Japan Functional Gummies Market Size, Share, Trends and Forecast by Nature, Application, Distribution Channel, End User, and Region, 2026-2034

Japan Functional Gummies Market Overview:

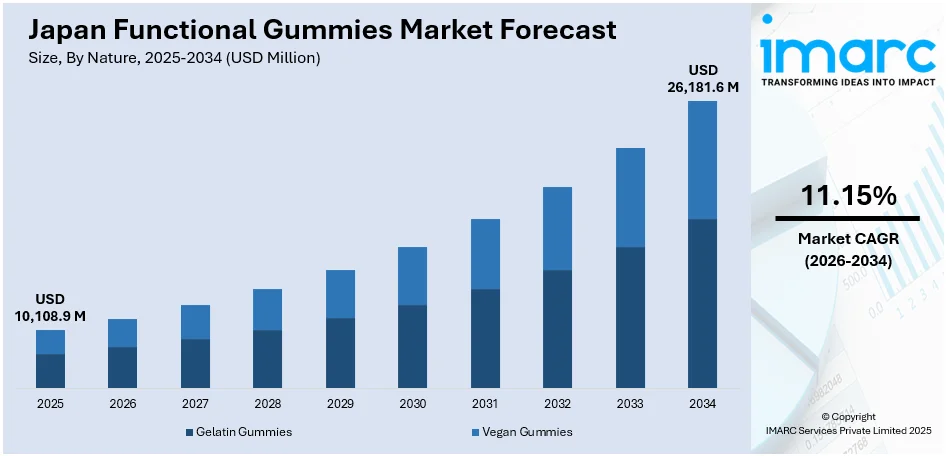

The Japan functional gummies market size reached USD 10,108.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,181.6 Million by 2034, exhibiting a growth rate (CAGR) of 11.15% during 2026-2034. The market for Japan functional gummies is largely fueled by growing health and wellness awareness among consumers, a desire for ease of use of dietary supplements, and the growing demand for functional ingredients that are beneficial to immunity, digestion, beauty, and mental focus. All these trends further find support from changing lifestyles, most notably among youth who require delicious, easy-to-swallow substitutes for capsules or pills. All of these elements work together to ensure the continued growth in the Japan functional gummies market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,108.9 Million |

| Market Forecast in 2034 | USD 26,181.6 Million |

| Market Growth Rate 2026-2034 | 11.15% |

Japan Functional Gummies Market Trends:

Emerging Consumer Demand for Health-Focused Snacking

Japan is experiencing a definite consumer move toward health-focused snacking, and this is helping to drive the higher demand for functional gummies. They provide a very attractive mix of nutrition and flavor, an alternative to traditional supplements such as tablets or capsules. Buyers are turning to products that help them attain preventative health and wellness objectives without having to change their routines. Functional gummies are also perceived as fun and easy to take, particularly by consumers looking for targeted benefits like immunity, energy, or relaxation. This fits in with the general trend toward personalization in nutrition, wherein shoppers choose products that address their own specific health issues and lifestyle interests. As people learn more about dietary supplementation, demand for new delivery formats expands. The increasing popularity of convenient-to-consume, on-the-move health solutions makes functional gummies particularly viable in contemporary Japanese culture. The growth in Japan functional gummies is a reflection of this overall relationship between nutrition, convenience, and lifestyle incorporation. For instance, in April 2025, MUJI introduced four new "Care for Your Skin" gummies nationwide with collagen, vitamin C, lactic acid bacteria, and iron to assist with skin health and daily nutritional support.

To get more information on this market Request Sample

Formulation Innovation and Nutritional Attributes

A characteristic trend among Japan's functional gummies is the focus on ongoing innovation in formulation and nutritional benefits. Producers are tapping the developments in nutrition science to create gummies with dual-function advantages like pairing collagen with hyaluronic acid to improve skin health or adding prebiotics and probiotics for digestive well-being. For example, in September 2024, Kaneka Corporation introduced "Watashi no Chikara™ - Kaneka Q10™ Fruit Gummies" in Seven-Eleven stores nationwide with active coenzyme Q10 to help assist with skin moisture and minimize temporary stress. Adding natural sweeteners, plant-based compounds, and clean-label formats is becoming more common practice to address changing consumer needs. Improved flavor, texture, and bioavailability are similarly integral to product formulation, such that gummies not only work but are also enjoyable to eat. These technologies are part of a better user experience that sets functional gummies apart from other forms of supplement. Japan's technology-forward focus on food science further solidifies this movement, creating a competitive and rapidly evolving environment. Consequently, the Japan functional gummy market growth is progressing with high-performance products that cater to consumer demands for effectiveness, flavor, and clean nutrition.

