Japan Grid Modernization Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2026-2034

Japan Grid Modernization Market Overview:

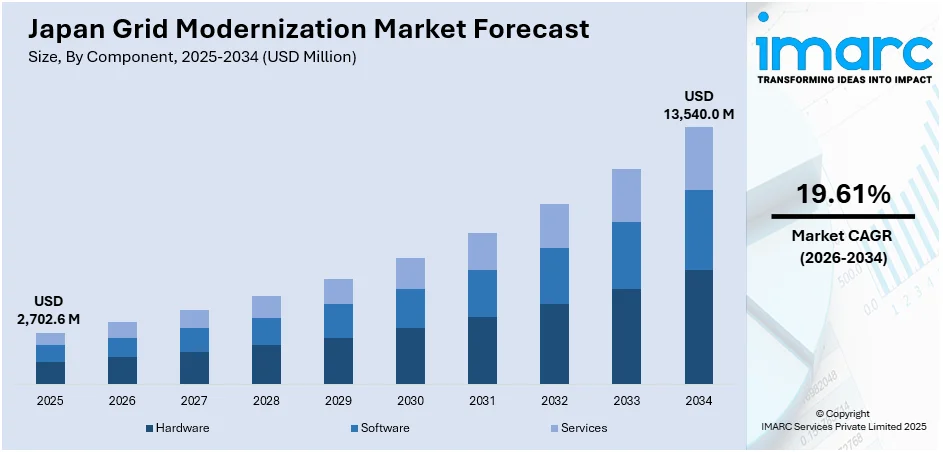

The Japan grid modernization market size reached USD 2,702.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 13,540.0 Million by 2034, exhibiting a growth rate (CAGR) of 19.61% during 2026-2034. The market is driven by disaster-resilient infrastructure investments and grid sectionalization. Also, carbon neutrality mandates, renewable integration targets, and energy storage deployments are fueling the product adoption. Additionally, regulatory reforms and liberalized power trading support grid intelligence. Flexible systems, predictive tools, and market-based operations are some of the factors positively impacting the Japan grid modernization market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,702.6 Million |

| Market Forecast in 2034 | USD 13,540.0 Million |

| Market Growth Rate 2026-2034 | 19.61% |

Japan Grid Modernization Market Trends:

Resilience Upgrades and Disaster-Ready Infrastructure

Japan’s vulnerability to earthquakes, typhoons, and tsunamis has placed grid resilience at the forefront of national energy planning. The country’s electric utilities are investing heavily in underground cabling, grid sectionalization, self-healing networks, and microgrids to ensure continuity of service during emergencies. Urban centers are being prioritized for these upgrades, especially in areas where previous disasters caused prolonged blackouts. Advanced control systems, automated substations, and distributed energy storage are helping maintain voltage and frequency stability under stress. Utilities are also integrating geographic risk models with grid design to preemptively mitigate damage in hazard-prone zones. This strategic emphasis on resilience, safety, and operational redundancy is a strong contributing force behind Japan grid modernization market growth, as energy regulators align disaster mitigation strategies with digital infrastructure upgrades. Local governments are also coordinating with grid operators to deploy backup systems at critical facilities including hospitals, data centers, and water utilities. On August 27, 2024, Hitachi Energy launched its Grid-enSure™ portfolio at CIGRE 2024, calling for urgent upgrades to global power systems, with 3,000 GW of renewable projects stalled in grid connection queues. The initiative addresses voltage, frequency, and inertia challenges caused by increasing renewable penetration, leveraging advanced technologies such as STATCOM, HVDC, and synthetic inertia systems.

