Japan Grid Energy Storage Solutions Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2026-2034

Japan Grid Energy Storage Solutions Market Overview:

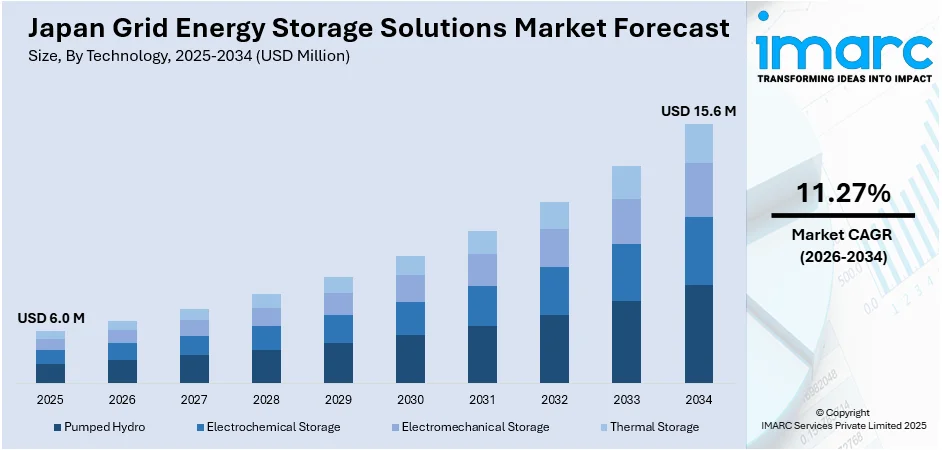

The Japan grid energy storage solutions market size reached USD 6.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 15.6 Million by 2034, exhibiting a growth rate (CAGR) of 11.27% during 2026-2034. The market is driven by Japan’s transition to renewable energy and the need to stabilize intermittent power output. Also, modernization of aging infrastructure and industrial efforts to optimize energy use are fueling the product adoption. Renewable integration, infrastructure upgrades, and commercial energy strategies are some of the factors positively impacting the Japan grid energy storage solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.0 Million |

| Market Forecast in 2034 | USD 15.6 Million |

| Market Growth Rate 2026-2034 | 11.27% |

Japan Grid Energy Storage Solutions Market Trends:

Transition Toward Renewable Energy Integration

Japan’s policy-driven shift from traditional fossil fuels to renewable power sources, particularly solar and wind, has placed significant strain on the national grid, necessitating scalable and reliable storage mechanisms. With intermittent generation characteristics inherent to renewables, maintaining a steady power supply has emerged as a critical challenge. Energy storage technologies serve as the balancing component, allowing excess energy produced during peak conditions to be stored and dispatched during low-generation periods. This functionality is essential in stabilizing frequency, reducing curtailment, and enhancing overall grid reliability. Government mandates under Japan’s Strategic Energy Plan prioritize renewable integration and explicitly highlight storage infrastructure as a backbone for decarbonization. In tandem, Japan’s Feed-in Tariff (FiT) revisions and new regulatory frameworks for virtual power plants (VPPs) encourage private sector investment into storage technologies. Domestic corporations, in partnership with municipal utilities, are deploying advanced battery systems at both utility and distributed levels. On September 30, 2024, ITOCHU Corporation launched Japan’s first fund for utility-scale energy storage, securing over 8 billion yen (approx. USD 54 million) from 11 public and private investors. Operated with Gore Street Capital, the fund targets new storage projects in the Kanto region to support renewable energy integration. The first plant is set to launch in FY2025 under Tokyo’s HTT initiative. These developments support the Japan grid energy storage solutions market growth and align with national climate goals under the Paris Agreement. With solar capacity already surpassing 80 GW and grid balancing challenges rising in tandem, the role of storage is no longer supplementary but fundamental in operationalizing Japan’s clean energy ambitions.

