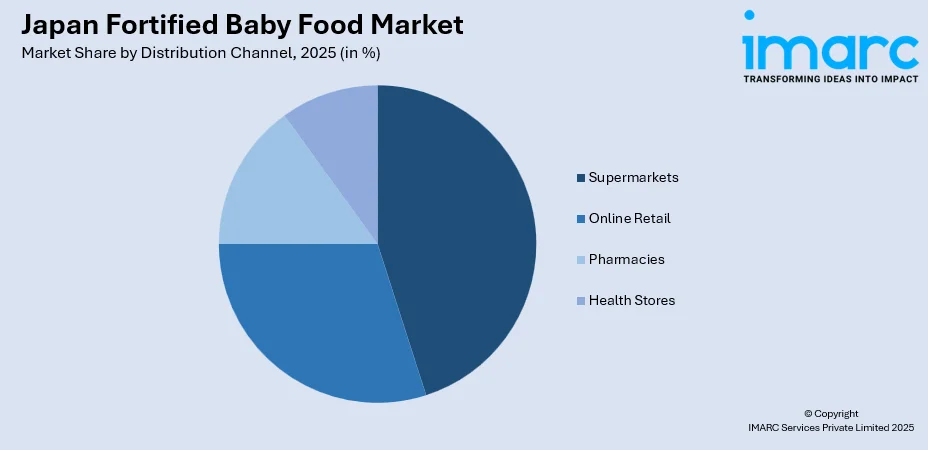

By Distribution Channel: Supermarkets dominate the market with a share of 45.09% in 2025, driven by consumer preference for one-stop shopping convenience, extensive product selection, and the ability to physically examine products before purchase.

-

By Age Group: Infants lead the market with a share of 55.05% in 2025, attributed to the critical nutritional requirements during the first year of life when fortified foods supplement breast milk or formula feeding.

-

By Region: Kanto Region dominates the market with a share of 34% in 2025, driven by Tokyo's concentrated population, high birth rates in urban areas, and premium product adoption among affluent metropolitan consumers.

-

Key Players: The Japan fortified baby food market features a competitive landscape with established domestic manufacturers and international brands competing through product innovation, nutritional differentiation, and comprehensive distribution strategies tailored to discerning Japanese parents.

To get more information on this market Request Sample

The Japan fortified baby food market continues to evolve in response to changing family dynamics, increasing workforce participation among mothers, and growing scientific understanding of early childhood nutrition. In fact, according to a 2025 survey, it is found that a record 80% of mothers in Japan had jobs in 2024, up 3.1 percentage points from the previous year, underscoring a rising demand for convenient readytouse baby meals among working parents. Japanese parents demonstrate strong preference for premium products that offer comprehensive nutritional profiles supporting cognitive development, immune health, and physical growth. The market is characterized by stringent quality standards, sophisticated packaging innovations ensuring product integrity, and increasing adoption of organic and natural ingredient formulations that align with health-conscious consumer preferences.

Japan Fortified Baby Food Market Trends:

Growing Demand for Organic and Natural Fortified Products

Japanese parents increasingly seek fortified baby foods made with organic ingredients and natural nutritional additives, reflecting broader health and environmental consciousness. For example, in 2025, Meiji, a leading baby‑food and infant‑formula manufacturer in Japan, continues to promote its “Meiji Hohoemi RakuRaku Cube” infant formula, marketed as the industry’s first cube‑type formula that offers convenience without compromising nutritional fortification. Manufacturers are responding by developing products free from artificial preservatives, colors, and flavors while maintaining comprehensive vitamin and mineral fortification profiles that meet infant developmental requirements.

Innovation in Convenient Packaging Formats

The market is witnessing significant innovation in packaging solutions designed for on-the-go consumption and portion control. For example, Wakodo expanded its ready-to-eat pouch line, offering portable, nutrient-complete meals for infants and toddlers, catering to busy parents seeking convenience without compromising quality. Single-serve pouches, resealable containers, and ready-to-feed formats are gaining popularity among working parents seeking convenient yet nutritionally complete feeding options that maintain product freshness and safety standards.

