Japan Heat Recovery Systems Market Size, Share, Trends and Forecast by Type, Technology, Industry, and Region, 2026-2034

Japan Heat Recovery Systems Market Overview:

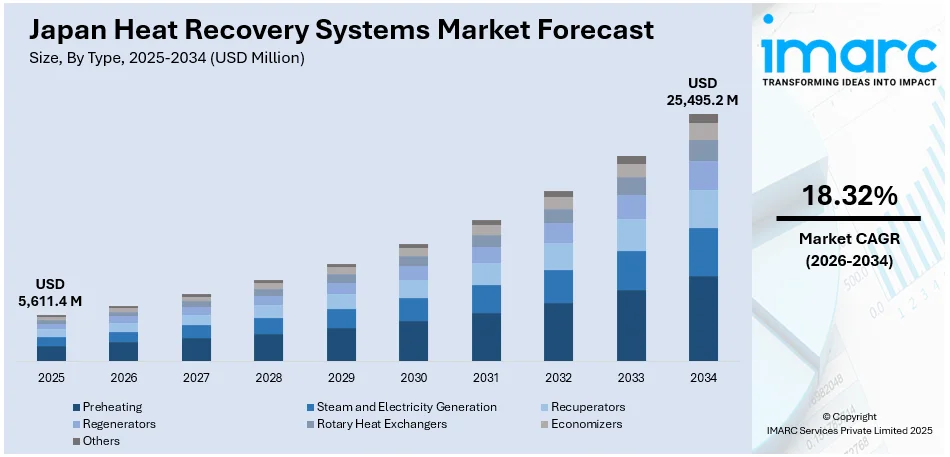

The Japan heat recovery systems market size reached USD 5,611.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 25,495.2 Million by 2034, exhibiting a growth rate (CAGR) of 18.32% during 2026-2034. The market is driven by industrial energy efficiency programs designed to reduce fossil fuel reliance and align with national decarbonization policies. Urban infrastructure development and smart city upgrades are embedding centralized HVAC systems with energy recovery capabilities, thereby fueling the market. The growing trend of zero-energy homes and eco-conscious housing is transforming residential ventilation standards, further augmenting the Japan heat recovery systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,611.4 Million |

| Market Forecast in 2034 | USD 25,495.2 Million |

| Market Growth Rate 2026-2034 | 18.32% |

Japan Heat Recovery Systems Market Trends:

Energy Security Measures and Industrial Thermal Efficiency

Japan’s limited domestic energy resources and high dependence on imports have elevated energy security to a national priority. Industrial enterprises, especially in steel, chemicals, and automotive sectors, are under increasing pressure to reduce energy intensity while maintaining output. Heat recovery systems have gained importance as part of energy-saving programs implemented by the Ministry of Economy, Trade and Industry (METI), including under the Energy Conservation Act. Waste heat recovery from exhaust gas, kilns, or steam systems is now integral to factory design, enabling enterprises to cut costs and align with decarbonization objectives. Large manufacturers are installing regenerative heat exchangers and cogeneration units to utilize recovered heat for secondary applications like space heating, preheating, or electricity generation. Engineering firms offer detailed thermal audits to identify recovery potential, while digital monitoring tools ensure ongoing performance efficiency. On April 17, 2025, GE Vernova announced that the Goi Thermal Power Station in Japan began commercial operations, adding over 2.3 GW of electricity to the grid, equivalent to 2.2% of the nation’s homes' power needs. This facility, powered by GE Vernova's 9HA.02 gas turbines and advanced Heat Recovery Steam Generators (HRSGs), aims to enhance energy efficiency and reduce CO2 emissions by 16% compared to the previous plant. These interventions not only improve operational competitiveness but also meet carbon neutrality targets pledged under Japan’s 2050 strategy. With the rising cost of LNG and coal imports, coupled with stricter energy efficiency benchmarks, industrial sectors are scaling deployment across legacy and greenfield facilities. These developments collectively underscore the structural momentum driving Japan heat recovery systems market growth across industrial applications.