Growing Demand from Younger Audiences

Young Japanese consumers are at the center of driving demand for functional gummies, attracted by the product's convenience, ease of use, and versatility. Millennials and Gen Z are very active in wellness trends, preferring supplement forms that easily become part of their lifestyle without necessitating heavy behavior adjustment. Functional gummies speak directly to this generation because of their convenience in snack form and extensive variety of flavors, which present a more fun alternative to pills or powders. Furthermore, younger consumers are influenced by social media and digital marketing trends, where packaging that is aesthetically pleasing and messages centered around wellness play major roles. They also emphasize transparency and natural ingredients, pushing the growth of clean-label gummy solutions even more. Focusing on consumer-friendly health solutions supports current values of efficiency, enjoyment, and self-care. As they grow older into future functional gummies customers, their tastes are projected to drive future dynamics in Japan's functional gummies market.

Japan Functional Gummies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on nature, application, distribution channel, and end user.

Nature Insights:

- Gelatin Gummies

- Vegan Gummies

The report has provided a detailed breakup and analysis of the market based on the nature. This includes gelatin gummies and vegan gummies.

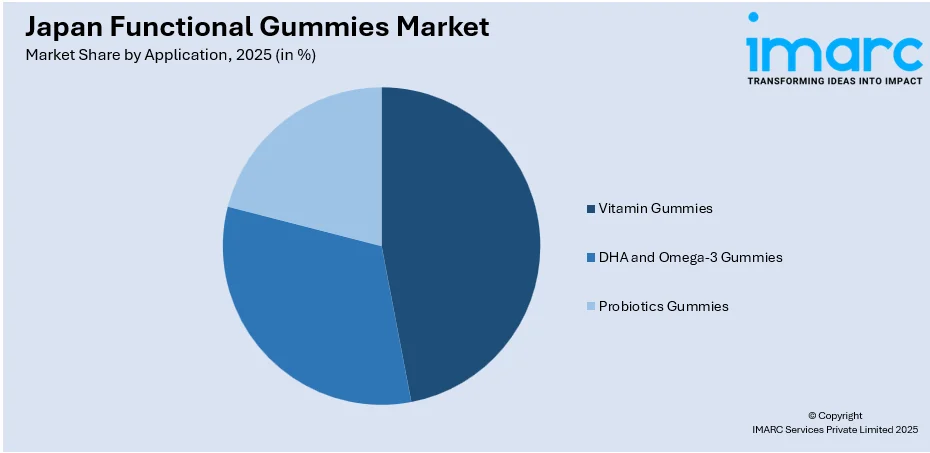

Application Insights:

Access the comprehensive market breakdown Request Sample

- Vitamin Gummies

- DHA and Omega-3 Gummies

- Probiotics Gummies

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes vitamin gummies, DHA and omega-3 gummies, and probiotics gummies.

Distribution Channel Insights:

- Online Platforms

- Offline Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online platforms and offline stores.

End User Insights:

- Children

- Adults

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes children and adults.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Functional Gummies Market News:

- In April 2024, Issei Mochi Gummies rolled out at World Market stores across the country, reaching more than 2,000 locations. The all-natural, plant-based mochi candies are shelf-stable, gluten-free, and made without artificial additives, providing a novel chewy texture and variety of flavors, aligning with high dietary requirements and increasing consumer demand.

Japan Functional Gummies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Gelatin Gummies, Vegan Gummies |

| Applications Covered | Vitamin Gummies, DHA and Omega-3 Gummies, Probiotics Gummies |

| Distribution Channels Covered | Online Platforms, Offline Stores |

| End Users Covered | Children, Adults |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan functional gummies market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan functional gummies market on the basis of nature?

- What is the breakup of the Japan functional gummies market on the basis of application?

- What is the breakup of the Japan functional gummies market on the basis of distribution channel?

- What is the breakup of the Japan functional gummies market on the basis of end user?

- What is the breakup of the Japan functional gummies market on the basis of region?

- What are the various stages in the value chain of the Japan functional gummies market?

- What are the key driving factors and challenges in the Japan functional gummies?

- What is the structure of the Japan functional gummies market and who are the key players?

- What is the degree of competition in the Japan functional gummies market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan functional gummies market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan functional gummies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan functional gummies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)