Emphasis on Cognitive Development Formulations

Fortified baby food products increasingly incorporate specialized nutrients supporting brain development, including DHA, omega-3 fatty acids, and choline. For example, Meiji rolled out new offerings under its Meiji MIRAFUL line, including baby cheeses, powdered drinks, and snacks, that explicitly list DHA, described as “very important for the brains of young children,” as a core ingredient. This trend reflects growing parental awareness of the critical importance of early nutrition for cognitive outcomes and manufacturers' response through scientifically formulated products addressing developmental milestones.

Market Outlook 2026-2034:

The Japan fortified baby food market is positioned for continued growth through the forecast period, supported by sustained parental investment in infant nutrition, premiumization trends, and ongoing product innovation addressing evolving consumer preferences. The market is expected to benefit from increasing awareness of nutritional requirements during early childhood, expanding distribution through e-commerce channels, and growing demand for specialized formulations targeting specific developmental needs. The market generated a revenue of USD 636.70 Million in 2025 and is projected to reach a revenue of USD 1,062.08 Million by 2034, growing at a compound annual growth rate of 5.85% from 2026-2034.

Japan Fortified Baby Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Powdered Baby Food | 45.04% |

| Ingredient | Cereals | 30.06% |

| Nutritional Additive | Vitamins | 40.12% |

| Distribution Channel | Supermarkets | 45.09% |

| Age Group | Infants | 55.05% |

| Region | Kanto Region | 34% |

Product Type Insights:

- Powdered Baby Food

- Jarred Baby Food

- Ready-To-Feed Baby Food

- Snack Bars

The powdered baby food dominates with a market share of 45.04% of the total Japan fortified baby food market in 2025.

Powdered baby food maintains its dominant market position due to exceptional storage convenience and extended shelf life that appeals to Japanese households. This trend aligns with government-led efforts under the HSFE initiative, where Japan’s Ministry of Health, Labour and Welfare promotes nutrition education (Shokuiku) for mothers and infants, reinforcing safe, balanced weaning and infant feeding practices. The format allows parents to prepare fresh servings according to their infant's appetite while minimizing waste. Powdered formulations enable manufacturers to incorporate comprehensive nutritional fortification profiles including essential vitamins, minerals, and developmental nutrients that remain stable throughout the product's lifespan.

The segment's leadership is reinforced by cost-effectiveness compared to ready-to-feed alternatives, making premium fortified nutrition accessible to broader consumer segments. Japanese parents appreciate the preparation flexibility that powdered products offer, allowing customization of consistency and portion sizes based on individual infant preferences and developmental stages. This versatility supports smooth transitions from liquid to semi-solid foods during the weaning process.

Ingredients Insights:

- Fruits

- Vegetables

- Cereals

- Meats

- Dairy

The cereals leads with a share of 30.06% of the total Japan fortified baby food market in 2025.

Cereal-based fortified baby foods maintain market leadership as they represent the traditional first solid food introduced during infant weaning in Japanese households. For example, Wakodo continues to offer cereal‑based puffed products, such as rice- or vegetable‑cereal puffs, underlining the continued importance of cereal-based foods in early weaning stages. Their mild flavor profile and smooth texture make them ideal for introducing babies to complementary feeding. Cereals provide easily digestible carbohydrates supplying essential energy while serving as excellent carriers for iron, zinc, and B-vitamin fortification critical for optimal infant development.

The segment benefits from strong cultural acceptance and pediatric recommendations positioning rice-based and wheat-based cereals as foundational weaning foods. Japanese parents value the versatility of fortified cereals that can be mixed with breast milk, formula, or water to achieve desired consistency. The neutral taste profile also facilitates combination with fruits and vegetables, enabling gradual flavor introduction during the dietary diversification process.

Nutritional Additives Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

The vitamins dominate with a market share of 40.12% of the total Japan fortified baby food market in 2025.