To get more information on this market Request Sample

Decarbonization of Urban Infrastructure and Smart City Projects

Japan’s urban development is deeply integrated with low-carbon strategies, with smart city initiatives acting as testing grounds for high-efficiency building technologies. In Tokyo, Yokohama, and Fukuoka, district energy systems are embedding centralized HVAC systems with heat recovery functionalities to serve mixed-use complexes. These systems are increasingly being installed in new high-rise buildings, data centers, and airports to minimize energy losses and support net-zero objectives. The Green Building Certification System (CASBEE) encourages adoption of mechanical ventilation with energy recovery, especially in facilities targeting top-tier sustainability ratings. Developers now routinely factor in the lifecycle energy performance of buildings, with HVAC recovery technologies reducing long-term carbon footprint and operating costs. On July 29, 2024, Panasonic began a demonstration experiment utilizing heat from pure hydrogen fuel cell generators as a heat source for absorption chillers, aiming to achieve a carbon-free society. By improving the temperature of heat produced by the fuel cell generators from 60°C to 70°C, Panasonic has successfully bridged the gap between the low heat output of hydrogen fuel cells and the minimum temperature required for absorption chillers, enabling efficient heat recovery and cooling in industrial applications. This integration of hydrogen-powered heat recovery systems with air conditioning technologies highlights a new approach to utilizing low-temperature waste heat, thereby reducing energy consumption and advancing sustainable energy solutions. Additionally, large-scale real estate developers are retrofitting older commercial and public buildings to integrate rotary wheel heat exchangers and enthalpy-based ERVs. Government subsidies for green construction, such as those under Japan’s Environmentally Sustainable Buildings Program, are accelerating this transition. As heat recovery plays a pivotal role in achieving both building-level and district-level efficiency, the technology is becoming integral to Japan’s low-emission urban renewal plans, driving consistent demand across metropolitan infrastructure.

Japan Heat Recovery Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, technology, and industry.

Type Insights:

- Preheating

- Steam and Electricity Generation

- Recuperators

- Regenerators

- Rotary Heat Exchangers

- Economizers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes preheating, steam and electricity generation, recuperators, regenerators, rotary heat exchangers, economizers, and others.

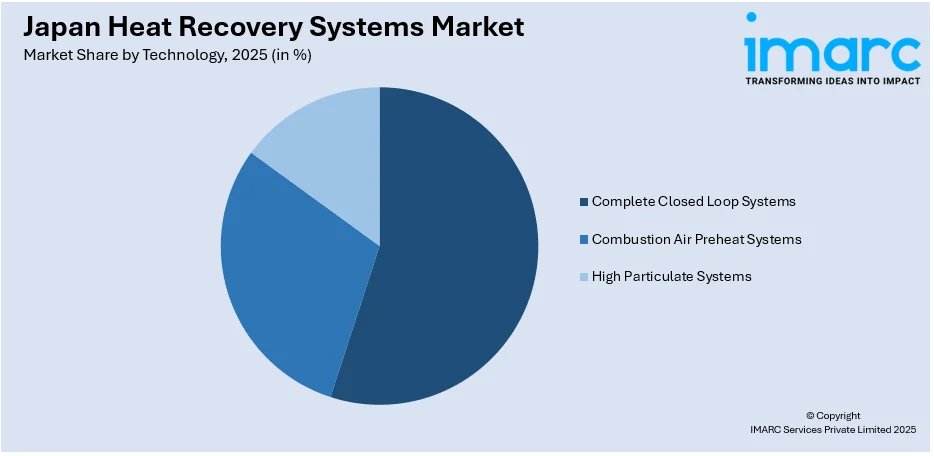

Technology Insights:

Access the comprehensive market breakdown Request Sample

- Complete Closed Loop Systems

- Combustion Air Preheat Systems

- High Particulate Systems

The report has provided a detailed breakup and analysis of the market based on the technology. This includes complete closed loop systems, combustion air preheat systems, and high particulate systems.

Industry Insights:

- Petroleum Refining

- Metal Production

- Cement

- Chemical

- Paper and Pulp

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes petroleum refining, metal production, cement, chemical, paper and pulp, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Heat Recovery Systems Market News:

- On April 24, 2025, Japan introduced a new financial assistance program designed to lower expenses associated with renewable heat technologies and equipment for recovering industrial waste heat. Funded through the fiscal 2024 supplementary budget, the scheme focuses on promoting energy-efficient enhancements and specifically supports non-PV renewable heating systems as well as heat recovery solutions for manufacturing facilities. The program, managed by the Japan Environmental Technology Association, accepts proposals from April 3 to May 8, 2025, to encourage the adoption of technologies that help lower emissions and improve energy efficiency in various sectors.

Japan Heat Recovery Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Preheating, Steam and Electricity Generation, Recuperators, Regenerators, Rotary Heat Exchangers, Economizers, Others |

| Technologies Covered | Complete Closed Loop Systems, Combustion Air Preheat Systems, High Particulate Systems |

| Industries Covered | Petroleum Refining, Metal Production, Cement, Chemical, Paper and Pulp, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan heat recovery systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan heat recovery systems market on the basis of type?

- What is the breakup of the Japan heat recovery systems market on the basis of technology?

- What is the breakup of the Japan heat recovery systems market on the basis of industry?

- What is the breakup of the Japan heat recovery systems market on the basis of region?

- What are the various stages in the value chain of the Japan heat recovery systems market?

- What are the key driving factors and challenges in the Japan heat recovery systems market?

- What is the structure of the Japan heat recovery systems market and who are the key players?

- What is the degree of competition in the Japan heat recovery systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan heat recovery systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan heat recovery systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan heat recovery systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)