Japan Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Sales Channel, and Region, 2026-2034

Japan Gluten Free Food Market Overview:

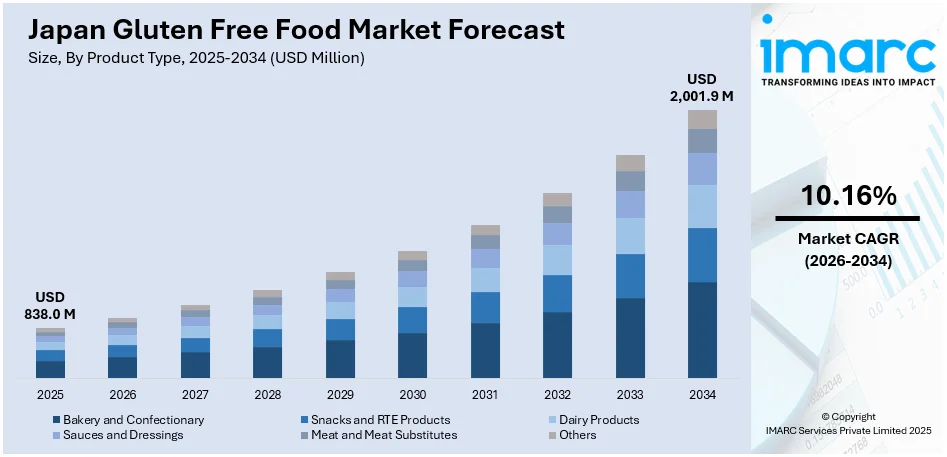

The Japan gluten free food market size reached USD 838.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,001.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.16% during 2026-2034. The increasing health awareness, rising celiac disease cases, and government labeling support are creating positive market outlook. Moreover, expanding retail availability, lifestyle changes, influence of Western diets, food technology advances, and product innovation are stimulating the market growth. Furthermore, demand from tourists, urbanization, cultural focus on quality, and rising online sales are supporting the market growth. Apart from this, development of new products and expansion of distribution channels are factors providing a thrust to the Japan gluten-free food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 838.0 Million |

| Market Forecast in 2034 | USD 2,001.9 Million |

| Market Growth Rate 2026-2034 | 10.16% |

Japan Gluten Free Food Market Trends:

Increasing Health Awareness Among Consumers

In Japan, there is a growing trend toward healthier eating habits, largely driven by consumers who are becoming more aware of how food affects their overall well-being. People are now more careful about what they consume, with a rising interest in clean eating and natural ingredients. As part of this shift, gluten-free foods have become more popular, not just among those with allergies, but also among health-conscious individuals. These consumers believe that avoiding gluten can help improve digestion, boost energy, and support a healthier lifestyle. Media coverage, diet trends, and influencer promotion of gluten-free eating have also helped raise awareness. Additionally, the COVID-19 pandemic prompted many people to focus more on their health, leading them to try new diets and become more mindful about food labels. Supermarkets and restaurants in Japan have started responding to this demand by stocking and serving more gluten-free items, making these products more visible and acceptable. This change in attitude shows that gluten-free foods are no longer a niche option but are becoming part of mainstream health trends, which is driving the Japan gluten-free food market growth.

To get more information on this market Request Sample

Growing Prevalence of Celiac Disease and Gluten Sensitivity

Celiac disease is rare in Japan, with a prevalence of about 0.05% among asymptomatic adults, as reported in a study of over 2,000 subjects. Its rarity is attributed to low genetic risk and a historically low-gluten diet, but changed food habits could influence future prevalence. Doctors and researchers have become better aware of gluten diseases, thus enhancing diagnosis and expertise. In the past, many patients may not have been diagnosed because there was low awareness and also a lack of tests. However, since ever more individuals are reporting symptoms like bloating, abdominal pain, and fatigue after consuming gluten, doctors are now prescribing gluten-free diets as a means of alleviating these states. In addition, non-celiac gluten sensitivity, in which people experience negative symptoms but lack celiac disease, is increasingly being supported. This growing acceptance is driving customers to seek out gluten-free products and demand improved labeling on food. Japanese consumers, especially those with enigmatic digestive conditions, are increasingly willing to embrace gluten-free diets as a relief. As news of gluten intolerance and its effects spreads, consumers require more product availability and more information from food companies.