Vitamin fortification leads the nutritional additive segment as parents prioritize these essential micronutrients for comprehensive infant health support. Key vitamins including A, C, D, and B-complex are fundamental to immune system development, bone formation, and metabolic function during critical growth periods. Japanese parents demonstrate strong awareness of vitamin requirements, driving demand for products offering complete micronutrient profiles aligned with pediatric nutritional guidelines. This trend reflects Japan’s MHLW “Nutrition Policy to Leave No One Behind,” promoting life‑course nutrition and providing standardized dietary guidance and nutrition education for infants, young children, and all age groups.

The segment's dominance reflects manufacturer focus on addressing common nutritional gaps in infant diets through strategic vitamin fortification. Products emphasizing immune-supporting vitamins and those promoting cognitive development through B-vitamin enrichment resonate strongly with health-conscious Japanese parents.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets

- Online Retail

- Pharmacies

- Health Stores

The supermarkets leads with a share of 45.09% of the total Japan fortified baby food market in 2025.

Supermarkets maintain their dominant distribution position by offering Japanese parents convenient one-stop shopping experiences combining baby food purchases with regular household groceries. These retail environments provide extensive product assortments enabling comparison across brands, formulations, and price points. Parents appreciate the ability to physically examine packaging, verify ingredient lists, and check expiration dates before purchasing products intended for their infants' consumption.

The channel's leadership is supported by Japan's sophisticated supermarket infrastructure featuring dedicated baby care sections with knowledgeable staff assistance. Supermarkets frequently offer promotional pricing, loyalty programs, and bulk purchase incentives appealing to budget-conscious families with ongoing baby food requirements. Immediate product availability eliminates delivery wait times, effectively addressing urgent feeding needs that commonly arise in infant care situations.

Age Group Insights:

- Infants

- Toddlers

- Preschoolers

The infants dominate with a market share of 55.05% of the total Japan fortified baby food market in 2025.

The infant segment commands market leadership as the first year of life represents the most critical period for nutritional intervention through fortified foods. During this developmental stage, infants transition from exclusive milk feeding to complementary solid foods, creating substantial demand for age-appropriate fortified products. The Japan infant healthcare products market size is projected to exhibit a growth rate of 7.80% during 2025–2033, reflecting rising parental investment in premium fortified nutrition for infants. Parents demonstrate heightened nutritional awareness during infancy, investing in premium fortified options to support optimal growth and developmental milestones.

The segment's dominance reflects intensive nutritional requirements of rapid infant growth, where fortified foods play essential roles in supplementing breast milk or formula feeding. Japanese pediatric guidelines emphasize introduction of iron-fortified cereals and vitamin-enriched foods from around six months, driving structured purchasing patterns among new parents. This medically supported weaning approach sustains consistent market demand throughout the entire infant age category.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 34% share of the total Japan fortified baby food market in 2025.

The Kanto region dominates the Japan fortified baby food market with its concentrated metropolitan population centered around Tokyo. This economically vital region features the highest household income levels and most sophisticated retail infrastructure in Japan. Parents in the greater Tokyo area demonstrate strong premium product preferences, driving demand for advanced fortified formulations featuring comprehensive nutritional profiles and organic ingredient certifications addressing health-conscious consumer expectations.

The region's market leadership is reinforced by extensive distribution networks including major supermarket chains, specialty baby stores, and advanced e-commerce logistics enabling convenient product access. Kanto's urban lifestyle, characterized by dual-income households and time constraints, creates substantial demand for convenient fortified baby food solutions. Additionally, the region serves as the primary market for new product launches and premium brand introductions.

Market Dynamics:

Growth Drivers:

Why is the Japan Fortified Baby Food Market Growing?

Increasing Parental Awareness of Infant Nutrition

Japanese parents demonstrate heightened awareness regarding the importance of comprehensive nutrition during early childhood development. Growing access to nutritional education through healthcare providers, parenting resources, and digital platforms is driving demand for fortified baby foods that address specific developmental requirements. A 2025 nationwide survey of Japanese infants aged 0–60 months found clear differences in growth patterns depending on whether children were breastfed, formula‑fed, or mixed‑fed, underlining the real impact of early feeding choices on physical development. Parents increasingly seek products offering complete nutritional profiles supporting cognitive development, immune function, and physical growth during critical infant developmental stages.