To get more information on this market Request Sample

Grid Liberalization and Competitive Power Market Dynamics

Japan’s ongoing liberalization of its electricity market has introduced new dynamics that require modernization of grid operations. Following the unbundling of generation, transmission, and distribution, a competitive multi-player environment has emerged. This complexity demands improved coordination, open data protocols, and smarter control systems to ensure grid reliability across varying supply and demand conditions. The entry of independent power producers, energy retailers, and aggregators has led to the deployment of advanced metering infrastructure, blockchain-based transaction platforms, and real-time market balancing tools. On March 27, 2025, GridPoint secured USD 45 million in strategic funding, including a USD 20 million investment from Mitsubishi Corporation-backed Marunouchi Innovation Partners to support its international expansion into Japan and South Korea. GridPoint’s platform, deployed in over 20,000 commercial buildings, enables dynamic load flexibility and real-time energy automation, directly addressing grid stability and capacity challenges. This investment advances Japan grid modernization market goals by introducing AI-powered energy management technologies capable of decarbonizing commercial buildings and supporting grid resilience. Enhanced grid transparency and responsiveness are essential for handling variable inputs and competitive bidding processes. Transmission system operators must now support more agile grid services while also adhering to new regulatory reporting standards. In urban areas, peer-to-peer trading pilots and VPPs are becoming mainstream, adding additional layers of complexity that legacy infrastructure cannot handle. The liberalized environment is also accelerating customer-centric models, requiring utilities to invest in demand analytics and interactive grid interfaces. These shifts are not only modernizing physical infrastructure but are redefining operational models entirely. Grid operators are now facilitators of market access, requiring tools and systems capable of managing a fluid and decentralized power landscape.

Japan Grid Modernization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, application, and end-user.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

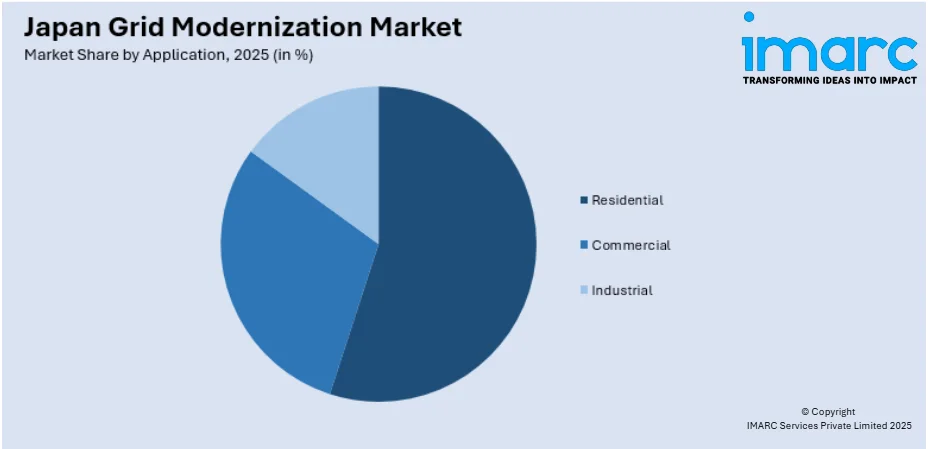

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

End-User Insights:

- Utilities

- Independent Power Producers (IPPs)

- Government and Municipalities

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes utilities, independent power producers (IPPs), and government and municipalities.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has provided a comprehensive analysis of all major regional markets, including Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Grid Modernization Market News:

- On April 16, 2024, Yokogawa Electric Corporation and GridBeyond announced a strategic partnership to deliver integrated electricity trading and energy consulting services to industrial users in Japan. The collaboration leverages GridBeyond’s AI-powered aggregation and robotic trading platform, proven across 1.7 GW of managed load globally, to optimize demand-response and maximize energy market participation. This alliance strengthens Japan grid modernization market capabilities by enhancing real-time flexibility, supporting virtual power plant deployment, and enabling smarter grid-connected industrial operations.

Japan Grid Modernization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Applications Covered | Residential, Commercial, Industrial |

| End-Users Covered | Utilities, Independent Power Producers (IPPs), Government and Municipalities |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan grid modernization market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan grid modernization market on the basis of component?

- What is the breakup of the Japan grid modernization market on the basis of application?

- What is the breakup of the Japan grid modernization market on the basis of end-user?

- What is the breakup of the Japan grid modernization market on the basis of region?

- What are the various stages in the value chain of the Japan grid modernization market?

- What are the key driving factors and challenges in the Japan grid modernization market?

- What is the structure of the Japan grid modernization market and who are the key players?

- What is the degree of competition in the Japan grid modernization market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan grid modernization market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan grid modernization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan grid modernization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)