To get more information on this market Request Sample

Industrial and Commercial Energy Optimization

Japan’s industrial and commercial sectors are investing heavily in energy optimization to manage high electricity tariffs and maintain supply continuity during grid disruptions. Storage systems are being integrated into energy management strategies, particularly for large manufacturing plants, data centers, and logistics hubs that require uninterrupted operations. By deploying battery storage, these facilities can offset peak-time consumption, participate in demand response programs, and hedge against market price volatility. Such deployments are not only cost-containment measures but also steps toward operational autonomy. Additionally, energy storage allows facilities to function as prosumers, both consuming and producing power, thereby participating in local energy trading markets. The Ministry of Economy, Trade and Industry (METI) has endorsed regulatory models supporting energy self-sufficiency in industrial zones, which is encouraging wider adoption. As corporate environmental responsibility gains traction, firms are aligning energy strategies with sustainability targets, further strengthening the case for storage systems. On May 6, 2025, Taiwan-based HD Renewable Energy secured five new BESS projects totaling 300MW (1.5GWh) in Japan’s Long-Term Decarbonisation Power Source Auction, accounting for around 20% of the 1.37GW awarded capacity. This marks HDRE’s second consecutive win, following its 2024 success with 73MW of projects in Mie and Fukuoka. All awarded projects are backed by 20-year capacity payments and support Japan’s growing grid-scale storage market and decarbonization targets. Combined with capital expenditure incentives and declining battery costs, the adoption rate in non-residential settings is scaling rapidly. These dynamics are intensifying demand across multiple use cases, reinforcing the need for versatile, modular, and scalable energy storage architectures. This cross-sectoral relevance places energy storage at the intersection of economic strategy and sustainability planning across Japan’s commercial landscape.

Japan Grid Energy Storage Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Pumped Hydro

- Electrochemical Storage

- Electromechanical Storage

- Thermal Storage

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pumped hydro, electrochemical storage, electromechanical storage, and thermal storage.

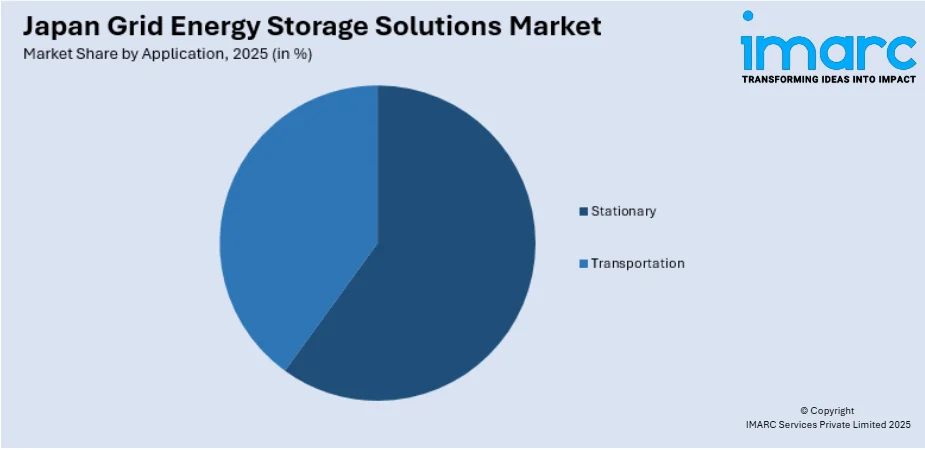

Application Insights:

Access the comprehensive market breakdown Request Sample

- Stationary

- Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes stationary and transportation.

End User Insights:

- Residential

- Non-Residential

- Utilities

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, non-residential, and utilities.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Grid Energy Storage Solutions Market News:

- On May 14, 2024, Stonepeak and CHC announced the launch of a battery energy storage platform in Japan, aiming to develop 1GW of projects over five years. The platform secured 20-year fixed revenue contracts for four projects through Japan’s first Long-term Decarbonization Auction. This initiative supports Japan’s grid stability and carbon neutrality goals by enhancing large-scale storage capacity.

Japan Grid Energy Storage Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pumped Hydro, Electrochemical Storage, Electromechanical Storage, Thermal Storage |

| Applications Covered | Stationary, Transportation |

| End Users Covered | Residential, Non-Residential, Utilities |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan grid energy storage solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan grid energy storage solutions market on the basis of technology?

- What is the breakup of the Japan grid energy storage solutions market on the basis of application?

- What is the breakup of the Japan grid energy storage solutions market on the basis of end user?

- What is the breakup of the Japan grid energy storage solutions market on the basis of region?

- What are the various stages in the value chain of the Japan grid energy storage solutions market?

- What are the key driving factors and challenges in the Japan grid energy storage solutions market?

- What is the structure of the Japan grid energy storage solutions market and who are the key players?

- What is the degree of competition in the Japan grid energy storage solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan grid energy storage solutions market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan grid energy storage solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan grid energy storage solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)