Rising Female Workforce Participation

The increasing participation of Japanese mothers in the workforce is driving demand for convenient, nutritionally complete baby food solutions that minimize meal preparation time while ensuring optimal infant nutrition. Working parents seek fortified products that provide comprehensive nutritional support without requiring extensive preparation, creating sustained demand for ready-to-use and easily prepared fortified formulations across various product categories.

Premiumization and Quality Focus

Japanese consumers' willingness to invest in premium infant nutrition products is supporting market growth and encouraging manufacturer innovation. For example, a 2024 study by Meiji Co., Ltd. showed that specific humanmilk oligosaccharides (HMOs) in Japanese mothers’ breast milk, compounds linked to brain and neurodevelopment, correlate positively with infants’ head circumference growth and neurodevelopmental indices. Parents prioritize product quality and nutritional completeness over price considerations when selecting baby foods, driving development of advanced formulations featuring organic ingredients, specialized nutrients, and innovative delivery formats that command premium positioning in the marketplace.

Market Restraints:

What Challenges the Japan Fortified Baby Food Market is Facing?

Declining Birth Rates

Japan's persistently low birth rates present a fundamental challenge for the fortified baby food market, constraining the natural consumer base for infant nutrition products. The declining number of newborns limits market expansion potential and intensifies competition among manufacturers seeking to capture larger shares of a shrinking target demographic.

Strong Preference for Homemade Baby Food

Traditional Japanese parenting practices emphasizing homemade baby food preparation present competition to commercial fortified products. Some parents perceive homemade foods as fresher and more natural, requiring manufacturers to effectively communicate the nutritional advantages and safety assurances of commercially fortified alternatives.

Stringent Regulatory Requirements

Japan's rigorous food safety and labeling regulations for infant nutrition products create compliance challenges and development costs for manufacturers. Stringent requirements for nutritional claims, ingredient sourcing, and product testing increase operational complexity while potentially limiting formulation innovation and market entry for new competitors.

Competitive Landscape:

The Japan fortified baby food market features a competitive landscape characterized by established domestic manufacturers with strong brand recognition competing alongside international nutrition companies. Leading players differentiate through product innovation, nutritional research partnerships, and comprehensive marketing addressing parental concerns about infant development. Competition centers on fortification profiles, organic and natural ingredient positioning, convenient packaging formats, and distribution reach ensuring broad product accessibility across urban and regional markets.

Recent Developments:

-

In November 2025, Meiji launched a new fortified infant formula under its “Meiji Hohoemi” line, featuring the probiotic Bifidobacterium OLB6378, aiming to support infant gut health and simplify feeding for parents.

Japan Fortified Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powdered Baby Food, Jarred Baby Food, Ready-To-Feed Baby Food, Snack Bars |

| Ingredients Covered | Fruits, Vegetables, Cereals, Meats, Dairy |

| Nutritional Additives Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids |

| Distribution Channels Covered | Supermarkets, Online Retail, Pharmacies, Health Stores |

| Age Groups Covered | Infants, Toddlers, Preschoolers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan fortified baby food market size was valued at USD 636.70 Million in 2025.

The Japan fortified baby food market is expected to grow at a compound annual growth rate of 5.85% from 2026-2034 to reach USD 1,062.08 Million by 2034.

Powdered baby food dominated the Japan fortified baby food market with a share of 45.04%, driven by its extended shelf life, convenient preparation, and cost-effectiveness that appeals to Japanese parents seeking practical infant feeding solutions.

Key factors driving the Japan fortified baby food market include increasing parental awareness of infant nutrition, rising female workforce participation creating demand for convenient solutions, premiumization trends as parents prioritize quality, growing emphasis on cognitive development formulations, and expanding distribution through diverse retail channels.

Major challenges include Japan's declining birth rates constraining the consumer base, strong cultural preferences for homemade baby food, stringent regulatory requirements increasing compliance costs, and intense competition among established domestic and international manufacturers seeking market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)