Government Support through Labeling Specifications and Certifications

The Japanese government has made strides towards improving food safety and building consumer confidence, especially in regard to diet restrictions like gluten intolerance. One way this has been achieved is through clearer food labeling law and certification policies. The Ministry of Health, Labour and Welfare has encouraged food manufacturers to label allergens like wheat that contain gluten properly. Despite the lack of a rigid gluten-free labeling law in Japan like that of some Western countries, the call for standardization is on the rise. Consumers and advocacy groups are calling for consistent and reliable gluten-free labeling. To meet the demand, some Japanese non-governmental organizations have started offering gluten-free certification services to help brands win consumers' trust. These labels ensure that products meet stringent gluten-free requirements and are safe for consumers with allergies or sensitivities. As the market grows, government bodies will play an increasingly active role in regulation and support, offering a more secure arena for consumers. When consumers see that gluten-free items have strong backing through labels and regulations, they are more apt to try them.

Japan Gluten Free Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, source, and sales channel.

Product Type Insights:

- Bakery and Confectionary

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery and confectionary, snacks and RTE products, dairy products, sauces and dressings, meat and meat substitutes, and others.

Source Insights:

- Plant-Based

- Animal-Based

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant-based and animal-based.

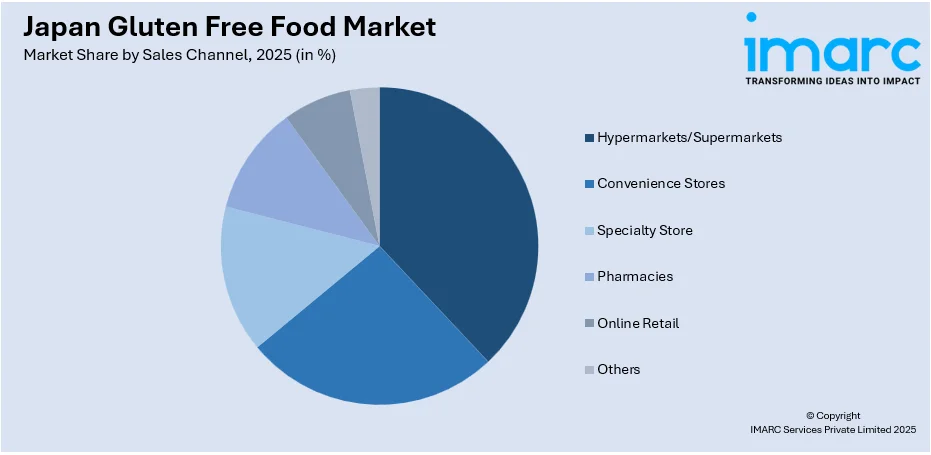

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Store

- Pharmacies

- Online Retail

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes hypermarkets/supermarkets, convenience stores, specialty store, pharmacies, online retail, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Gluten Free Food Market News:

- In 2023, Nestlé Japan expanded its gluten-free product portfolio by introducing a new line of gluten-free pasta and snacks, responding to the increasing consumer demand for dietary-specific foods.

Japan Gluten Free Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery and Confectionary, Snacks and RTE Products, Dairy Products, Sauces and Dressings, Meat and Meat Substitutes, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Sales Channels Covered | Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Pharmacies, Online Retail, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan gluten free food market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan gluten free food market on the basis of product type?

- What is the breakup of the Japan gluten free food market on the basis of source?

- What is the breakup of the Japan gluten free food market on the basis of sales channel?

- What is the breakup of the Japan gluten free food market on the basis of region?

- What are the various stages in the value chain of the Japan gluten free food market?

- What are the key driving factors and challenges in the Japan gluten free food market?

- What is the structure of the Japan gluten free food market and who are the key players?

- What is the degree of competition in the Japan gluten free food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan gluten free food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan gluten free food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan gluten free food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)