Japan Fuel Station Market Size, Share, Trends and Forecast by Fuel Type, End Use, and Region, 2026-2034

Japan Fuel Station Market Overview:

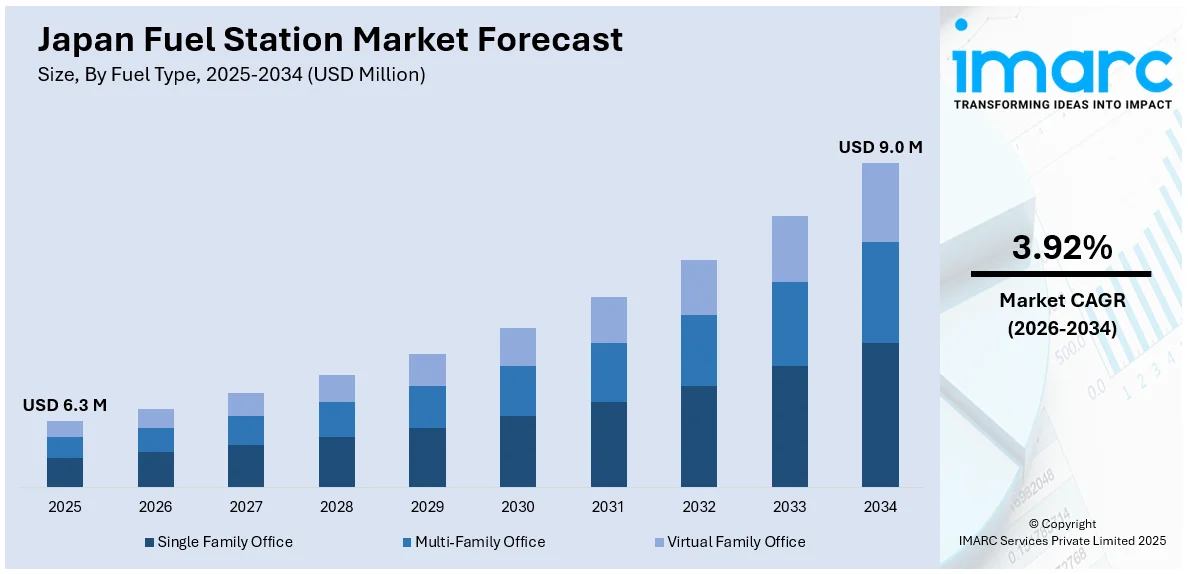

The Japan fuel station market size reached USD 6.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 9.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.92% during 2026-2034. The market is driven by upgrades or complete replacement of fuel stations, robust policy backing for hydrogen fuel infrastructure, and accelerating service integration activities, such as automatic car wash, car maintenance, and package drop-off, in station buildings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.3 Million |

| Market Forecast in 2034 | USD 9.0 Million |

| Market Growth Rate 2026-2034 | 3.92% |

Japan Fuel Station Market Trends:

Aging Fuel Station Infrastructure and Shift Toward Modernization

The aging fuel stations of Japan are impelling the growth of the market. Many of these facilities now require upgrades or complete replacement due to outdated safety standards, inefficient layouts, and declining compliance with environmental regulations. This aging of infrastructure is encouraging station owners to either modernize old premises or merge with newer, improved ones. In turn, power companies are funding automated systems, advanced underground storage technologies, and intelligent fuel dispensers. Such advanced upgrades are also being constructed to accommodate alternative fuels and hybrid services like electric vehicle (EV) charging stations and hydrogen refueling, pointing toward a shift towards multifunctional service hubs. Governmental incentives favoring compliance upgrades and green infrastructure stimulate this change as well.

To get more information on this market Request Sample

Government Push for Energy Diversification and Hydrogen Fuel Adoption

Japan's energy security policy features weaning off imported oil and encouraging low-emission substitutes. This is resulting in robust policy backing for hydrogen fuel infrastructure. The government's Basic Hydrogen Strategy and "Green Growth Strategy Through Achieving Carbon Neutrality" aim at the installation of hundreds of hydrogen refueling stations nationwide. Operators of fuel stations are encouraged with subsidies and public-private partnerships to invest in hydrogen dispensing infrastructure in addition to conventional gasoline and diesel pumps. Key market players are building out their hydrogen footprint to reach targets, establishing themselves as significant players in the future mobility economy. The government of Japan launched Japan Climate Transition Bonds in February 2024 to provide 20 trillion yen and support Green Transformation (GX) efforts through its issuance over the next decade to establish a decarbonized society.

