Japan Healthy Instant Meals Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, Packaging Type, Distribution Channel, End User, and Region, 2026-2034

Japan Healthy Instant Meals Market Overview:

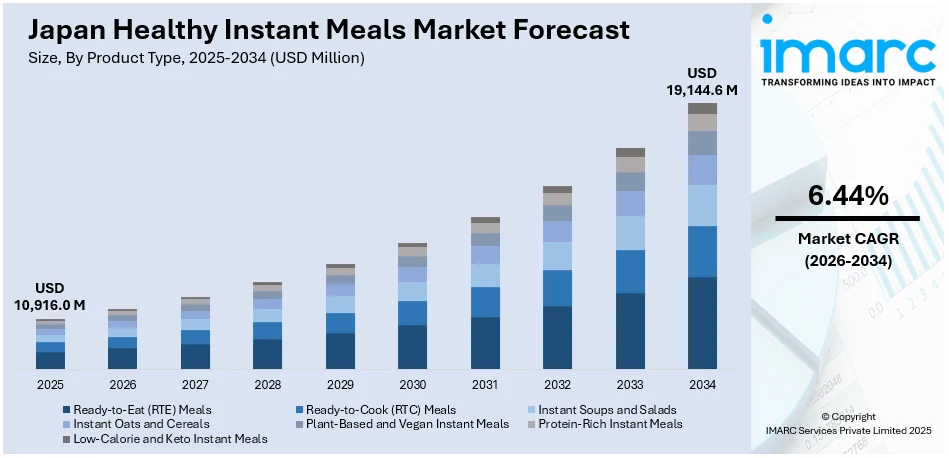

The Japan healthy instant meals market size reached USD 10,916.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 19,144.6 Million by 2034, exhibiting a growth rate (CAGR) of 6.44% during 2026-2034. The market is driven by Japan’s aging population and growing demand for nutrient-rich, easy-to-prepare foods that support independent living. Busy urban lifestyles and shrinking home cooking habits are elevating demand for healthy, ready-to-eat solutions, thereby fueling the market. Continued food tech innovations and product premiumization are improving meal quality and shelf-life, further augmenting the Japan healthy instant meals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,916.0 Million |

| Market Forecast in 2034 | USD 19,144.6 Million |

| Market Growth Rate 2026-2034 | 6.44% |

Japan Healthy Instant Meals Market Trends:

Aging Population and Demand for Functional, Ready-to-Eat Meals

Japan’s rapidly aging population is creating sustained demand for convenient, nutritious, and easy-to-consume meal solutions. Elderly consumers often seek foods that are soft in texture, rich in essential nutrients, and require minimal preparation, making healthy instant meals an ideal choice. Manufacturers are innovating with offerings that cater to specific dietary needs like low-sodium, high-fiber, and protein-fortified options suitable for managing age-related health conditions. Ready-to-eat soups, grain bowls, and low-fat entrees now include labeling for key health benefits, such as bone support, heart health, or digestive aid. These meals are often designed with clear packaging and microwave-safe features to enhance usability for seniors. Research shows that elderly Japanese individuals with poor cooking skills who live alone face 2.5 times higher risk of mortality compared to those with better cooking skills, underscoring the importance of accessible meal solutions. Additionally, healthcare providers and caregivers are increasingly relying on medically tailored meal solutions to meet the nutritional needs of patients and the elderly. Government initiatives supporting healthy aging and dietary management for chronic diseases further drive development in this segment. As Japan prioritizes aging in place and independent living, functional instant meals play a pivotal role in sustaining nutrition without compromising convenience. This demographic trend is a core factor accelerating Japan healthy instant meals market growth, particularly in both urban and rural elderly populations.

To get more information on this market Request Sample

Busy Urban Lifestyles and Decline in Home Cooking

Japan’s fast-paced urban work culture and declining household cooking frequency are key contributors to the rising demand for healthy instant meals. With long working hours and limited kitchen space in major cities such as Tokyo and Osaka, consumers increasingly seek ready-made meals that align with their health goals. Traditional convenience foods, once dominated by high-sodium, preservative-heavy offerings, are being replaced by nutritionally balanced alternatives featuring whole grains, lean proteins, and reduced sodium content. Bento boxes, single-portion rice dishes, and microwavable miso soups are evolving to meet these new consumer preferences. The retail sales value of the ready-to-eat food market reached JPY 10.98 trillion (approximately USD 74.6 billion), with JPY 3.46 trillion (approximately USD 23.3 billion) coming from convenience store sales, representing about 31.5% of the total market. Additionally, the average annual household expenditure on prepared foods stood at JPY 126,700 (approximately USD 850), indicating a significant shift toward convenience foods in Japanese households. Convenience stores and vending machines have significantly upgraded their healthy offerings, with premium options labeled for calorie control, vegan content, or allergen-free ingredients. In parallel, younger consumers and working professionals are turning away from traditional meal prep, instead favoring products that require little to no cooking. This shift has prompted retailers and manufacturers to invest in expanded refrigerated sections, eco-friendly packaging, and co-branded meal solutions with fitness and wellness influencers. As convenience increasingly overlaps with health, the demand for high-quality, ready-to-eat meals continues to grow, reflecting deeper shifts in how Japanese consumers approach everyday nutrition and time management.