Shifting Behavior and Demand for Integrated Services

Japanese service stations are becoming more multi-purpose convenience centers as a reaction to changing customer needs. In response to a decrease in population and car ownership in rural areas, operators are left with little choice but to make the best use of each customer visit. This is accelerating service integration activities such as automatic car wash, car maintenance, package drop-off, bill payments, and shopping in station buildings. Commuters appreciate these time-saving one-stop solutions and minimize the necessity of doing multiple errands. Moreover, digital innovation like mobile app-based refueling, dynamic pricing, and reward programs make the experience more personal and help build repeat usage. As stations develop into wider service ecosystems, their relevance grows beyond refueling vehicle sales. In 2025, Itochu started operating its first Renewable Diesel*1 refueling station in the Kansai region at the Osaka Nanko Station.

Japan Fuel Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on fuel type and end use.

Fuel Type Insights:

- Petrol

- Diesel

- Gas

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes petrol, diesel, and gas.

End Use Insights:

Access the comprehensive market breakdown Request Sample

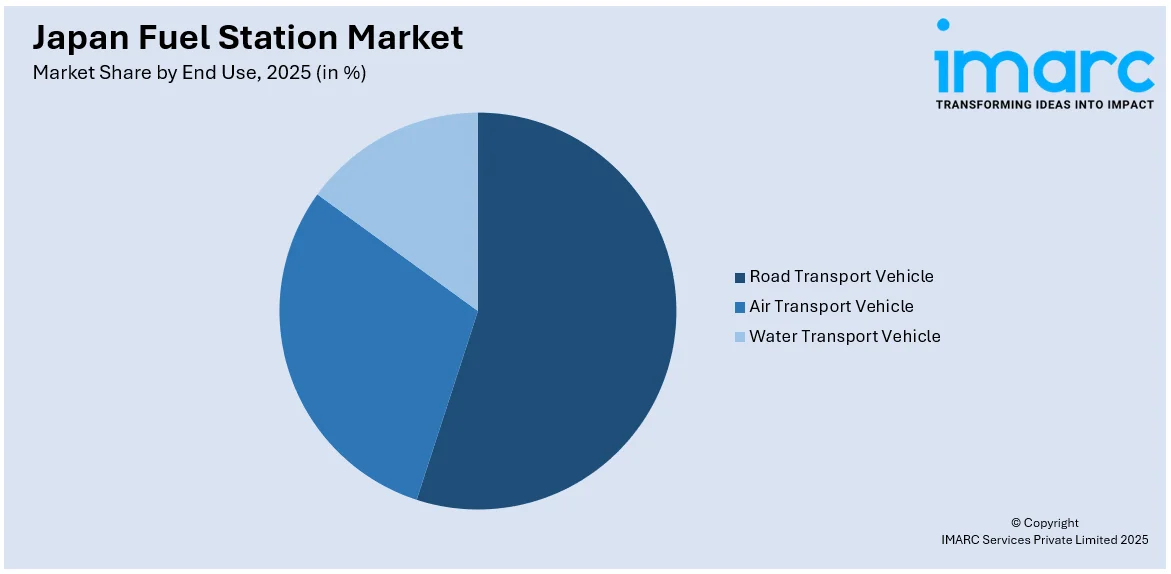

- Road Transport Vehicle

- Air Transport Vehicle

- Water Transport Vehicle

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes road transport vehicle, air transport vehicle, and water transport vehicle.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, And Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fuel Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Petrol, Diesel, Gas |

| End Uses Covered | Road Transport Vehicle, Air Transport Vehicle, Water Transport Vehicle |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fuel station market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan fuel station market on the basis of fuel type?

- What is the breakup of the Japan fuel station market on the basis of end use?

- What is the breakup of the Japan fuel station market on the basis of region?

- What are the various stages in the value chain of the Japan fuel station market?

- What are the key driving factors and challenges in the Japan fuel station market?

- What is the structure of the Japan fuel station market and who are the key players?

- What is the degree of competition in the Japan fuel station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fuel station market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fuel station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fuel station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)