Japan Healthy Instant Meals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, ingredient type, packaging type, distribution channel, and end user.

Product Type Insights:

- Ready-to-Eat (RTE) Meals

- Ready-to-Cook (RTC) Meals

- Instant Soups and Salads

- Instant Oats and Cereals

- Plant-Based and Vegan Instant Meals

- Protein-Rich Instant Meals

- Low-Calorie and Keto Instant Meals

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ready-to-eat (RTE) meals, ready-to-cook (RTC) meals, instant soups and salads, instant oats and cereals, plant-based and vegan instant meals, protein-rich instant meals, and low-calorie and keto instant meals.

Ingredient Type Insights:

- Organic and Natural Ingredients

- Plant-Based Ingredients

- Gluten-Free Ingredients

- Protein-Fortified Ingredients

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes organic and natural ingredients, plant-based ingredients, gluten-free ingredients, and protein-fortified ingredients.

Packaging Type Insights:

- Pouches

- Cups and Bowls

- Trays and Boxes

- Cans and Bottles

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches, cups and bowls, trays and boxes, and cans and bottles.

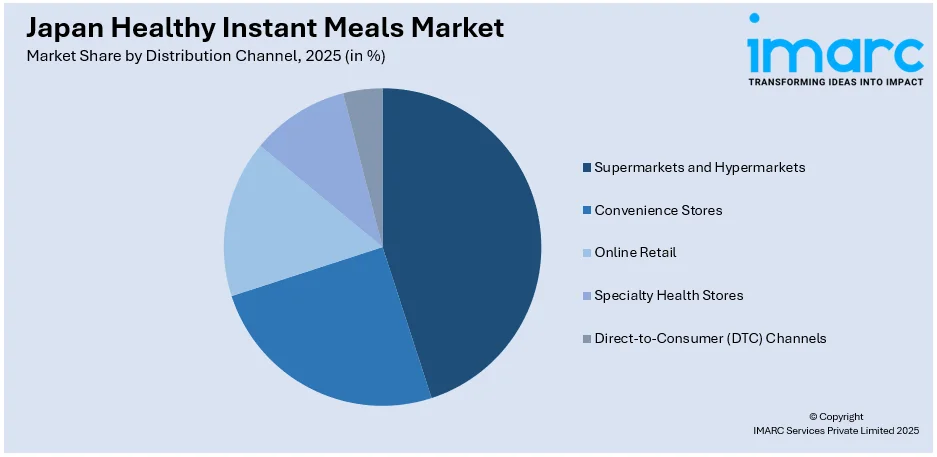

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Health Stores

- Direct-to-Consumer (DTC) Channels

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online retail, specialty health stores, and direct-to-consumer (DTC) channels.

End User Insights:

- Working Professionals

- Students

- Fitness Enthusiasts

- Travelers and Outdoor Consumers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes working professionals, students, fitness enthusiasts, and travelers and outdoor consumers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Healthy Instant Meals Market News:

- On November 5, 2024, Dusit Foods, a subsidiary of Dusit International, formed a partnership with Green House Co., Ltd., a major Japanese food industry player, to expand the operations of Epicure Catering. This collaboration will enhance Epicure’s reach in sectors such as education, healthcare, and airlines, both in Thailand and globally, with a focus on providing high-quality, healthy meal options. Green House will acquire a 20% share in Epicure Catering, while Dusit Foods retains a 70% stake, with the remaining 10% held by already existing shareholders.

Japan Healthy Instant Meals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ready-to-Eat (RTE) Meals, Ready-to-Cook (RTC) Meals, Instant Soups and Salads, Instant Oats and Cereals, Plant-Based and Vegan Instant Meals, Protein-Rich Instant Meals, Low-Calorie and Keto Instant Meals |

| Ingredient Types Covered | Organic and Natural Ingredients, Plant-Based Ingredients, Gluten-Free Ingredients, Protein-Fortified Ingredients |

| Packaging Types Covered | Pouches, Cups and Bowls, Trays and Boxes, Cans and Bottles |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Health Stores, Direct-to-Consumer (DTC) Channels |

| End Users Covered | Working Professionals, Students, Fitness Enthusiasts, Travelers and Outdoor Consumers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan healthy instant meals market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan healthy instant meals market on the basis of product type?

- What is the breakup of the Japan healthy instant meals market on the basis of ingredient type?

- What is the breakup of the Japan healthy instant meals market on the basis of packaging type?

- What is the breakup of the Japan healthy instant meals market on the basis of distribution channel?

- What is the breakup of the Japan healthy instant meals market on the basis of end user?

- What is the breakup of the Japan healthy instant meals market on the basis of region?

- What are the various stages in the value chain of the Japan healthy instant meals market?

- What are the key driving factors and challenges in the Japan healthy instant meals market?

- What is the structure of the Japan healthy instant meals market and who are the key players?

- What is the degree of competition in the Japan healthy instant meals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan healthy instant meals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan healthy instant meals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan healthy instant meals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)